|

市場調查報告書

商品編碼

1716615

3D NAND 快閃記憶體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測3D NAND Flash Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

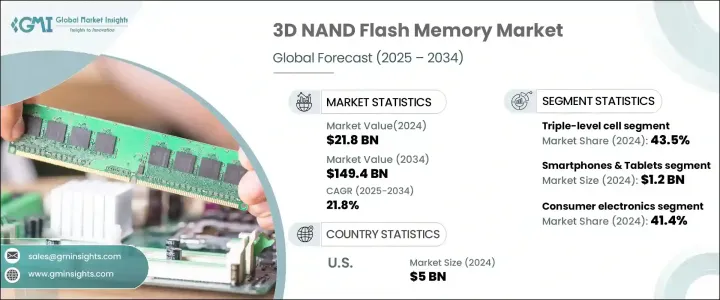

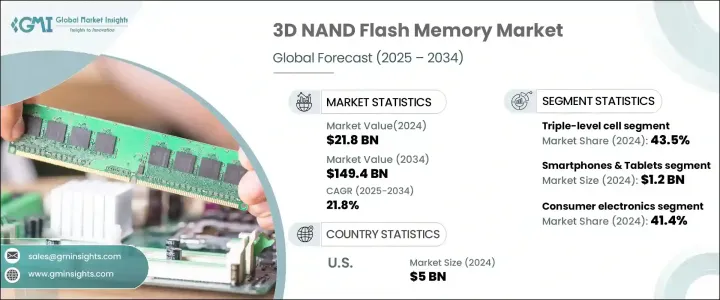

2024 年全球 3D NAND 快閃記憶體市場規模達 218 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 21.8%。這一強勁成長主要歸因於資料儲存解決方案需求的激增,而這得益於資料中心的激增和消費性電子產業的快速擴張。隨著世界日益由數據驅動,對大容量、高速儲存的需求正在加速成長,特別是隨著雲端運算、人工智慧 (AI) 和巨量資料分析等技術的廣泛採用。超大規模和企業資料中心需要更快的資料存取速度和更高的儲存容量來管理各行業產生的不斷成長的資料量。此外,人工智慧與醫療保健、金融和汽車等各個領域的整合也增加了對可靠、高效的記憶體解決方案的需求。隨著這些技術的發展,對 3D NAND 快閃記憶體等先進儲存選項的需求將持續上升,為未來十年市場持續成長奠定基礎。

市場按單元類型細分,其中三級單元 (TLC) 內存部分在 2024 年佔據 43.5% 的佔有率。 TLC 內存每個單元存儲三位資料,與單級單元 (SLC) 和多級單元 (MLC) 內存相比,提供更高的存儲容量和更低的成本,使其成為智慧型手機、平板電腦和固態硬碟 (SSD) 等消費性電子產品的理想選擇。隨著消費者偏好轉向具有更大儲存容量且價格更實惠的設備,基於 TLC 的 3D NAND 記憶體正成為尋求滿足這些需求的製造商的首選。隨著高效能設備普及率的不斷提高,TLC記憶體的普及率預計將進一步上升,從而推動市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 218億美元 |

| 預測值 | 1494億美元 |

| 複合年成長率 | 21.8% |

從應用角度來看,3D NAND快閃記憶體市場分為幾個領域,包括相機、筆記型電腦和個人電腦、智慧型手機和平板電腦。 2024 年,智慧型手機和平板電腦領域的產值將達到 12 億美元。隨著行動裝置融入高解析度攝影機、4K 錄影和資料密集型應用程式等先進功能,對大容量儲存的需求顯著增加。 3D NAND 快閃記憶體透過提供無縫的效能和可靠性來滿足這些要求,使用戶能夠不間斷地執行多任務、玩高清遊戲和串流內容。消費者對功能豐富的設備的需求持續成長,推動了這一領域的成長。

2024年美國3D NAND快閃記憶體市值為50億美元。隨著雲端運算和人工智慧技術的擴展,超大規模和企業資料中心的快速成長,對高速可靠儲存設備的需求也隨之增加。此外,多個產業對人工智慧應用的日益依賴加劇了對先進記憶體解決方案的需求,進一步推動了預測期內美國市場的成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 資料中心數量的增加

- 消費性電子產品需求激增

- 固態硬碟 (SSD) 日益普及

- 5G技術的出現

- 3D NAND 技術不斷進步

- 產業陷阱與挑戰

- 安全和資料隱私問題

- 3D NAND快閃記憶體相關的技術挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 單層單元

- 多層單元

- 三層電池

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 相機

- 筆記型電腦和桌上型電腦

- 智慧型手機和平板電腦

- 其他

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 消費性電子產品

- 企業

- 衛生保健

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ADATA Technology

- GigaDevice Semiconductor (Beijing) Inc.

- Goodram

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Corporation (formerly Toshiba Memory Corporation)

- Lexar International

- Macronix International

- Micron Technology, Inc

- Nanya Technology Corporation

- Netac Technology

- Netlist, Inc.

- PNY Technologies, Inc.

- Samsung Electronics

- SanDisk (a division of Western Digital)

- SK Hynix

- Transcend Information

- Western Digital Corporation

The Global 3D NAND Flash Memory Market generated USD 21.8 billion in 2024 and is expected to grow at a CAGR of 21.8% between 2025 and 2034. This robust growth is largely attributed to the surging demand for data storage solutions, driven by the proliferation of data centers and the rapid expansion of the consumer electronics sector. As the world becomes increasingly data-driven, the need for high-capacity, high-speed storage is accelerating, particularly with the widespread adoption of technologies such as cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale and enterprise data centers require faster data access speeds and higher storage capacity to manage the ever-growing volumes of data generated across industries. Furthermore, the integration of AI into various sectors, including healthcare, finance, and automotive, has amplified the need for reliable and efficient memory solutions. As these technologies evolve, the demand for advanced storage options like 3D NAND flash memory will continue to rise, positioning the market for sustained growth over the next decade.

The market is segmented by cell type, with the triple-level cell (TLC) memory segment holding a 43.5% share in 2024. TLC memory, which stores three bits of data per cell, offers higher storage capacity and lower costs compared to single-level cell (SLC) and multi-level cell (MLC) memory, making it an ideal choice for consumer electronics such as smartphones, tablets, and solid-state drives (SSDs). As consumer preferences shift toward devices with larger storage capacities at affordable prices, TLC-based 3D NAND memory is becoming the preferred option for manufacturers looking to meet these demands. With the increasing penetration of high-performance devices, the popularity of TLC memory is expected to rise further, fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.8 Billion |

| Forecast Value | $149.4 Billion |

| CAGR | 21.8% |

In terms of applications, the 3D NAND flash memory market is divided into several segments, including cameras, laptops and PCs, and smartphones and tablets. The smartphones and tablets segment generated USD 1.2 billion in 2024. As mobile devices incorporate advanced features such as high-resolution cameras, 4K video recording, and data-intensive applications, the need for high-capacity storage has increased significantly. 3D NAND flash memory meets these requirements by providing seamless performance and reliability, enabling users to multitask, play high-definition games, and stream content without interruptions. The consistent increase in consumer demand for feature-rich devices is driving the growth of this segment.

The U.S. 3D NAND flash memory market was valued at USD 5 billion in 2024. The rapid growth of hyperscale and enterprise data centers fueled by the expansion of cloud computing and AI technologies has heightened the demand for high-speed and reliable storage devices. Additionally, the growing reliance on AI applications across multiple sectors has intensified the need for advanced memory solutions, further propelling market growth in the U.S. during the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise in number of data centers

- 3.6.1.2 Surge in demand for consumer electronics

- 3.6.1.3 Increasing proliferation of Solid State Drives (SSDs)

- 3.6.1.4 Emergence of 5G technology

- 3.6.1.5 Growing advancements in 3D NAND technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Security and data privacy concerns

- 3.6.2.2 Technical challenges associated with 3D NAND flash memory

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Single-level cell

- 5.3 Multi-level cell

- 5.4 Triple-level cell

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Camera

- 6.3 Laptops and PCs

- 6.4 Smartphones & tablets

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Consumer electronics

- 7.4 Enterprise

- 7.5 Healthcare

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADATA Technology

- 9.2 GigaDevice Semiconductor (Beijing) Inc.

- 9.3 Goodram

- 9.4 Intel Corporation

- 9.5 Kingston Technology Corporation

- 9.6 Kioxia Corporation (formerly Toshiba Memory Corporation)

- 9.7 Lexar International

- 9.8 Macronix International

- 9.9 Micron Technology, Inc

- 9.10 Nanya Technology Corporation

- 9.11 Netac Technology

- 9.12 Netlist, Inc.

- 9.13 PNY Technologies, Inc.

- 9.14 Samsung Electronics

- 9.15 SanDisk (a division of Western Digital)

- 9.16 SK Hynix

- 9.17 Transcend Information

- 9.18 Western Digital Corporation