|

市場調查報告書

商品編碼

1716576

NAND 快閃記憶體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測NAND Flash Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

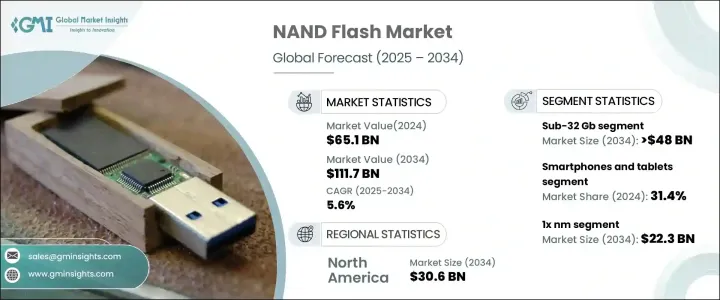

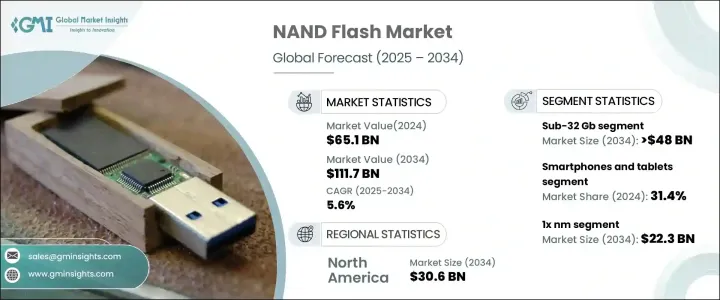

2024 年全球 NAND 快閃記憶體市場規模達到 651 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.6%。市場成長主要得益於消費性電子產品對高效能儲存解決方案的需求不斷成長,以及 3D NAND 技術的快速進步。隨著各行各業數位轉型的加速,NAND閃存在實現無縫資料處理、高速運算和大規模儲存應用方面發揮著至關重要的作用。連網設備普及率的不斷提高、高解析度媒體的激增以及向人工智慧驅動應用的持續轉變進一步擴大了對先進 NAND 解決方案的需求。雲端運算、邊緣運算和物聯網整合也加劇了對高密度、節能儲存的需求,促使製造商專注於提高效能、減少延遲和最佳化能耗的創新。

如今的消費者要求設備具有更大的儲存容量和更快的性能,從而推動了對 NAND 快閃記憶體產品的龐大需求。製造商正在透過提供高密度、高速記憶體解決方案來應對這一需求,旨在滿足智慧型手機、平板電腦和下一代 5G 設備不斷變化的需求。隨著 4K 和 8K 視訊消費、手機遊戲和人工智慧應用的激增,NAND 儲存的需求從未如此高漲。業內公司不斷投資研發,突破儲存效率和耐用性的界限,以滿足自動駕駛汽車、智慧家電和工業自動化等新興技術的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 651億美元 |

| 預測值 | 1117億美元 |

| 複合年成長率 | 5.6% |

NAND 快閃記憶體市場根據記憶體密度分為幾類,包括 32 Gb 以下、32 Gb - 128 Gb、256 Gb - 1 Tb 和 1 Tb 以上。預計到 2034 年,32 Gb 以下市場的產值將達到 480 億美元,這得益於其在嵌入式系統、消費性電子產品和工業應用中的廣泛應用。隨著對緊湊、經濟高效和節能儲存解決方案的需求不斷成長,物聯網設備尤其促進了該領域的成長。此類別的 NAND 晶片在智慧家電、汽車資訊娛樂系統和工業自動化領域備受青睞,因為這些領域的性能和耐用性至關重要。

根據應用,智慧型手機和平板電腦領域在 2024 年佔據了 31.4% 的市場。由於內容創作、基於雲端的儲存和人工智慧驅動的功能不斷增加,行動裝置使用量的激增極大地促進了這一領域的擴張。現代智慧型手機需要大量儲存空間來處理高解析度照片、4K 和 8K 影片以及高級遊戲體驗。隨著行動裝置的不斷發展,預計在整個預測期內,對此類 NAND 快閃記憶體解決方案的需求將保持強勁。

預計到 2034 年,美國 NAND 快閃記憶體市場規模將達到 306 億美元。美國成熟的半導體研發部門將繼續推動 NAND 快閃記憶體技術的創新,進一步鞏固其作為全球記憶體解決方案領導者的地位。大型科技公司的資料中心嚴重依賴 NAND 快閃存儲,以確保持續的需求。由於美國繼續處於數位經濟的前沿,對高效、高密度儲存解決方案的需求將持續上升,從而塑造 NAND 快閃記憶體市場的未來。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費性電子產品對高效能儲存解決方案的需求不斷成長

- 資料中心擴大採用固態硬碟 (SSD)

- 3D NAND技術的進步

- 人工智慧和物聯網應用的擴展

- 汽車產業需求不斷成長

- 產業陷阱與挑戰

- 供應鏈中斷

- 競爭加劇和價格壓力

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按記憶體密度,2021 - 2034 年

- 主要趨勢

- 低於 32 Gb

- 32 GB - 128 GB

- 256 GB - 1 TB

- 1 Tb 以上

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 智慧型手機和平板電腦

- SSD 和企業儲存

- 消費性電子產品

- 工業和汽車

- 其他

第7章:市場估計與預測:按技術節點,2021 - 2034 年

- 主要趨勢

- 1x 奈米

- 1年奈米

- 2x 奈米

- 3x 奈米以上

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ADATA

- Cypress Semiconductor

- Greenliant Systems

- Infineon Technologies

- Intel

- ISSI

- Kingston Technology

- Kioxia

- Macronix International

- Micron Technology

- Netlist

- Phison Electronics

- Powerchip Semiconductor

- Samsung Electronics

- Sandisk

- SK Hynix

- SMIC

- Western Digital

- Winbond Electronics

- Yangtze Memory Technologies Co. (YMTC)

The Global NAND Flash Market reached USD 65.1 billion in 2024 and is expected to grow at a CAGR of 5.6% between 2025 and 2034. The market growth is largely fueled by the increasing demand for high-performance storage solutions in consumer electronics, alongside rapid advancements in 3D NAND technology. As digital transformation accelerates across industries, NAND flash memory plays a crucial role in enabling seamless data processing, high-speed computing, and large-scale storage applications. The rising penetration of connected devices, the proliferation of high-resolution media, and the ongoing shift toward AI-driven applications are further amplifying the need for advanced NAND solutions. Cloud computing, edge computing, and IoT integration have also intensified the demand for high-density, power-efficient storage, prompting manufacturers to focus on innovations that enhance performance, reduce latency, and optimize energy consumption.

Consumers today require larger storage capacities and faster performance in their devices, driving substantial demand for NAND flash products. Manufacturers are responding by delivering high-density, high-speed memory solutions designed to support the ever-evolving needs of smartphones, tablets, and next-generation 5G devices. With the surge in 4K and 8K video consumption, mobile gaming, and AI-powered applications, the necessity for NAND storage has never been higher. Companies in the industry continue to invest in research and development, pushing the boundaries of storage efficiency and endurance to cater to emerging technologies such as autonomous vehicles, smart appliances, and industrial automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.1 Billion |

| Forecast Value | $111.7 Billion |

| CAGR | 5.6% |

The NAND Flash Market is segmented by memory density into several categories, including sub-32 Gb, 32 Gb - 128 Gb, 256 Gb - 1 Tb, and above 1 Tb. The sub-32 Gb segment is projected to generate USD 48 billion by 2034, driven by its widespread adoption in embedded systems, consumer electronics, and industrial applications. IoT devices, in particular, have contributed to the segment's growth as demand for compact, cost-effective, and energy-efficient storage solutions rises. NAND chips in this category are highly favored for use in smart appliances, automotive infotainment systems, and industrial automation, where performance and durability are critical.

Based on applications, the smartphones and tablets segment accounted for a 31.4% market share in 2024. The surge in mobile device usage, driven by increasing content creation, cloud-based storage, and AI-driven functionalities, has significantly contributed to this segment's expansion. Modern smartphones require substantial storage to handle high-resolution photos, 4K and 8K video, and advanced gaming experiences. As mobile devices continue to evolve, the demand for NAND flash solutions in this category is expected to remain strong throughout the forecast period.

The U.S. NAND Flash Market is expected to generate USD 30.6 billion by 2034. The country's well-established semiconductor research and development sector continues to drive innovation in NAND flash technology, further solidifying its position as a global leader in memory storage solutions. Major technology companies rely heavily on NAND flash storage for their data centers, ensuring sustained demand. As the U.S. remains at the forefront of the digital economy, the need for efficient, high-density storage solutions will continue to rise, shaping the future of the NAND flash market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-performance storage solutions in consumer electronics

- 3.2.1.2 Rising adoption of solid-state drives (SSDs) in data centres

- 3.2.1.3 Advancements in 3D NAND technology

- 3.2.1.4 Expansion of ai and IoT applications

- 3.2.1.5 Rising demand in automotive industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Rising competition and price pressure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Memory Density, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Sub-32 Gb

- 5.3 32 Gb - 128 Gb

- 5.4 256 Gb - 1 Tb

- 5.5 Above 1 Tb

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Smartphones and tablets

- 6.3 SSDs and enterprise storage

- 6.4 Consumer electronics

- 6.5 Industrial and automotive

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Technology Node, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 1x nm

- 7.3 1y nm

- 7.4 2x nm

- 7.5 3x nm and beyond

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADATA

- 9.2 Cypress Semiconductor

- 9.3 Greenliant Systems

- 9.4 Infineon Technologies

- 9.5 Intel

- 9.6 ISSI

- 9.7 Kingston Technology

- 9.8 Kioxia

- 9.9 Macronix International

- 9.10 Micron Technology

- 9.11 Netlist

- 9.12 Phison Electronics

- 9.13 Powerchip Semiconductor

- 9.14 Samsung Electronics

- 9.15 Sandisk

- 9.16 SK Hynix

- 9.17 SMIC

- 9.18 Western Digital

- 9.19 Winbond Electronics

- 9.20 Yangtze Memory Technologies Co. (YMTC)