|

市場調查報告書

商品編碼

1716612

鋼筋市場機會、成長動力、產業趨勢分析及2025-2034年預測Steel Rebar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

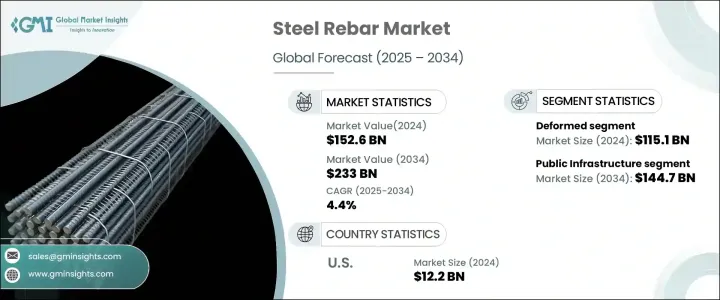

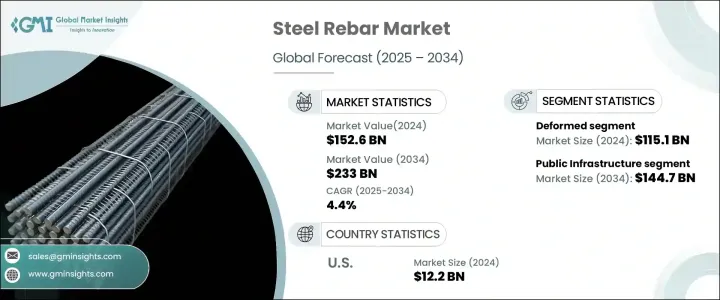

2024 年全球鋼筋市場規模達 1,526 億美元,預估 2025 年至 2034 年的複合年成長率為 4.4%。這一成長主要得益於基礎建設的大量投資,尤其是在新興經濟體。隨著各國不斷實現交通系統的現代化、城市地區的擴張和公共設施的加強,對鋼筋等可靠、高強度材料的需求持續激增。鋼筋對於加固混凝土結構以及提高其強度、穩定性和壽命至關重要。快速的城市化和人口成長導致住宅和商業領域的建築活動增加,進一步刺激了對鋼筋的需求。此外,政府旨在升級老化基礎設施和建造永續建築的措施也為製造商創造了豐厚的機會。鋼鐵製造技術的進步以及改善與混凝土黏合的創新鋼筋設計的引入也促進了市場的成長,從而能夠建造耐用且有彈性的結構。

鋼筋市場主要分為兩類:異型鋼筋和低碳鋼筋。螺紋鋼筋因其獨特的表面紋理和優異的粘合性能而聞名,2024 年其市場價值為 1151 億美元,預計到 2034 年複合年成長率將達到 4.4%。其對混凝土的增強黏合性可最大限度地減少滑移,並顯著提高結構穩定性,使其成為高應力應用的首選。這一領域的主導地位歸因於其在梁、柱和地基等鋼筋混凝土結構建造中的廣泛應用。隨著高層建築、橋樑、工業設施等大型基礎設施項目的不斷擴大,對螺紋鋼的需求仍然強勁。此外,人們對永續建築實踐的日益重視以及對抗震結構的需求進一步擴大了螺紋鋼筋的使用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1526億美元 |

| 預測值 | 2330億美元 |

| 複合年成長率 | 4.4% |

從應用角度來看,公共基礎設施領域在2024年佔據了61.6%的市場。許多國家正在向交通網路、機場和橋樑等大型基礎設施項目投入資金,這些項目都需要大量鋼筋進行結構加強。這些項目旨在創建能夠承受環境壓力並確保公共安全的持久耐用的基礎設施。對基礎設施現代化的高度重視,加上政府支持的措施和資金,正在推動公共基礎設施項目對高品質鋼筋的需求。隨著全球經濟體大力投資擴大城市景觀和改善公共設施,對鋼筋加強關鍵結構的依賴持續成長。

2024 年美國鋼筋市場價值為 122 億美元,預計受道路、橋樑和公共交通系統等基本基礎設施建設和維護支出增加的推動,該市場將穩步成長。政府旨在振興國家基礎設施的舉措,加上對建築材料的投資增加,正在推動美國對鋼筋的需求。市場參與者正致力於增強產品供應,以滿足大型公共工程和私人建築項目所需的嚴格品質標準,確保現代基礎設施的彈性和壽命。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 技術概述

- 監管格局

- 衝擊力

- 成長動力

- 建築業和房地產開發業蓬勃發展

- 增加房屋裝修和改造

- 注重能源效率

- 都市化進程加快,可支配所得增加

- 產業陷阱與挑戰

- 原物料成本和價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- 變形

- 輕微

第6章:市場估計與預測:依工藝,2021-2034

- 主要趨勢

- 鹼性氧氣煉鋼

- 電弧爐

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 住宅建築

- 公共基礎設施

- 工業的

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Acerinox SA

- ArcelorMittal

- Commercial Metals Company

- Daido Steel Co Ltd

- Gerdau S/A

- HBIS Group

- Jiangsu Shagang Group

- JSW

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- POSCO HOLDINGS INC.

- SAIL

- Steel Dynamics, Inc

- Tata Steel

The Global Steel Rebar Market reached USD 152.6 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. This growth is primarily driven by substantial investments in infrastructure development, particularly across emerging economies. As countries continue to modernize their transportation systems, expand urban areas, and enhance public utilities, the demand for reliable, high-strength materials such as steel rebar continues to surge. Steel rebar is essential for reinforcing concrete structures and improving their strength, stability, and longevity. Rapid urbanization and population growth have led to increased construction activities in both residential and commercial sectors, further boosting the demand for steel rebar. Moreover, government initiatives aimed at upgrading aging infrastructure and constructing sustainable buildings are creating lucrative opportunities for manufacturers. Technological advancements in steel manufacturing and the introduction of innovative rebar designs that improve bonding with concrete have also contributed to the market's growth, enabling the construction of durable and resilient structures.

The steel rebar market is segmented into two primary categories: deformed and mild steel rebar. Deformed steel rebar, known for its superior bonding properties due to its distinct surface patterns, generated USD 115.1 billion in 2024 and is projected to grow at a CAGR of 4.4% through 2034. Its enhanced adhesion to concrete minimizes slippage and significantly improves structural stability, making it the preferred choice in high-stress applications. This segment's dominance is attributed to its extensive use in the construction of reinforced concrete structures such as beams, columns, and foundations. As large-scale infrastructure projects, including high-rise buildings, bridges, and industrial facilities, continue to expand, the demand for deformed steel rebar remains robust. Additionally, the growing emphasis on sustainable construction practices and the need for earthquake-resistant structures are further amplifying the use of deformed steel rebar.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.6 Billion |

| Forecast Value | $233 Billion |

| CAGR | 4.4% |

In terms of application, the public infrastructure segment accounted for a 61.6% share of the market in 2024. Numerous countries are channeling investments into large-scale infrastructure projects such as transportation networks, airports, and bridges, all of which require significant quantities of steel rebar for structural reinforcement. These projects aim to create long-lasting, durable infrastructure that can withstand environmental stress and ensure public safety. The strong focus on infrastructure modernization, coupled with government-backed initiatives and funding, is fueling the demand for high-quality steel rebar in public infrastructure projects. As global economies invest heavily in expanding their urban landscapes and improving public utilities, the reliance on steel rebar to fortify critical structures continues to grow.

The U.S. steel rebar market was valued at USD 12.2 billion in 2024, with projections indicating steady growth driven by increased spending on the construction and maintenance of essential infrastructure, including roads, bridges, and public transportation systems. Government initiatives aimed at revitalizing the nation's infrastructure, combined with increased investments in building materials, are propelling the demand for steel rebar in the U.S. Market players are focusing on enhancing product offerings to meet the stringent quality standards required for large-scale public works and private construction projects, ensuring the resilience and longevity of modern infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising construction and real estate development

- 3.6.1.2 Increasing home renovation and remodeling

- 3.6.1.3 Focus on energy efficiency

- 3.6.1.4 Rising urbanization and rising disposable income

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Raw material costs and price volatility

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Million Tones)

- 5.1 Key trends

- 5.2 Deformed

- 5.3 Mild

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 (USD Million) (Million Tones)

- 6.1 Key trends

- 6.2 Basic oxygen steelmaking

- 6.3 Electric arc furnace

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Million Tones)

- 7.1 Key trends

- 7.2 Residential buildings

- 7.3 Public infrastructure

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Tones)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acerinox S.A

- 9.2 ArcelorMittal

- 9.3 Commercial Metals Company

- 9.4 Daido Steel Co Ltd

- 9.5 Gerdau S/A

- 9.6 HBIS Group

- 9.7 Jiangsu Shagang Group

- 9.8 JSW

- 9.9 NIPPON STEEL CORPORATION

- 9.10 NLMK

- 9.11 Nucor

- 9.12 POSCO HOLDINGS INC.

- 9.13 SAIL

- 9.14 Steel Dynamics, Inc

- 9.15 Tata Steel