|

市場調查報告書

商品編碼

1716604

汽車經銷商會計軟體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Auto Dealership Accounting Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

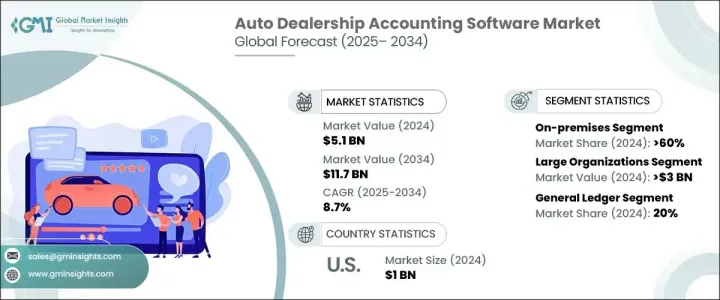

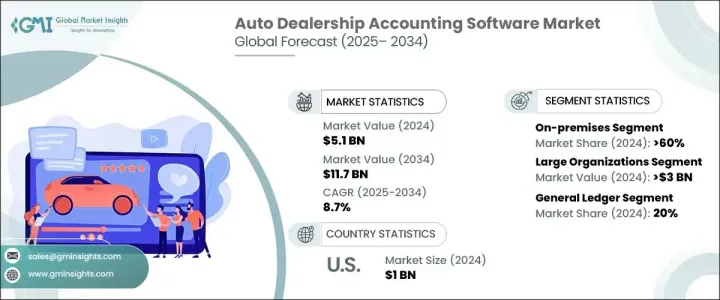

2024 年全球汽車經銷商會計軟體市場規模達到 51 億美元,預計 2025 年至 2034 年的複合年成長率為 8.7%。推動這一成長的主要動力是基於雲端的會計解決方案的廣泛採用。經銷商正在迅速轉向雲端平台,以提高營運效率、簡化財務流程並即時存取關鍵業務資料。隨著汽車產業財務管理日益複雜,企業越來越重視與經銷商管理系統 (DMS) 無縫整合的會計軟體。這種轉變使經銷商能夠實現稅務計算、工資處理、費用追蹤和合規管理的自動化,同時減少人工錯誤和營運成本。此外,基於雲端的解決方案具有高度可擴展性,使經銷商無需大量基礎設施投資即可擴展業務。

對數據驅動決策的偏好日益成長是推動市場擴張的另一個因素。汽車經銷商正在利用現代會計軟體中嵌入的高級分析和人工智慧 (AI) 功能來深入了解銷售趨勢、客戶購買行為和庫存週轉率。對人工智慧自動化工具的需求不斷成長,加速了軟體的採用,幫助企業最佳化其財務工作流程。隨著數位轉型成為焦點,軟體供應商正在整合機器學習演算法和預測分析,以提供增強的財務預測和風險評估能力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 117億美元 |

| 複合年成長率 | 8.7% |

市場根據部署模式分為基於雲端的解決方案和內部部署的解決方案。雖然基於雲端的系統越來越受歡迎,但內部部署解決方案在 2024 年佔據了 60% 的主導市場。許多經銷商喜歡內部部署會計軟體,因為安全性較高,並且能夠完全控制敏感財務資料。汽車銷售、醫療保健和金融服務等行業優先考慮嚴格的資料保護措施,儘管擴大轉向雲端技術,但內部部署解決方案仍是首選。

根據組織規模,市場分為大型企業和中小型企業(SME)。大型經銷商在 2024 年的營收為 30 億美元,這主要歸功於他們投資先進會計和經銷商管理軟體的財務能力。這些企業經營著廣泛的經銷商網路,需要整合的解決方案來管理庫存、銷售、客戶關係和合規性。透過利用全面的會計系統,大型組織可以提高透明度、改善現金流量管理並最佳化業務績效。

2024 年,北美將佔據汽車經銷商會計軟體市場的主導地位,市場佔有率為 34%,其中美國占主導地位。該國先進的基礎設施、強勁的經濟以及領先軟體公司的存在促進了對複雜會計解決方案的需求不斷成長。美國的監管架構推動企業採用合規的財務管理系統,進一步推動市場成長。隨著基於雲端和人工智慧的會計解決方案的日益普及,北美經銷商處於數位財務轉型的前沿,確保了營運效率和長期業務永續性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 軟體供應商

- 服務提供者

- 技術提供者

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 用例

- 衝擊力

- 成長動力

- 擴大採用基於雲端的會計解決方案

- 財務管理自動化需求不斷成長

- 嚴格的監管合規和稅務報告要求

- 與客戶關係管理 (CRM) 和企業資源規劃 (ERP) 系統整合

- 產業陷阱與挑戰

- 實施和維護成本高

- 資料安全和網路安全問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按軟體,2021 - 2034 年

- 主要趨勢

- 總帳

- 庫存管理

- 應付帳款和應收帳款

- 薪資管理

- 財務報告與分析

- 其他

第6章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 雲

- 本地

第7章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型組織

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Autosoft

- Autpraptor

- CAMS

- CDK Global

- DealerBuilt

- DealerSocket

- Fishbowl

- Frazer

- FreshBooks

- Intuit

- LBMC

- MYOB

- NetSuite

- PBS Systems

- Procede Software

- Reynolds and Reynolds

- RouteOne LLC

- Sage Group

- SAP SE

- Xero

The Global Auto Dealership Accounting Software Market reached USD 5.1 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. A primary driver fueling this growth is the widespread adoption of cloud-based accounting solutions. Dealerships are rapidly transitioning to cloud platforms to enhance operational efficiency, streamline financial processes, and gain real-time access to crucial business data. With the increasing complexity of financial management in the auto industry, businesses are prioritizing accounting software that integrates seamlessly with dealer management systems (DMS). This shift allows dealerships to automate tax calculations, payroll processing, expense tracking, and compliance management while reducing manual errors and operational costs. Additionally, cloud-based solutions are highly scalable, enabling dealerships to expand their operations without significant infrastructure investments.

The rising preference for data-driven decision-making is another factor propelling market expansion. Auto dealerships are leveraging advanced analytics and artificial intelligence (AI) features embedded within modern accounting software to gain insights into sales trends, customer purchasing behavior, and inventory turnover. The growing demand for AI-powered automation tools is accelerating software adoption, helping businesses optimize their financial workflows. As digital transformation takes center stage, software providers are integrating machine learning algorithms and predictive analytics to offer enhanced financial forecasting and risk assessment capabilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $11.7 Billion |

| CAGR | 8.7% |

The market is segmented by deployment mode into cloud-based and on-premises solutions. While cloud-based systems are gaining traction, on-premises solutions held a dominant 60% market share in 2024. Many dealerships prefer on-premises accounting software due to heightened security concerns and the ability to maintain full control over sensitive financial data. Industries such as automotive sales, healthcare, and financial services prioritize stringent data protection measures, making on-premises solutions a preferred choice despite the increasing shift toward cloud technology.

Based on organization size, the market is categorized into large enterprises and small to medium enterprises (SME ). Large dealerships accounted for USD 3 billion in revenue in 2024, largely due to their financial capability to invest in advanced accounting and dealer management software. These enterprises operate extensive dealership networks that require integrated solutions for managing inventory, sales, customer relationships, and compliance. By leveraging comprehensive accounting systems, large organizations can enhance transparency, improve cash flow management, and optimize business performance.

North America dominated the auto dealership accounting software market with a 34% share in 2024, led by the United States. The country's advanced infrastructure, strong economy, and the presence of leading software firms contribute to the growing demand for sophisticated accounting solutions. Regulatory frameworks in the U.S. push businesses toward adopting compliant financial management systems, further driving market growth. With the increasing adoption of cloud-based and AI-driven accounting solutions, North American dealerships are at the forefront of digital financial transformation, ensuring operational efficiency and long-term business sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Software providers

- 3.1.1.2 Service providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Use cases

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of cloud-based accounting solutions

- 3.6.1.2 Growing demand for automation in financial management

- 3.6.1.3 Stringent regulatory compliance and tax reporting requirements

- 3.6.1.4 Integration with Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High implementation and maintenance costs

- 3.6.2.2 Data security and cybersecurity concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Software, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 General ledger

- 5.3 Inventory management

- 5.4 Accounts payable and receivable

- 5.5 Payroll management

- 5.6 Financial reporting and analysis

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large organization

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autosoft

- 9.2 Autpraptor

- 9.3 CAMS

- 9.4 CDK Global

- 9.5 DealerBuilt

- 9.6 DealerSocket

- 9.7 Fishbowl

- 9.8 Frazer

- 9.9 FreshBooks

- 9.10 Intuit

- 9.11 LBMC

- 9.12 MYOB

- 9.13 NetSuite

- 9.14 PBS Systems

- 9.15 Procede Software

- 9.16 Reynolds and Reynolds

- 9.17 RouteOne LLC

- 9.18 Sage Group

- 9.19 SAP SE

- 9.20 Xero