|

市場調查報告書

商品編碼

1716600

工業齒輪箱市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Gearbox Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

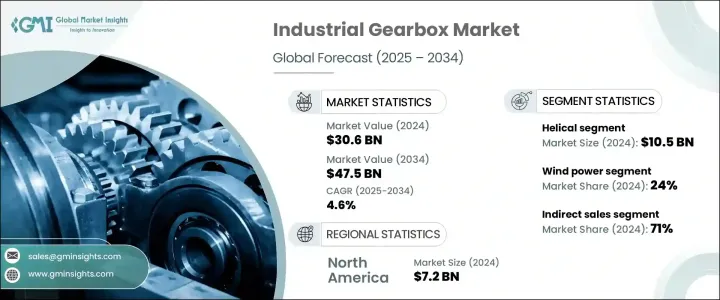

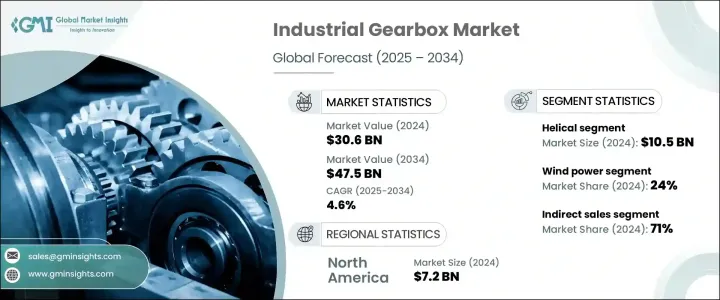

2024 年全球工業齒輪箱市場規模達到 306 億美元,預計 2025 年至 2034 年的複合年成長率為 4.6%。這一成長得益於各行業日益採用工業自動化以及齒輪箱技術的不斷進步。工業齒輪箱在CNC工具機、機器人、傳送系統和組裝線等自動化應用中發揮著至關重要的作用。這些系統需要能夠提供高扭力的變速箱,同時保持緊湊的設計以確保準確的動力傳輸。各行業對重型機械的需求不斷成長,進一步加速了市場擴張。全球對基礎設施、公共工程和建築業日益成長的需求也推動了建築機械對工業變速箱驅動器的需求。變速箱是起重機、升降機、起重設備以及物料搬運設備中必不可少的部件,在要求苛刻的應用中具有高可靠性和耐用性。

2024年,工業齒輪箱市場的斜齒輪部分價值將達到105億美元。預計從 2025 年到 2034 年,行星齒輪領域的複合年成長率將達到約 5%。斜齒輪以其運作平穩、耐用和承受高負荷的能力而聞名,廣泛應用於汽車、航太、工業機械和機器人等行業。汽車產業,尤其是自動變速箱汽車產量的不斷成長以及向電動車(EV)的日益轉變,是斜齒輪需求的重要來源。航太工業也依賴斜齒輪在惡劣條件下有效運作的能力,使其成為飛行、無人機和太空應用的理想選擇。亞太地區以其強大的汽車製造基礎引領斜齒輪的需求,中國、日本和印度等國家是主要供應國。歐洲由於注重替代能源和先進的汽車技術,也發揮關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 306億美元 |

| 預測值 | 475億美元 |

| 複合年成長率 | 4.6% |

受清潔和再生能源需求不斷成長的推動,風電領域到 2024 年將佔工業變速箱市場的約 24%。離岸風電場需要能夠承受惡劣環境條件的高容量、高效率變速箱,推動了這項成長。倉儲和物流等行業採用自動化進一步推動了對輸送系統和自動化機械中安全有效的變速箱的需求。電動車的日益普及也改變了變速箱的需求,因為電動車需要支援高扭力和高效傳輸能量的專用變速箱。

2024年,間接銷售將成為配銷通路的主導,佔超過71%的市場。對於需要客製化和大量採購的大規模工業應用,公司通常更喜歡直接分銷管道。同時,中小企業更傾向於從工業設備經銷商處採購,因為經銷商備有各種不同品牌的變速箱。當設備或機械需要專用變速箱時,一些公司會從 OEM 購買變速箱。

在北美,美國在 2024 年引領工業變速箱市場,佔約 80% 的區域市場佔有率,創造約 72 億美元的收入。美國市場的擴張受到變速箱技術的進步、多個行業需求的成長以及對專用變速箱日益成長的興趣的推動。製造業和能源等行業自動化程度的提高推動了對高效變速箱的需求,而對再生能源(尤其是風能)的投資繼續為市場成長創造機會。汽車領域電動車的興起進一步促進了傳動系統和轉向系統中對緊湊、高扭力變速箱的需求不斷增加。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 各行各業工業自動化的興起

- 整體變速箱技術的進步

- 產業陷阱與挑戰

- 維護要求高

- 齒輪磨損和故障

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 螺旋

- 斜角

- 蠕蟲

- 行星

- 其他(直齒、螺旋齒等)

第6章:市場估計與預測:按功率,2021-2034

- 主要趨勢

- 小型(高達 500 kW)

- 中型(500 千瓦至 10 兆瓦)

- 大型(10MW以上)

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 風力

- 物料處理

- 建造

- 海洋

- 能源

- 運輸

- 其他(農業、礦業等)

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Abex Corporation

- Bonfiglioli

- Davall Gears

- Elecon Engineering

- Flender

- HJ Corporation

- Ishibashi Manufacturing

- Kissling

- Nippon Gear

- Premium Transmission

- Schaeffler

- Stober Antriebstechnik

- Sumitomo Heavy Industries

- WM Berg

- ZF Friedrichshafen

The Global Industrial Gearbox Market reached USD 30.6 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2034. This growth is driven by the increasing adoption of industrial automation across diverse sectors and the continuous advancement in gearbox technology. Industrial gearboxes play a crucial role in automated applications such as CNC machines, robots, conveyor systems, and assembly lines. These systems require gearboxes that deliver high torque while maintaining compact designs to ensure accurate power transmission. The rising demand for heavy-duty machinery across industries further accelerates market expansion. The growing need for infrastructure, public works, and construction globally has also fueled the demand for industrial gearbox drives in construction machinery. Gearboxes are essential in cranes, lifts, hoists, and material-handling equipment, providing high reliability and durability in demanding applications.

In 2024, the helical segment of the industrial gearbox market accounted for USD 10.5 billion. The planetary segment is anticipated to grow at a CAGR of approximately 5% from 2025 to 2034. Helical gears, known for their smooth operation, durability, and capacity to handle high loads, are widely utilized in industries such as automotive, aerospace, industrial machinery, and robotics. The automotive industry, particularly with the growing production of automatic transmission vehicles and the increasing shift toward electric vehicles (EVs), is a significant source of demand for helical gears. The aerospace industry also relies on helical gears for their ability to function effectively in harsh conditions, making them ideal for use in flights, drones, and space applications. Asia Pacific leads the demand for helical gears, driven by its strong automobile manufacturing base, with countries like China, Japan, and India serving as major suppliers. Europe also plays a pivotal role due to its focus on alternative power and advanced automotive technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.6 Billion |

| Forecast Value | $47.5 Billion |

| CAGR | 4.6% |

The wind power segment accounted for approximately 24% of the industrial gearbox market in 2024, driven by increasing demand for clean and renewable energy sources. Offshore wind farms, which require high-capacity and efficient gearboxes capable of withstanding harsh environmental conditions, have fueled this growth. The adoption of automation in industries such as warehousing and logistics has further boosted the demand for secure and effective gearboxes in conveyor systems and automated machinery. The growing popularity of electric cars has also transformed gearbox demand, as EVs require specialized gearboxes that support high torque and transmit energy efficiently.

In 2024, indirect sales dominated the distribution channel, accounting for over 71% of the market share. Companies typically prefer direct distribution channels for large-scale industrial applications where customization and bulk purchases are essential. Meanwhile, small and medium-sized enterprises prefer purchasing from industrial equipment distributors who stock a wide variety of gearboxes from different brands. Some companies source gearboxes from OEMs when specialized gearboxes are needed for equipment or machinery.

In North America, the United States led the industrial gearbox market in 2024, holding around 80% of the regional market share and generating an estimated USD 7.2 billion in revenue. The US market's expansion is fueled by advancements in gearbox technology, rising demand from multiple industries, and growing interest in specialized gearboxes. Increasing automation in industries like manufacturing and energy has driven demand for efficient gearboxes, while investments in renewable energy, particularly wind power, continue to create opportunities for market growth. The rise of EVs in the automotive sector further contributes to the increasing need for compact, high-torque gearboxes in driveline and steering systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise of industrial automation across various sectors

- 3.6.1.2 Advancement in overall gearbox technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High maintenance requirement

- 3.6.2.2 Gear wear and failure

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Helical

- 5.3 Bevel

- 5.4 Worm

- 5.5 Planetary

- 5.6 Others (spur, spiral, etc.)

Chapter 6 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small (up to 500 kW)

- 6.3 Medium (500 kW to 10 MW)

- 6.4 Large (above 10 MW)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Wind power

- 7.3 Material handling

- 7.4 Construction

- 7.5 Marine

- 7.6 Energy

- 7.7 Transportation

- 7.8 Others (agriculture, mining etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Abex Corporation

- 10.2 Bonfiglioli

- 10.3 Davall Gears

- 10.4 Elecon Engineering

- 10.5 Flender

- 10.6 HJ Corporation

- 10.7 Ishibashi Manufacturing

- 10.8 Kissling

- 10.9 Nippon Gear

- 10.10 Premium Transmission

- 10.11 Schaeffler

- 10.12 Stober Antriebstechnik

- 10.13 Sumitomo Heavy Industries

- 10.14 WM Berg

- 10.15 ZF Friedrichshafen