|

市場調查報告書

商品編碼

1773434

變速箱及齒輪馬達市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gearbox and Gear Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

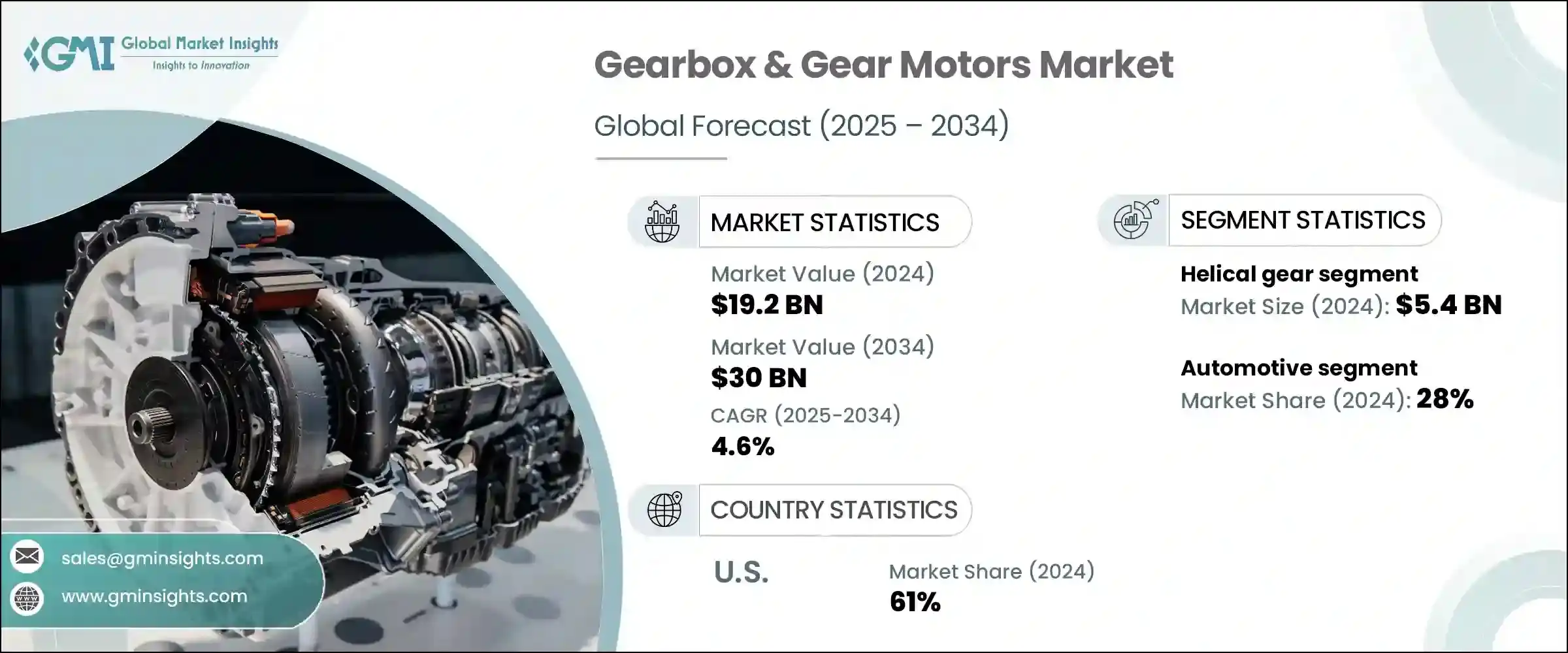

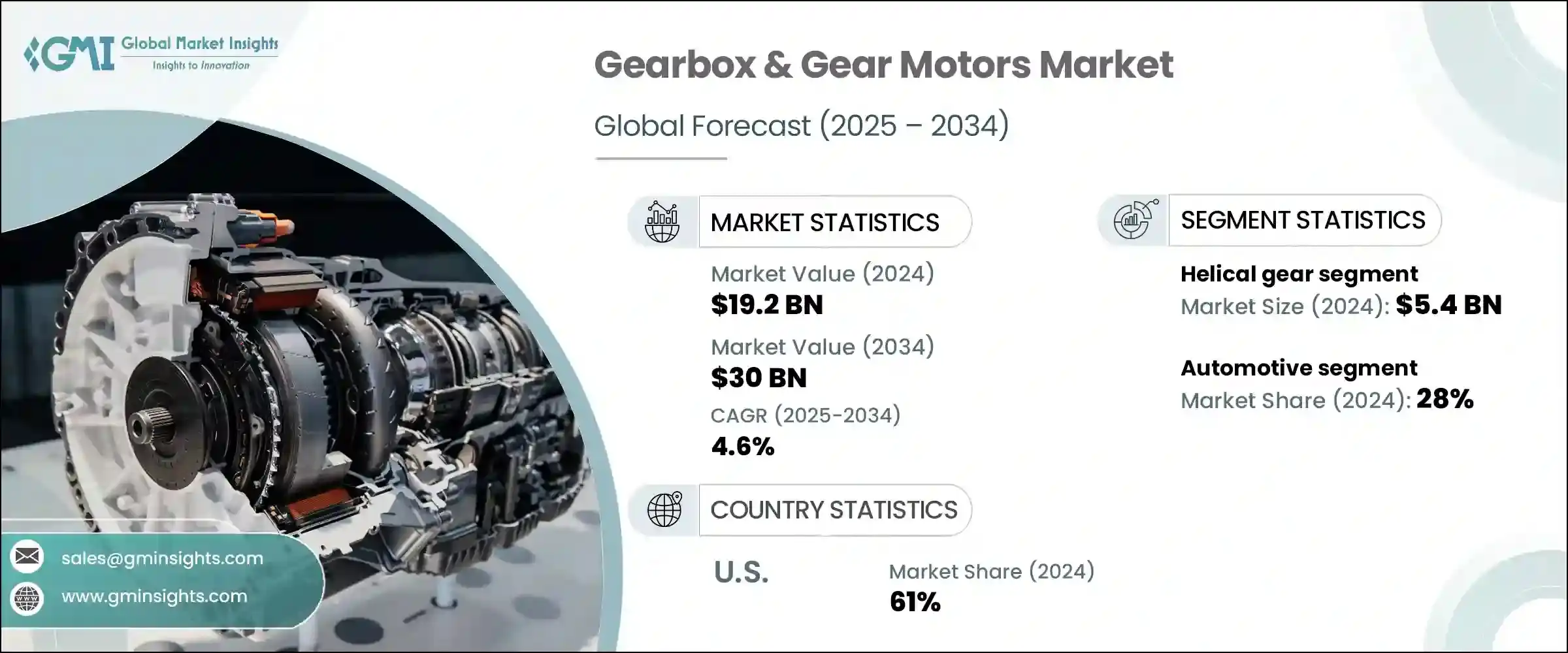

2024年,全球齒輪箱和齒輪馬達市場規模達192億美元,預計2034年將以4.6%的複合年成長率成長,達到300億美元。電動車的日益普及,以及工業自動化的不斷擴展和機器人技術的進步,持續推動市場需求。對清潔能源(尤其是風能)的投資不斷成長,進一步推動了各種電力應用領域對可靠、高性能齒輪馬達的需求。隨著全球各行各業致力於基礎設施現代化和能源效率的提高,對創新齒輪箱技術的需求也日益成長。

齒輪馬達,尤其是在能源領域,因其能夠增強能量捕獲和最佳化旋轉效率而變得越來越重要。因此,該市場在多個終端應用垂直領域(包括汽車、製造業和發電業)正呈現強勁成長。然而,儘管市場規模不斷擴大,高昂的維護費用仍然是一個顯著的障礙。齒輪組件、馬達和控制系統的整合特性增加了複雜性,通常需要專業的維護。零件價格波動以及對專業維護的需求也導致營運成本上升,這可能會阻礙其在成本敏感型市場的廣泛應用。儘管如此,持續的研發和產品改進正在幫助減少長期維護的擔憂。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 192億美元 |

| 預測值 | 300億美元 |

| 複合年成長率 | 4.6% |

斜齒輪領域在2024年創造了54億美元的市場規模。這些馬達採用斜齒設計,可最大限度地降低振動和運行噪音,並提高效率。它們通常用於需要平穩運動和高負載能力的行業,例如起重機、起重系統、輸送機械和重型工業工具。這些齒輪解決方案非常適合需要安靜運作和高扭力性能的環境,包括製造、自動化系統和醫療設備中的高精度應用。它們能夠承受高負載並提供高扭矩,也使其在物料搬運、採礦和基礎設施等行業中備受青睞。

2024年,汽車產業佔據了28%的市場。每年,各類汽車產量達數百萬輛,汽車產業對齒輪傳動系統的需求持續保持巨大且穩定。無論是電動、混合動力還是傳統的內燃機配置,變速箱對於實現最佳動力輸出至關重要。汽車行業的快速創新進一步增加了對齒輪部件的需求,這些部件能夠支援更高的燃油效率、先進的安全技術和流暢的駕駛體驗。現代車輛配備了多速系統和智慧齒輪機構,以滿足不斷變化的排放法規和性能要求。

2024年,美國變速箱和齒輪馬達市場佔61%的市場。工業自動化和智慧製造概念的廣泛應用推動了該市場的成長。包括建築、包裝、食品生產和製藥在內的多個行業正日益採用高效的動力傳輸技術。此外,工業機器人和能源基礎設施投資的不斷增加也創造了新的機會。美國製造商注重效率、可靠性和緊湊型設計,透過提供可客製化的產品線、低維護設計以及能夠進行狀態監測和預測性維護的智慧系統來推動創新。

影響全球變速箱和齒輪馬達市場的關鍵公司包括邦飛利 (Bonfiglioli SpA)、Elecon Engineering Co. Ltd.、Portescap、諾德驅動系統集團 (NORD Drivesystems Group)、Shanthi Gears Limited、日本電產 (Nidec Corporation)、Top Gear Transmissions、Dunkermoto CorporationReconn. (Siemens AG)、弗蘭德國際有限公司 (Flender International GmbH)、ABB、住友重工 (Sumitomo Heavy Industries Ltd.) 和 NGL。為了鞏固市場地位,領先的變速箱和齒輪馬達製造商正在採取一系列積極主動的策略。

許多企業正在大力投資產品開發,以打造高效能、低噪音、更長使用壽命和更少維護需求的解決方案。企業也在增強其全球供應鏈,並建立本地生產設施,以確保更好地回應區域需求。策略合作夥伴關係和收購正在幫助企業開拓新市場並擴展產品組合。此外,一些製造商正在整合智慧監控系統,用於即時診斷和預測性維護,以順應轉型為工業4.0的步伐。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 電動車需求不斷成長

- 再生能源領域的成長

- 工業自動化和機器人技術的進步

- 產業陷阱與挑戰

- 維護成本高

- 原料成本波動

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 斜齒輪

- 行星齒輪

- 錐齒輪

- 蝸輪

- 其他

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 變速箱

- 齒輪馬達單元

第7章:市場估計與預測:按額定功率,2021 - 2034 年

- 主要趨勢

- 高達 7.5 千瓦

- 7.5千瓦至75千瓦

- 75千瓦以上

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 物料處理

- 汽車

- 食品和飲料

- 醫療的

- 風力

- 金屬和採礦業

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ABB

- Bonfiglioli SpA

- Dunkermotoren

- Elecon Engineering Co. Ltd.

- Flender International GmbH

- NGL

- Nidec Corporation

- NORD Drivesystems Group

- Portescap

- Regal Rexnord Corporation

- SEW-EURODRIVE GmbH & Co. KG

- Shanthi Gears Limited

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Top Gear Transmissions

The Global Gearbox & Gear Motors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 30 billion by 2034. The rising popularity of electric vehicles, along with expanding industrial automation and advancements in robotics, continues to drive market demand. Growing investments in clean energy sources, particularly wind energy, are further boosting the need for dependable and high-performing gear motors across various power applications. As industries worldwide focus on modernizing infrastructure and improving energy efficiency, the demand for innovative gearbox technologies is surging.

Gear motors, especially in energy sectors, are becoming increasingly critical due to their ability to enhance energy capture and optimize rotational efficiency. As a result, the market is witnessing strong growth in several end-use verticals, including automotive, manufacturing, and power generation. However, despite this expansion, high upkeep expenses remain a notable barrier. The integrated nature of gear assemblies, motors, and control systems increases complexity, often requiring specialized servicing. Variability in component prices and the need for expert maintenance also contribute to elevated operational costs, which can deter broader adoption in cost-sensitive markets. Nevertheless, ongoing R&D and product enhancements are helping reduce long-term maintenance concerns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $30 Billion |

| CAGR | 4.6% |

The helical gear segment generated USD 5.4 billion in 2024. These motors are designed with angled teeth, minimizing vibration and operating noise and boosting efficiency. They're commonly found in industries requiring smooth motion and load capacity, such as cranes, hoisting systems, conveyor machinery, and heavy industrial tools. These gear solutions are well-suited for environments where quiet operation and torque performance are vital, including high-precision applications in manufacturing, automation systems, and medical devices. Their capacity to manage significant loads and deliver high torque also makes them favorable for sectors such as material handling, mining, and infrastructure.

In 2024, the automotive segment accounted for a 28% share. With millions of vehicles produced each year across various categories, the sector continues to generate a massive and consistent demand for gear-driven systems. Whether in electric, hybrid, or traditional internal combustion engine configurations, gearboxes remain essential for optimal power delivery. Rapid innovation within the automotive industry is further increasing the need for gear components that support enhanced fuel efficiency, advanced safety technologies, and seamless driving experiences. Modern vehicles are being equipped with multi-speed systems and smart gear mechanisms tailored for evolving emission regulations and performance requirements.

United States Gearbox & Gear Motors Market held a 61% share in 2024. Growth in this market is supported by the widespread implementation of industrial automation and smart manufacturing concepts. Multiple sectors-including construction, packaging, food production, and pharmaceuticals-are increasingly adopting efficient power transmission technologies. Additionally, rising investments in industrial robotics and energy infrastructure are creating new opportunities. With an emphasis on efficiency, reliability, and compact design, US manufacturers push innovation by offering customizable product lines, reduced-maintenance designs, and intelligent systems capable of condition monitoring and predictive maintenance.

Key companies shaping the Global Gearbox & Gear Motors Market include Bonfiglioli S.p.A., Elecon Engineering Co. Ltd., Portescap, NORD Drivesystems Group, Shanthi Gears Limited, Nidec Corporation, Top Gear Transmissions, Dunkermotoren, SEW-EURODRIVE GmbH & Co. KG, Regal Rexnord Corporation, Siemens AG, Flender International GmbH, ABB, Sumitomo Heavy Industries Ltd., and NGL. To strengthen their market standing, leading gearbox, and gear motor manufacturers are adopting a range of proactive strategies.

Many are investing significantly in product development to create high-efficiency and low-noise solutions with longer lifespans and reduced maintenance needs. Companies are also enhancing their global supply chains and establishing local production facilities to ensure better responsiveness to regional demands. Strategic partnerships and acquisitions are helping firms tap into new markets and extend product portfolios. Additionally, several manufacturers are incorporating smart monitoring systems for real-time diagnostics and predictive maintenance, aligning with the shift toward Industry 4.0.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Product Type

- 2.2.4 Rated Power

- 2.2.5 End use Industry

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electrical vehicles

- 3.2.1.2 Growth in renewable energy sector

- 3.2.1.3 Advancements in industrial automation and robotics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance costs

- 3.2.2.2 Fluctuations in raw material costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Helical gear

- 5.3 Planetary gear

- 5.4 Bevel gear

- 5.5 Worm gear

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Gearbox

- 6.3 Gear motor unit

Chapter 7 Market Estimates and Forecast, By Rated Power, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 7.5 kW

- 7.3 7.5 kW to 75 kW

- 7.4 Above 75 kW

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Material handling

- 8.3 Automotive

- 8.4 Food and beverages

- 8.5 Medical

- 8.6 Wind power

- 8.7 Metals and mining

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bonfiglioli S.p.A.

- 11.3 Dunkermotoren

- 11.4 Elecon Engineering Co. Ltd.

- 11.5 Flender International GmbH

- 11.6 NGL

- 11.7 Nidec Corporation

- 11.8 NORD Drivesystems Group

- 11.9 Portescap

- 11.10 Regal Rexnord Corporation

- 11.11 SEW-EURODRIVE GmbH & Co. KG

- 11.12 Shanthi Gears Limited

- 11.13 Siemens AG

- 11.14 Sumitomo Heavy Industries Ltd.

- 11.15 Top Gear Transmissions