|

市場調查報告書

商品編碼

1716546

採血椅市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Blood Drawing Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

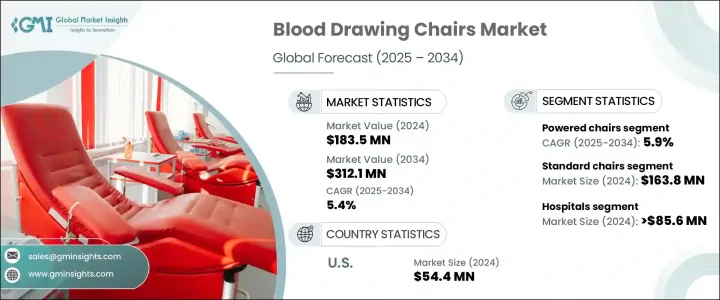

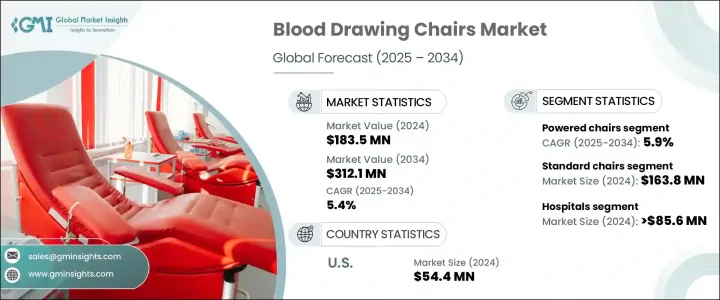

2024 年全球採血椅市場規模達到 1.835 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.4%。全球診斷中心、醫院和診所數量的不斷成長,以及全球對捐血的需求不斷成長,在很大程度上推動了該市場的穩定擴張。隨著糖尿病、心血管疾病和癌症等慢性疾病的不斷增加,常規血液檢查和診斷篩檢變得越來越重要,進一步推動了對高效且患者友善的血液採集解決方案的需求。醫療保健提供者越來越注重提高患者在手術過程中的舒適度和安全性,而抽血椅等專用設備對於確保順利有效地採血過程已成為不可或缺的。

這些椅子旨在為所有年齡和身體狀況的患者提供支持,幫助醫護人員輕鬆地進行抽血,同時最大限度地減少患者的不適。此外,家庭醫療服務和行動採血裝置的快速擴張(尤其是在已開發經濟體中)正在推動對攜帶式和自動採血椅的需求。椅子設計的創新,包括增強的人體工學和電動調節,也促進了市場的成長,因為這使得醫療保健提供者能夠有效地處理更多的患者,同時保持高品質的護理標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.835億美元 |

| 預測值 | 3.121億美元 |

| 複合年成長率 | 5.4% |

市場大致分為手動和電動採血椅,預計電動採血椅在 2025 年至 2034 年期間的複合年成長率為 5.9%。電動採血椅越來越受到青睞,這源自於其增強的功能和易用性。這些椅子可以讓醫護人員順利調整高度和位置,顯著提高病患和臨床醫師在採血過程中的舒適度。電動椅的多功能性也使其適用於常規抽血以外的各種醫療應用,包括小型手術和檢查,從而推動其在醫療機構中的廣泛應用。由於醫療保健提供者專注於改善患者的治療效果並減少手術時間,電動採血椅的多功能性和高效性使其成為現代醫療環境中的首選。

就最終用戶而言,醫院、捐血中心、診斷實驗室和其他醫療設施是關鍵部分。 2024 年醫院部分的收入為 8,560 萬美元,反映了住院和門診環境中抽血椅的大量使用。醫院依靠這些椅子進行常規診斷測試和術前評估,確保患者在抽血時處於舒適的位置。此外,農村和服務欠缺地區的醫療中心在刺激需求方面發揮著至關重要的作用,因為他們經常組織捐血活動和社區健康營,需要耐用舒適的抽血椅。

2024 年,美國採血椅市場產值達到 5,440 萬美元,家庭護理環境中的需求激增,其中家庭採血服務和行動採血裝置變得越來越受歡迎。隨著越來越多的患者選擇家庭醫療保健解決方案,對攜帶式、帶襯墊且易於使用的椅子的需求正在增加,以確保患者在家庭就診期間的安全和便利。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 血液和血液相關產品的需求日益成長

- 血液相關疾病盛行率上升

- 提高捐血意識

- 不斷成長的診斷測試和實驗室服務

- 產業陷阱與挑戰

- 高級採血椅價格昂貴

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術格局

- 定價分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- 手動椅

- 電動椅

第6章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 標準椅子

- 可調節的

- 不可調節

- 躺椅

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 醫院

- 捐血中心

- 診斷實驗室

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Clinton Industries

- The Brewer Company

- DUKAL Corporation

- Med Care Manufacturing

- Zhangjiagang Medi Medical Equipment

- VELA Medical

- SEERS Medical

- Plinth Medical

- Promotal

- Naugra Medical

- Remi Lab World

The Global Blood Drawing Chairs Market reached USD 183.5 million in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. The steady expansion of this market is largely fueled by the growing number of diagnostic centers, hospitals, and clinics worldwide, alongside a rising global demand for blood donations. As chronic diseases such as diabetes, cardiovascular conditions, and cancer continue to escalate, routine blood tests and diagnostic screenings are becoming essential, further driving the demand for efficient and patient-friendly blood collection solutions. Healthcare providers are increasingly focusing on enhancing patient comfort and safety during procedures, and specialized equipment like blood drawing chairs has become indispensable for ensuring smooth and effective blood collection processes.

These chairs are designed to support patients of all ages and physical conditions, helping healthcare professionals carry out blood draws with ease while minimizing patient discomfort. Additionally, the rapid expansion of home healthcare services and mobile phlebotomy units, especially in developed economies, is pushing the demand for portable and automated blood drawing chairs. Innovations in chair design, including enhanced ergonomics and motorized adjustments, are also contributing to market growth by allowing healthcare providers to handle a higher volume of patients efficiently while maintaining quality care standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $183.5 Million |

| Forecast Value | $312.1 Million |

| CAGR | 5.4% |

The market is broadly segmented into manual and powered blood drawing chairs, with powered chairs expected to exhibit a 5.9% CAGR from 2025 to 2034. The increasing preference for powered chairs stems from their enhanced functionality and ease of use. These chairs allow healthcare staff to adjust the height and position smoothly, significantly improving both patient and clinician comfort during blood collection. The multifunctionality of powered chairs also makes them suitable for various medical applications beyond routine blood draws, including minor procedures and examinations, driving their wider adoption across healthcare facilities. As healthcare providers focus on improving patient outcomes and reducing procedural time, the versatility and efficiency of powered blood drawing chairs make them a preferred choice in modern medical environments.

In terms of end users, hospitals, blood donation centers, diagnostic labs, and other medical facilities represent key segments. The hospital segment accounted for USD 85.6 million in 2024, reflecting the substantial use of blood drawing chairs in inpatient and outpatient settings. Hospitals rely on these chairs to facilitate routine diagnostic testing and pre-surgical evaluations, ensuring patients are positioned comfortably during blood draws. Furthermore, healthcare centers in rural and underserved regions are playing a vital role in fueling demand, as they frequently organize blood donation drives and community health camps that require durable and comfortable blood drawing chairs.

The U.S. blood drawing chairs market generated USD 54.4 million in 2024, with demand surging in homecare settings where in-home phlebotomy services and mobile blood collection units are becoming increasingly popular. As more patients opt for at-home healthcare solutions, the need for portable, cushioned, and easy-to-use chairs that ensure patient safety and convenience during home visits is on the rise.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing need for blood and blood-related products

- 3.2.1.2 Rising prevalence of blood-related disorders

- 3.2.1.3 Increasing awareness towards blood donation

- 3.2.1.4 Growing diagnostic testing and laboratory services

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced blood drawing chairs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technological landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

- 3.10 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manual chairs

- 5.3 Powered chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard chairs

- 6.2.1 Adjustable

- 6.2.2 Non-adjustable

- 6.3 Recliner chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Blood donation centers

- 7.4 Diagnostic laboratories

- 7.5 Ambulatory surgical centers

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Clinton Industries

- 9.2 The Brewer Company

- 9.3 DUKAL Corporation

- 9.4 Med Care Manufacturing

- 9.5 Zhangjiagang Medi Medical Equipment

- 9.6 VELA Medical

- 9.7 SEERS Medical

- 9.8 Plinth Medical

- 9.9 Promotal

- 9.10 Naugra Medical

- 9.11 Remi Lab World