|

市場調查報告書

商品編碼

1858994

專業醫療椅市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Specialty Medical Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

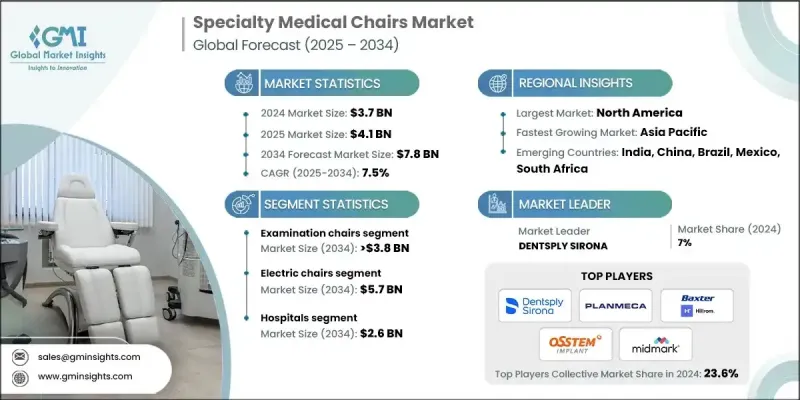

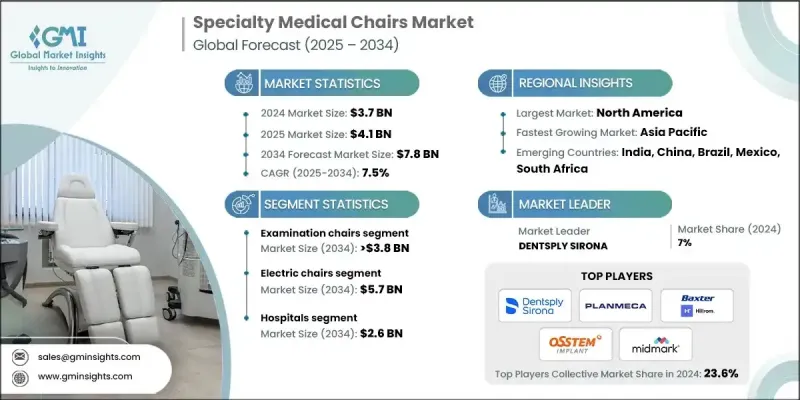

2024 年全球專業醫療椅市場價值為 37 億美元,預計到 2034 年將以 7.5% 的複合年成長率成長至 78 億美元。

市場擴張的驅動力在於對先進醫療設備日益成長的需求,這些設備能夠提升病患照護水準和臨床效率。專業醫療椅在多個醫療領域都至關重要,它們在治療過程中能夠顯著提高患者的舒適度、功能性和安全性。這些醫療椅擴大應用於牙科、眼科、耳鼻喉科、透析和復健等診療流程中,從而最佳化工作流程並提升治療效果。技術創新、自動化以及與數位平台的整合,已將這些醫療椅轉變為智慧醫療設備,能夠根據患者的特定需求進行調整。醫療服務提供者優先考慮符合現代衛生、感染控制和人體工學標準的設備。門診服務和居家治療方案的普及也推動了對攜帶式、易用型和多功能醫療椅的需求。對醫療基礎設施的投資,尤其是在拉丁美洲和亞太地區,正在促進更廣泛的市場應用。同時,研發工作和產品開發對於提升產品品質和符合監管要求至關重要。醫療服務提供者的目標是在醫院、專科護理單位和門診機構中,提供更優質的臨床服務,並改善病患的就醫體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 78億美元 |

| 複合年成長率 | 7.5% |

2024年,電動椅市佔率高達70.4%,預計到2034年將達到57億美元。其市場主導地位反映了對電動輔助功能(如電子定位、傾斜和高度調節)日益成長的需求,這些功能顯著提高了患者安全性和操作便利性。電動椅廣泛應用於需要持續使用的醫療環境中,例如手術室、恢復室和物理治療中心。它們能夠支持長時間的治療,同時最大限度地減少患者和照護者的負擔,因此成為臨床環境中的首選解決方案。

2024年,醫院領域佔據了35%的市場佔有率,預計到2034年將達到26億美元。該領域的成長與醫療基礎設施的擴張和醫院整合趨勢密切相關,尤其是在快速成長的經濟體中。市場對耐用且適應性強的醫用椅的需求不斷成長,這些醫用椅可用於心臟科、神經科、腫瘤科等多個科室,以及重症監護室和急診。醫院越來越重視能夠滿足高患者量環境下不斷變化的臨床需求的耐用設備。

預計到2024年,北美專業醫療椅市佔率將達到35%。心血管疾病、關節炎和糖尿病等慢性病的持續成長推高了長期照護需求,並增加了對先進座椅解決方案的需求。在美國,不斷攀升的醫療保健支出反映出醫療基礎設施和服務正朝著以患者為中心的方向發展。醫院投資的增加、專業設備的廣泛應用以及醫療中心和診所治療能力的提升,都為市場成長提供了支持。

全球專業醫療椅市場的主要參與者包括 OSSTEM、Midmark、Hill Laboratories、Baxter、A-dec、MARCO、PLANMECA、CLINTON INDUSTRIES、ActiveAid、Dentsply Sirona、Champion Healthcare Solutions、Lemi MD、FRESENIUS MEDICAL C、ATMOSALEinTech ARE、ATMOSA全球專業醫療椅市場的主要企業正透過有針對性的產品開發、併購和區域擴張來提升其競爭地位。許多企業正大力投資研發,以設計出符合人體工學、配備數位控制系統和先進安全功能的座椅。與醫療服務提供者和機構建立策略合作夥伴關係,使這些公司能夠使產品功能與臨床需求相符。一些企業也會在新興經濟體擴大生產規模,以滿足區域需求並降低對供應鏈的依賴。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 專科診所、血庫和急診中心的數量不斷增加

- 技術進步和對電動輪椅的需求

- 老年人口不斷成長,對復健治療的需求日益增加

- 門診手術量不斷增加

- 產業陷阱與挑戰

- 專業設備成本高昂

- 有限的報銷政策

- 市場機遇

- 擴大門診和家庭醫療保健服務

- 醫療旅遊成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 家庭醫療保健和門診服務機構的擴張

- 智慧互聯技術的融合

- 對符合人體工學和自適應設計的需求日益成長

- 技術格局

- 當前技術趨勢

- 攜帶式和家用專業醫療椅的成長

- 支援遠端監測的數位健康平台

- 方便患者使用的可調式自動專用座椅

- 新興技術

- 人工智慧驅動的使用分析和預測性維護

- 互聯物聯網專用醫療椅

- 具有個人化配置的自適應智慧座椅

- 當前技術趨勢

- 2024年各地區定價分析

- 產業演變

- 價值鏈分析

- 客戶體驗轉型與旅程最佳化

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新服務類型推出

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 考試主席

- 牙科

- 婦產科

- 透析

- 眼科

- 皮膚科

- 抽血

- 乳房X光檢查

- 其他考官

- 治療椅

- 牙科

- 眼科

- 耳鼻喉科

- 皮膚科

- 其他治療椅

- 復健椅

- 老人專用椅

- 兒童椅

- 肥胖症患者專用椅

- 其他復健椅

第6章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 電椅

- 手動椅

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 診所

- 門診手術中心(ASC)

- 點滴中心

- 緊急護理

- 復健中心

- 醫療水療中心

- 家庭護理機構

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ActiveAid

- A-dec

- ATMOS MedizinTechnik

- Baxter

- Champion Healthcare Solutions

- CLINTON INDUSTRIES

- DENTALEZ

- Dentsply Sirona

- FRESENIUS MEDICAL CARE

- Hill Laboratories

- Lemi MD

- MARCO

- Midmark

- OSSTEM

- PLANMECA

- TOPCON

The Global Specialty Medical Chairs Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 7.8 billion by 2034.

Market expansion is driven by rising demand for advanced healthcare equipment that enhances both patient care and clinical efficiency. Specialty medical chairs are essential across multiple medical disciplines, providing improved comfort, functionality, and safety during treatments. These chairs are increasingly integrated into dental, ophthalmology, ENT, dialysis, and rehabilitation procedures, optimizing workflow and supporting better therapeutic outcomes. Technological innovation, automation, and integration with digital platforms have transformed these chairs into smart medical assets, capable of adjusting to specific patient needs. Healthcare providers are prioritizing equipment that aligns with modern standards for hygiene, infection control, and ergonomic support. The shift toward outpatient services and in-home treatment options is also pushing demand for portable, user-friendly, and multi-use chairs. Investments in healthcare infrastructure, especially across Latin America and Asia-Pacific are fueling broader market adoption. Meanwhile, R&D efforts and product development are central to enhancing quality and compliance with regulatory expectations. Providers aim to deliver better clinical value while improving patient experiences across hospitals, specialty care units, and ambulatory facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.5% |

The electric chairs segment held a 70.4% share in 2024 and is projected to generate USD 5.7 billion by 2034. Their dominance reflects the rising need for power-assisted features like electronic positioning, recline, and height adjustment, which significantly enhance patient safety and operational convenience. These chairs are widely adopted in healthcare environments that demand continuous usage, including surgical suites, recovery rooms, and physical therapy centers. Their ability to support prolonged procedures with minimal strain on patients and caregivers makes them a preferred solution across clinical settings.

The hospital segment held a 35% share in 2024 and is anticipated to reach USD 2.6 billion by 2034. Growth in this segment is closely tied to the expansion of healthcare infrastructure and hospital consolidation trends, particularly in fast-growing economies. Demand is rising for durable and adaptable medical chairs that can be used across departments such as cardiology, neurology, and oncology, as well as in intensive care units and emergency services. Hospitals increasingly prioritize long-lasting equipment that meets the evolving clinical needs of high-patient-volume environments.

North America Specialty Medical Chairs Market held a 35% share in 2024. A steady rise in chronic conditions such as cardiovascular disease, arthritis, and diabetes is driving long-term care requirements and increasing the need for advanced seating solutions. In the U.S., escalating healthcare expenditures reflect a broader shift toward patient-centered infrastructure and services. Growth is supported by rising investments in hospitals, greater adoption of specialized equipment, and expanded treatment capacity across medical centers and clinics.

Key industry participants in the Global Specialty Medical Chairs Market include OSSTEM, Midmark, Hill Laboratories, Baxter, A-dec, MARCO, PLANMECA, CLINTON INDUSTRIES, ActiveAid, Dentsply Sirona, Champion Healthcare Solutions, Lemi MD, FRESENIUS MEDICAL CARE, ATMOS MedizinTechnik, DENTALEZ, and TOPCON. Major companies in the Global Specialty Medical Chairs Market are enhancing their competitive position through targeted product development, mergers, and regional expansion. Many are investing heavily in R&D to design chairs with enhanced ergonomics, digital control systems, and advanced safety features. Strategic partnerships with healthcare providers and institutions allow these firms to align product capabilities with clinical requirements. Some players are also expanding their manufacturing presence in emerging economies to meet regional demand and reduce supply chain dependencies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of specialty clinics, blood banks, and urgent care centers

- 3.2.1.2 Technological advancements and demand for powered chairs

- 3.2.1.3 Growing geriatric population and need for rehab procedures

- 3.2.1.4 Rising ambulatory surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized equipment

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and home healthcare

- 3.2.3.2 Medical tourism growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.5.1 Expansion in home healthcare and outpatient settings

- 3.5.2 Integration of smart and connected technologies

- 3.5.3 Rising demand for ergonomic and adaptive designs

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based specialty medical chairs

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly adjustable and automated specialty chairs

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-powered usage analytics and predictive maintenance

- 3.6.2.2 Connected and IoT-enabled specialty medical chairs

- 3.6.2.3 Adaptive and smart chairs with personalized configurations

- 3.6.1 Current technological trends

- 3.7 Pricing analysis, by region, 2024

- 3.8 Industry evolution

- 3.9 Value chain analysis

- 3.10 Customer experience transformation & journey optimization

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Examination chairs

- 5.2.1 Dental

- 5.2.2 OB/GYN

- 5.2.3 Dialysis

- 5.2.4 Ophthalmic

- 5.2.5 Dermatology

- 5.2.6 Blood drawing

- 5.2.7 Mammography

- 5.2.8 Other examination chairs

- 5.3 Treatment chairs

- 5.3.1 Dental

- 5.3.2 Ophthalmic

- 5.3.3 ENT

- 5.3.4 Dermatology

- 5.3.5 Other treatment chairs

- 5.4 Rehabilitation chairs

- 5.4.1 Geriatric chairs

- 5.4.2 Pediatric chairs

- 5.4.3 Bariatric chairs

- 5.4.4 Other rehabilitation chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electric chairs

- 6.3 Manual chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Infusion center

- 7.6 Urgent care

- 7.7 Rehabilitation centers

- 7.8 Medical spa

- 7.9 Home care settings

- 7.10 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ActiveAid

- 9.2 A-dec

- 9.3 ATMOS MedizinTechnik

- 9.4 Baxter

- 9.5 Champion Healthcare Solutions

- 9.6 CLINTON INDUSTRIES

- 9.7 DENTALEZ

- 9.8 Dentsply Sirona

- 9.9 FRESENIUS MEDICAL CARE

- 9.10 Hill Laboratories

- 9.11 Lemi MD

- 9.12 MARCO

- 9.13 Midmark

- 9.14 OSSTEM

- 9.15 PLANMECA

- 9.16 TOPCON