|

市場調查報告書

商品編碼

1716463

電鍋市場機會、成長動力、產業趨勢分析及2025-2034年預測Electric Rice Cooker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

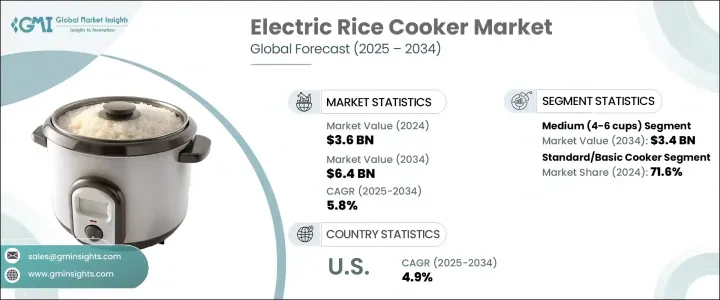

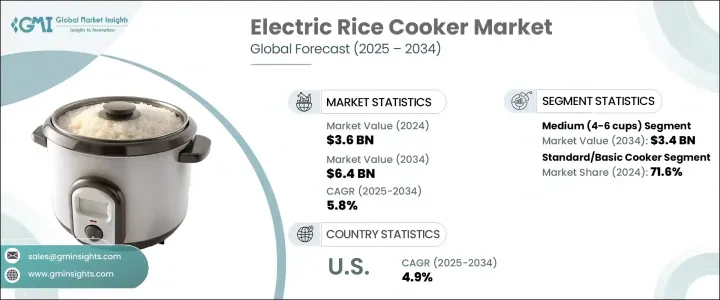

2024 年全球電鍋市場價值為 36 億美元,預計 2025 年至 2034 年期間將以 5.8% 的複合年成長率穩步成長。這一成長主要得益於全球可支配收入的增加和城市化進程的快速推進。隨著購買力的增加,越來越多的消費者開始選擇方便、高效、省時的現代廚房電器。城市化的特徵是居住空間越來越小,生活節奏越來越快,導致人們不再使用傳統的烹飪方式,對電鍋等緊湊、自動化的烹飪解決方案的需求強勁。此外,智慧家庭技術和節能電器的日益普及,增強了電鍋對不同人群的吸引力。消費者越來越尋求能夠簡化日常生活的智慧家電,而電鍋恰好契合了這個趨勢。它們的可編程設定、節能功能以及提供一致結果的能力與現代家庭不斷變化的偏好完美契合。

隨著越來越多的人開始忙碌地生活,電鍋的吸引力也越來越大。由於其易於使用、高效且能夠節省廚房時間,因此成為許多家庭(尤其是城市地區)的必需品。中型電鍋可煮 4-6 杯米飯,2024 年的市場規模為 19 億美元。這個細分市場之所以受歡迎,是因為其多功能性和價格實惠,非常適合小家庭、專業人士和單人家庭。中型型號在尺寸和容量之間實現了完美的平衡,讓消費者無需使用更大、更耗電的電器即可準備普通餐點。此外,年輕的專業人士和注重健康的個人對家常飯菜的偏好日益增加,也極大地促進了對這些炊具的需求的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 64億美元 |

| 複合年成長率 | 5.8% |

從產品類型來看,市場分為基礎型電鍋和多功能型電鍋。基本炊具在 2024 年創造了 26 億美元的市場價值,佔據了 71.6% 的主導市場佔有率。它們的簡單性、成本效益和可靠性使其成為許多消費者的首選,特別是在新興市場,因為價格在購買決策中起著重要作用。基本款炊具以較低的價格提供可靠的性能,讓更廣泛的消費者能夠使用。這些炊具在以米為主食的地區尤其受歡迎,精打細算的買家更重視其功能性而不是附加功能。同時,具有蒸煮、慢煮和可編程設定等先進功能的多功能型號正在受到那些尋求廚房電器更多功能的技術型消費者的青睞。

美國電鍋市場規模在 2024 年達到 5.3 億美元,預計 2025 年至 2034 年的複合年成長率為 4.9%。由於強勁的消費者支出、廣泛的消費者偏好以及完善的零售和電子商務管道,美國在北美保持主導地位。各大零售平台和網路商店讓美國消費者可以輕鬆購買到各種電鍋,從基本型號到更先進的多功能型號,滿足不同的烹飪需求。此外,人們對亞洲美食的興趣日益濃厚以及移民人口的不斷成長進一步推動了美國對電鍋的需求,美國消費者欣賞這些電器提供的便利性和一致性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 增加可支配所得和都市化

- 對快速方便的廚房電器的需求不斷成長

- 技術進步與產品創新

- 產業陷阱與挑戰

- 高級電鍋成本高

- 仿冒品的競爭

- 成長動力

- 技術概述

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 標準/基本型炊具

- 多功能炊具

第6章:市場估計與預測:依數量,2021 - 2034

- 主要趨勢

- 低(1-3 杯)

- 中(4-6杯)

- 大號(7+杯)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Aroma Housewares Company

- Black & Decker

- Breville Group Limited

- Cuckoo Electronics Company

- Electrolux AB

- Hamilton Holdings Company

- Hitachi Limited

- Koninklijke Philips NV

- Midea Group Company

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Tiger Corporation

- Toshiba Corporation

- Xiaomi Corporation

- Zojirushi Corporation

The Global Electric Rice Cooker Market, valued at USD 3.6 billion in 2024, is expected to experience steady growth at a CAGR of 5.8% from 2025 to 2034. This growth is primarily fueled by rising disposable incomes and the rapid pace of urbanization worldwide. As purchasing power increases, more consumers are turning to modern kitchen appliances that offer convenience, efficiency, and time-saving capabilities. Urbanization, characterized by smaller living spaces and increasingly fast-paced lifestyles, has led to a shift away from traditional cooking methods, creating a strong demand for compact and automated cooking solutions like electric rice cookers. Furthermore, the growing popularity of smart home technologies and energy-efficient appliances is enhancing the appeal of electric rice cookers across various demographics. Consumers are increasingly seeking smart appliances that simplify daily routines, and electric rice cookers fit seamlessly into this trend. Their programmable settings, energy-saving features, and ability to deliver consistent results align perfectly with the evolving preferences of modern households.

As more individuals adopt busy routines, the appeal of electric rice cookers continues to grow. Their ease of use, efficiency, and ability to save time in the kitchen have made them an essential item in many households, particularly in urban areas. The medium-sized cookers, capable of cooking 4-6 cups of rice, generated USD 1.9 billion in 2024. This segment's popularity stems from its versatility and affordability, making it ideal for small families, working professionals, and single-person households. Medium-sized models strike a perfect balance between size and capacity, allowing consumers to prepare regular meals without the need for larger, more power-hungry appliances. Additionally, the increasing preference for home-cooked meals among young professionals and health-conscious individuals has contributed significantly to the rising demand for these cookers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.8% |

In terms of product types, the market is divided between basic electric rice cookers and multifunctional models. Basic cookers, which generated USD 2.6 billion in 2024, held a dominant 71.6% market share. Their simplicity, cost-effectiveness, and reliability have made them the preferred choice for many consumers, particularly in emerging markets where affordability plays a significant role in purchasing decisions. Basic cookers provide dependable performance at a lower price point, making them accessible to a wider range of consumers. These cookers are especially popular in regions where rice is a staple food, and budget-conscious buyers prioritize function over additional features. Meanwhile, multifunctional models offering advanced features, such as steaming, slow cooking, and programmable settings, are gaining traction among tech-savvy consumers seeking more versatility in their kitchen appliances.

The U.S. Electric Rice Cooker Market reached USD 0.53 billion in 2024, with a projected CAGR of 4.9% from 2025 to 2034. The U.S. maintains a dominant position in North America due to strong consumer spending, a wide range of consumer preferences, and the presence of well-established retail and e-commerce channels. Major retail platforms and online stores make it easy for American consumers to access a variety of electric rice cookers, from basic models to more advanced, multifunctional units catering to diverse cooking needs. Additionally, the increasing interest in Asian cuisine and the growing immigrant population have further driven demand for electric rice cookers in the U.S., where consumers appreciate the convenience and consistency these appliances offer.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing disposable income and urbanization

- 3.2.1.2 Growing demand for quick and convenient kitchen appliances

- 3.2.1.3 Technological advancements and product innovations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced electric rice cookers

- 3.2.2.2 Competition from counterfeit products

- 3.2.1 Growth drivers

- 3.3 Technological overview

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key Trends

- 5.2 Standard/Basic cooker

- 5.3 Multifunctional cooker

Chapter 6 Market Estimates & Forecast, By Volume, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (1-3 Cups)

- 6.3 Medium (4-6 Cups)

- 6.4 Large (7+ Cups)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Aroma Housewares Company

- 10.2 Black & Decker

- 10.3 Breville Group Limited

- 10.4 Cuckoo Electronics Company

- 10.5 Electrolux AB

- 10.6 Hamilton Holdings Company

- 10.7 Hitachi Limited

- 10.8 Koninklijke Philips NV

- 10.9 Midea Group Company

- 10.10 Mitsubishi Electric Corporation

- 10.11 Panasonic Corporation

- 10.12 Tiger Corporation

- 10.13 Toshiba Corporation

- 10.14 Xiaomi Corporation

- 10.15 Zojirushi Corporation