|

市場調查報告書

商品編碼

1716449

伴侶動物藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Companion Animal Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

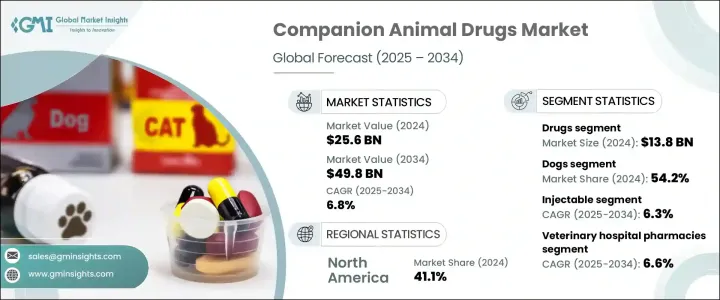

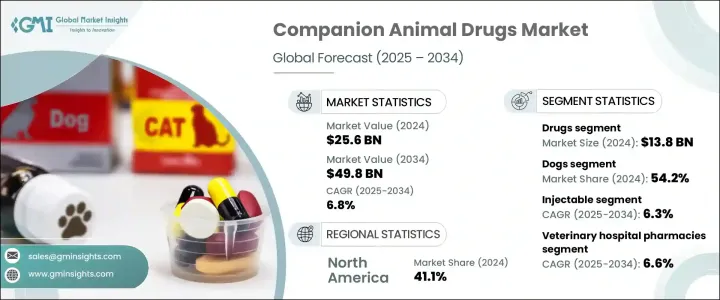

2024 年全球伴侶動物藥物市場價值為 256 億美元,預計 2025 年至 2034 年的複合年成長率為 6.8%。伴侶動物的收養率不斷提高、寵物慢性病盛行率不斷上升以及寵物主人對先進治療和獸醫護理的投資意願不斷增強,推動了這一成長。寵物主人擴大將他們的動物視為家庭成員,這促使他們花錢進行預防性護理、接種疫苗和藥物治療,以確保它們的健康。這種態度的轉變對市場擴張做出了巨大貢獻。隨著獸醫科學的不斷進步,創新配方、標靶治療和改進的藥物傳遞方法正在提高寵物主人的治療效果和依從性,從而加速市場成長。

藥品領域在 2024 年佔據了 138 億美元的最高市場佔有率,由於寵物慢性病和感染發病率的上升,該領域將繼續佔據市場主導地位。寵物擁有量的增加和寵物人性化趨勢的日益增強推動了對抗生素、消炎藥和殺寄生蟲藥的需求。製藥公司正積極投資研發,推出咀嚼片和調味藥物等新劑型,讓給藥更容易,提高依從性。獸醫學領域的監管批准和創新也在推動該領域持續成長方面發揮了關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 256億美元 |

| 預測值 | 498億美元 |

| 複合年成長率 | 6.8% |

按動物類型分類,受高收養率和狗護理支出增加的推動,狗類在 2024 年保持了 54.2% 的最大收入佔有率。人們對狗的慢性疾病(如癌症和糖尿病)的認知不斷提高,導致對先進治療和藥物的需求增加。這些疾病的盛行率不斷上升,凸顯了對有效治療的需求,促使製藥公司開發針對犬類健康的專門藥物。全面的醫療保健選擇和寵物主人支出的增加進一步促進了該領域的成長。

注射給藥途徑在 2024 年佔據最大的市場佔有率,預計在預測期內將以 6.3% 的複合年成長率實現顯著成長。注射藥物,包括疫苗、抗生素和止痛藥,具有快速起效和精確劑量的特點,是緊急治療的理想選擇。注射藥物傳輸技術的進步和無針注射器的引入提高了寵物及其主人的便利性並減少了壓力,促使人們越來越喜歡這種方式。

2024 年,獸醫院藥局佔據了配銷通路的主導地位,預計 2025 年至 2034 年的複合年成長率將達到 6.6%。這些藥房提供各種動物保健產品,包括處方藥、疫苗和補充劑,使其成為寵物主人的可靠來源。他們建立的聲譽、品質保證以及配藥方面的專業知識推動了他們在市場上的持續主導地位。

2024 年,北美佔最大市場佔有率,為 41.1%,其中美國的收入為 91 億美元。該地區受益於發達的獸醫醫療保健體系、較高的寵物擁有率以及寵物醫療保健支出的增加,支持了伴侶動物藥物市場的持續成長。領先製藥公司的存在進一步確保了創新有效藥物的穩定供應,推動了該地區市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球寵物保險需求激增

- 伴侶動物肥胖率上升

- 全球政府加大對寵物照護的支持

- 在線獸醫藥房的需求不斷成長

- 產業陷阱與挑戰

- 伴侶動物藥物成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 差距分析

- 消費者行為趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 藥物

- 抗寄生蟲藥

- 消炎劑

- 抗感染藥物

- 皮質類固醇

- 鎮靜劑

- 心血管藥物

- 胃腸道藥物

- 疫苗

- 減毒活疫苗(MLV)

- 去活化疫苗

- 重組疫苗

- 藥物飼料添加劑

- 抗生素

- 維生素

- 胺基酸

- 酵素

- 抗氧化劑

- 益生元和益生菌

- 礦物質

- 碳水化合物

- 丙二醇

第6章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 狗

- 貓

- 馬匹

- 其他動物類型

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

- 外用

- 其他給藥途徑

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 獸醫院藥房

- 電子商務

- 零售藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 波蘭

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 台灣

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 海灣合作理事會國家

- 以色列

第10章:公司簡介

- Agrolabo

- Boehringer Ingelheim International

- Ceva Sante Animale

- Chanelle Pharma

- Dechra Pharmaceuticals

- Elanco Animal Health Incorporated

- Endovac Animal Health

- HIPRA

- Indian Immunologicals

- Merck.

- Norbrook

- Symrise

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Drugs Market was valued at USD 25.6 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2034. The increasing adoption of companion animals, the rising prevalence of chronic diseases in pets, and the growing willingness of pet owners to invest in advanced treatments and veterinary care are fueling this growth. Pet owners increasingly perceive their animals as family members, prompting them to spend on preventive care, vaccinations, and medications to ensure their well-being. This shift in attitude has contributed significantly to the expansion of the market. As veterinary science continues to advance, innovative formulations, targeted therapies, and improved drug delivery methods are enhancing treatment efficacy and compliance among pet owners, thereby accelerating market growth.

The drugs segment, which accounted for the highest market share of USD 13.8 billion in 2024, continues to dominate the market due to the rising incidence of chronic diseases and infections in pets. Increased pet ownership and the growing trend of pet humanization have boosted the demand for antibiotics, anti-inflammatory drugs, and parasiticides. Pharmaceutical companies are actively investing in research and development to introduce novel formulations such as chewable tablets and flavored medications, making administration easier and improving compliance. Regulatory approvals and innovations in veterinary medicine have also played a pivotal role in driving the sustained growth of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $49.8 Billion |

| CAGR | 6.8% |

By animal type, the dogs segment maintained the largest revenue share of 54.2% in 2024, driven by high adoption rates and increased spending on dog care. Growing awareness of chronic diseases among dogs, such as cancer and diabetes, has led to a higher demand for advanced treatments and medications. The rising prevalence of these conditions highlights the need for effective therapies, encouraging pharmaceutical companies to develop specialized drugs targeting canine health. The availability of comprehensive healthcare options and increased expenditure by pet owners further bolster segment growth.

The injectable route of administration, which held the largest market share in 2024, is anticipated to witness significant growth at a CAGR of 6.3% during the forecast period. Injectable drugs, including vaccines, antibiotics, and analgesics, offer rapid onset of action and precise dosing, making them ideal for emergency treatments. Advancements in injectable drug delivery technologies and the introduction of needle-free injectors have enhanced convenience and reduced stress for both pets and their owners, contributing to the growing preference for this route.

Veterinary hospital pharmacies dominated the distribution channel in 2024 and are projected to grow at a CAGR of 6.6% from 2025 to 2034. These pharmacies offer a wide range of animal healthcare products, including prescription drugs, vaccines, and supplements, making them a reliable source for pet owners. Their established reputation, quality assurance, and expertise in dispensing medications drive their continued dominance in the market.

North America accounted for the largest market share of 41.1% in 2024, with the U.S. generating USD 9.1 billion in revenue. The region benefits from a well-developed veterinary healthcare system, high pet ownership rates, and increased spending on pet healthcare, supporting the continuous growth of the companion animal drugs market. The presence of leading pharmaceutical companies further ensures a steady supply of innovative and effective drugs, driving the expansion of the market in this region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging demand for pet insurance policies worldwide

- 3.2.1.2 Rising rate of obesity in companion animals

- 3.2.1.3 Increasing government support for pet care across the globe

- 3.2.1.4 Growing demand for online veterinary pharmacies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with companion animal drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 GAP analysis

- 3.6 Consumer behaviour trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Drugs

- 5.2.1 Antiparasitic

- 5.2.2 Anti-inflammatory

- 5.2.3 Anti-infectives

- 5.2.4 Corticosteroids

- 5.2.5 Tranquilizers

- 5.2.6 Cardiovascular drugs

- 5.2.7 Gastrointestinal drugs

- 5.3 Vaccines

- 5.3.1 Modified live vaccines (MLV)

- 5.3.2 Killed inactivated vaccines

- 5.3.3 Recombinant vaccines

- 5.4 Medicated feed additives

- 5.4.1 Antibiotics

- 5.4.2 Vitamins

- 5.4.3 Amino acids

- 5.4.4 Enzymes

- 5.4.5 Antioxidants

- 5.4.6 Prebiotics and probiotics

- 5.4.7 Minerals

- 5.4.8 Carbohydrates

- 5.4.9 Propandiol

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

- 6.5 Other animal types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 E-commerce

- 8.4 Retail pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Taiwan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 GCC Countries

- 9.6.3 Israel

Chapter 10 Company Profiles

- 10.1 Agrolabo

- 10.2 Boehringer Ingelheim International

- 10.3 Ceva Sante Animale

- 10.4 Chanelle Pharma

- 10.5 Dechra Pharmaceuticals

- 10.6 Elanco Animal Health Incorporated

- 10.7 Endovac Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck.

- 10.11 Norbrook

- 10.12 Symrise

- 10.13 Vetoquinol

- 10.14 Virbac

- 10.15 Zoetis