|

市場調查報告書

商品編碼

1773226

伴侶動物保健市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Companion Animal Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

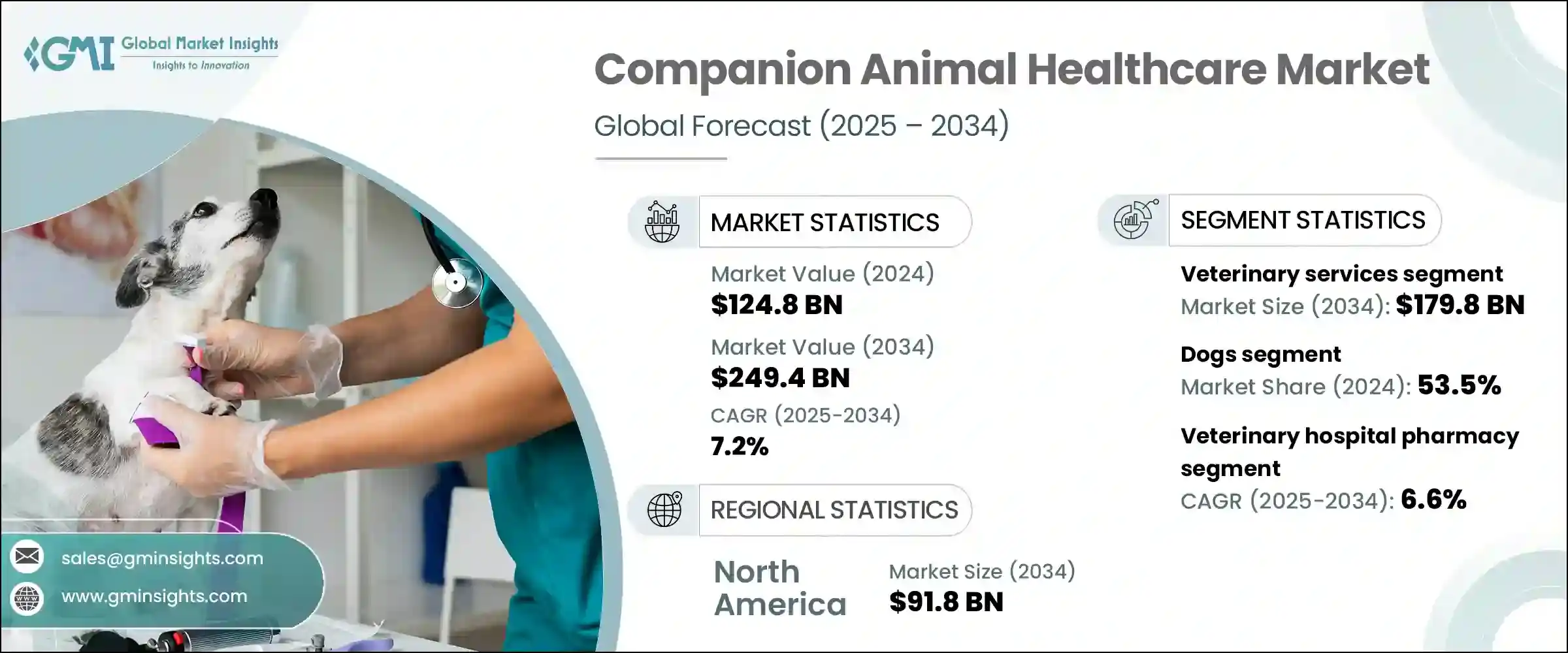

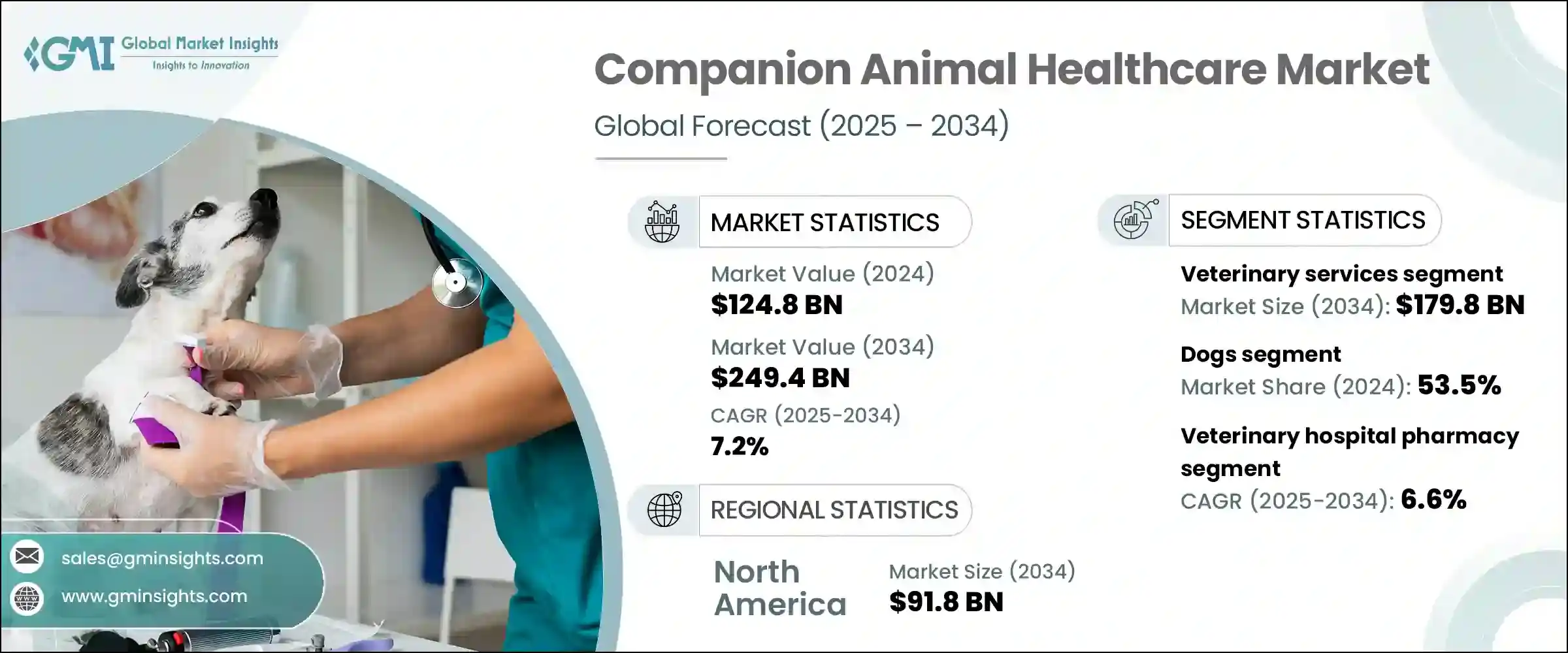

2024年,全球伴侶動物保健市場規模達1,248億美元,預計到2034年將以7.2%的複合年成長率成長,達到2,494億美元。寵物日益人性化,以及人們對動物健康和保健意識的不斷提升,導致對綜合獸醫解決方案的需求不斷成長。如今,越來越多的寵物主人積極投資於預防性醫療保健、定期健康體檢和寄生蟲控制,從而推動了伴侶動物保健領域的支出成長。除了這些行為轉變之外,全球寵物收養率的上升和可支配收入的提高也進一步刺激了對寵物醫療服務、產品和高級護理解決方案的需求。

獸醫護理領域的數位轉型也已成為關鍵的成長動力。隨著遠距醫療平台和遠端監控工具的引入,寵物主人可以比以往更便捷地獲得獸醫專業知識。寵物保險的日益普及也使市場受益,這提高了寵物醫療的可負擔性,並增加了獲得必要治療和預防保健服務的管道。隨著寵物主人擴大尋求為其寵物提供專業和全面的醫療保健,該行業不斷創新,推出健康產品和數位工具,以增強護理服務。這些進步不僅擴大了獸醫服務的覆蓋範圍,也改善了不同動物物種的健康狀況。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1248億美元 |

| 預測值 | 2494億美元 |

| 複合年成長率 | 7.2% |

伴侶動物醫療保健涵蓋了為家養動物(例如狗、貓、馬等)設計的廣泛的醫療服務和解決方案。該市場涵蓋各種產品和服務,從藥品、診斷到獸醫服務。在這些細分市場中,獸醫服務在2024年佔據最大佔有率,價值890億美元,預計到2034年將加倍,達到1798億美元。此細分市場提供廣泛的服務,例如醫療、寵物寄養、美容、訓練、保險服務和健康計劃。伴侶動物慢性病盛行率的上升以及常規和預防性照護支出的增加,持續推動對這些服務的需求。

根據動物種類,市場可分為狗、貓、馬和其他動物。 2024年,狗類市場佔據全球市場佔有率的53.5%,領先全球市場。強勁表現得益於狗作為家庭伴侶的普及,這意味著在營養、常規體檢、疫苗接種、美容和特殊治療方面的支出增加。寵物主人也越來越關注特定品種的健康需求,並擴大選擇量身定做的健康計劃,這進一步增強了這一領域的需求。

從通路來看,伴侶動物保健市場細分為獸醫院藥局、零售藥局和電商平台。獸醫院藥局在2024年佔據了最大的市場佔有率,預計在預測期內將以6.6%的複合年成長率成長。這些藥房通常設在獸醫院和診所內,方便患者在諮詢後立即獲得處方藥和非處方藥。由於靠近診斷和治療中心,這些藥房可以更快地配藥並提供個人指導。此外,這些藥房配備了專業的獸醫藥理學人員,提高了寵物治療的安全性和精準度。隨著處方藥和複雜療法的需求不斷成長,這一細分市場的相關性和影響力也將持續擴大。

從區域來看,北美引領全球伴侶動物保健市場,2024年營收達544億美元,預計2034年將達到918億美元,複合年成長率為5.4%。該地區受益於完善的獸醫基礎設施、高度的寵物健康意識以及強大的保險生態系統。強大的診所網路、日益成長的人工智慧診斷應用以及成熟的寵物護理市場進一步鞏固了其領先地位。北美還擁有多家從事寵物藥物、診斷和健康解決方案開發與分銷的公司,這有助於其在全球市場中保持競爭優勢。

伴侶動物保健市場競爭激烈,全球企業和專業供應商均力求提升自身影響力。產業參與者透過投資研發、數位技術和服務拓展,不斷提升自身產品服務。合作夥伴關係、數位醫療創新以及對個人化寵物照護的關注等策略性舉措,將繼續主導這一快速發展產業的競爭態勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有率上升

- 慢性病盛行率不斷上升

- 不斷進步的技術

- 擴大獸醫服務線上平台

- 產業陷阱與挑戰

- 治療費用高昂

- 發展中地區的准入受限

- 市場機會

- 擴大寵物保險覆蓋範圍

- 個性化獸藥需求不斷成長

- 成長動力

- 成長潛力分析

- 2024年寵物數量統計

- 報銷場景

- 動物保健產業的創投場景

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 製藥

- 藥物

- 抗寄生蟲藥

- 消炎劑

- 抗感染藥物

- 皮質類固醇

- 鎮靜劑

- 心血管藥物

- 胃腸道藥物

- 疫苗

- 減毒活疫苗(MLV)

- 去活化疫苗

- 重組疫苗

- 藥物飼料添加劑

- 抗生素

- 維生素

- 胺基酸

- 酵素

- 抗氧化劑

- 益生元和益生菌

- 礦物質

- 碳水化合物

- 丙二醇

- 藥物

- 醫療器材

- 獸醫診斷設備

- 獸醫麻醉設備

- 獸醫病人監護設備

- 獸醫手術設備

- 獸醫耗材

- 其他醫療器材

- 獸醫服務

- 美容服務

- 寄宿及日托

- 培訓服務

- 寵物保險

- 醫療服務

- 其他獸醫服務

第6章:市場估計與預測:按動物,2021 - 2034 年

- 主要趨勢

- 狗

- 貓

- 馬匹

- 其他動物

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 電子商務

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B Braun

- Boehringer Ingelheim

- Ceva

- Dechra

- Elanco

- Endovac

- Figo Pet Insurance

- Hartville

- Hester

- HIPRA

- Hollard

- IDEXX Laboratories

- Mars

- Medtronic

- Merck

- Neogen

- PetIQ

- Phibro

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Healthcare Market was valued at USD 124.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 249.4 billion by 2034. The increasing humanization of pets, along with the growing awareness around animal health and wellness, has led to a rising demand for comprehensive veterinary solutions. More pet owners today are actively investing in preventive healthcare, regular wellness checkups, and parasite control, contributing to higher spending across the companion animal health sector. Alongside these behavioral shifts, rising global pet adoption rates and higher disposable incomes are further fueling the demand for medical services, products, and advanced care solutions for pets.

Digital transformation in veterinary care has also emerged as a key growth driver. With the introduction of telemedicine platforms and remote monitoring tools, pet owners can access veterinary expertise more conveniently than ever before. The market is also benefiting from the growing adoption of pet insurance, which improves affordability and access to necessary treatments and preventive care services. As pet owners increasingly seek specialized and holistic healthcare for their animals, the industry continues to innovate with wellness products and digital tools that enhance care delivery. These advancements are not only expanding the reach of veterinary services but also improving health outcomes across various animal species.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.8 Billion |

| Forecast Value | $249.4 Billion |

| CAGR | 7.2% |

Companion animal healthcare encompasses a wide spectrum of medical services and solutions designed for domesticated animals such as dogs, cats, horses, and others. The market includes a variety of products and services, from pharmaceuticals and diagnostics to veterinary services. Among these segments, veterinary services held the largest share in 2024, valued at USD 89 billion, and are expected to double to USD 179.8 billion by 2034. This segment includes a broad range of offerings such as medical treatments, pet boarding, grooming, training, insurance services, and wellness programs. The rising prevalence of chronic conditions among companion animals and increasing expenditures on routine and preventive care continue to drive demand for these services.

Based on the type of animal, the market is divided into dogs, cats, horses, and others. The dogs segment led the global market in 2024, accounting for a 53.5% share. This strong performance is attributed to the high popularity of dogs as household companions, which translates into greater spending on nutrition, routine checkups, vaccinations, grooming, and specialized treatments. Pet owners are also becoming more aware of breed-specific health needs and are increasingly opting for tailored wellness plans, thereby further strengthening the demand within this segment.

In terms of distribution, the companion animal healthcare market is segmented into veterinary hospital pharmacies, retail pharmacies, and e-commerce platforms. Veterinary hospital pharmacies commanded the largest market share in 2024 and are projected to grow at a CAGR of 6.6% during the forecast period. These pharmacies are typically integrated within veterinary clinics and hospitals, providing immediate access to prescribed and over-the-counter medications after consultations. Their proximity to diagnostic and treatment services allows for faster medication dispensing and personalized guidance. Moreover, these pharmacies are staffed with professionals specialized in veterinary pharmacology, improving safety and precision in pet treatments. As the demand for prescription-based drugs and complex therapies grows, the relevance and influence of this segment continue to expand.

Regionally, North America led the global companion animal healthcare market with a revenue of USD 54.4 billion in 2024 and is projected to reach USD 91.8 billion by 2034, registering a CAGR of 5.4%. The region benefits from well-established veterinary infrastructure, high awareness around pet wellness, and a robust insurance ecosystem. A strong network of clinics, growing use of AI-driven diagnostics, and a mature pet care market further contribute to its leadership position. North America also houses several companies involved in the development and distribution of pet medications, diagnostics, and wellness solutions, which helps maintain a competitive edge in the global landscape.

The companion animal healthcare market is highly competitive, with a mix of global players and specialized providers aiming to strengthen their presence. Industry participants are continuously enhancing their offerings by investing in research, digital technologies, and service expansion. Strategic initiatives such as partnerships, innovation in digital health, and a focus on personalized pet care continue to define the competitive dynamics of this rapidly evolving sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Animal

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Increasing prevalence of chronic conditions

- 3.2.1.3 Growing technological advancements

- 3.2.1.4 Expanding online platforms for veterinary services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Limited access in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding pet insurance coverage

- 3.2.3.2 Growing demand for personalized veterinary medicines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pet population statistics 2024

- 3.5 Reimbursement scenario

- 3.6 Venture capitalist scenario in animal health industry

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Drugs

- 5.2.1.1 Antiparasitic

- 5.2.1.2 Anti-inflammatory

- 5.2.1.3 Anti-infectives

- 5.2.1.4 Corticosteroids

- 5.2.1.5 Tranquilizers

- 5.2.1.6 Cardiovascular drugs

- 5.2.1.7 Gastrointestinal drugs

- 5.2.2 Vaccines

- 5.2.2.1 Modified live vaccines (MLV)

- 5.2.2.2 Killed inactivated vaccines

- 5.2.2.3 Recombinant vaccines

- 5.2.3 Medicated feed additives

- 5.2.3.1 Antibiotics

- 5.2.3.2 Vitamins

- 5.2.3.3 Amino acids

- 5.2.3.4 Enzymes

- 5.2.3.5 Antioxidants

- 5.2.3.6 Prebiotics and probiotics

- 5.2.3.7 Minerals

- 5.2.3.8 Carbohydrates

- 5.2.3.9 Propandiol

- 5.2.1 Drugs

- 5.3 Medical devices

- 5.3.1 Veterinary diagnostic equipment

- 5.3.2 Veterinary anesthesia equipment

- 5.3.3 Veterinary patient monitoring equipment

- 5.3.4 Veterinary surgical equipment

- 5.3.5 Veterinary consumables

- 5.3.6 Other medical devices

- 5.4 Veterinary services

- 5.4.1 Grooming services

- 5.4.2 Boarding and daycare

- 5.4.3 Training services

- 5.4.4 Pet insurance

- 5.4.5 Medical services

- 5.4.6 Other veterinary services

Chapter 6 Market Estimates and Forecast, By Animal, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

- 6.5 Other animals

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospital pharmacy

- 7.3 Retail pharmacy

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Boehringer Ingelheim

- 9.3 Ceva

- 9.4 Dechra

- 9.5 Elanco

- 9.6 Endovac

- 9.7 Figo Pet Insurance

- 9.8 Hartville

- 9.9 Hester

- 9.10 HIPRA

- 9.11 Hollard

- 9.12 IDEXX Laboratories

- 9.13 Mars

- 9.14 Medtronic

- 9.15 Merck

- 9.16 Neogen

- 9.17 PetIQ

- 9.18 Phibro

- 9.19 Vetoquinol

- 9.20 Virbac

- 9.21 Zoetis