|

市場調查報告書

商品編碼

1699405

臨床試驗市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Clinical Trials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

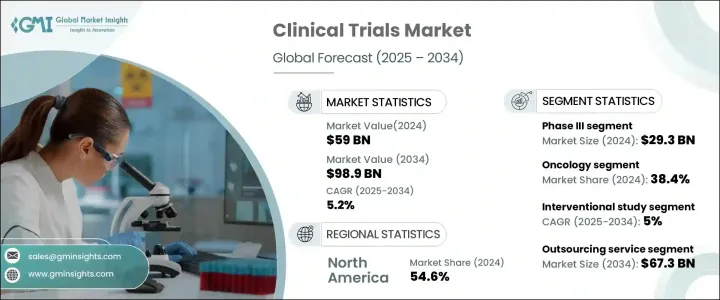

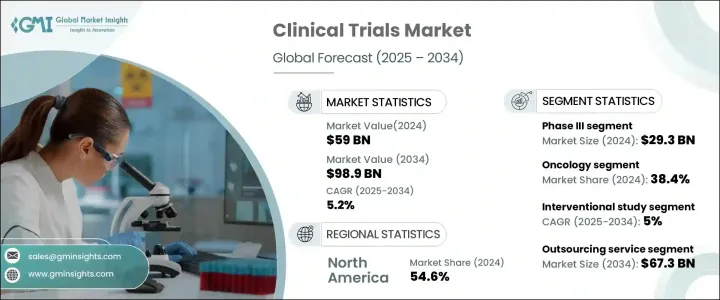

2024 年全球臨床試驗市場價值為 590 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.2%。對先進治療方案的需求不斷成長,加上對藥物開發的投資不斷增加,正在推動市場擴張。隨著癌症、糖尿病和心血管疾病等慢性疾病變得越來越普遍,製藥和生技公司正在加強推出創新療法。臨床研究活動的激增反映了向精準醫療和標靶治療的更廣泛轉變,進一步推動了臨床試驗領域的成長。此外,人工智慧 (AI)、巨量資料分析和分散試驗等技術進步正在改變臨床研究,使試驗更有效率、更具成本效益。監管部門對快速藥品核准的支持以及研究機構和醫療保健提供者之間合作的加強也促進了市場擴張。隨著對以患者為中心的方法和自適應試驗設計的日益關注,臨床試驗市場將在未來幾年見證重大變革。

臨床試驗市場依階段分為 I 期、II 期、III 期和 IV 期。其中,III 期臨床試驗佔主導地位,2024 年市場規模將達 293 億美元。這些大規模試驗對於在監管部門批准之前驗證藥物的安全性和有效性至關重要。鑑於其複雜性和對多樣化患者群體的需求,第三階段研究在多個地點進行,以產生全面的臨床資料。隨著各公司不斷推動新型藥物配方和生物相似藥的研發,對廣泛的 III 期試驗的需求持續上升,鞏固了該領域在市場上的領先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 590億美元 |

| 預測值 | 989億美元 |

| 複合年成長率 | 5.2% |

根據研究設計,臨床試驗分為介入性研究、觀察性研究、擴展研究。介入研究領域在 2024 年引領市場,預計 2025 年至 2034 年的複合年成長率為 5%。這些研究透過積極讓參與者參與受控治療方案,在確定新醫療干預措施的有效性方面發揮關鍵作用。透過消除回憶偏差並提供對治療結果的結構化評估,介入試驗提供了最高水準的臨床證據。因此,製藥公司和監管機構越來越依賴這些研究來加速藥物核准並提高治療標準。

2024 年,北美臨床試驗市場佔有 54.6% 的佔有率,由於製藥和生物技術公司高度集中,保持了主導地位。隨著藥物開發(尤其是精準醫療和生物製劑)的日益複雜,該地區的公司正在大力投資臨床試驗,將下一代治療方法推向市場。強力的監管框架、完善的研究基礎設施以及增加的臨床研究資金進一步支持了北美在該領域的領導地位。隨著對創新療法的需求不斷增加,該地區有望繼續成長,鞏固其在全球臨床研究中的關鍵作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球慢性病盛行率不斷上升

- 將臨床試驗外包給CRO的需求不斷成長

- 政府和非政府對臨床試驗的資助增加

- 亞太國家進行臨床試驗的機會日益增多

- 產業陷阱與挑戰

- 缺乏臨床研究的熟練勞動力

- 發展中國家的基礎建設障礙

- 北美和歐洲進行臨床試驗所面臨的挑戰

- 成長動力

- 成長潛力分析

- 臨床試驗量分析

- 2021 - 2024 年各地區臨床試驗數量分析

- 2021 - 2024 年臨床試驗數量分析(依開發階段分類)

- 2021 - 2024 年臨床試驗量分析(依適應症)

- 監管格局

- 美國

- 歐洲

- 亞太地區

- 新加坡

- 馬來西亞

- 印尼

- 泰國

- 韓國

- 菲律賓

- 臨床試驗—亞太優勢

- 波特分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 併購格局

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依階段,2021 年至 2034 年

- 主要趨勢

- 第一階段

- 第二階段

- 第三階段

- 第四階段

第6章:市場估計與預測:依研究設計,2021 年至 2034 年

- 主要趨勢

- 干預性研究

- 觀察性研究

- 擴展訪問研究

第7章:市場估計與預測:依服務類型,2021 年至 2034 年

- 主要趨勢

- 外包服務

- 內部服務

第8章:市場估計與預測:按治療領域,2021 年至 2034 年

- 主要趨勢

- 自體免疫疾病

- 腫瘤學

- 心臟病學

- 傳染病

- 皮膚科

- 眼科

- 神經病學

- 血液學

- 其他治療領域

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 波蘭

- 荷蘭

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 新加坡

- 馬來西亞

- 印尼

- 泰國

- 菲律賓

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Charles River Laboratories

- Clinipace

- Eli Lilly and Company

- ICON

- IQVIA

- Laboratory Corporation of America Holdings (Covance Inc)

- Medpace

- Merck & Co

- Parexel International Corporation

- Pfizer

- SGS SA

- Syneos Health

- The Emmes Company

- Thermo Fisher Scientific (PPD)

- Veeda Clinical Research

- Worldwide Clinical Trials

- WuXi AppTech

The Global Clinical Trials Market was valued at USD 59 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. The rising demand for advanced treatment options, coupled with increasing investments in drug development, is driving market expansion. As chronic diseases such as cancer, diabetes, and cardiovascular conditions become more prevalent, pharmaceutical and biotechnology companies are ramping up their efforts to introduce innovative therapies. The surge in clinical research activity reflects a broader shift toward precision medicine and targeted treatments, further fueling growth in the clinical trials sector. Additionally, technological advancements such as artificial intelligence (AI), big data analytics, and decentralized trials are transforming clinical research, making trials more efficient and cost-effective. Regulatory support for fast-track drug approvals and increased collaboration between research institutions and healthcare providers are also contributing to market expansion. With an increasing focus on patient-centric approaches and adaptive trial designs, the clinical trials market is set to witness significant evolution in the coming years.

The clinical trials market is segmented by phase into Phase I, II, III, and IV. Among these, Phase III dominates the sector, accounting for USD 29.3 billion in 2024. These large-scale trials are critical for validating a drug's safety and efficacy before regulatory approval. Given their complexity and the need for diverse patient populations, Phase III studies are conducted across multiple locations to generate comprehensive clinical data. As companies push forward with novel drug formulations and biosimilars, the demand for extensive Phase III trials continues to rise, reinforcing this segment's leading position in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59 Billion |

| Forecast Value | $98.9 Billion |

| CAGR | 5.2% |

Based on study design, clinical trials are categorized into interventional, observational, and expanded access studies. The interventional study segment led the market in 2024 and is anticipated to grow at a CAGR of 5% from 2025 to 2034. These studies play a pivotal role in determining the efficacy of new medical interventions by actively involving participants in controlled treatment protocols. By eliminating recall bias and offering a structured evaluation of treatment outcomes, interventional trials provide the highest level of clinical evidence. As a result, pharmaceutical companies and regulatory bodies increasingly rely on these studies to accelerate drug approvals and enhance treatment standards.

North America Clinical Trials Market held a 54.6% share in 2024, maintaining its dominance due to a high concentration of pharmaceutical and biotechnology companies. With the growing complexity of drug development, particularly in precision medicine and biologics, companies across the region are investing heavily in clinical trials to bring next-generation treatments to market. Strong regulatory frameworks, well-established research infrastructure, and increased funding for clinical studies further support North America's leadership in the sector. As demand for innovative therapies escalates, the region is poised for continued growth, reinforcing its pivotal role in global clinical research.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases across the globe

- 3.2.1.2 Growing demand for outsourcing clinical trials to CROs

- 3.2.1.3 Rise in government and non-government funding for clinical trials

- 3.2.1.4 Growing opportunities for conducting clinical trials in countries of Asia Pacific

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled workforce in clinical research

- 3.2.2.2 Infrastructural barriers in developing countries

- 3.2.2.3 Challenges faced in North America and Europe for conducting clinical trials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Clinical trials volume analysis

- 3.4.1 Clinical trials volume analysis, by region, 2021 - 2024

- 3.4.2 Clinical trials volume analysis, by phase of development, 2021 - 2024

- 3.4.3 Clinical trials volume analysis, by indication, 2021 - 2024

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.3.1 Singapore

- 3.5.3.2 Malaysia

- 3.5.3.3 Indonesia

- 3.5.3.4 Thailand

- 3.5.3.5 South Korea

- 3.5.3.6 Philippines

- 3.6 Clinical trials - Asia Pacific advantage

- 3.7 Porters analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Merger and acquisition landscape

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Phase, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Phase I

- 5.3 Phase II

- 5.4 Phase III

- 5.5 Phase IV

Chapter 6 Market Estimates and Forecast, By Study Design, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Interventional study

- 6.3 Observational study

- 6.4 Expanded access study

Chapter 7 Market Estimates and Forecast, By Service Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Outsourcing service

- 7.3 In-house service

Chapter 8 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Autoimmune disease

- 8.3 Oncology

- 8.4 Cardiology

- 8.5 Infectious disease

- 8.6 Dermatology

- 8.7 Ophthalmology

- 8.8 Neurology

- 8.9 Hematology

- 8.10 Other therapeutic areas

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.3.8 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Thailand

- 9.4.10 Philippines

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Charles River Laboratories

- 10.2 Clinipace

- 10.3 Eli Lilly and Company

- 10.4 ICON

- 10.5 IQVIA

- 10.6 Laboratory Corporation of America Holdings (Covance Inc)

- 10.7 Medpace

- 10.8 Merck & Co

- 10.9 Parexel International Corporation

- 10.10 Pfizer

- 10.11 SGS SA

- 10.12 Syneos Health

- 10.13 The Emmes Company

- 10.14 Thermo Fisher Scientific (PPD)

- 10.15 Veeda Clinical Research

- 10.16 Worldwide Clinical Trials

- 10.17 WuXi AppTech