|

市場調查報告書

商品編碼

1871158

分散式臨床試驗市場機會、成長促進因素、產業趨勢分析及預測(2025-2034 年)Decentralized Clinical Trials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

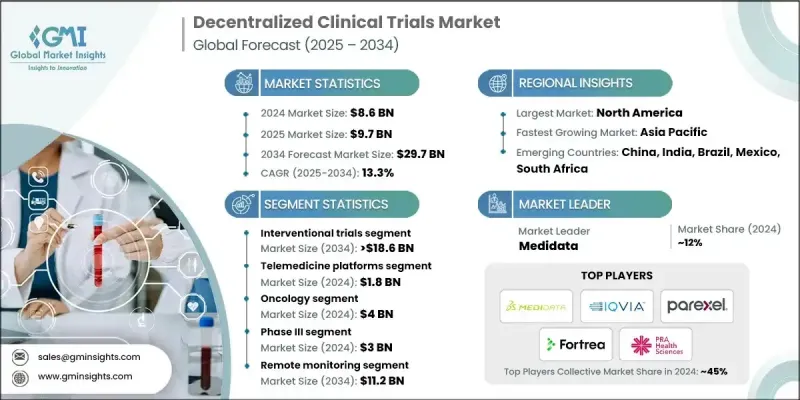

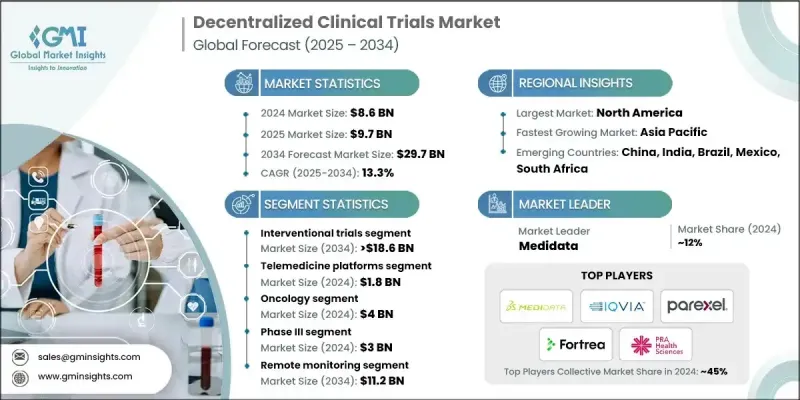

2024 年全球分散式臨床試驗市場價值為 86 億美元,預計到 2034 年將以 13.3% 的複合年成長率成長至 297 億美元。

市場快速成長的驅動力來自數位健康解決方案的廣泛應用,例如遠距醫療平台、電子病患報告結果 (ePRO)、穿戴式醫療設備和電子知情同意系統,這些解決方案正在重塑臨床研究的進行方式。分散式模式打破了傳統研究中心的限制,使不同地區的患者無需前往中心地點即可參與研究。主要市場的監管機構正日益引入結構化框架,以支持分散式試驗方法的實施。這一全球轉變反映了人們越來越重視患者便利性、即時資料收集以及研究參與的包容性。隨著人口老化、慢性病發病率上升以及個人化醫療的興起,醫療保健系統正朝著以患者為中心的模式發展,使臨床試驗更加便捷高效。分散式試驗透過整合數位工具來簡化流程、降低營運成本並提高患者在整個研究週期中的參與度,從而順應了這些發展趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 86億美元 |

| 預測值 | 297億美元 |

| 複合年成長率 | 13.3% |

在分散式研究中,部分或全部試驗相關流程在傳統研究場所之外進行,使參與者能夠在家中或透過當地醫療機構參與。這些試驗利用數位平台、連網設備和遠端監測系統收集臨床資料,並直接為參與者提供治療。這種設計有助於最大限度地減少出行需求,增強包容性,從而創造更多樣化、更具代表性的研究人群。

2024年,介入性試驗領域佔據了63.7%的市場佔有率,預計到2034年將達到186億美元。這一成長得益於遠端參與能力的提升,它最大限度地減少了患者到場的次數,並提高了老年人和居住地分散人群參與試驗的便利性。更好的患者體驗有助於提高試驗的保留率,而行動應用程式、遠距醫療和電子病患報告結局(ePRO)平台等互聯數位工具則實現了持續的即時監測和更快的資料採集,從而使介入性試驗更具規模化和高效性。

預計到2024年,遠距醫療平台市場規模將達到18億美元。這些平台有助於消除出行和地理障礙,並支持更多來自偏遠和醫療資源匱乏地區的病患參與研究。它們與連網設備和數位化報告系統的整合,提高了資料收集的品質和速度,從而提升了整體試驗效率。遠距醫療的數位化特性也降低了研究中心的管理成本,縮短了研究週期,並簡化了申辦者、研究者和病患之間的協調。透過建構互聯互通的數位化框架,遠距醫療平台能夠實現更精簡且靈活的去中心化試驗營運。

預計到2024年,北美分散式臨床試驗市佔率將達到44.1%。該地區受益於高度先進的數位基礎設施,包括廣泛的行動網路、雲端系統和互聯醫療技術。患者對靈活且便利的參與方式的需求日益成長,推動了分散式臨床試驗在各個治療領域的應用。該地區的分散式模式允許患者直接在家中或附近的醫療中心參與試驗,從而提高了招募效率和患者留存率。北美的申辦方越來越依賴這些模式來最佳化研發週期、加速產品上市並提高整體投資報酬率。

引領全球分散式臨床試驗市場發展的領導者包括 OpenClinica、Medidata、Covance、Sano Genetics、PPD(賽默飛世爾科技)、Florence Healthcare、Reify Health、Mahalo Health、Bio-Optronics、Trialize、ClinOne、Veeva Systems、ClinTex、Parexel、PCONron Sciences(IIOCON)。分散式臨床試驗領域的企業正透過專注於數位化創新、平台整合和全球合作來鞏固其市場地位。許多企業正在開發統一的雲端系統,將遠距醫療、電子病患報告結局(ePRO)和資料分析工具連接起來,以實現無縫的試驗管理。與生物製藥申辦者和技術提供者的策略合作有助於增強互通性並擴展服務組合。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 數位健康領域的技術進步

- 成本效益和加速進度

- 監管支持和框架制定

- 提高病患就醫便利性和多樣性

- 產業陷阱與挑戰

- 資料完整性和標準化

- 監理複雜性

- 市場機遇

- 人工智慧與穿戴式裝置的融合

- 向服務不足的地區擴張

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品/服務發布

- 擴張計劃

第5章:市場估計與預測:依研究設計分類,2021-2034年

- 主要趨勢

- 干預性試驗

- 隨機對照試驗(RCT)

- 適應性臨床試驗

- 實用性臨床試驗

- 觀察性試驗

- 隊列研究

- 回顧性研究

- 縱貫研究

- 擴大使用試驗

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 遠距醫療平台

- 穿戴式裝置

- 行動健康應用

- 電子資料擷取(EDC)系統

- 其他技術

第7章:市場估計與預測:依治療領域分類,2021-2034年

- 主要趨勢

- 腫瘤學

- 心臟病學

- 神經病學

- 傳染病

- 呼吸系統疾病

- 其他慢性疾病

第8章:市場估算與預測:依研究階段分類,2021-2034年

- 主要趨勢

- 第一階段

- 第二階段

- 第三階段

- 第四階段

第9章:市場估計與預測:依參與者參與度分類,2021-2034年

- 主要趨勢

- 以患者為中心的方法

- 遠端監控

- 數位調查

- 虛擬實地考察

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Propharma

- IQVIA

- Medidata

- Parexel

- Fortrea

- Covance

- PRA Health Sciences (ICON)

- PPD (Thermo Fisher Scientific)

- Mahalo Health

- Clinical Research IO

- Veeva Systems

- OpenClinica

- Bio-Optronics

- Sano Genetics

- ClinOne

- Sanguine Bio

- Florence Healthcare

- Reify Health

- Trialize

- ClinTex

The Global Decentralized Clinical Trials Market was valued at USD 8.6 Billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 29.7 Billion by 2034.

The market's rapid growth is fueled by the widespread use of digital health solutions such as telemedicine platforms, electronic patient-reported outcomes (ePRO), wearable medical devices, and e-consent systems that are reshaping the way clinical research is conducted. Decentralized models remove traditional site constraints, enabling participation from patients across different geographic regions without the need to travel to centralized locations. Regulatory authorities across major markets are increasingly introducing structured frameworks to support the implementation of decentralized trial approaches. This global transition reflects the growing emphasis on patient convenience, real-time data collection, and inclusivity in research participation. With aging populations, higher incidences of chronic diseases, and the shift toward personalized medicine, healthcare systems are moving toward patient-focused models that make clinical trials more accessible and efficient. Decentralized trials align with these evolving trends by integrating digital tools to streamline processes, reduce operational costs, and improve patient engagement throughout the study lifecycle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 13.3% |

In decentralized studies, some or all trial-related procedures occur outside traditional research sites, allowing participants to engage from home or through local medical facilities. These trials use digital platforms, connected devices, and remote monitoring systems to collect clinical data and deliver treatments directly to participants. This design helps minimize travel demands and enhances inclusivity, creating more diverse and representative study populations.

The interventional trials segment captured a 63.7% share in 2024 and is forecast to reach USD 18.6 Billion by 2034. This growth is supported by remote participation capabilities that minimize the need for physical visits and improve trial accessibility for elderly and geographically distributed populations. Enhanced patient experience leads to stronger retention rates, while connected digital tools such as mobile applications, telehealth, and ePRO platforms enable continuous real-time monitoring and faster data acquisition, making interventional trials more scalable and efficient.

The telemedicine platforms segment generated USD 1.8 Billion in 2024. These platforms help eliminate travel and location barriers, supporting wider participation among patients from remote and underserved areas. Their integration with connected devices and digital reporting systems enhances the quality and speed of data collection, improving overall trial efficiency. The digital nature of telemedicine also lowers site management costs, shortens study durations, and simplifies coordination between sponsors, investigators, and patients. By creating an interconnected digital framework, telemedicine platforms allow more streamlined and adaptive decentralized trial operations.

North America Decentralized Clinical Trials Market held 44.1% share in 2024. The region benefits from highly advanced digital infrastructure, including widespread access to mobile networks, cloud-based systems, and connected health technologies. Growing patient demand for flexible, convenient participation options is driving adoption across various therapeutic areas. Decentralized models in this region are improving recruitment efficiency and retention rates by allowing participation directly from patients' homes or nearby healthcare centers. Sponsors in North America are increasingly relying on these models to optimize development timelines, accelerate product launches, and improve overall return on investment.

Leading companies shaping the Global Decentralized Clinical Trials Market include OpenClinica, Medidata, Covance, Sano Genetics, PPD (Thermo Fisher Scientific), Florence Healthcare, Reify Health, Mahalo Health, Bio-Optronics, Trialize, ClinOne, Veeva Systems, ClinTex, Parexel, PRA Health Sciences (ICON), Sanguine Bio, IQVIA, ProPharma, Fortrea, and Clinical Research IO. Companies in the decentralized clinical trials sector are strengthening their market position by focusing on digital innovation, platform integration, and global partnerships. Many are developing unified cloud-based systems that connect telemedicine, ePRO, and data analytics tools for seamless trial management. Strategic collaborations with biopharma sponsors and technology providers are helping enhance interoperability and expand service portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancement in digital health

- 3.2.1.2 Cost efficiency and accelerated timelines

- 3.2.1.3 Regulatory support and framework development

- 3.2.1.4 Improved patient accessibility and diversity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data integrity and standardization

- 3.2.2.2 Regulatory complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and wearables

- 3.2.3.2 Expansion into underserved regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product/services launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Study Design, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Interventional trials

- 5.2.1 Randomized controlled trials (RCTs)

- 5.2.2 Adaptive clinical trials

- 5.2.3 Pragmatic clinical trials

- 5.3 Observational trials

- 5.3.1 Cohort studies

- 5.3.2 Retrospective studies

- 5.3.3 Longitudinal studies

- 5.4 Expanded access trials

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Telemedicine platforms

- 6.3 Wearable devices

- 6.4 Mobile health applications

- 6.5 Electronic data capture (EDC) systems

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Therapeutic Area, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Cardiology

- 7.4 Neurology

- 7.5 Infectious diseases

- 7.6 Respiratory disorders

- 7.7 Other chronic conditions

Chapter 8 Market Estimates and Forecast, By Study Phase, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Phase I

- 8.3 Phase II

- 8.4 Phase III

- 8.5 Phase IV

Chapter 9 Market Estimates and Forecast, By Participant Engagement, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Patient-centric approaches

- 9.3 Remote monitoring

- 9.4 Digital surveys

- 9.5 Virtual site visits

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Propharma

- 11.2 IQVIA

- 11.3 Medidata

- 11.4 Parexel

- 11.5 Fortrea

- 11.6 Covance

- 11.7 PRA Health Sciences (ICON)

- 11.8 PPD (Thermo Fisher Scientific)

- 11.9 Mahalo Health

- 11.10 Clinical Research IO

- 11.11 Veeva Systems

- 11.12 OpenClinica

- 11.13 Bio-Optronics

- 11.14 Sano Genetics

- 11.15 ClinOne

- 11.16 Sanguine Bio

- 11.17 Florence Healthcare

- 11.18 Reify Health

- 11.19 Trialize

- 11.20 ClinTex