|

市場調查報告書

商品編碼

1699318

商業及工業太陽能光電市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Commercial and Industrial Solar PV Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

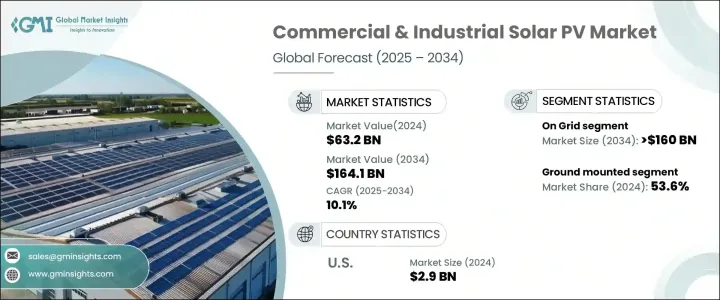

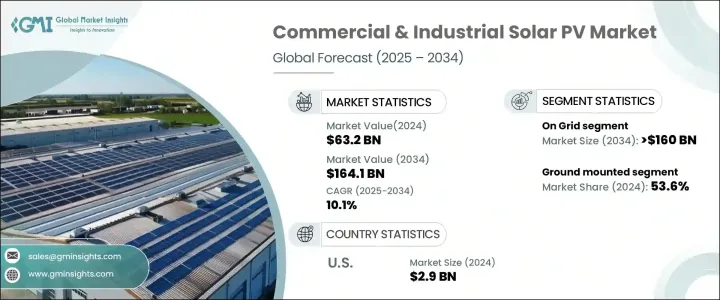

2024 年全球商業和工業太陽能光電市場規模達 632 億美元,預計 2025 年至 2034 年的複合年成長率將達到 10.1%。市場上升勢頭的動力源於對永續能源解決方案日益成長的需求,而企業為減少碳足跡和提高能源效率所做的努力也推動了這一需求。各行各業的企業都優先採用再生能源,以滿足嚴格的環境法規、降低營運成本並實現長期能源節約。擴大淨計量政策允許太陽能光電系統所有者將多餘的電力送回電網以換取信用額,進一步加速市場採用。這項激勵措施大大提高了太陽能光電裝置的財務可行性,使其成為希望降低未來能源支出的企業的可行且有吸引力的選擇。

世界各國政府正在實施支持政策,推動太陽能光電的應用,提供稅收優惠、補貼和補助,鼓勵商業和工業參與者投資太陽能基礎設施。太陽能電池板技術、電池儲存和智慧能源管理系統的進步正在解決間歇性問題,進一步增強市場信心。隨著越來越多的企業向能源獨立轉型,對高效能太陽能光電系統的需求持續上升,為大規模商業應用鋪平了道路。此外,電力成本上升和電網不穩定性增加促使企業尋求替代能源,將太陽能光電定位為現代能源策略的關鍵組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 632億美元 |

| 預測值 | 1641億美元 |

| 複合年成長率 | 10.1% |

市場依連接性分為併網系統和離網系統。依賴現有電力基礎設施的併網太陽能光電系統因其成本效益和增強的可靠性而越來越受到關注。在電池儲存解決方案和先進電網技術投資的推動下,預計到 2034 年,該領域將創造 1,600 億美元的收入。這些創新正在提高能源儲存能力,減少對傳統電網的依賴,並使企業能夠最大限度地提高能源利用率。此外,不斷擴大的輸電和配電網路正在簡化再生能源的整合,進一步鞏固併網太陽能光電裝置的成長。該公司正在利用人工智慧能源最佳化工具和智慧逆變器等尖端技術來提高系統效率,使太陽能光伏成為長期能源成本節約的極具吸引力的投資。

按安裝類型分類,地面安裝太陽能光電系統憑藉其卓越的能量捕獲能力和易於維護的特點,在 2024 年佔據了 53.6% 的市場佔有率。這些系統可以實現最佳面板方向,最大限度地提高陽光吸收和總能量輸出。企業青睞地面安裝,因為其具有可擴展性、成本效益以及容納大型太陽能電池陣列的能力。此外,政府支持的再生能源招標和長期購電協議(PPA)正在推動對地面太陽能專案的進一步投資。

2024年美國商業和工業太陽能光電市場產值將達29億美元,其中北美佔全球市場佔有率的5%。隨著促進再生能源應用的政策持續獲得動力,監管支持仍然是主要驅動力。不斷擴大的公用事業規模太陽能專案和清潔能源計劃正在重塑區域市場格局。國內外參與者之間的合作正在幫助企業應對複雜的監管問題,確保市場穩定成長。

目錄

第1章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依連結性,2021 年至 2032 年

- 主要趨勢

- 在電網上

- 離網

第6章:市場規模及預測:依安裝情況,2021 年至 2032 年

- 主要趨勢

- 地面安裝

- 屋頂

第7章:市場規模及預測:依地區,2021 年至 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 奧地利

- 挪威

- 丹麥

- 芬蘭

- 法國

- 德國

- 義大利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 約旦

- 阿曼

- 非洲

- 南非

- 埃及

- 阿爾及利亞

- 奈及利亞

- 摩洛哥

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

第8章:公司簡介

- Canadian Solar

- CSUN SolarTech

- EMMVEE SOLAR

- JA SOLAR Technology Co., Ltd.

- GCL-SI

- Jinko Solar

- Motech Industries Inc.

- LONGi

- Hanwa Q cells

- Renesola

- REC Solar Holdings AS

- Risen Energy Co., Ltd.

The Global Commercial and Industrial Solar Pv Market reached USD 63.2 billion in 2024 and is projected to expand at a CAGR of 10.1% from 2025 to 2034. The market's upward momentum is fueled by the increasing need for sustainable energy solutions backed by corporate efforts to reduce carbon footprints and enhance energy efficiency. Businesses across various industries are prioritizing renewable energy adoption to meet stringent environmental regulations, cut operational costs, and capitalize on long-term energy savings. Expanding net metering policies further accelerate market adoption by allowing solar PV system owners to send surplus electricity back to the grid in exchange for credits. This incentive significantly enhances the financial feasibility of solar PV installations, making them a viable and attractive option for businesses looking to reduce future energy expenses.

Governments worldwide are implementing supportive policies to drive solar PV adoption, providing tax benefits, subsidies, and grants to encourage commercial and industrial players to invest in solar infrastructure. Advancements in solar panel technology, battery storage, and smart energy management systems are addressing intermittency concerns, further strengthening market confidence. As more businesses transition towards energy independence, the demand for high-efficiency solar PV systems continues to rise, paving the way for large-scale commercial adoption. Additionally, rising electricity costs and increasing grid instability are prompting companies to seek alternative energy sources, positioning solar PV as a key component of modern energy strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.2 Billion |

| Forecast Value | $164.1 Billion |

| CAGR | 10.1% |

The market is segmented based on connectivity into on-grid and off-grid systems. On-grid solar PV systems, which rely on existing electricity infrastructure, are gaining traction due to their cost-effectiveness and enhanced reliability. This segment is expected to generate USD 160 billion by 2034, driven by investments in battery storage solutions and advanced grid technologies. These innovations are improving energy storage capabilities, reducing reliance on traditional power grids, and enabling businesses to maximize energy utilization. Moreover, expanding transmission and distribution networks are streamlining the integration of renewable energy sources, further solidifying the growth of on-grid solar PV installations. Companies are leveraging cutting-edge technologies such as AI-powered energy optimization tools and smart inverters to enhance system efficiency, making solar PV a highly attractive investment for long-term energy cost savings.

By mounting type, ground-mounted solar PV systems held a 53.6% market share in 2024, thanks to their superior energy capture capabilities and ease of maintenance. These systems allow for optimal panel orientation, maximizing sunlight absorption and overall energy output. Businesses favor ground-mounted installations due to their scalability, cost-effectiveness, and ability to accommodate large solar arrays. Additionally, government-backed renewable energy tenders and long-term power purchase agreements (PPAs) are driving further investments in ground-mounted solar projects.

The U.S. commercial & industrial solar PV market generated USD 2.9 billion in 2024, with North America accounting for 5% of the global market share. Regulatory support remains a primary driver as policies promoting renewable energy adoption continue to gain momentum. Expanding utility-scale solar projects and clean energy initiatives are reshaping the regional market landscape. Collaboration between domestic and international players is helping businesses navigate regulatory complexities, ensuring steady market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2023

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 – 2032 (USD Billion & MW)

- 5.1 Key trends

- 5.2 On grid

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Mounting, 2021 – 2032 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Ground mounted

- 6.3 Roof top

Chapter 7 Market Size and Forecast, By Region, 2021 – 2032 (USD Billion & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Austria

- 7.3.2 Norway

- 7.3.3 Denmark

- 7.3.4 Finland

- 7.3.5 France

- 7.3.6 Germany

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 Jordan

- 7.5.5 Oman

- 7.6 Africa

- 7.6.1 South Africa

- 7.6.2 Egypt

- 7.6.3 Algeria

- 7.6.4 Nigeria

- 7.6.5 Morocco

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Argentina

- 7.7.3 Chile

- 7.7.4 Peru

Chapter 8 Company Profiles

- 8.1 Canadian Solar

- 8.2 CSUN SolarTech

- 8.3 EMMVEE SOLAR

- 8.4 JA SOLAR Technology Co., Ltd.

- 8.5 GCL-SI

- 8.6 Jinko Solar

- 8.7 Motech Industries Inc.

- 8.8 LONGi

- 8.9 Hanwa Q cells

- 8.10 Renesola

- 8.11 REC Solar Holdings AS

- 8.12 Risen Energy Co., Ltd.