|

市場調查報告書

商品編碼

1699297

寵物配件市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Pet Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

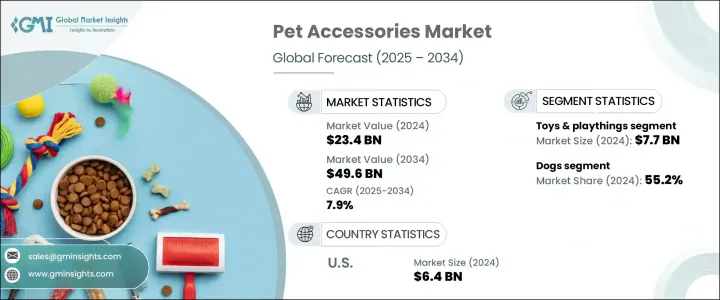

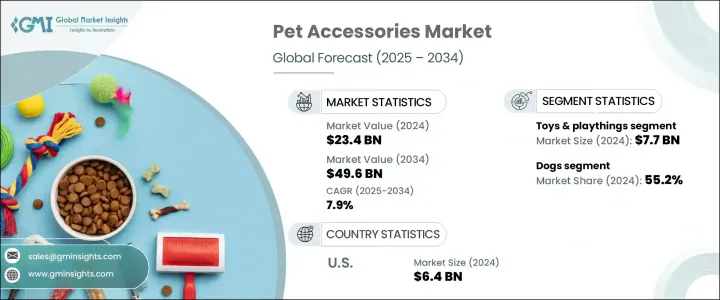

2024 年全球寵物配件市場規模達到 234 億美元,預計 2025 年至 2034 年的複合年成長率將達到 7.9%。市場成長的動力包括寵物擁有量的增加、消費者對高階產品的支出增加以及將寵物視為家庭成員的轉變。寵物主人優先考慮高品質、注重健康且創新的配件,以提高寵物的舒適度、安全性和整體健康。永續和環保產品越來越受到青睞,反映出消費者越來越傾向於選擇對環境負責的產品。隨著科技越來越融入寵物照護日常,對智慧寵物配件(包括 GPS 項圈、自動餵食器和健康監測設備)的需求也不斷成長。

此外,寵物主人越來越被符合他們個人生活方式偏好的可客製化且美觀的配件所吸引。推動這一快速擴張的因素包括消費者偏好的不斷變化、寵物產品的高階化以及推廣時尚和實用的寵物配件的社交媒體趨勢的日益增強的影響力。各大品牌正利用這一趨勢,推出以設計師寵物服裝、豪華寵物床和手工美容必需品為特色的高階系列產品。直接面對消費者 (DTC) 品牌的興起進一步改變了市場,實現了個人化產品供應和基於訂閱的模式,以滿足尋求便利性和獨特性的寵物主人的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 234億美元 |

| 預測值 | 496億美元 |

| 複合年成長率 | 7.9% |

該行業根據寵物類型分為狗、貓、鳥、魚和水生寵物、爬行動物等。 2024 年,狗類市場佔據了 55.2% 的佔有率,預計 2025 年至 2034 年期間的複合年成長率為 8.1%。隨著寵物收養率的提高和人們對犬類健康意識的增強,對高級項圈、牽引繩、服裝和美容必需品等配件的需求不斷成長。主人優先考慮注重健康的產品,包括矯形床、寵物健身追蹤器以及旨在延長壽命和增強活力的營養補充劑。

根據產品類型,市場包括服裝和服飾、床和家具、玩具和玩物、美容產品、餵食和飲水配件、健康和保健產品等。 2024 年,玩具和玩樂類別的估值達到 77 億美元,位居榜首,預計 2025 年至 2034 年期間的複合年成長率為 8.3%。製造商正在推出支持寵物智力刺激和身體參與的互動和認知玩具,以滿足消費者對寵物豐富化日益成長的關注。人們對寵物心理健康的認知不斷提高,加劇了對先進且引人入勝的產品的需求。

2024 年美國寵物配件市場價值為 64 億美元,預計在整個預測期內複合年成長率為 8.4%。受生活方式的改變和電子商務的興起的影響,城市市場的購買行為正在轉變。可支配收入的增加和對高品質、耐用產品的偏好正在推動市場成長。消費者越來越傾向於永續的高科技寵物護理解決方案,環保材料和智慧配件塑造了行業趨勢。網上購物的便利,加上專業寵物零售商的不斷湧現,進一步加速了美國各地對優質寵物配件的採用

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 技術概述

- 監管格局

- 衝擊力

- 成長動力

- 寵物主人數量不斷增加

- 寵物人性化趨勢日益明顯

- 消費者在寵物照護方面的支出增加

- 產業陷阱與挑戰

- 寵物服裝和配件的季節性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 服飾

- 毛衣

- T恤

- 夾克

- 其他(雨衣、靴子等)

- 床和家具

- 寵物床

- 沙發

- 其他(沙發、墊子等)

- 玩具和玩物

- 咀嚼玩具

- 球

- 絨毛玩具

- 其他(拼圖等)

- 餵食及飲水配件

- 碗

- 自動餵食器

- 飲水機

- 其他(餵食墊、食物儲存容器等)

- 美容產品

- 刷子

- 碗

- 洗髮精

- 其他(指甲刀、牙齒護理產品等)

- 健康與保健產品

- 補充品

- 維生素

- 鎮靜劑

- 其他(蜱蟲控制產品等)

- 其他(訓練和行為配件、身份標籤和寵物安全配件等)

第6章:市場估計與預測:依寵物類型,2021-2034

- 主要趨勢

- 狗

- 貓

- 鳥類

- 魚類和水生寵物

- 爬蟲類

- 其他(哺乳動物、兔子、倉鼠等)

第7章:市場估計與預測:依價格區間,2021-2034

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市和大賣場

- 寵物專賣店

- 其他零售商店(寵物醫院等)

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- MEA 其餘地區

第10章:公司簡介

- Central Garden & Pet Company

- Coastal Pet Products, Inc.

- Ferplast SpA

- Hartz Mountain Corporation

- Jollyes Pet Superstores

- KONG Company

- Merrick Pet Care, Inc.

- MidWest Homes for Pets

- Nestlé Purina PetCare

- Pets at Home Group Plc

The Global Pet Accessories Market reached USD 23.4 billion in 2024 and is projected to expand at a CAGR of 7.9% from 2025 to 2034. The market growth is driven by increasing pet ownership, rising consumer spending on premium products, and a shift toward treating pets as family members. Pet owners are prioritizing high-quality, health-focused, and innovative accessories that enhance their pets' comfort, safety, and overall well-being. Sustainable and eco-friendly products are gaining traction, reflecting a broader consumer shift toward environmentally responsible choices. The demand for smart pet accessories, including GPS-enabled collars, automated feeders, and health monitoring devices, is also on the rise as technology becomes more integrated into pet care routines.

Additionally, pet parents are increasingly drawn to customizable and aesthetically appealing accessories that align with their personal lifestyle preferences. The rapid expansion is fueled by evolving consumer preferences, the premiumization of pet products, and the increasing influence of social media trends that promote stylish and functional pet accessories. Brands are capitalizing on this trend by launching high-end collections featuring designer pet apparel, luxury pet beds, and artisanal grooming essentials. The rise of direct-to-consumer (DTC) brands has further transformed the market, enabling personalized product offerings and subscription-based models that cater to pet owners seeking convenience and exclusivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.4 Billion |

| Forecast Value | $49.6 Billion |

| CAGR | 7.9% |

The industry is segmented by pet type into dogs, cats, birds, fish and aquatic pets, reptiles, and others. The dogs segment held a 55.2% share in 2024 and is anticipated to grow at a CAGR of 8.1% between 2025 and 2034. Increased pet adoption and heightened awareness of canine well-being are driving demand for accessories such as premium collars, leashes, clothing, and grooming essentials. Owners are prioritizing health-conscious products, including orthopedic beds, pet fitness trackers, and nutritional supplements designed to enhance longevity and vitality.

By product type, the market includes apparel and clothing, beds and furniture, toys and playthings, grooming products, feeding and drinking accessories, health and wellness products, and others. In 2024, the toys and playthings category led with a valuation of USD 7.7 billion and is projected to register a CAGR of 8.3% between 2025 and 2034. Manufacturers are introducing interactive and cognitive playthings that support pets' mental stimulation and physical engagement, catering to a growing consumer focus on pet enrichment. The increasing awareness of pets' psychological well-being has intensified the demand for advanced and engaging products.

The U.S. pet accessories market was worth USD 6.4 billion in 2024 and is anticipated to grow at a CAGR of 8.4% throughout the forecast period. Urban markets are witnessing a shift in purchasing behaviors influenced by evolving lifestyles and the surge of e-commerce. Expanding disposable incomes and a preference for high-quality, durable products are propelling market growth. Consumers are gravitating toward sustainable, high-tech pet care solutions, with eco-friendly materials and smart accessories shaping industry trends. The convenience of online shopping, coupled with the growing presence of specialized pet retailers, is further accelerating the adoption of premium pet accessories across the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing number of pet owners

- 3.6.1.2 Growing trend of pet humanization

- 3.6.1.3 Higher consumer spending on pet care

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Seasonality in pet clothing & accessories

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Apparel and clothing

- 5.2.1 Sweaters

- 5.2.2 T-shirts

- 5.2.3 Jackets

- 5.2.4 Others (raincoats, boots, etc.)

- 5.3 Beds and furniture

- 5.3.1 Pet beds

- 5.3.2 Sofas

- 5.3.3 Others (couches, cushions, etc.)

- 5.4 Toys and playthings

- 5.4.1 Chew toys

- 5.4.2 Balls

- 5.4.3 Plush toys

- 5.4.4 Others (puzzles, etc.)

- 5.5 Feeding and drinking accessories

- 5.5.1 Bowls

- 5.5.2 Automatic feeders

- 5.5.3 Water dispensers

- 5.5.4 Others (feeding mats, food storage containers, etc.)

- 5.6 Grooming products

- 5.6.1 Brushes

- 5.6.2 Bowls

- 5.6.3 Shampoo

- 5.6.4 Others (nail clippers, dental care products, etc.)

- 5.7 Health and wellness products

- 5.7.1 Supplements

- 5.7.2 Vitamins

- 5.7.3 Calming aids

- 5.7.4 Others (tick control products, etc.)

- 5.8 Others (training and behavior accessories, ID tags and pet safety accessories, etc.)

Chapter 6 Market Estimates & Forecast, By Pet type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fish & aquatic pets

- 6.6 Reptiles

- 6.7 Others (mammals, rabbits, hamsters, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Supermarkets and hypermarkets

- 8.3.2 Pet specialty stores

- 8.3.3 Other retail stores (pet hospitals, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Central Garden & Pet Company

- 10.2 Coastal Pet Products, Inc.

- 10.3 Ferplast S.p.A.

- 10.4 Hartz Mountain Corporation

- 10.5 Jollyes Pet Superstores

- 10.6 KONG Company

- 10.7 Merrick Pet Care, Inc.

- 10.8 MidWest Homes for Pets

- 10.9 Nestlé Purina PetCare

- 10.10 Pets at Home Group Plc