|

市場調查報告書

商品編碼

1699284

成人紙尿褲市場機會、成長動力、產業趨勢分析及2025-2034年預測Adult Diaper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

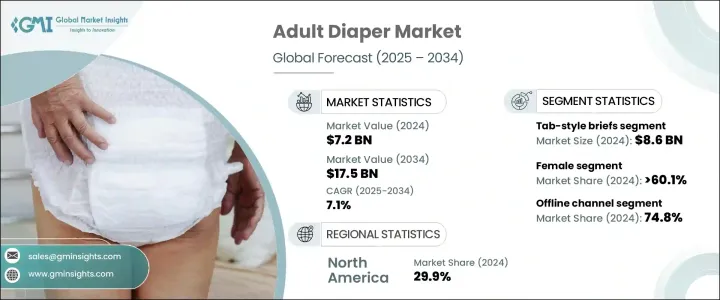

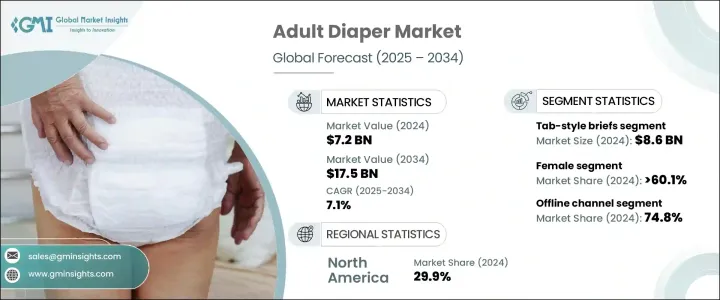

2024 年全球成人紙尿褲市場價值為 72 億美元,預計 2025 年至 2034 年期間複合年成長率將穩定在 7.1%。老年人口的成長和失禁管理意識的提高推動了這一成長。由於老化、骨盆肌肉無力、荷爾蒙變化和膀胱容量下降等因素,全球尿失禁的盛行率正在激增。因此,對隱蔽、高吸收性和舒適的失禁解決方案的需求持續成長,顯著提高用戶的生活品質。

隨著科技的進步,成人紙尿褲市場也不斷發展,推出了超吸收材料、除臭功能和親膚布料。這些創新既適合活躍人士,也適合臥床不起的人士,使失禁產品更加人性化。成人紙尿褲的接受度越來越高,尤其是在城市地區,這減少了人們對使用成人紙尿褲的恥辱感。各品牌正積極參與行銷活動,以提高人們的意識並鼓勵公開討論失禁問題。此外,電子商務可近性的提高使得消費者能夠謹慎地購買這些產品,從而進一步推動市場滲透。醫療機構和護理人員在推廣失禁解決方案方面也發揮關鍵作用,因為更好的產品可用性有助於改善老年人護理和衛生管理。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 72億美元 |

| 預測值 | 175億美元 |

| 複合年成長率 | 7.1% |

市場按產品類型分類,其中標籤式內褲、套穿式內褲和增強墊為主要部分。 2024 年,Tab 式內褲的收入為 86 億美元,預計在預測期內的複合年成長率為 7.4%。這些產品因其卓越的吸收性和牢固的貼合性而受到青睞,使其成為中度至重度失禁患者的理想選擇。護理人員通常會選擇有標籤的內褲,因為它們使用方便,特別是對於行動不便的人。由於具有增強的防漏功能並注重舒適性,這些產品仍然是家庭護理和醫療保健環境中的主要產品。

市場根據消費者人口統計進一步細分,男性和女性使用者表現出不同的需求模式。 2024 年,女性市場佔據主導地位,佔有 60.1% 的市場佔有率,預計到 2034 年將以 7.2% 的複合年成長率成長。由於懷孕、更年期、荷爾蒙波動和分娩等因素,女性更容易失禁,這些因素都會導致骨盆底無力。此外,女性預期壽命的延長也增加了與年齡相關的膀胱控制問題的可能性。針對特定性別、提供更合身和更舒適體驗的產品的出現繼續推動著這一領域的需求。

北美仍然是成人紙尿褲市場的領先地區,佔有 29.9% 的佔有率,到 2024 年將創造 101 億美元的市場價值。老年人口的增加刺激了對失禁產品的需求,而公眾意識的提高和教育活動有助於規範這些產品的使用。政府醫療保健計劃和私人保險覆蓋失禁解決方案的覆蓋範圍提高了可及性,進一步支持了市場成長。先進的產品創新專注於超吸收性、親膚材料,滿足了注重謹慎和舒適的活躍用戶的需求。各大品牌不斷擴大的線上零售業務使得這些產品更容易取得,從而促進了不同消費群體的成長。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 人口老化

- 慢性健康狀況增加

- 醫療支出不斷上漲

- 產業陷阱與挑戰

- 環境問題

- 競爭激烈

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 附扣式內褲

- 套穿式內衣

- 增壓墊

第6章:市場估計與預測:按類別,2021 - 2034 年(十億美元)

- 主要趨勢

- 可重複使用的

- 一次性的

第7章:市場估計與預測:按規模,2021 - 2034 年(十億美元)

- 主要趨勢

- 小的

- 中等的

- 大的

- 特大號

第8章:市場估計與預測:按材料,2021 - 2034 年(十億美元)

- 主要趨勢

- 棉布

- 非織物

- 超細纖維

- 其他(絨毛漿、竹子)

第9章:市場估計與預測:依包裝數量,2021-2034(十億美元)

- 主要趨勢

- 小包裝(1-25)

- 中包(25-100)

- 散裝(100個以上)

第 10 章:市場估計與預測:按價格,2021 年至 2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第 11 章:市場估計與預測:按消費者群體分類,2021 年至 2034 年(十億美元)

- 主要趨勢

- 男性

- 女性

第 12 章:市場估計與預測:按配銷通路,2021 年至 2034 年(十億美元)

- 主要趨勢

- 線上通路

- 電子商務

- 公司網站

- 線下通路

- 專賣店

- 大型零售商店

- 其他(個體店、百貨店)

第 13 章:市場估計與預測:按地區,2021 年至 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 14 章:公司簡介

- Attends Healthcare Products

- BetterDry

- DSG International

- Essity

- First Quality Enterprises

- Hengan International

- Kao

- Kimberly-Clark

- Majors Medical Service

- Meddcare

- Procter & Gamble

- Svenska Cellulosa

- Tranquility Products

- Tykables

- Unicharm

The Global Adult Diaper Market was valued at USD 7.2 billion in 2024 and is projected to reflect a steady CAGR of 7.1% from 2025 to 2034. The growth is fueled by a rising elderly population and increasing awareness regarding incontinence management. The prevalence of incontinence is surging worldwide due to factors such as aging, weakened pelvic muscles, hormonal changes, and declining bladder capacity. As a result, the demand for discreet, highly absorbent, and comfortable incontinence solutions continues to grow, significantly improving users' quality of life.

The adult diaper market has evolved with technological advancements, introducing ultra-absorbent materials, odor control features, and skin-friendly fabrics. These innovations cater to both active and bedridden individuals, making incontinence products more user-friendly. Greater acceptance of adult diapers, particularly in urban areas, has reduced the stigma surrounding their use. Brands are actively engaging in marketing campaigns to raise awareness and encourage open discussions about incontinence. Additionally, improvements in e-commerce accessibility have enabled consumers to purchase these products discreetly, driving market penetration further. Healthcare institutions and caregivers are also playing a critical role in promoting incontinence solutions, as better product availability supports improved elderly care and hygiene management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $17.5 Billion |

| CAGR | 7.1% |

The market is categorized by product type, with tab-style briefs, pull-on underwear, and booster pads as key segments. Tab-style briefs generated USD 8.6 billion in revenue in 2024 and are expected to grow at a CAGR of 7.4% over the forecast period. These products are preferred for their superior absorbency and secure fit, making them ideal for individuals with moderate to severe incontinence. Caregivers often opt for tab-style briefs due to their ease of use, particularly for those with limited mobility. With enhanced leakage protection and a focus on comfort, these products remain a staple in homecare and healthcare settings.

The market is further segmented based on consumer demographics, with male and female users exhibiting distinct demand patterns. The female segment dominated with a 60.1% market share in 2024 and is expected to grow at a CAGR of 7.2% through 2034. Women experience incontinence more frequently due to factors such as pregnancy, menopause, hormonal fluctuations, and childbirth, all contributing to pelvic floor weakness. Additionally, a longer life expectancy among women increases the likelihood of age-related bladder control concerns. The availability of gender-specific products offering a more tailored fit and improved comfort continues to drive demand within this segment.

North America remains a leading region in the adult diaper market, holding a 29.9% share and generating USD 10.1 billion in 2024. The rising elderly population has fueled demand for incontinence products, while public awareness initiatives and education campaigns have helped normalize their use. Government healthcare programs and private insurance coverage for incontinence solutions have enhanced accessibility, further supporting market growth. Advanced product innovations focusing on ultra-absorbent, skin-friendly materials are addressing the needs of active users who prioritize discretion and comfort. The expanding online retail presence of major brands has made these products more accessible, reinforcing growth across diverse consumer demographics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Aging population

- 3.10.1.2 Increase in chronic health conditions

- 3.10.1.3 Rising healthcare expenditure

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Environmental concerns

- 3.10.2.2 High competition

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Tab-Style briefs

- 5.3 Pull-On underwear

- 5.4 Booster pads

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Reusable

- 6.3 Disposable

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Small

- 7.3 Medium

- 7.4 Large

- 7.5 Extra large

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Cotton

- 8.3 Non-woven fabric

- 8.4 Microfiber

- 8.5 Others (Fluff pulp, Bamboo)

Chapter 9 Market Estimates & Forecast, By Packaging Quantity, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Small pack (1-25)

- 9.3 Mid pack (25- 100)

- 9.4 Bulk pack (More than 100)

Chapter 10 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Male

- 11.3 Female

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 Online channels

- 12.2.1 E-commerce

- 12.2.2 Company websites

- 12.3 Offline channels

- 12.3.1 Specialty Stores

- 12.3.2 Mega retails stores

- 12.3.3 Others (Individual stores, Departmental stores)

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Nordics

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.4.6 Southeast Asia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 South Africa

- 13.6.3 Saudi Arabia

Chapter 14 Company Profiles

- 14.1 Attends Healthcare Products

- 14.2 BetterDry

- 14.3 DSG International

- 14.4 Essity

- 14.5 First Quality Enterprises

- 14.6 Hengan International

- 14.7 Kao

- 14.8 Kimberly-Clark

- 14.9 Majors Medical Service

- 14.10 Meddcare

- 14.11 Procter & Gamble

- 14.12 Svenska Cellulosa

- 14.13 Tranquility Products

- 14.14 Tykables

- 14.15 Unicharm