|

市場調查報告書

商品編碼

1699238

散裝容器包裝市場機會、成長動力、產業趨勢分析及2025-2034年預測Bulk Container Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

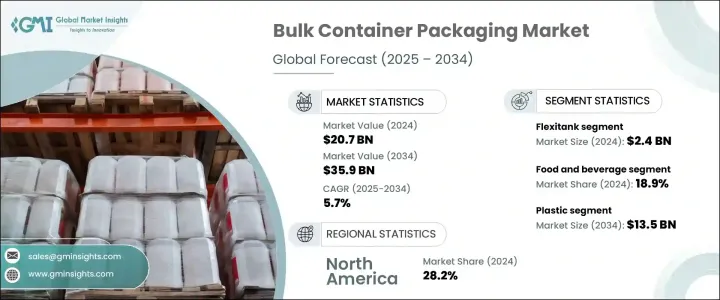

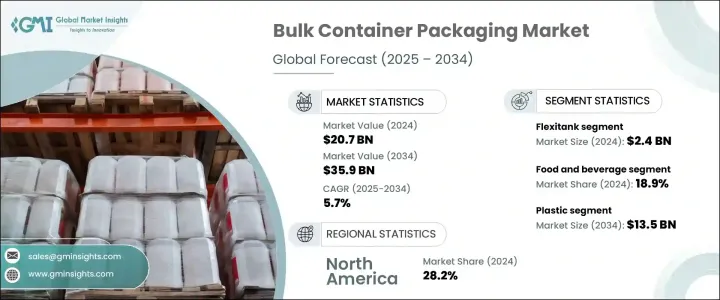

2024 年全球散裝容器包裝市場價值為 207 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.7%。全球貿易和工業化步伐的加快,以及電子商務的快速成長,正在推動對高效且經濟的散裝包裝解決方案的需求。隨著各行業擴大營運以滿足日益成長的需求,對可靠的貨物運輸和儲存的需求也不斷增加。化學品、食品飲料和製藥等行業的公司正在轉向使用中型散裝容器 (IBC) 和軟性罐等散裝容器來提高物流效率並保持產品完整性。對長距離和經濟高效的運輸解決方案的需求進一步促進了市場擴張。隨著全球加工食品和飲料消費量的不斷增加,對專業散裝包裝的需求大幅增加。

製造商強調衛生、無污染包裝和法規遵循以確保產品安全。散裝包裝形式,包括軟性罐、桶、散裝袋和 IBC,在食用油、乳製品、果汁、酒精飲料和其他液體食品的運輸中發揮著至關重要的作用。全球貿易量的不斷成長以及對敏感貨物安全運輸的需求預計將為製造商創造新的機遇,特別是在開發具有增強阻隔性能的多層容器方面。預計物聯網追蹤和即時監控解決方案的整合將推動競爭格局中的產品創新和差異化。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 207億美元 |

| 預測值 | 359億美元 |

| 複合年成長率 | 5.7% |

根據產品,市場可細分為軟體罐、中型散裝貨櫃和散裝貨櫃內襯。 2024 年,軟性罐市場的規模將達到 24 億美元,由於其比傳統桶和 IBC 具有成本優勢,因此需求強勁。作為一次性解決方案,軟性罐可最大限度地降低液體貨物的污染風險,使其成為處理食品級液體、工業化學品和藥物成分的行業的首選。

根據最終用途,市場進一步分為食品和飲料、化學品、石油和天然氣、製藥、油漆、油墨和染料以及其他行業。 2024 年,食品和飲料業的市佔率為 18.9%。對安全、衛生和經濟高效的散裝運輸解決方案的需求不斷成長,推動著市場成長。散裝容器(例如軟性罐、IBC 和內襯)廣泛用於運輸穀物、糖、麵粉和乳製品等商品。人們對永續性和食品級包裝的日益重視刺激了可重複使用和可生物分解的散裝容器的創新。

根據材料類型,市場分為塑膠、金屬和其他。由於塑膠重量輕、耐用且具有成本效益,預計到 2034 年塑膠市場的規模將達到 135 億美元。食品飲料、化學品、製藥和農業等行業依賴塑膠包裝,因為它具有耐腐蝕性和易於處理的特性。為了應對環境問題,可生物分解和可回收塑膠的進步正在進一步加速其應用。

從地區來看,受強勁的農業和化學品出口支撐,北美在 2024 年佔據了 28.2% 的市場佔有率。政府推行的可回收和可生物分解包裝法規正在促進永續散裝容器解決方案的採用。 2024年,美國散裝貨櫃包裝市場規模將超過50億美元,對經濟高效的運輸解決方案的需求不斷成長,推動了市場擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球貿易和工業化日益成長

- 政府對永續包裝的監管

- 食品飲料產業需求不斷成長

- 電子商務領域的擴張

- 新興市場和基礎建設發展

- 產業陷阱與挑戰

- 原物料價格波動

- 供應鏈中斷與物流問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 液袋

- 中型散貨貨櫃

- 死板的

- 固定的

- 散裝貨櫃內襯

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 化學品

- 石油和天然氣

- 食品和飲料

- 油漆、油墨,還有

- 製藥

- 其他

- 農業

- 紡織品

第7章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 金屬

- 其他

- 木頭

- 纖維

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Bulk Lift

- CDF Corporation

- CL Smith

- DENIOS

- DS Smith

- Greif

- Hazmatpac

- Hoover CS

- IDEX Corporation

- ILC Dover

- International Paper

- LC Packaging

- Mauser Packaging Solutions

- Mondi

- Myers Industries

- Pyramid Technoplast

- Schafer Werke

- Schoeller Allibert

- Schutz

- Signode Industrial Group

- Smurfit Kappa

- Snyder Industries

- Time Technoplast

The Global Bulk Container Packaging Market was valued at USD 20.7 billion in 2024 and is projected to expand at a CAGR of 5.7% from 2025 to 2034. The increasing pace of global trade and industrialization, along with the rapid growth of e-commerce, is driving demand for efficient and cost-effective bulk packaging solutions. As industries scale up operations to meet growing demand, the need for reliable transportation and storage of goods continues to rise. Companies across sectors, including chemicals, food and beverages, and pharmaceuticals, are turning to bulk containers such as intermediate bulk containers (IBCs) and flexitanks to enhance logistics efficiency and maintain product integrity. The demand for long-distance and cost-effective transportation solutions further contributes to market expansion. With the increasing consumption of processed food and beverages worldwide, the demand for specialized bulk packaging has grown substantially.

Manufacturers are emphasizing hygiene, contamination-free packaging, and regulatory compliance to ensure product safety. Bulk packaging formats, including flexitanks, drums, bulk bags, and IBCs, play a crucial role in the transportation of edible oils, dairy products, fruit juices, alcoholic beverages, and other liquid food items. Growing global trade volumes and the need for secure transportation of sensitive goods are expected to create new opportunities for manufacturers, particularly in the development of multi-layered containers with enhanced barrier properties. The integration of IoT-enabled tracking and real-time monitoring solutions is anticipated to drive product innovation and differentiation in the competitive landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.7 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 5.7% |

The market is segmented based on product into flexitanks, intermediate bulk containers, and bulk container liners. The flexitank segment, which reached USD 2.4 billion in 2024, is experiencing strong demand due to its cost advantages over traditional barrels and IBCs. As a single-use solution, flexitanks minimize contamination risks for liquid cargo, making them a preferred choice for industries handling food-grade liquids, industrial chemicals, and pharmaceutical ingredients.

The market is further categorized by end use into food and beverages, chemicals, oil and gas, pharmaceuticals, paints, inks and dyes, and other industries. The food and beverage sector held an 18.9% market share in 2024. The rising demand for safe, hygienic, and cost-efficient bulk transportation solutions is propelling market growth. Bulk containers such as flexitanks, IBCs, and liners are extensively used for transporting commodities like grains, sugar, flour, and dairy products. Growing emphasis on sustainability and food-grade packaging has spurred innovation in reusable and biodegradable bulk containers.

By material type, the market is segmented into plastics, metals, and others. The plastic segment is projected to reach USD 13.5 billion by 2034, driven by its lightweight nature, durability, and cost-effectiveness. Industries such as food and beverage, chemicals, pharmaceuticals, and agriculture rely on plastic packaging due to its corrosion resistance and ease of handling. Advancements in biodegradable and recyclable plastics are further accelerating adoption in response to environmental concerns.

Regionally, North America held a 28.2% market share in 2024, supported by strong agricultural and chemical exports. Government regulations promoting recyclable and biodegradable packaging are fostering the adoption of sustainable bulk container solutions. The US bulk container packaging market surpassed USD 5 billion in 2024, with increasing demand for cost-effective transportation solutions fueling market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Global Trade & Industrialization

- 3.2.1.2 Government Regulation on Sustainable Packaging

- 3.2.1.3 Rising Demand from Food & Beverage Industry

- 3.2.1.4 Expansion of E-Commerce Sector

- 3.2.1.5 Emerging Market and Infrastructure Development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating Raw Material Prices

- 3.2.2.2 Supply Chain Disruption & Logistics Issue

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Flexitanks

- 5.3 Intermediate bulk container

- 5.3.1 Rigid

- 5.3.2 Fixed

- 5.4 Bulk container liners

Chapter 6 Market Estimates and Forecast, By End-Use, 2021 – 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 Chemicals

- 6.3 Oil & gas

- 6.4 Food and beverages

- 6.5 Paints, inks, and yes

- 6.6 Pharmaceutical

- 6.7 Others

- 6.7.1 Agriculture

- 6.7.2 Textiles

Chapter 7 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Metal

- 7.4 Others

- 7.4.1 Wood

- 7.4.2 Fiber

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bulk Lift

- 9.2 CDF Corporation

- 9.3 CL Smith

- 9.4 DENIOS

- 9.5 DS Smith

- 9.6 Greif

- 9.7 Hazmatpac

- 9.8 Hoover CS

- 9.9 IDEX Corporation

- 9.10 ILC Dover

- 9.11 International Paper

- 9.12 LC Packaging

- 9.13 Mauser Packaging Solutions

- 9.14 Mondi

- 9.15 Myers Industries

- 9.16 Pyramid Technoplast

- 9.17 Schafer Werke

- 9.18 Schoeller Allibert

- 9.19 Schutz

- 9.20 Signode Industrial Group

- 9.21 Smurfit Kappa

- 9.22 Snyder Industries

- 9.23 Time Technoplast