|

市場調查報告書

商品編碼

1708126

軟性中型散貨貨櫃 (FIBC) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Flexible Intermediate Bulk Container (FIBC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

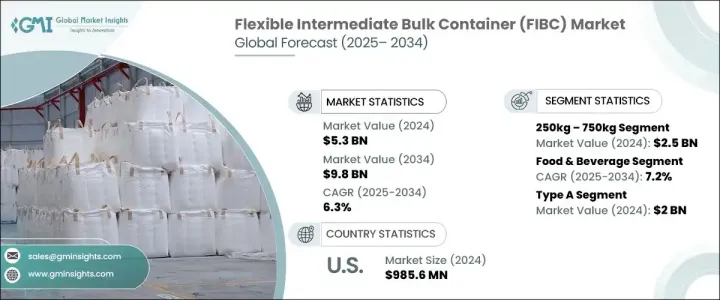

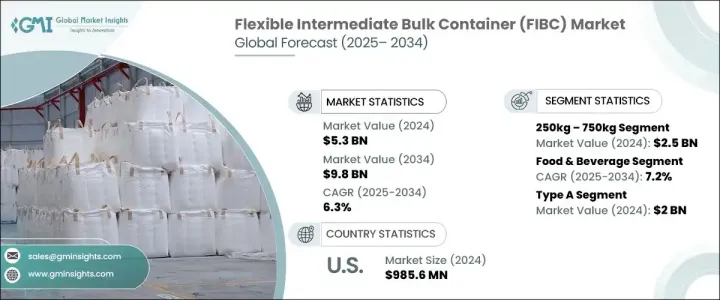

2024 年全球軟性中型散裝貨櫃市場價值為 53 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.3%。製藥、食品和飲料、化學品、農業和建築等行業日益成長的需求正在推動這一擴張。這些貨櫃為散裝物料處理提供了經濟高效、耐用且輕巧的解決方案,使其成為多個行業的首選。此外,全球貿易的激增、工業化程度的提高以及嚴格的包裝法規也極大地促進了市場的成長。

隨著全球企業不斷強調效率和永續性,FIBC 因其環保特性、可重複使用性和符合國際包裝標準而越來越受到關注。人們對永續散裝包裝的偏好日益成長,尤其是在已開發地區,這進一步支持了市場擴張。隨著線上零售商和物流公司擴大採用 FIBC 進行經濟高效且安全的散裝運輸,電子商務的興起也發揮了關鍵作用。在製藥和食品加工等領域,這些容器可確保無污染的儲存和運輸,並遵守嚴格的衛生和安全規定。此外,FIBC 技術的不斷創新,包括防潮、防紫外線和防靜電袋,使其更能適應多樣化的工業需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 6.3% |

250 公斤至 750 公斤細分市場在 2024 年創造了 25 億美元的收入,主要滿足農業、食品加工和建築等中型產業的需求。這些貨櫃為處理大量貨物提供了一種經濟高效的解決方案,同時降低了勞動力成本並提高了營運效率。各行各業對衛生和無污染包裝的需求日益成長,尤其是食品、化學品和藥品行業,這些行業對安全和法規遵循至關重要。這些行業擴大採用先進的散裝包裝解決方案,預計將在未來十年維持該行業的上升趨勢。

在主要應用領域中,食品和飲料行業是成長最快的領域,預計從 2025 年到 2034 年的複合年成長率將達到 7.2%。政府對食品衛生包裝的監管愈加嚴格,加上全球穀物、豆類和其他食品貿易的不斷成長,推動了這一成長。對可靠、大容量散裝包裝解決方案的需求導致食品業對 FIBC 的需求增加。此外,FIBC 材料和設計的進步,包括防篡改、防潮和防紫外線選項,正在增強其吸引力,確保長途運輸過程中產品的完整性。

受製藥、食品和化學工業強勁需求的推動,美國軟性中型散裝容器 (FIBC) 市場在 2024 年創造了 9.856 億美元的收入。更嚴格的永續法規,加上日益轉向具有成本效益和環保的包裝解決方案,正在推動市場成長。美國各地的企業都優先考慮高效的物料處理,而 FIBC 成為降低營運成本和提高生產力的首選。食品加工、製藥和化學品等行業對永續和衛生包裝的高度重視進一步加強了對這些散裝容器的需求,為未來幾年市場穩步擴張奠定了基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 擴大國際貿易

- 永續且環保的包裝

- 蓬勃發展的電子商務產業

- 成本效益和營運效率

- 食品和製藥業的成長

- 產業陷阱與挑戰

- 供應鏈中斷

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- A型(非導電、非靜電)

- B 型(非導電、有限靜電)

- C 型(導電 FIBC,接地)

- D型(靜電耗散,無接地)

第6章:市場估計與預測:按產能,2021 - 2034 年

- 主要趨勢

- 最多 250 公斤

- 250公斤 – 750公斤

- 750公斤以上

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 化學品

- 製藥

- 礦業

- 建造

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Bag Corp

- Berry Global Group, Inc.

- Bulk Container Europe BV

- Bulk Lift International

- CL Smith

- FlexiblePackagingSolutions.com

- Global-Pak

- Halsted

- Intertape Polymer Group

- Isbir Sentetik

- Jumbo Bag Limited

- Langston Companies Inc.

- LC Packaging International BV

- Masterpack Group

- Palmetto Industries International Inc.

- Rishi FIBC Solutions

- Taihua Group

The Global Flexible Intermediate Bulk Container Market was valued at USD 5.3 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. The increasing demand from industries such as pharmaceuticals, food and beverage, chemicals, agriculture, and construction is fueling this expansion. These containers offer cost-effective, durable, and lightweight solutions for bulk material handling, making them a preferred choice across multiple sectors. Additionally, the surge in global trade, rising industrialization, and stringent packaging regulations have significantly contributed to the market's growth.

As businesses worldwide continue to emphasize efficiency and sustainability, FIBCs are gaining traction due to their eco-friendly properties, reusability, and compliance with international packaging standards. The growing preference for sustainable bulk packaging, particularly in developed regions, is further supporting market expansion. The rise of e-commerce has also played a pivotal role as online retailers and logistics companies increasingly adopt FIBCs for cost-effective and secure bulk transportation. In sectors such as pharmaceuticals and food processing, these containers ensure contamination-free storage and transit, adhering to strict hygiene and safety regulations. Moreover, continuous innovations in FIBC technology, including moisture-resistant, UV-protected, and anti-static bags, are making them more adaptable to diverse industrial needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6.3% |

The 250kg-750kg segment generated USD 2.5 billion in 2024, primarily catering to medium-sized industries such as agriculture, food processing, and construction. These containers provide a cost-efficient solution for handling large volumes of goods while reducing labor costs and improving operational efficiency. The demand for hygienic and contamination-free packaging is growing across various industries, particularly in food, chemicals, and pharmaceuticals, where safety and regulatory compliance are paramount. The increasing adoption of advanced bulk packaging solutions in these sectors is expected to sustain the segment's upward trajectory over the coming decade.

Among the key application areas, the food and beverage industry stands out as the fastest-growing segment, anticipated to expand at a CAGR of 7.2% from 2025 to 2034. Stricter government regulations regarding hygienic food packaging, coupled with the rising global trade of grains, pulses, and other food commodities, are driving this growth. The need for reliable and large-capacity bulk packaging solutions has led to an increased demand for FIBCs in the food sector. Furthermore, advancements in FIBC materials and designs, including tamper-proof, moisture-resistant, and UV-shielded options, are enhancing their appeal, ensuring product integrity during long-distance transportation.

The United States Flexible Intermediate Bulk Container (FIBC) Market generated USD 985.6 million in 2024, driven by robust demand from the pharmaceutical, food, and chemical industries. Stricter sustainability regulations, coupled with an increasing shift toward cost-effective and environmentally friendly packaging solutions, are propelling market growth. Businesses across the U.S. are prioritizing efficient material handling, with FIBCs emerging as a preferred choice for reducing operational costs and improving productivity. The heightened focus on sustainable and hygienic packaging in industries such as food processing, pharmaceuticals, and chemicals has further strengthened the demand for these bulk containers, positioning the market for steady expansion in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of international trade

- 3.2.1.2 Sustainable and eco-friendly packaging

- 3.2.1.3 Booming e-commerce industry

- 3.2.1.4 Cost effectiveness and operational efficiency

- 3.2.1.5 Growth in food and pharmaceutical industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption

- 3.2.2.2 Fluctuating price of raw materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Type A (Non-conductive, Non-static)

- 5.3 Type B (Non-conductive, Limited-static)

- 5.4 Type C (Conductive FIBCs, Grounded)

- 5.5 Type D (Static dissipative, No Grounding)

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Upto 250 kg

- 6.3 250kg – 750 kg

- 6.4 Above 750 kg

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Chemicals

- 7.4 Pharmaceuticals

- 7.5 Mining

- 7.6 Construction

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Units)

- 9.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bag Corp

- 9.2 Berry Global Group, Inc.

- 9.3 Bulk Container Europe BV

- 9.4 Bulk Lift International

- 9.5 C.L. Smith

- 9.6 FlexiblePackagingSolutions.com

- 9.7 Global-Pak

- 9.8 Halsted

- 9.9 Intertape Polymer Group

- 9.10 Isbir Sentetik

- 9.11 Jumbo Bag Limited

- 9.12 Langston Companies Inc.

- 9.13 LC Packaging International BV

- 9.14 Masterpack Group

- 9.15 Palmetto Industries International Inc.

- 9.16 Rishi FIBC Solutions

- 9.17 Taihua Group