|

市場調查報告書

商品編碼

1698591

上游石油與天然氣分析市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Upstream Oil and Gas Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

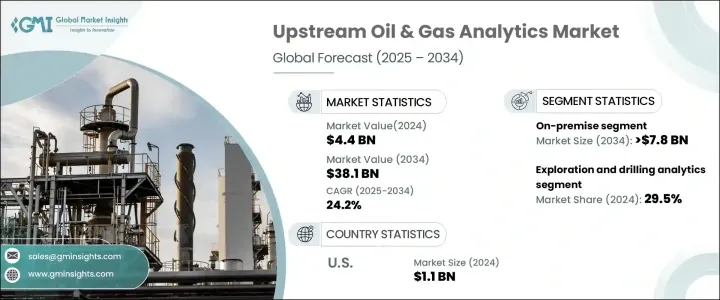

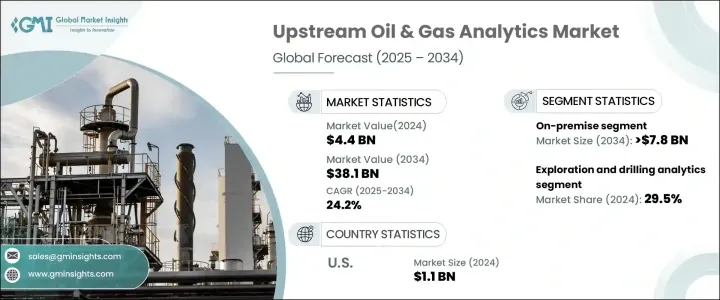

2024 年全球上游石油和天然氣分析市值為 44 億美元,預計 2025 年至 2034 年的複合年成長率為 24.2%。這一成長得益於對基礎設施的大量投資和能源開發的進步,尤其是在石油和天然氣領域。隨著全球電力需求的不斷成長,能源資源的開採也隨之激增,人們更加重視石油和天然氣的探勘,以滿足住宅、商業和工業領域日益成長的需求。

經濟成長和城市化也推動能源需求穩定上升,促使政府和能源公司加強探勘和生產力。人工智慧 (AI) 與石油和天然氣營運的整合正變得越來越普遍,旨在提高生產力和效率,許多公司都在投資人工智慧驅動的工具和分析。隨著越來越多的組織轉向雲端平台進行人工智慧應用,先進技術的採用將推動上游分析市場的進一步成長。此外,即時監控和供應鏈管理等上游流程的日益複雜,也推動了對最佳化營運和降低風險的分析的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 381億美元 |

| 複合年成長率 | 24.2% |

在部署方面,預計到 2034 年,內部部署部分規模將超過 78 億美元,這主要歸因於對石油和天然氣的需求不斷成長。隨著能源公司越來越依賴基於雲端的解決方案,託管分析平台正在提供更具成本效益的替代方案,從而無需對內部部署基礎設施進行大量投資。雲端部署實現了更靈活的營運,允許公司根據市場活動擴展其資源。隨著業界擴大採用基於雲端的分析來增強營運洞察力,預計這一趨勢將會持續下去。

從應用角度來看,探勘和鑽井分析佔據市場主導地位,到 2024 年將佔據 29.5% 的市場佔有率。用於地震資料分析和油藏建模的人工智慧工具正在幫助公司提高探勘精度並最佳化鑽井效率。隨著越來越多的物聯網感測器和邊緣運算設備被整合到鑽井作業中,對這些分析的需求預計會增加,從而實現即時設備監控並減少停機時間。現場監控和監控分析也至關重要,2024 年的市場價值將達到 9 億美元。人工智慧驅動的分析可幫助公司在潛在問題出現之前發現它們,從而減少停機時間和維護成本。遠端監控功能越來越受到關注,因為操作員現在無需親自檢查現場即可管理資產,從而提高了安全性和營運效率。

受能源需求成長和工業化推動,美國上游石油和天然氣分析市場預計將繼續成長,到 2024 年將超過 11 億美元,並在未來幾年大幅擴張。

目錄

第1章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依部署,2021 年至 2034 年

- 主要趨勢

- 本地

- 託管

第6章:市場規模及預測:依服務,2021 年至 2034 年

- 主要趨勢

- 專業的

- 雲

- 一體化

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 探勘和鑽探

- 現場監測和監控

- 生產計劃和預測

- 設備維護管理

- 資產表現

- 勞動力管理

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Accenture

- Capgemini

- Cisco Systems

- Cognizant

- Deloitte

- Hewlett Packard Enterprise

- Hitachi

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Tableau Software

- Teradata

- TIBCO Software

The Global Upstream Oil And Gas Analytics Market was valued at USD 4.4 billion in 2024 and is projected to grow at a CAGR of 24.2% from 2025 to 2034. This growth is driven by significant investments in infrastructure and advancements in energy source development, particularly within the oil and gas sector. With increasing global demand for electricity, there is a surge in the extraction of energy resources, leading to a heightened focus on oil and gas exploration to meet the growing needs across residential, commercial, and industrial sectors.

Economic growth and urbanization have also contributed to a steady rise in energy demand, prompting governments and energy companies to enhance exploration and production efforts. The integration of artificial intelligence (AI) within oil and gas operations, aimed at improving productivity and efficiency, is becoming more widespread, with many companies investing in AI-driven tools and analytics. As more organizations turn to cloud platforms for AI applications, the adoption of advanced technologies is set to drive further growth in the upstream analytics market. Additionally, the increasing complexity of upstream processes, such as real-time monitoring and supply chain management, is fueling the demand for analytics to optimize operations and mitigate risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $38.1 Billion |

| CAGR | 24.2% |

In terms of deployment, the on-premise segment is expected to surpass USD 7.8 billion by 2034, largely due to the rising demand for oil and gas. As energy companies increasingly rely on cloud-based solutions, hosted analytics platforms are providing more cost-effective alternatives, eliminating the need for significant investments in on-premise infrastructure. Cloud deployment enables more flexible operations, allowing companies to scale their resources according to market activity. This trend is expected to continue as the industry increasingly adopts cloud-based analytics for enhanced operational insights.

By application, exploration and drilling analytics dominate the market, accounting for 29.5% of the market share in 2024. AI-powered tools for seismic data analysis and reservoir modeling are helping companies improve exploration accuracy and optimize drilling efficiency. The demand for these analytics is expected to increase as more IoT sensors and edge computing devices are integrated into drilling operations, allowing for real-time equipment monitoring and reducing operational downtime. Field surveillance and monitoring analytics are also vital, with a market value of USD 900 million in 2024. AI-driven analytics help companies identify potential issues before they arise, reducing downtime and maintenance costs. Remote monitoring capabilities are gaining traction as operators can now manage assets without physically inspecting sites, which enhances security and operational efficiency.

The U.S. upstream oil & gas analytics market is expected to continue its growth, surpassing USD 1.1 billion in 2024 and expanding significantly in the years to come, driven by rising energy demands and industrialization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Deployment, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 On premise

- 5.3 Hosted

Chapter 6 Market Size and Forecast, By Service, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Professional

- 6.3 Cloud

- 6.4 Integration

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Exploration and drilling

- 7.3 Field surveillance and monitoring

- 7.4 Production planning and forecasting

- 7.5 Equipment maintenance management

- 7.6 Asset performance

- 7.7 Workforce management

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Accenture

- 9.2 Capgemini

- 9.3 Cisco Systems

- 9.4 Cognizant

- 9.5 Deloitte

- 9.6 Hewlett Packard Enterprise

- 9.7 Hitachi

- 9.8 IBM

- 9.9 Microsoft

- 9.10 Oracle

- 9.11 SAP

- 9.12 SAS Institute

- 9.13 Tableau Software

- 9.14 Teradata

- 9.15 TIBCO Software