|

市場調查報告書

商品編碼

1666918

中游石油和天然氣分析市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Midstream Oil and Gas Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

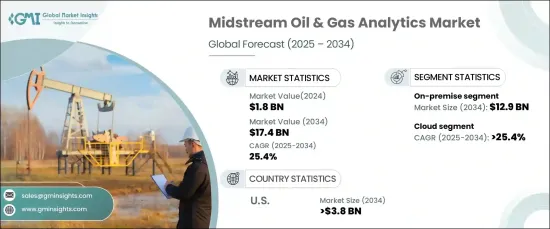

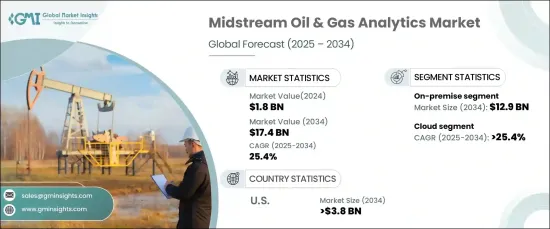

2024 年全球中游石油和天然氣分析市場規模達到 18 億美元,預計到 2034 年將以 25.4% 的複合年成長率強勁成長。

行業內的公司正在採用先進的分析技術來最佳化其管道營運、監控資產績效並支持更明智的決策。預測分析起著至關重要的作用,可以幫助操作員檢測潛在的設備故障並在問題變得嚴重之前解決問題。這種積極主動的方法可以減少停機時間和維護成本,從而促進整個行業的廣泛使用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 174億美元 |

| 複合年成長率 | 25.4% |

人工智慧(AI)和機器學習(ML)與分析工具的整合正在極大地重塑中游石油和天然氣產業。這些技術透過處理大型資料集來識別新興趨勢、預測需求並最佳化供應鏈,從而實現更深入的洞察。人工智慧分析還可以透過檢測即時異常來增強安全協議,使操作員能夠迅速應對潛在風險。

市場按部署模式分類,包括內部部署和基於雲端的解決方案。預計到 2034 年,內部部署部分規模將超過 129 億美元,這將受到那些重視資料安全並希望保持對敏感資訊控制的公司的青睞。內部部署解決方案可與現有 IT 基礎架構無縫整合,確保無需依賴外部網路即可實現高效能和即時分析。

此外,市場也按專業、雲端和整合等服務進行分類。預計到 2034 年,雲端運算領域的複合年成長率將超過 24.5%,這得益於其成本效益、可擴展性和易於存取性。雲端解決方案可實現即時資料分析和遠端監控,幫助營運商及時做出決策。這些平台還降低了 IT 基礎設施成本,同時提供與物聯網 (IoT) 設備的無縫整合,提高了營運可見度。基於雲端的分析的靈活性使其成為管理動態工作負載、預測需求和最佳化管道效率的理想選擇。

預計到 2034 年,美國中游石油和天然氣分析市場規模將超過 38 億美元。分析工具現在對於最佳化運輸、監控資產績效和確保法規合規性至關重要。此外,人工智慧和物聯網技術的結合可以實現即時監控和預測性維護,有助於減少營運停機時間和成本。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依部署,2021 – 2034 年

- 主要趨勢

- 本地

- 託管

第6章:市場規模及預測:依服務,2021 – 2034 年

- 主要趨勢

- 專業的

- 雲

- 一體化

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 管道 SCADA

- 艦隊

- 儲存最佳化

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Accenture

- Capgemini

- Cisco Systems

- Cognizant

- Deloitte

- Hewlett Packard Enterprise

- Hitachi

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Tableau Software

- Teradata

- TIBCO Software

The Global Midstream Oil And Gas Analytics Market reached USD 1.8 billion in 2024 and is poised to expand at a robust growth rate of 25.4% CAGR through 2034. This growth is driven by the increasing demand for enhanced operational efficiency and cost management within the midstream sector.

Companies in the industry are adopting advanced analytics to optimize their pipeline operations, monitor asset performance, and support more informed decision-making. Predictive analytics plays a critical role, helping operators detect potential equipment failures and address issues before they become major problems. This proactive approach leads to reduced downtime and maintenance costs, encouraging widespread use across the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 25.4% |

The integration of artificial intelligence (AI) and machine learning (ML) into analytics tools is significantly reshaping the midstream oil and gas industry. These technologies enable deeper insights by processing large datasets to identify emerging trends, forecast demand, and optimize supply chains. AI-powered analytics also enhance safety protocols by detecting real-time anomalies, enabling operators to act swiftly in response to potential risks.

The market is divided by deployment models, including on-premise and cloud-based solutions. The on-premise segment is expected to surpass USD 12.9 billion by 2034, favored by companies that prioritize data security and wish to maintain control over sensitive information. On-premise solutions offer seamless integration with existing IT infrastructures, ensuring high performance and real-time analytics without depending on external networks.

In addition, the market is categorized by services such as professional, cloud, and integration. The cloud segment is projected to grow at a CAGR exceeding 24.5% through 2034, driven by its cost-effectiveness, scalability, and ease of access. Cloud solutions enable real-time data analysis and remote monitoring, which help operators make timely decisions. These platforms also reduce IT infrastructure costs while providing seamless integration with Internet of Things (IoT) devices, boosting operational visibility. The flexibility of cloud-based analytics makes it ideal for managing dynamic workloads, forecasting demand, and optimizing pipeline efficiency.

U.S. midstream oil and gas analytics market is anticipated to exceed USD 3.8 billion by 2034. This growth is fueled by the increasing investments in pipeline infrastructure and the adoption of cutting-edge technologies. Analytics tools are now essential for optimizing transportation, monitoring asset performance, and ensuring regulatory compliance. Additionally, the combination of AI and IoT technologies enables real-time monitoring and predictive maintenance, helping reduce operational downtime and costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Deployment, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 On premise

- 5.3 Hosted

Chapter 6 Market Size and Forecast, By Service, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Professional

- 6.3 Cloud

- 6.4 Integration

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Pipeline SCADA

- 7.3 Fleet

- 7.4 Storage optimization

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Accenture

- 9.2 Capgemini

- 9.3 Cisco Systems

- 9.4 Cognizant

- 9.5 Deloitte

- 9.6 Hewlett Packard Enterprise

- 9.7 Hitachi

- 9.8 IBM

- 9.9 Microsoft

- 9.10 Oracle

- 9.11 SAP

- 9.12 SAS Institute

- 9.13 Tableau Software

- 9.14 Teradata

- 9.15 TIBCO Software