|

市場調查報告書

商品編碼

1698544

軟體機器人市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Soft Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

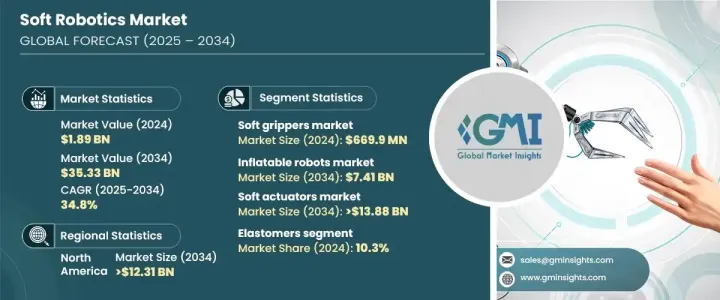

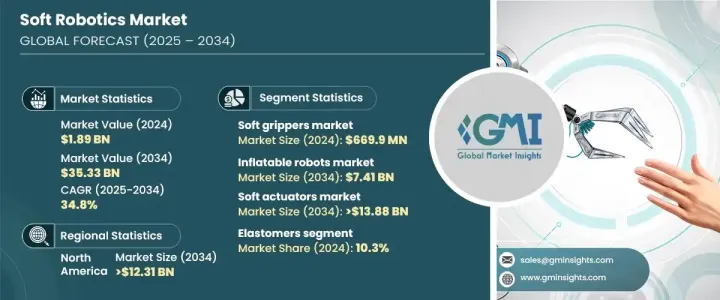

2024 年全球軟體機器人市場價值為 18.9 億美元,預計 2025 年至 2034 年的複合年成長率為 34.8%。自動化需求的不斷成長以及醫療保健和酒店業的擴張正在推動這一成長。各行各業正在整合軟機器人技術來增強自動化,使機器人能夠在各個領域執行複雜的任務。軟機器人在醫療保健、物流和製造業的應用日益廣泛,這促進了市場擴張,因為它們能夠精確、有效率地處理精密物體。

在醫療保健領域,人口老化和勞動力短缺正在加速對機器人自動化的需求。該行業正在轉向軟機器人技術來簡化操作、自動化重複性任務並改善患者護理。這些機器人可以協助復健、執行精細的外科手術,並透過提高操作效率來支援醫療專業人員。同樣,酒店業正在整合自動化來提供服務,提高效率並降低營運成本。物流業也採用軟機器人來最佳化供應鏈管理、自動化庫存處理並提高整體生產力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18.9億美元 |

| 預測值 | 353.3億美元 |

| 複合年成長率 | 34.8% |

軟機器人依類型分為軟夾持器、充氣機器人、外骨骼和穿戴式裝置。軟夾爪廣泛應用於工業自動化、農業和醫療保健領域,為處理易碎物品提供了靈活的解決方案。受倉庫和製造工廠日益普及的推動,軟夾持器市場規模到 2024 年將達到 6.699 億美元。先進的感官回饋、視覺系統和增強設計的發展正在進一步提高它們的效率和多功能性。充氣機器人的價值到 2034 年將超過 74.1 億美元,由於其重量輕且適應性強的結構而越來越受到關注,使其成為醫療應用、災難應變和太空探索的理想選擇。

按組件分類,市場包括軟致動器、感測器、控制系統和電源。受醫療保健、物流和農業領域自動化需求的推動,軟執行器市場的規模到 2034 年預計將超過 138.8 億美元。軟感測器在 2024 年佔據了 25.7% 的市場佔有率,在基於人工智慧的自動化和觸覺感應技術中發揮著至關重要的作用。控制系統的價值到 2034 年將超過 57 億美元,它整合了人工智慧和機器學習,以增強機器人操作的自主性。電源供應器在 2024 年也將佔據 25.7% 的市場佔有率,並隨著緊湊高效的能源解決方案的創新而不斷發展。

市場進一步按材料細分,包括彈性體、凝膠和織物。 2024 年,彈性體佔據了 10.3% 的市場佔有率,為機器人應用提供了高度的靈活性和彈性。凝膠基機器人能夠適應熱和電等刺激,在生物醫學和製藥應用領域越來越受歡迎。織物整合軟機器人正在推動穿戴式技術的發展,使其成為輔助醫療設備和自適應服裝的理想選擇。

應用範圍涵蓋醫療保健、食品和物流、汽車和農業。預計醫療保健產業從 2025 年到 2034 年的複合年成長率將達到 35.2%,該產業正在利用軟機器人進行義肢、行動輔助和外科手術。食品和飲料產業正在實施加工、包裝和品質控制的自動化,預計到 2034 年將達到 117.8 億美元以上。物流的複合年成長率為 33.8%,正在透過人工智慧整合機器人解決方案最佳化倉庫營運。預計到 2034 年,汽車產業的產值將超過 36 億美元,該產業使用軟機器人進行精密組裝、噴漆和品質檢查。農業的複合年成長率為 31.3%,正在採用機器人解決方案進行收割、病蟲害防治和精準農業。

從地理上看,在監管支援和技術進步的推動下,北美預計到 2034 年將達到 123.1 億美元以上。美國市場預計將超過 102.2 億美元,在政府大力支持和資助機器人技術研發的情況下,引領自動化領域的創新。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 自動化需求不斷成長

- 材料科學的進步

- 酒店和醫療保健行業的成長

- 人們對人機協作的興趣日益濃厚

- 環境永續性

- 產業陷阱與挑戰

- 耐久性和強度有限

- 資料安全和隱私問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 軟夾持器

- 充氣機器人

- 外骨骼

- 穿戴式裝置

- 其他

第6章:市場估計與預測:按組件,2021 年至 2034 年

- 主要趨勢

- 軟執行器

- 軟感應器

- 控制系統

- 電源

- 其他

第7章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 彈性體

- 凝膠

- 布料

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 醫療保健

- 食品和飲料

- 後勤

- 汽車

- 農業

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Soft Robotics Inc. (Schmalz)

- Festo AG

- ReWalk Robotics

- Yaskawa Electric Corporation

- ABB Group

- Kawada Robotics

- Techman Robot Inc.

- Permanently closed

- Righthand Robotics

- Fanuc Corporation

- Universal Robots

- Cyberdyne Inc.

- Beijing Soft Robotics Technology Co.,

- OnRobot A/S

- Empire Robotics

- iCobots

- Pneubotics Inc.

- Squishy Robotics

- embotech GmbH

- SpectroPlast

- Somnox

The Global Soft Robotics Market size was valued at USD 1.89 billion in 2024 and is projected to reach USD 35.33 billion by 2034, growing at a CAGR of 34.8% from 2025 to 2034. The rising demand for automation and the expansion of the healthcare and hospitality industries are fueling this growth. Industries are integrating soft robotics to enhance automation, enabling robots to perform complex tasks across various sectors. The increasing adoption of soft robots in healthcare, logistics, and manufacturing is contributing to market expansion, driven by their ability to handle delicate objects with precision and efficiency.

In the healthcare sector, a growing aging population and labor shortages are accelerating the demand for robotic automation. The industry is turning to soft robotics to streamline operations, automate repetitive tasks, and improve patient care. These robots can assist in rehabilitation, perform delicate surgical procedures, and support medical professionals by enhancing operational efficiency. Similarly, the hospitality industry is integrating automation for service delivery, improving efficiency while reducing operational costs. The logistics sector is also adopting soft robotics to optimize supply chain management, automate inventory handling, and enhance overall productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.89 Billion |

| Forecast Value | $35.33 Billion |

| CAGR | 34.8% |

Soft robotics is segmented by type into soft grippers, inflatable robots, exoskeletons, and wearables. Soft grippers, widely used in industrial automation, agriculture, and healthcare, offer a flexible solution for handling delicate items. The market for soft grippers is valued at USD 669.9 million in 2024, driven by increasing adoption in warehouses and manufacturing facilities. The development of advanced sensory feedback, vision systems, and enhanced designs is further improving their efficiency and versatility. Inflatable robots, valued at over USD 7.41 billion by 2034, are gaining traction due to their lightweight and adaptable structure, making them ideal for medical applications, disaster response, and space exploration.

By component, the market includes soft actuators, sensors, control systems, and power sources. The soft actuators segment is set to exceed USD 13.88 billion by 2034, driven by the need for automation in healthcare, logistics, and agriculture. Soft sensors accounted for 25.7% of the market in 2024, playing a crucial role in AI-based automation and tactile sensing technologies. Control systems, valued at over USD 5.7 billion by 2034, integrate AI and machine learning for enhanced autonomy in robotic operations. Power sources, also holding a 25.7% market share in 2024, are evolving with innovations in compact and efficient energy solutions.

The market is further segmented by material, including elastomers, gels, and fabrics. Elastomers held a 10.3% market share in 2024, offering high flexibility and resilience for robotic applications. Gel-based robots, which adapt to stimuli such as heat and electricity, are gaining popularity in biomedical and pharmaceutical applications. Fabric-integrated soft robotics are advancing wearable technology, making them ideal for assistive medical devices and adaptive clothing.

Applications span healthcare, food and logistics, automotive, and agriculture. The healthcare sector, projected to grow at a CAGR of 35.2% from 2025 to 2034, is leveraging soft robotics for prosthetics, mobility assistance, and surgical procedures. The food and beverage sector, set to reach over USD 11.78 billion by 2034, is implementing automation for processing, packaging, and quality control. Logistics, with a CAGR of 33.8%, is optimizing warehouse operations through AI-integrated robotic solutions. The automotive industry, anticipated to surpass USD 3.6 billion by 2034, uses soft robotics for precision assembly, painting, and quality inspections. Agriculture, growing at a CAGR of 31.3%, is adopting robotic solutions for harvesting, pest control, and precision farming.

Geographically, North America is projected to reach over USD 12.31 billion by 2034, driven by regulatory support and technological advancements. The U.S. market, expected to exceed USD 10.22 billion, is leading innovations in automation, with strong government support and funding for research and development in robotics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automation

- 3.2.1.2 Advancements in material science

- 3.2.1.3 Growth in the hospitality and healthcare industries

- 3.2.1.4 Growing interest in human-robot collaborations

- 3.2.1.5 Environmental sustainability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited durability and strength

- 3.2.2.2 Data security and privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Soft grippers

- 5.3 Inflatable robots

- 5.4 Exoskeletons

- 5.5 Wearables

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 Soft actuators

- 6.3 Soft sensors

- 6.4 Control systems

- 6.5 Power sources

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Elastomers

- 7.3 Gels

- 7.4 Fabrics

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Medical and healthcare

- 8.3 Food and beverages

- 8.4 Logistics

- 8.5 Automotive

- 8.6 Agriculture

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Soft Robotics Inc. (Schmalz)

- 10.2 Festo AG

- 10.3 ReWalk Robotics

- 10.4 Yaskawa Electric Corporation

- 10.5 ABB Group

- 10.6 Kawada Robotics

- 10.7 Techman Robot Inc.

- 10.8 Permanently closed

- 10.9 Righthand Robotics

- 10.10 Fanuc Corporation

- 10.11 Universal Robots

- 10.12 Cyberdyne Inc.

- 10.13 Beijing Soft Robotics Technology Co.,

- 10.14 OnRobot A/S

- 10.15 Empire Robotics

- 10.16 iCobots

- 10.17 Pneubotics Inc.

- 10.18 Squishy Robotics

- 10.19 embotech GmbH

- 10.20 SpectroPlast

- 10.21 Somnox