|

市場調查報告書

商品編碼

1698517

蛋白粉市場機會、成長動力、產業趨勢分析及2025-2034年預測Protein Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

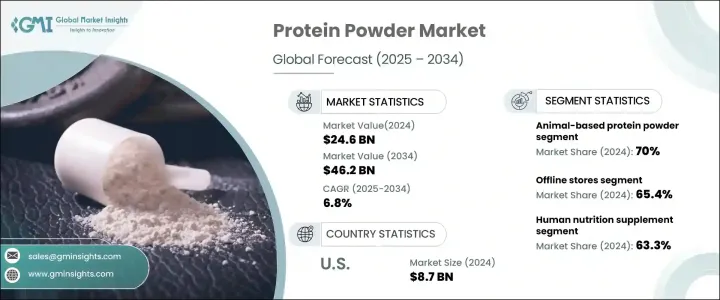

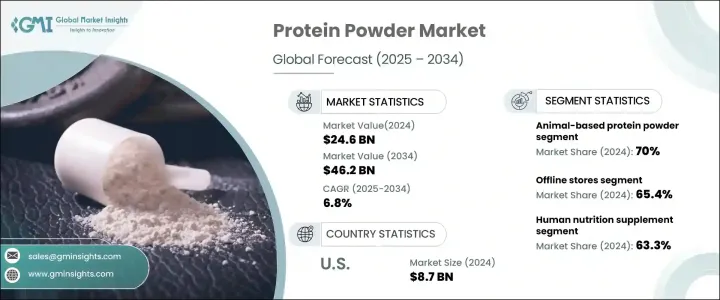

2024 年全球蛋白粉市場價值為 246 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.8%,這得益於消費者對營養和健康的意識不斷增強。這種激增的原因是人們對高蛋白飲食的偏好日益成長、口味的多樣化以及蛋白質在肌肉發育、代謝功能和免疫支持中發揮的關鍵作用。注重健康的個人和健身愛好者正在積極將蛋白粉納入他們的飲食中,從而增強了不同人群的需求。

隨著對預防性醫療保健的日益關注,消費者正在尋求支持整體健康和健身目標的產品。人們的生活方式變得更加積極,這推動了蛋白粉的需求,人們優先考慮膳食補充劑來提高運動表現和恢復能力。此外,快速的城市化和現代生活的快節奏導致人們更傾向於方便、隨時可用的營養解決方案,這進一步推動了市場擴張。消費者正在尋找符合其飲食偏好的配方,無論是植物性的、有機的還是添加了額外營養素的。隨著品牌不斷創新,迎合不斷變化的消費者偏好的新產品的推出正在極大地影響購買行為。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 246億美元 |

| 預測值 | 462億美元 |

| 複合年成長率 | 6.8% |

市場依蛋白質來源分為植物性蛋白質粉和動物性蛋白質粉。 2024 年,動物蛋白粉佔據了 70% 的市場佔有率,這歸功於其優越的氨基酸成分以及在肌肉恢復、體重管理和整體營養方面的有效性。這些配方被需要高品質蛋白質來最佳化表現的運動員、健美運動員和健身專業人士廣泛採用。源自乳製品的乳清蛋白和酪蛋白由於其吸收迅速且對肌肉合成具有公認的益處而繼續佔據領先地位。同時,隨著消費者尋求純素和無過敏原的替代品,包括豌豆、大豆和大麻蛋白在內的植物蛋白粉也越來越受歡迎。各大品牌正在透過改進產品配方來應對這種轉變,以提供可比較的蛋白質含量和更高的消化率。

蛋白粉市場的分銷格局正在發生變化,線下和線上通路塑造著消費者的購買行為。 2024年,線下零售店將佔65.4%的市場佔有率,這得益於消費者對店內產品試用和立即購買的偏好。超市、專業營養品商店和保健食品零售商仍是主要的銷售管道,提供多種產品以滿足不同消費者的需求。然而,電子商務平台的影響力日益增強,正在重塑市場格局。送貨上門的便利,加上獨家的線上折扣和訂閱模式,促使消費者購買模式發生了轉變。數位購物趨勢加速發展,推動品牌透過有針對性的廣告、影響力合作夥伴關係和社群媒體行銷策略來最佳化其線上形象。公司正在利用資料分析來個人化產品、增強客戶參與度並在競爭激烈的數位環境中推動銷售。

美國蛋白粉市場預計到 2024 年將創造 87 億美元的產值,仍然是全球產業擴張的關鍵參與者。預計到 2025 年,獲得許可的食品商店數量將超過 165,000 家,線下分銷管道將進一步成長。零售商正在積極適應不斷變化的消費者偏好,透過改善產品展示、擴大類別選擇以及提供店內諮詢來增強客戶體驗。同時,受線上參與度和品牌主導行銷活動的推動,數位銷售管道正在呈指數級成長。公司不斷創新以滿足現代消費者的動態期望,確保產品在多個接觸點上保持相關性和可近性。隨著產業的發展,透過產品創新、策略合作夥伴關係和全通路分銷實現競爭差異化對於維持市場動能仍然至關重要。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

- 初步研究和驗證

- 主要來源

- 資料探勘來源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 健康意識不斷提高

- 有多種口味可供選擇

- 拓展線下分銷通路

- 產業陷阱與挑戰

- 原物料價格波動

- 標籤錯誤或產品效力不一致

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按來源,2021 年至 2034 年

- 主要趨勢

- 植物性

- 大豆

- 螺旋藻

- 麻

- 米

- 豌豆

- 其他

- 動物性

- 乳清

- 酪蛋白

- 蛋

- 魚

- 昆蟲

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 人類營養補充品

- 運動營養

- 功能性食品

- 動物營養補充品

- 家禽

- 豬

- 牛

- 水產養殖

- 馬

- 其他

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 超市/大賣場

- 線上

- 藥局

- 營養保健食品店

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ABH Pharma Inc

- Melaleuca Inc

- Amway

- Abbott Laboratories

- Glanbia Group.

- GlaxoSmithKline

- Herbalife International of America, Inc.

- GNC Holdings

- Living Inc

- Omega Protein

- Vitaco Health

- Atlantic Multipower UK Limited

- Dalblads

- Atlantic Multipower

The Global Protein Powder Market, valued at USD 24.6 billion in 2024, is projected to expand at a CAGR of 6.8% from 2025 to 2034, driven by increasing consumer awareness of nutrition and wellness. This surge is fueled by a rising preference for high-protein diets, the availability of diverse flavors, and the crucial role protein plays in muscle development, metabolic function, and immune support. Health-conscious individuals and fitness enthusiasts are actively incorporating protein powders into their diets, reinforcing demand across various demographics.

With an increasing focus on preventive healthcare, consumers are seeking products that support overall well-being and fitness goals. The demand for protein powders is also being driven by a shift toward active lifestyles, where individuals prioritize dietary supplementation to enhance performance and recovery. Additionally, rapid urbanization and the fast-paced nature of modern living have led to a preference for convenient, on-the-go nutrition solutions, further propelling market expansion. Consumers are looking for formulations that align with their dietary preferences, whether plant-based, organic, or fortified with additional nutrients. As brands continue to innovate, new product launches catering to evolving consumer preferences are significantly influencing purchasing behavior.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $46.2 Billion |

| CAGR | 6.8% |

The market is segmented by protein source into plant-based and animal-based protein powders. Animal-based protein powders dominated the market with a 70% share in 2024, attributed to their superior amino acid profile and effectiveness in muscle recovery, weight management, and overall nutrition. These formulations are widely adopted by athletes, bodybuilders, and fitness professionals who require high-quality protein for optimized performance. Whey and casein proteins, derived from dairy sources, continue to lead the segment due to their rapid absorption and proven benefits in muscle synthesis. Meanwhile, plant-based protein powders, including pea, soy, and hemp protein, are gaining traction as consumers seek vegan and allergen-free alternatives. Brands are responding to this shift by enhancing product formulations to offer comparable protein content and improved digestibility.

The distribution landscape of the protein powder market is evolving, with offline and online channels shaping consumer purchasing behavior. In 2024, offline retail stores held a 65.4% market share, driven by consumer preference for in-store product trials and immediate purchases. Supermarkets, specialty nutrition stores, and health food retailers continue to be primary sales channels, offering a diverse range of products catering to different consumer needs. However, the growing influence of e-commerce platforms is reshaping the market dynamics. The convenience of doorstep delivery, coupled with exclusive online discounts and subscription models, has prompted a shift in consumer buying patterns. Digital shopping trends have accelerated, pushing brands to optimize their online presence through targeted advertising, influencer partnerships, and social media marketing strategies. Companies are leveraging data analytics to personalize offerings, enhance customer engagement, and drive sales in a competitive digital landscape.

The U.S. protein powder market, generating USD 8.7 billion in 2024, remains a key player in global industry expansion. With the number of licensed edible stores expected to surpass 165,000 in 2025, offline distribution channels are poised for further growth. Retailers are actively adapting to changing consumer preferences by improving product placement, expanding category selections, and offering in-store consultations to enhance customer experiences. At the same time, digital sales channels are witnessing exponential growth, fueled by increasing online engagement and brand-led marketing initiatives. Companies are continuously innovating to meet the dynamic expectations of modern consumers, ensuring product offerings remain relevant and accessible across multiple touchpoints. As the industry advances, competitive differentiation through product innovation, strategic partnerships, and omnichannel distribution will remain critical in sustaining market momentum.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising health awareness

- 3.6.1.2 Availability of various flavors

- 3.6.1.3 Expansion of offline distribution channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuations in price of raw materials

- 3.6.2.2 Mislabelling or inconsistent product potency

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based

- 5.2.1 Soy

- 5.2.2 Spirulina

- 5.2.3 Hemp

- 5.2.4 Rice

- 5.2.5 Pea

- 5.2.6 Others

- 5.3 Animal-based

- 5.3.1 Whey

- 5.3.2 Casein

- 5.3.3 Egg

- 5.3.4 Fish

- 5.3.5 Insect

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Human nutrition supplement

- 6.2.1 Sports nutrition

- 6.2.2 Functional foods

- 6.3 Animal nutrition supplement

- 6.3.1 Poultry

- 6.3.2 Swine

- 6.3.3 Cattle

- 6.3.4 Aquaculture

- 6.3.5 Equine

- 6.3.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarket/Hypermarket

- 7.3 Online

- 7.4 Drugstore

- 7.5 Nutrition & health food store

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABH Pharma Inc

- 9.2 Melaleuca Inc

- 9.3 Amway

- 9.4 Abbott Laboratories

- 9.5 Glanbia Group.

- 9.6 GlaxoSmithKline

- 9.7 Herbalife International of America, Inc.

- 9.8 GNC Holdings

- 9.9 Living Inc

- 9.10 Omega Protein

- 9.11 Vitaco Health

- 9.12 Atlantic Multipower UK Limited

- 9.13 Dalblads

- 9.14 Atlantic Multipower