|

市場調查報告書

商品編碼

1698281

電子藥物市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Electroceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

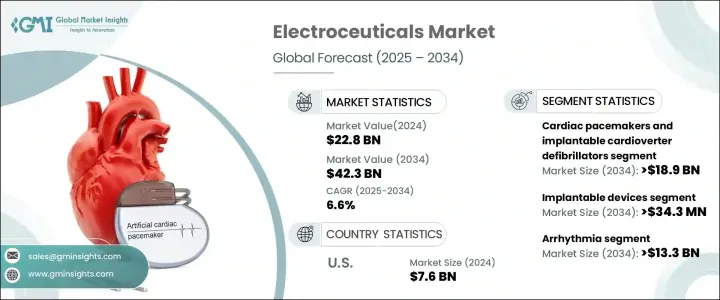

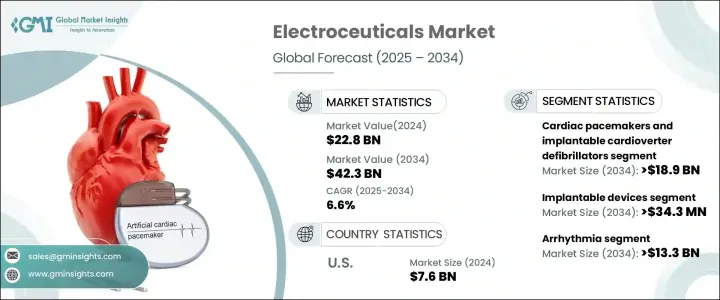

2024 年全球電子藥物市場價值為 228 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.6%。受生物電子醫學技術進步、慢性病盛行率上升以及對非藥物治療替代品的需求不斷成長的推動,該市場正在顯著擴張。電療利用電刺激來治療疾病,隨著患者和醫療保健提供者尋求比傳統藥物更有效、微創且副作用更少的治療方法,電療正受到廣泛關注。心血管疾病、神經系統疾病和疼痛管理挑戰等慢性病負擔日益加重,激發了人們對這些設備的興趣。隨著醫療保健行業轉向以患者為中心的護理,電子藥物正在成為現代治療方法的重要組成部分。

生物電子醫學的創新正在推動更有效率、更精確的電療設備的開發,進一步推動市場成長。不斷增加的研究投入和有利的監管政策正在鼓勵製造商擴大其產品組合。此外,消費者對非侵入性治療方案的認知不斷提高以及醫療保健解決方案的可近性不斷提高,也提高了採用率。隨著人工智慧和智慧監控功能的整合,電子藥物設備在管理長期病症方面變得更加個人化和有效。該市場也受惠於醫療科技公司和研究機構之間的合作,推動了設備小型化、無線通訊和電池壽命改進的突破。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 228億美元 |

| 預測值 | 423億美元 |

| 複合年成長率 | 6.6% |

市場根據產品類別進行細分,包括心臟設備、神經調節器和植入物。心臟節律器和除顫器等心臟設備預計將經歷最高成長,複合年成長率為 6.7%,到 2034 年將達到 189 億美元。心血管疾病的盛行率不斷上升,加上全球人口老化,正在推動對這些救生設備的需求。心臟技術的不斷改進,例如 MRI 相容起搏器和遠端病人監控系統,使得這些解決方案更加有效和易於使用。人工智慧診斷和即時健康追蹤的結合進一步增強了它們在臨床環境中的應用。

電子藥物市場也分為植入式設備和非侵入式設備。預計到 2034 年植入式設備市場規模將達到 343 億美元,複合年成長率為 6.3%。慢性病發病率的上升和生物電子醫學的不斷進步是主要的成長動力。植入式電療,例如脊髓刺激器和人工耳蝸,為無需持續用藥的疾病管理提供了長期解決方案,使其成為患者和醫療保健提供者都青睞的選擇。

美國電子藥物市場在 2024 年創造了 76 億美元的產值,預計在 2025 年至 2034 年期間的複合年成長率為 5.7%。慢性疾病(尤其是心血管和神經系統疾病)的盛行率不斷上升,推動了對電子藥物解決方案的需求。人口快速老化和醫療技術的不斷進步進一步支持了市場成長。心律調節器、深部腦部刺激器和其他電療設備因其在治療慢性疼痛、心臟病和神經系統疾病方面的療效而被廣泛需求。隨著醫療基礎設施的加強和報銷政策變得更加優惠,美國電子藥物市場將持續擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 生物電子學和神經刺激技術的進步

- 微創手術的採用率不斷提高

- 疼痛管理解決方案的需求不斷成長

- 擴大在神經和精神疾病領域的應用

- 生物電醫學研究投資不斷增加

- 產業陷阱與挑戰

- 電療設備成本高

- 設備故障風險與安全問題

- 替代治療方案的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 價值鏈分析

- 臨床驅動的智慧植入式電子設備邁向精準治療概述

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 心臟節律器和植入式心律轉復除顫器

- 神經調節劑

- 脊髓刺激器

- 深部腦部刺激器

- 迷走神經刺激器

- 薦神經刺激器

- 胃電刺激器

- 經皮電神經刺激器

- 經顱磁刺激器

- 其他神經調節劑

- 人工耳蝸

- 視網膜植入物

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 植入式裝置

- 非侵入式設備

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 心律不整

- 慢性疼痛管理

- 神經系統疾病

- 聽力損失

- 帕金森氏症

- 尿失禁

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心(ASC)

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott

- Axonics

- BIOTRONIK

- Boston Scientific

- Cala Health

- Cochlear

- LivaNova

- Medico SpA

- Medtronic

- MicroPort

- Monarch

- NEUROPACE

- Nevro

- Nurotron

- SetPoint Medical

- Sky Medical Technology

- SONOVA

The Global Electroceuticals Market was valued at USD 22.8 billion in 2024 and is projected to grow at a CAGR of 6.6% between 2025 and 2034. The market is witnessing significant expansion, driven by technological advancements in bioelectronic medicine, increasing prevalence of chronic diseases, and rising demand for non-drug treatment alternatives. Electroceuticals, which leverage electrical stimulation to treat medical conditions, are gaining widespread attention as patients and healthcare providers seek more effective, minimally invasive therapies with fewer side effects compared to traditional pharmaceuticals. The growing burden of chronic conditions such as cardiovascular diseases, neurological disorders, and pain management challenges has fueled interest in these devices. As the healthcare industry shifts towards more patient-centric care, electroceuticals are emerging as a critical component of modern treatment approaches.

Innovations in bioelectronic medicine are enabling the development of more efficient and precise electroceutical devices, further propelling market growth. Increasing research investments and favorable regulatory policies are encouraging manufacturers to expand their product portfolios. Moreover, rising consumer awareness about non-invasive treatment options and improved accessibility to healthcare solutions are boosting adoption rates. With the integration of artificial intelligence and smart monitoring capabilities, electroceutical devices are becoming more personalized and effective in managing long-term conditions. The market is also benefiting from collaborations between medtech companies and research institutions, driving breakthroughs in device miniaturization, wireless communication, and battery life improvements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.8 Billion |

| Forecast Value | $42.3 Billion |

| CAGR | 6.6% |

The market is segmented based on product categories, including cardiac devices, neuromodulators, and implants. Cardiac devices, which include pacemakers and defibrillators, are expected to experience the highest growth, with a CAGR of 6.7%, reaching USD 18.9 billion by 2034. The increasing prevalence of cardiovascular diseases, coupled with an aging global population, is driving demand for these life-saving devices. Continuous improvements in cardiac technologies, such as MRI-compatible pacemakers and remote patient monitoring systems, are making these solutions more effective and accessible. The integration of AI-powered diagnostics and real-time health tracking is further enhancing their adoption in clinical settings.

The electroceuticals market is also classified into implantable and non-invasive devices. The implantable devices segment is projected to reach USD 34.3 billion by 2034, growing at a CAGR of 6.3%. Rising incidences of chronic diseases and ongoing advancements in bioelectronic medicine are key growth drivers. Implantable electroceuticals, such as spinal cord stimulators and cochlear implants, offer long-term solutions for managing conditions without continuous medication use, making them an attractive option for both patients and healthcare providers.

U.S. Electroceuticals Market generated USD 7.6 billion in 2024 and is forecasted to grow at a CAGR of 5.7% between 2025 and 2034. The increasing prevalence of chronic diseases, particularly cardiovascular and neurological disorders, is fueling demand for electroceutical solutions. A rapidly aging population and continuous advancements in medical technology are further supporting market growth. Pacemakers, deep brain stimulators, and other electroceutical devices are in high demand due to their proven efficacy in treating chronic pain, heart conditions, and neurological disorders. As healthcare infrastructure strengthens and reimbursement policies become more favorable, the U.S. electroceuticals market is poised for sustained expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in bioelectronics and neurostimulation technologies

- 3.2.1.2 Increasing adoption of minimally invasive procedures

- 3.2.1.3 Rising demand for pain management solutions

- 3.2.1.4 Expansion of applications in neurological and psychiatric disorders

- 3.2.1.5 Growing investments in bioelectric medicine research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of electroceutical devices

- 3.2.2.2 Risk of device malfunction and safety concerns

- 3.2.2.3 Availability of alternative treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on clinically driven smart implantable electronic devices moving towards precision therapy

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac pacemakers and implantable cardioverter defibrillators

- 5.3 Neuromodulators

- 5.3.1 Spinal cord stimulators

- 5.3.2 Deep brain stimulators

- 5.3.3 Vagus nerve stimulators

- 5.3.4 Sacral nerve stimulators

- 5.3.5 Gastric electrical stimulators

- 5.3.6 Transcutaneous electrical nerve stimulators

- 5.3.7 Transcranial magnetic stimulators

- 5.3.8 Other neuromodulators

- 5.4 Cochlear implants

- 5.5 Retinal implants

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Implantable devices

- 6.3 Non-invasive devices

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Arrhythmia

- 7.3 Chronic pain management

- 7.4 Neurological disorders

- 7.5 Hearing loss

- 7.6 Parkinson's disease

- 7.7 Urine incontinence

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centers (ASCs)

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Axonics

- 10.3 BIOTRONIK

- 10.4 Boston Scientific

- 10.5 Cala Health

- 10.6 Cochlear

- 10.7 LivaNova

- 10.8 Medico S.p.A.

- 10.9 Medtronic

- 10.10 MicroPort

- 10.11 Monarch

- 10.12 NEUROPACE

- 10.13 Nevro

- 10.14 Nurotron

- 10.15 SetPoint Medical

- 10.16 Sky Medical Technology

- 10.17 SONOVA