|

市場調查報告書

商品編碼

1685180

藍莓原料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Blueberry Ingredient Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

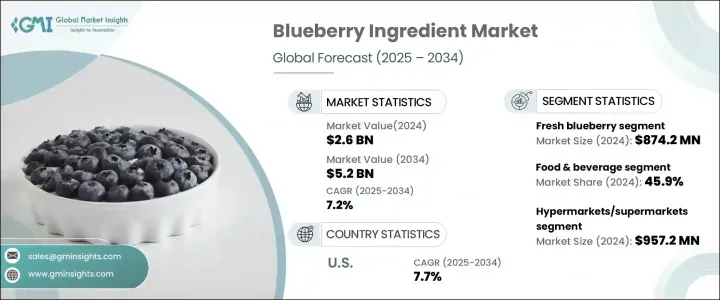

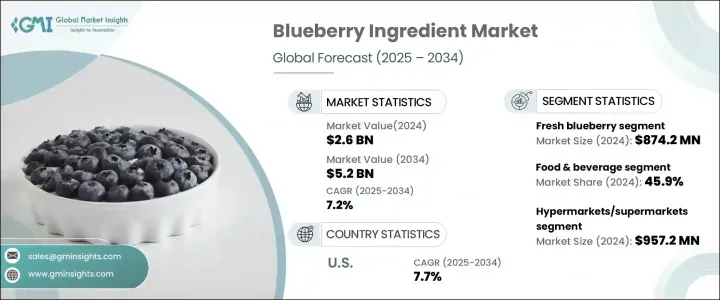

2024 年全球藍莓原料市場規模將達到 26 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.2%。推動這一成長的原因是消費者越來越意識到藍莓原料的卓越健康益處和優越營養價值。隨著對清潔標籤、天然和功能性食品的需求不斷增加,市場正在快速擴張。如今的消費者優先考慮有助於整體健康的成分,從而推動了食品和飲料行業的創新。藍莓成分已成為新產品配方的主要成分,幫助品牌滿足人們對更健康選擇的日益成長的偏好。

不斷擴大的市場的特點是轉向有機和最低限度加工的藍莓解決方案。產業參與者正在利用這種需求推出高品質、營養豐富的產品,以引起注重健康的消費者的共鳴。因此,製造商正在開發創新的藍莓配方,如粉末、果泥和濃縮物,以增強不同類別產品的吸引力。功能性食品、膳食補充劑和方便小吃正在加入這些成分,以滿足不斷變化的消費者需求。植物性飲食和超級食品的日益普及進一步加強了這一趨勢,使得藍莓成為塑造食品和飲料行業未來的關鍵因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 7.2% |

2024 年新鮮藍莓市場規模為 8.742 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.2%。消費者越來越喜歡富含抗氧化劑和必需營養素的超級食品,從而推動對新鮮藍莓的強勁需求。強調免疫支持、抗衰老功效和自然健康解決方案的健康趨勢增加了人們對新鮮藍莓,尤其是有機品種的興趣。以「從農場到餐桌」措施為重點的採購透明度和品質保證在加強這一領域發揮了至關重要的作用。新鮮藍莓現已廣泛用於功能性食品、冰沙和方便小吃,成為現代健康生活方式的重要組成部分。

由於人們對天然和功能性成分的偏好日益增加,藍莓成分在食品和飲料領域的市佔率在 2024 年將達到 45.9%。藍莓成分因其抗炎和認知支持特性而成為尋求更好營養的消費者的最愛。這些成分被廣泛應用於優格、飲料、小吃店、烘焙食品和冰沙中,滿足了人們對健康和創新食品選擇日益成長的需求。隨著品牌不斷強調藍莓的健康優勢,其在主流食品應用中的存在感不斷增強。

2024 年,美國藍莓原料市場規模達到 8.661 億美元,預計到 2034 年將以 7.7% 的複合年成長率成長。這一成長是由對天然和功能性食品的需求激增所推動的。產業領導者正在透過推出創新的藍莓解決方案(包括藍莓粉、藍莓果泥和藍莓濃縮液)來滿足不斷變化的消費者偏好。藍莓具有天然的甜味和強大的抗氧化特性,擴大出現在零食、乳製品、飲料和烘焙食品中,鞏固了其市場地位。隨著消費者對清潔標籤和營養選擇的興趣不斷上升,美國市場仍然是推動全球藍莓原料需求的關鍵參與者。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者對健康和天然成分的需求不斷成長

- 功能性食品和飲料的需求不斷增加

- 藍莓的健康益處日益受到關注

- 產業陷阱與挑戰

- 藍莓供應的季節性變化

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:依成分類型,2021-2034 年

- 主要趨勢

- 新鮮藍莓

- 冷凍藍莓

- 藍莓幹

- 藍莓濃縮果汁

- 藍莓泥

- 藍莓萃取物

- 其他

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 麵包和糖果

- 乳製品

- 飲料

- 小吃和酒吧

- 其他

- 製藥

- 化妝品和個人護理

- 營養保健品

- 其他

第 7 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 大賣場/超市

- 專賣店

- 便利商店

- 網路零售

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ADM

- Berry Global Group

- Döhler

- Graceland Fruit

- Givaudan

- Herbafood Ingredients

- Kerry Group

- Medtronic (Covidien)

- Milne Fruit Products

- Nutra Food Ingredients

- Ocean Spray Cranberries

- Symrise

- Sensient Technologies Corporation

- SVZ International

- The Green Labs

The Global Blueberry Ingredient Market reached USD 2.6 billion in 2024 and is set to grow at a CAGR of 7.2% between 2025 and 2034. This surge is driven by rising consumer awareness of the exceptional health benefits and superior nutritional value of blueberry ingredients. With increasing demand for clean-label, natural, and functional food products, the market is experiencing rapid expansion. Consumers today prioritize ingredients that contribute to overall well-being, fueling innovation in the food and beverage industry. Blueberry ingredients have become a staple in new product formulations, helping brands cater to the growing preference for healthier options.

The expanding market is characterized by a shift toward organic and minimally processed blueberry-based solutions. Industry players are leveraging this demand to introduce high-quality, nutrient-rich products that resonate with health-conscious consumers. As a result, manufacturers are developing innovative blueberry-based formulations such as powders, purees, and concentrates to enhance product appeal across different categories. Functional foods, dietary supplements, and convenient snack options are incorporating these ingredients to meet evolving consumer needs. This trend is further strengthened by the growing popularity of plant-based diets and superfoods, making blueberries a key ingredient in shaping the future of the food and beverage sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 7.2% |

The fresh blueberry segment accounted for USD 874.2 million in 2024 and is projected to expand at a CAGR of 8.2% between 2025 and 2034. Consumers are increasingly drawn to superfoods rich in antioxidants and essential nutrients, driving robust demand for fresh blueberries. Health trends emphasizing immunity support, anti-aging benefits, and natural wellness solutions have amplified interest in fresh blueberries, particularly organic varieties. Transparency in sourcing and quality assurance, underscored by farm-to-table initiatives, have played a crucial role in strengthening this segment. Fresh blueberries are now widely used in functional foods, smoothies, and convenient snack offerings, making them an essential part of the modern health-conscious lifestyle.

The blueberry ingredient market within the food and beverage sector held a 45.9% share in 2024, fueled by a rising preference for natural and functional ingredients. Recognized for their anti-inflammatory and cognitive support properties, blueberry ingredients have become a favorite among consumers seeking better nutrition. These ingredients are widely integrated into yogurts, beverages, snack bars, baked goods, and smoothies, aligning with the increasing demand for wholesome and innovative food choices. As brands continue to highlight the health advantages of blueberries, their presence in mainstream food applications continues to grow.

The U.S. blueberry ingredient market reached USD 866.1 million in 2024 and is expected to expand at a CAGR of 7.7% through 2034. This growth is driven by the surging demand for natural and functional food products. Industry leaders are responding by introducing innovative blueberry-based solutions, including powders, purees, and concentrates, to cater to shifting consumer preferences. With their natural sweetness and powerful antioxidant properties, blueberry ingredients are increasingly found in snacks, dairy products, beverages, and baked goods, solidifying their market position. As consumer interest in clean-label and nutritious options continues to rise, the U.S. market remains a key player in driving global demand for blueberry ingredients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for healthy and natural ingredients

- 3.6.1.2 Increasing demand for functional foods and beverages

- 3.6.1.3 Growing awareness of health benefits of blueberries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Seasonal variations in blueberry availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fresh blueberry

- 5.3 Frozen blueberry

- 5.4 Dried blueberry

- 5.5 Blueberry juice concentrate

- 5.6 Blueberry puree

- 5.7 Blueberry extracts

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.2.1 Bakery & Confectionery

- 6.2.2 Dairy Products

- 6.2.3 Beverages

- 6.2.4 Snacks & Bars

- 6.2.5 Others

- 6.3 Pharmaceutical

- 6.4 Cosmetics & personal care

- 6.5 Nutraceutical

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hypermarkets/Supermarkets

- 7.3 Specialty stores

- 7.4 Convenience stores

- 7.5 Online retail

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 Berry Global Group

- 9.3 Döhler

- 9.4 Graceland Fruit

- 9.5 Givaudan

- 9.6 Herbafood Ingredients

- 9.7 Kerry Group

- 9.8 Medtronic (Covidien)

- 9.9 Milne Fruit Products

- 9.10 Nutra Food Ingredients

- 9.11 Ocean Spray Cranberries

- 9.12 Symrise

- 9.13 Sensient Technologies Corporation

- 9.14 SVZ International

- 9.15 The Green Labs