|

市場調查報告書

商品編碼

1685131

主動式揚聲器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Active Speaker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

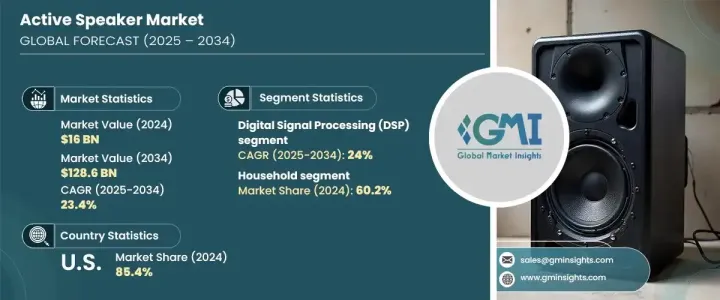

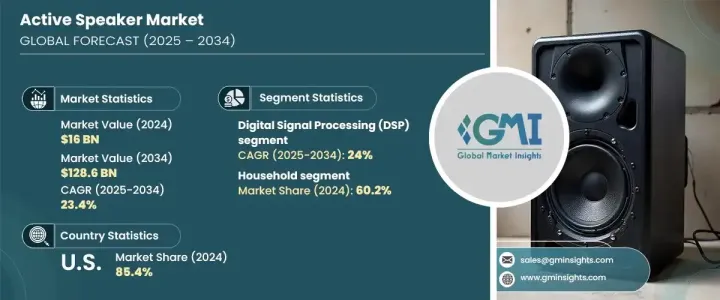

2024 年全球主動式揚聲器市場價值為 160 億美元,將經歷顯著成長,預計 2025 年至 2034 年的複合年成長率為 23.4%。有源揚聲器因其在揚聲器單元內結合了放大和訊號處理的整合設計而變得越來越受歡迎。這種內建方法使它們比需要外部擴大機的傳統被動揚聲器更方便。透過無縫整合和增強的聲音控制,主動揚聲器已成為現代音響系統的重要組成部分,簡化了安裝並提高了整體音質。這些揚聲器用於從個人家庭到商業應用的各種場合,並且由於技術進步、消費者偏好的不斷成長以及智慧家庭市場的不斷擴大,它們的需求持續上升。

有源揚聲器市場分為兩個主要部分:家用和商業應用。截至 2024 年,家庭市場佔據 60.2% 的主導市場佔有率,這主要得益於智慧家庭普及率的快速成長和連網設備的日益普及。消費者擴大尋求不僅能提供卓越音質而且還能與家庭自動化系統和語音助理無縫整合的音訊解決方案。對於希望增強居住空間的便利性和控制力的家庭來說,這種趨勢使得主動式揚聲器成為有吸引力的選擇。隨著對整合、方便用戶使用型技術的需求不斷成長,有源揚聲器市場的家庭部分在未來幾年可能會繼續蓬勃發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 160億美元 |

| 預測值 | 1286億美元 |

| 複合年成長率 | 23.4% |

從技術角度來看,市場分為類比主動式揚聲器和數位訊號處理 (DSP) 型號。預計到 2034 年,DSP 領域將以驚人的 24% 的複合年成長率成長。 DSP 技術正在獲得顯著的發展,因為它可以實現音訊效能的更大程度的客製化。透過調整均衡、壓縮和空間處理等參數,DSP 驅動的主動揚聲器為消費者提供了個人化音訊體驗的能力。這對於要求卓越音質和靈活性的家庭音響愛好者和專業用戶來說尤其有吸引力。隨著對高保真客製化音響系統的需求不斷成長,DSP 領域將在塑造市場前景方面發揮關鍵作用。

從地理角度來看,美國主動式揚聲器市場在 2024 年佔據主導地位,佔據 85.4% 的市場。這種主導地位可歸因於全國智慧家居技術和高階音響產品的廣泛使用。家庭自動化系統中人們對語音啟動、連網裝置的興趣日益濃厚,這極大地促進了對有源揚聲器的需求。此外,美國擁有活躍的娛樂文化,消費者優先考慮家庭劇院、遊戲設置和音樂串流服務的高品質音響系統。這種對高階音訊解決方案的文化重視有助於推動美國有源揚聲器市場的持續擴張

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 商業場所對高品質音訊解決方案的需求日益增加

- 家庭娛樂系統中有源揚聲器的採用日益增多

- 無線和藍牙主動式揚聲器因其便利性和靈活性而日益流行

- 汽車產業擴張

- 產業陷阱與挑戰

- 市場飽和與競爭

- 品質控制問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子產品商店

- 音響零售商

- 品牌專賣店

第 6 章:市場估計與預測:按技術,2021-2034 年

- 主要趨勢

- 模擬有源揚聲器

- 數位訊號處理 (DSP)

第 7 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 有線

- 無線的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 家庭

- 智慧家庭

- 電視

- 電腦

- 音樂播放器

- 商業的

- 零售店

- 餐廳和酒吧

- 會議室

- 大眾運輸

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Audioengine

- Beijing Edifier Technology Company, Ltd.

- Bose Corporation

- Creative Technology Ltd.

- Georg Neumann GmbH

- Harman International Industries, Incorporated

- Highland Technologies

- Klipsch Audio Technologies

- KRK Systems, Inc.

- Logitech International SA

- Mackie Thump

- Pyle Audio

- Rockville

- Sonos

- Sony Group Corporation

- Ultimate Ears

- Yamaha

The Global Active Speaker Market, valued at USD 16 billion in 2024, is set to experience remarkable growth, with projections showing a CAGR of 23.4% from 2025 to 2034. Active speakers have become increasingly popular due to their integrated design that combines both amplification and signal processing within the speaker unit. This built-in approach makes them more convenient than traditional passive speakers, which require external amplifiers. With seamless integration and enhanced sound control, active speakers have evolved into essential components of modern audio systems, simplifying installation and enhancing overall sound quality. These speakers are used across various settings, from personal households to commercial applications, and their demand continues to rise, driven by technological advancements, growing consumer preferences, and the expanding smart home market.

The active speaker market is divided into two primary segments: household and commercial applications. As of 2024, the household segment holds a dominant 60.2% market share, largely fueled by the rapid rise in smart home adoption and the growing popularity of connected devices. Consumers are increasingly seeking audio solutions that not only deliver exceptional sound quality but also integrate seamlessly with home automation systems and voice assistants. This trend has made active speakers an attractive choice for households looking to enhance convenience and control within their living spaces. As the demand for integrated, user-friendly technology grows, the household segment of the active speaker market will likely continue to thrive in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16 Billion |

| Forecast Value | $128.6 Billion |

| CAGR | 23.4% |

When it comes to technology, the market is divided into analog active speakers and Digital Signal Processing (DSP) models. The DSP segment is anticipated to grow at an impressive CAGR of 24% through 2034. DSP technology is gaining significant traction because it allows for greater customization of audio performance. By adjusting parameters such as equalization, compression, and spatial processing, DSP-powered active speakers provide consumers with the ability to personalize their audio experience. This is especially appealing to both home audio enthusiasts and professional users who demand superior sound quality and flexibility. As demand for high-fidelity, tailored audio systems grows, the DSP segment is poised to play a pivotal role in shaping the market outlook.

In terms of geography, the U.S. active speaker market dominated in 2024, capturing 85.4% of the market share. This dominance can be attributed to the widespread use of smart home technologies and premium audio products across the nation. The increasing interest in voice-activated, connected devices in home automation systems is contributing significantly to the demand for active speakers. Additionally, the U.S. has a vibrant entertainment culture where consumers prioritize high-quality audio systems for home theaters, gaming setups, and music streaming services. This cultural emphasis on high-end audio solutions is helping drive the ongoing expansion of the active speaker market in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-quality audio solutions in commercial venues

- 3.6.1.2 Growing adoption of active speakers in home entertainment systems

- 3.6.1.3 Rising popularity of wireless and Bluetooth-enabled active speakers for convenience and flexibility

- 3.6.1.4 Expansion of the automotive industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and competition

- 3.6.2.2 Quality control issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Online

- 5.3 Electronics stores

- 5.4 Audio retailers

- 5.5 Brand outlets

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Analog active speakers

- 6.3 Digital Signal Processing (DSP)

Chapter 7 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Household

- 8.2.1 Smart homes

- 8.2.2 TVs

- 8.2.3 Computers

- 8.2.4 Music players

- 8.3 Commercial

- 8.3.1 Retail stores

- 8.3.2 Restaurants and bars

- 8.3.3 Conference rooms

- 8.3.4 Public transportation

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Audioengine

- 10.2 Beijing Edifier Technology Company, Ltd.

- 10.3 Bose Corporation

- 10.4 Creative Technology Ltd.

- 10.5 Georg Neumann GmbH

- 10.6 Harman International Industries, Incorporated

- 10.7 Highland Technologies

- 10.8 Klipsch Audio Technologies

- 10.9 KRK Systems, Inc.

- 10.10 Logitech International S.A.

- 10.11 Mackie Thump

- 10.12 Pyle Audio

- 10.13 Rockville

- 10.14 Sonos

- 10.15 Sony Group Corporation

- 10.16 Ultimate Ears

- 10.17 Yamaha