|

市場調查報告書

商品編碼

1685061

鎧裝電纜市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Armored Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

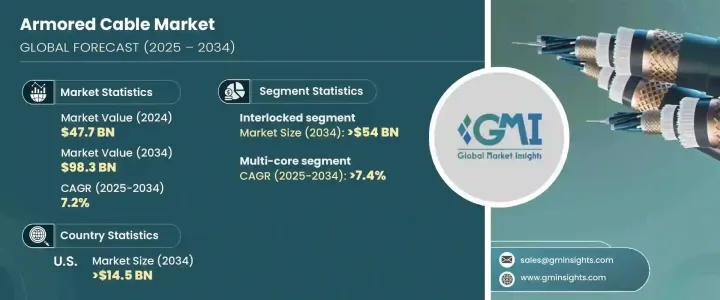

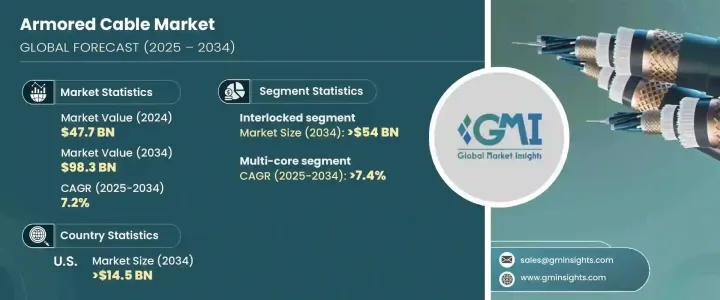

2024 年全球鎧裝電纜市場價值達到 477 億美元,預估 2025 年至 2034 年期間複合年成長率為 7.2%。這種快速成長源於建築、能源和製造等行業對安全、耐用和可靠的佈線解決方案日益成長的需求。隨著全球基礎設施項目的加速推進,特別是在新興經濟體,鎧裝電纜因其出色的抵禦機械損傷、惡劣天氣條件和環境挑戰的能力而受到青睞。

城市化以及住宅、商業和工業空間建設活動的增加進一步刺激了需求,特別是在易受不利環境條件影響的地區。此外,製造程序的進步,包括更強大的材料和創新設計的整合,正透過提高電纜的耐用性和性能來促進市場發展。各行業對電氣安全標準認知的不斷提高也大大推動了鎧裝電纜的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 477億美元 |

| 預測值 | 983億美元 |

| 複合年成長率 | 7.2% |

隨著各行各業轉向永續、高效的能源解決方案,對支持太陽能和風力發電場等再生能源專案的強大佈線基礎設施的需求日益加劇。鎧裝電纜因其即使在嚴苛的戶外環境中也能提供安全可靠的電力傳輸的能力而得到越來越多的應用。此外,隨著全球數位轉型的推進,電信業正在採用鎧裝電纜來保護關鍵通訊網路免受物理損壞和干擾。技術、環境和工業因素的整合繼續推動市場成長,使鎧裝電纜成為現代基礎設施發展中不可或缺的組成部分。

預計到 2034 年,互鎖鎧裝電纜市場將創收 540 億美元,這得益於其機械保護性、靈活性和成本效益。互鎖鎧裝電纜採用金屬帶纏繞電纜芯的設計,具有出色的抵抗物理損壞和外部壓力的能力。這種設計使其非常適合建築、工業設施和戶外設施等電纜面臨嚴峻條件的行業。它們的耐用性和可靠性使其成為需要增強機械強度的應用的必不可少的解決方案。

在核心類型類別中,多芯鎧裝電纜預計到 2034 年將以 7.4% 的複合年成長率成長。這些電纜在一條電纜內容納多個電路,簡化了安裝並降低了整體專案成本,使其成為製造業、電信業和建築業等行業的理想選擇。它們能夠支援有限空間內的高效配電和簡化佈線,這在空間最佳化和可靠性至關重要的環境中尤其有利。

受建築、電信和能源等關鍵領域對先進電力基礎設施投資不斷增加的推動,美國鎧裝電纜市場預計到 2034 年將創收 145 億美元。該國不斷擴大的城市化進程,加上智慧城市計畫的發展,進一步加速了對可靠佈線解決方案的需求。此外,再生能源專案的成長,特別是太陽能和風能,為鎧裝電纜創造了新的機遇,鎧裝電纜對於確保在惡劣的戶外環境中安全傳輸電力至關重要。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依裝甲類型,2021 – 2034 年

- 主要趨勢

- 互鎖

- 連續波紋焊接

第6章:市場規模及預測:依核心類型,2021 – 2034 年

- 主要趨勢

- 單核

- 多核心

第 7 章:市場規模與預測:按最終用戶,2021 – 2034 年

- 主要趨勢

- 石油和天然氣

- 製造業

- 礦業

- 建造

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Anixter

- AT&T

- Atkore

- Belden

- Finolex

- Furukawa Electric

- Havells

- Helukabel

- KEI Industries

- Leoni Cables

- LS Cable & System

- Nexans

- NKT

- Okonite

- Omni Cables

- Polycab

- Prysmian

- Riyadh Cables

- RR Kabel

- Southwire

- Sumitomo Electric

The Global Armored Cable Market reached a valuation of USD 47.7 billion in 2024 and is projected to expand at a CAGR of 7.2% from 2025 to 2034. This rapid growth stems from the increasing need for secure, durable, and reliable wiring solutions across industries such as construction, energy, and manufacturing. As global infrastructure projects accelerate, particularly in emerging economies, armored cables are gaining traction due to their superior ability to withstand mechanical damage, harsh weather conditions, and environmental challenges.

Urbanization and the rise in construction activities for residential, commercial, and industrial spaces are further fueling demand, particularly in areas prone to adverse environmental conditions. Additionally, advancements in manufacturing processes, including the integration of stronger materials and innovative designs, are bolstering the market by enhancing cable durability and performance. Rising awareness of electrical safety standards across industries is also significantly driving the adoption of armored cables.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.7 Billion |

| Forecast Value | $98.3 Billion |

| CAGR | 7.2% |

As industries shift toward sustainable and efficient energy solutions, the need for robust wiring infrastructure to support renewable energy projects, such as solar and wind farms, is intensifying. Armored cables are increasingly being utilized for their ability to provide safe and reliable power transmission, even in demanding outdoor environments. Moreover, as digital transformation advances globally, the telecommunications sector is adopting armored cables for their capacity to protect critical communication networks from physical damage and interference. This confluence of technological, environmental, and industrial factors continues to drive market growth, positioning armored cables as an indispensable component in modern infrastructure development.

The interlocked armored cable segment is anticipated to generate USD 54 billion by 2034, driven by its mechanical protection, flexibility, and cost-effectiveness. Designed with a metal strip wrapped around the cable core, interlocked armored cables offer exceptional resistance to physical damage and external pressures. This design makes them highly suitable for industries such as construction, industrial facilities, and outdoor installations, where cables are subjected to challenging conditions. Their durability and reliability make them an essential solution for applications requiring enhanced mechanical strength.

In the core type category, multi-core armored cables are projected to grow at a CAGR of 7.4% through 2034. These cables, which house multiple electrical circuits within a single cable, simplify installation and reduce overall project costs, making them ideal for industries such as manufacturing, telecommunications, and construction. Their ability to support efficient power distribution and streamline wiring in confined spaces is particularly advantageous in environments where space optimization and reliability are critical.

The US armored cable market is expected to generate USD 14.5 billion by 2034, driven by growing investments in advanced electrical infrastructure across critical sectors such as construction, telecommunications, and energy. The country's expanding urbanization, coupled with the development of smart city projects, is further accelerating the demand for dependable wiring solutions. Additionally, the growth of renewable energy projects, particularly in solar and wind power, is creating new opportunities for armored cables, which are essential for ensuring safe power transmission in rugged and outdoor environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Armor Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Interlocked

- 5.3 Continuously corrugated welded

Chapter 6 Market Size and Forecast, By Core Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Single core

- 6.3 Multi-core

Chapter 7 Market Size and Forecast, By End User, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Manufacturing

- 7.4 Mining

- 7.5 Construction

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Anixter

- 9.2 AT&T

- 9.3 Atkore

- 9.4 Belden

- 9.5 Finolex

- 9.6 Furukawa Electric

- 9.7 Havells

- 9.8 Helukabel

- 9.9 KEI Industries

- 9.10 Leoni Cables

- 9.11 LS Cable & System

- 9.12 Nexans

- 9.13 NKT

- 9.14 Okonite

- 9.15 Omni Cables

- 9.16 Polycab

- 9.17 Prysmian

- 9.18 Riyadh Cables

- 9.19 RR Kabel

- 9.20 Southwire

- 9.21 Sumitomo Electric