|

市場調查報告書

商品編碼

1684619

單芯鎧裝電纜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Single Core Armored Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

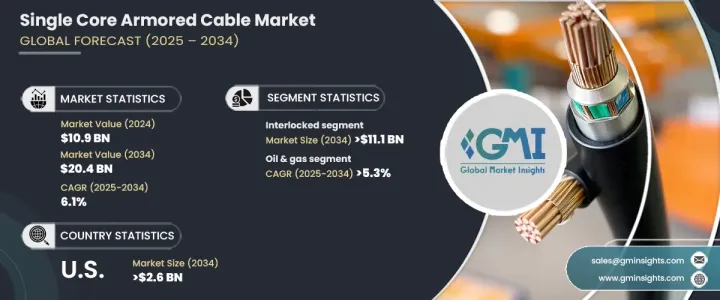

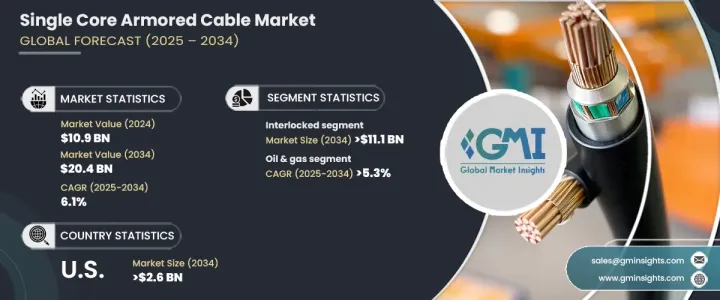

預計 2024 年全球單芯鎧裝電纜市場規模將達到 109 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.1%。這一市場成長的動力來自於各行業對安全、持久電力傳輸解決方案日益成長的需求。隨著各行各業對既能提供電氣安全性又能提供機械保護的電纜的需求日益增加,單芯鎧裝電纜的採用也持續獲得發展勢頭。這些電纜在確保電力安全分配方面發揮關鍵作用,特別是在電力系統暴露於物理損壞或惡劣天氣條件的環境中。

隨著城市化進程的加速,特別是亞太和中東等新興市場,這些電纜的需求迅速成長。基礎設施發展,包括智慧城市的擴張和能源網的現代化,是鎧裝電纜需求不斷成長的主要驅動力。此外,太陽能、風能等再生能源專案的興起對輸電系統提出了更高的要求。鎧裝電纜在這些項目中至關重要,因為它們提供了在惡劣的環境條件下分配能源所需的可靠性和耐用性。此外,電纜技術和材料的進步提高了鎧裝電纜的安全性和性能,確保它們符合日益嚴格的行業標準。隨著石油和天然氣、建築和採礦等行業的持續成長,對鎧裝電纜的需求只會加劇,從而鞏固市場的上升軌跡。此外,全球範圍內改善各地區能源基礎設施和電氣化的努力持續促進市場強勁發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 109億美元 |

| 預測值 | 204億美元 |

| 複合年成長率 | 6.1% |

預計到 2034 年,互鎖鎧裝電纜市場將產生 111 億美元的收入。該市場以其機械強度、靈活性和成本效益而聞名,其優勢在於能夠防止物理損壞,同時保持輕巧且易於安裝的設計。聯鎖鎧裝電纜通常用於各個領域,包括建築、公用事業、石油和天然氣以及再生能源。它們的耐用性和靈活性使其非常適合需要優先保護以免受惡劣條件影響的環境。

在終端用戶方面,預計到 2034 年,石油和天然氣行業的複合年成長率將達到 5.3%。該行業不斷擴大的探勘和生產活動,特別是海上鑽井和頁岩氣項目,正在推動對能夠承受極端機械應力、腐蝕環境和大幅溫度變化的鎧裝電纜的需求。

預計到 2034 年,美國單芯鎧裝電纜市場規模將達到 26 億美元。這一成長可歸因於工業、公用事業和基礎設施領域對可靠電力傳輸系統的需求不斷成長。電網的現代化和對再生能源項目的大量投資是該地區對鎧裝電纜需求不斷成長的關鍵因素。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依裝甲類型,2021 – 2034 年

- 主要趨勢

- 互鎖

- 連續波紋焊接

第 6 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 石油和天然氣

- 製造業

- 礦業

- 建造

- 其他

第 7 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Anixter

- AT&T

- Atkore

- Belden

- Finolex

- Furukawa Electric

- Havells

- Helukabel

- KEI Industries

- Leoni Cables

- LS Cable & System

- Nexans

- NKT

- Okonite

- Omni Cables

- Polycab

- Prysmian

- Riyadh Cables

- RR Kabel

- Southwire

- Sumitomo Electric

The Global Single Core Armored Cable Market is expected to reach USD 10.9 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2034. This market growth is fueled by the rising demand for secure and long-lasting power transmission solutions across various industries. As industries increasingly require cables that offer both electrical safety and mechanical protection, the adoption of single-core armored cables continues to gain momentum. These cables play a critical role in ensuring the safe distribution of electricity, particularly in environments where electrical systems are exposed to physical damage or harsh weather conditions.

As urbanization accelerates, especially in emerging markets in Asia Pacific and the Middle East, the demand for these cables grows rapidly. Infrastructure development, including the expansion of smart cities and the modernization of energy grids, is a major driving force behind the rising need for armored cables. Additionally, the rise of renewable energy projects, such as solar and wind power, places higher demands on power transmission systems. Armored cables are essential in these projects, as they provide the reliability and durability required for energy distribution in challenging environmental conditions. Furthermore, advancements in cable technology and materials have improved both the safety and performance of armored cables, ensuring they meet the increasingly stringent industry standards. As industries like oil and gas, construction, and mining continue to grow, the need for armored cables will only intensify, solidifying the market's upward trajectory. Moreover, global efforts to improve energy infrastructure and electrification across regions continue to contribute to the market's strong development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.9 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 6.1% |

The interlocked armored cable segment is anticipated to generate USD 11.1 billion by 2034. Known for its mechanical strength, flexibility, and cost-effectiveness, this segment benefits from its ability to protect against physical damage while maintaining a lightweight and easy-to-install design. Interlocked armored cables are commonly used in various sectors, including construction, utilities, oil and gas, and renewable energy. Their durability and flexibility make them highly suitable for environments where protection from harsh conditions is a priority.

In terms of end-users, the oil and gas sector is expected to experience a CAGR of 5.3% through 2034. The sector's expanding exploration and production activities, particularly offshore drilling and shale gas projects, are driving the demand for armored cables capable of withstanding extreme mechanical stresses, corrosive environments, and wide temperature variations.

The U.S. market for single-core armored cables is forecasted to generate USD 2.6 billion by 2034. This growth can be attributed to the increasing demand for dependable power transmission systems across industrial, utility, and infrastructure sectors. The modernization of the electrical grid and substantial investments in renewable energy projects are key factors contributing to the growing need for armored cables in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Armor Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Interlocked

- 5.3 Continuously corrugated welded

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Manufacturing

- 6.4 Mining

- 6.5 Construction

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Anixter

- 8.2 AT&T

- 8.3 Atkore

- 8.4 Belden

- 8.5 Finolex

- 8.6 Furukawa Electric

- 8.7 Havells

- 8.8 Helukabel

- 8.9 KEI Industries

- 8.10 Leoni Cables

- 8.11 LS Cable & System

- 8.12 Nexans

- 8.13 NKT

- 8.14 Okonite

- 8.15 Omni Cables

- 8.16 Polycab

- 8.17 Prysmian

- 8.18 Riyadh Cables

- 8.19 RR Kabel

- 8.20 Southwire

- 8.21 Sumitomo Electric