|

市場調查報告書

商品編碼

1684781

智慧標籤包裝市場機會、成長動力、產業趨勢分析與預測 2025-2034Smart Tag Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

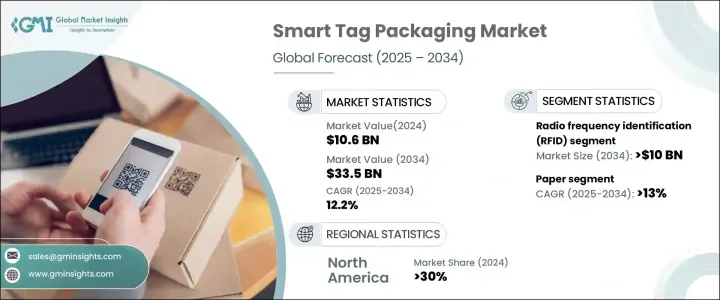

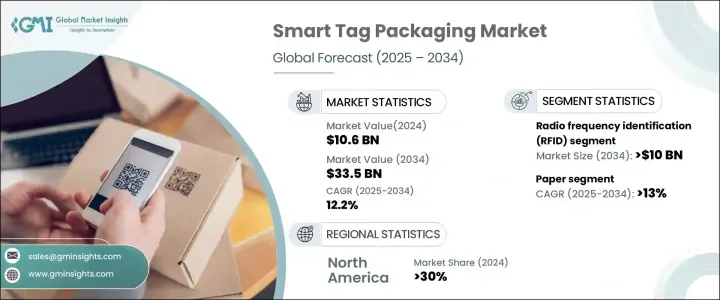

2024 年全球智慧標籤包裝市場規模將達到 106 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 12.2%。這項快速擴張的推動因素包括消費者對永續性的需求不斷成長、循環經濟原則的日益普及以及數位追蹤技術的進步。各行各業的企業都在利用智慧標籤技術來提高效率、最佳化供應鏈、提高透明度並最大限度地減少對環境的影響。隨著公司努力實現更好的產品追蹤和認證,將智慧標籤整合到包裝中正在成為現代物流和庫存管理的關鍵組成部分。對即時資料、減少浪費和增強安全性的需求正在加速採用,將智慧標籤包裝定位為下一代供應鏈解決方案的關鍵推動因素。隨著世界各地的監管框架強調可追溯性和減少浪費,企業正在轉向智慧包裝解決方案以保持合規性和競爭力。

根據技術,市場分為2D碼和條碼、近場通訊 (NFC)、低功耗藍牙 (BLE) 標籤、無線射頻識別 (RFID) 等。到 2034 年,RFID 市場預計將創收 100 億美元,這得益於其促進即時產品追蹤、簡化庫存管理和打擊假冒的能力。與傳統的條碼系統不同,RFID 不需要直接掃描,從而提高了操作效率。該技術可以實現精確的位置追蹤和自動資料收集,使其成為追求自動化和安全的行業的首選解決方案。由於 RFID 可以減少損失、提高工作流程準確性並加強防盜措施,零售、物流和醫療保健行業的應用日益廣泛。隨著企業專注於數位轉型,對RFID在高階資產追蹤方面的依賴預計會增加,從而鞏固其作為主導智慧標籤技術的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 106億美元 |

| 預測值 | 335億美元 |

| 複合年成長率 | 12.2% |

市場也按材料分類,包括紙張、塑膠、金屬和複合材料。受永續和環保包裝解決方案需求不斷成長的推動,預測期內紙張產業預計將以 13% 的複合年成長率成長。隨著全球對塑膠污染的擔憂日益加劇,企業正積極尋求可生物分解的替代方案。針對一次性塑膠的規定正在加速向可回收材料的轉變,使得紙質智慧標籤成為首選。智慧標籤整合到紙質包裝中,既保持了功能性,又減少了對環境的影響,符合品牌和消費者的永續發展目標。

2024年北美智慧標籤包裝市場佔有30%的佔有率,其中美國引領區域成長。美國對智慧標籤包裝的需求源自於增強供應鏈透明度、高效庫存管理和先進防盜解決方案的需求。該地區強大的技術基礎設施支援創新追蹤系統的廣泛採用,符合自動化和數位化的行業趨勢。強調透明度和減少浪費的監管要求進一步推動了智慧標籤在零售、物流和醫療保健領域的整合。由於企業優先考慮客戶滿意度和預防損失,智慧標籤技術在轉變營運效率方面發揮著至關重要的作用。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 永續發展和循環經濟舉措

- RFID 和物聯網的技術進步

- 消費者對透明度和產品認證的需求不斷成長

- 零售和電子商務中智慧包裝的採用率不斷提高

- 政府對可追溯性的法規和業界標準

- 產業陷阱與挑戰

- 智慧標籤生產成本高

- 相容性和整合問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 無線射頻識別 (RFID)

- 近場通訊 (NFC)

- QR 碼和條碼

- 低功耗藍牙 (BLE) 標籤

- 其他

第 6 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 紙

- 塑膠

- 金屬

- 複合材料

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 追蹤和監控

- 身份驗證和安全

- 防盜防損

- 環境監測

- 其他

第 8 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 汽車

- 食品和飲料

- 醫療保健和製藥

- 物流與供應鏈

- 零售和消費品

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amcor

- Checkpoint Systems

- Impinj

- International Paper

- Invengo Technology

- Multi-Color Corporation

- Schreiner Group

- Sealed Air

- Smart Label Solutions

- Stora Enso

- Tageos

- Zebra Technologies

The Global Smart Tag Packaging Market reached USD 10.6 billion in 2024 and is projected to expand at a CAGR of 12.2% from 2025 to 2034. This rapid expansion is fueled by increasing consumer demand for sustainability, the growing adoption of circular economy principles, and advancements in digital tracking technologies. Businesses across various industries are leveraging smart tag technologies to enhance efficiency, optimize supply chains, improve transparency, and minimize environmental impact. As companies strive for better product tracking and authentication, the integration of smart tags into packaging is becoming a critical component of modern logistics and inventory management. The demand for real-time data, reduced waste, and enhanced security is accelerating adoption, positioning smart tag packaging as a key enabler of next-generation supply chain solutions. With regulatory frameworks worldwide emphasizing traceability and waste reduction, organizations are turning to smart packaging solutions to stay compliant and competitive.

By technology, the market is segmented into QR codes and barcodes, near-field communication (NFC), Bluetooth Low Energy (BLE) tags, radio frequency identification (RFID), and others. The RFID segment is set to generate USD 10 billion by 2034, driven by its ability to facilitate real-time product tracking, streamline inventory management, and combat counterfeiting. Unlike traditional barcode systems, RFID does not require direct scanning, offering enhanced operational efficiency. The technology enables precise location tracking and automated data collection, making it a preferred solution for industries seeking automation and security. Retail, logistics, and healthcare sectors are witnessing increased adoption as RFID reduces losses, improves workflow accuracy, and strengthens anti-theft measures. As businesses focus on digital transformation, the reliance on RFID for advanced asset tracking is expected to rise, solidifying its role as the dominant smart tag technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $33.5 Billion |

| CAGR | 12.2% |

The market is also categorized by material, including paper, plastic, metal, and composite materials. The paper segment is poised to grow at a CAGR of 13% during the forecast period, fueled by the rising demand for sustainable and eco-friendly packaging solutions. With increasing global concerns over plastic pollution, businesses are actively seeking biodegradable alternatives. Regulations against single-use plastics are accelerating the shift toward recyclable materials, making paper-based smart tags a preferred choice. Smart tag integration into paper packaging maintains functionality while reducing environmental impact, aligning with the sustainability goals of brands and consumers alike.

The North American smart tag packaging market accounted for a 30% share in 2024, with the United States leading regional growth. The demand for smart tag packaging in the U.S. is driven by the need for enhanced supply chain transparency, efficient inventory management, and advanced anti-theft solutions. The region's strong technological infrastructure supports the widespread adoption of innovative tracking systems, aligning with industry trends in automation and digitalization. Regulatory requirements emphasizing transparency and waste reduction are further boosting the integration of smart tags across retail, logistics, and healthcare. With businesses prioritizing customer satisfaction and loss prevention, smart tag technologies are playing an essential role in transforming operational efficiencies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Sustainability and circular economy initiatives

- 3.4.1.2 Technological advancements in RFID and IoT

- 3.4.1.3 Rising consumer demand for transparency and product authentication

- 3.4.1.4 Increased adoption of smart packaging in retail and e-commerce

- 3.4.1.5 Government regulations and industry standards for traceability

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of smart tags

- 3.4.2.2 Compatibility and integration issues

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Radio frequency identification (RFID)

- 5.3 Near field communication (NFC)

- 5.4 QR codes and barcodes

- 5.5 Bluetooth low energy (BLE) Tags

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Paper

- 6.3 Plastic

- 6.4 Metal

- 6.5 Composite materials

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Tracking & monitoring

- 7.3 Authentication & security

- 7.4 Anti-theft & loss prevention

- 7.5 Environmental monitoring

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Food & beverages

- 8.4 Healthcare & pharmaceuticals

- 8.5 Logistics & supply chain

- 8.6 Retail and consumer goods

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Checkpoint Systems

- 10.3 Impinj

- 10.4 International Paper

- 10.5 Invengo Technology

- 10.6 Multi-Color Corporation

- 10.7 Schreiner Group

- 10.8 Sealed Air

- 10.9 Smart Label Solutions

- 10.10 Stora Enso

- 10.11 Tageos

- 10.12 Zebra Technologies