|

市場調查報告書

商品編碼

1721449

輕量化包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lightweight Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

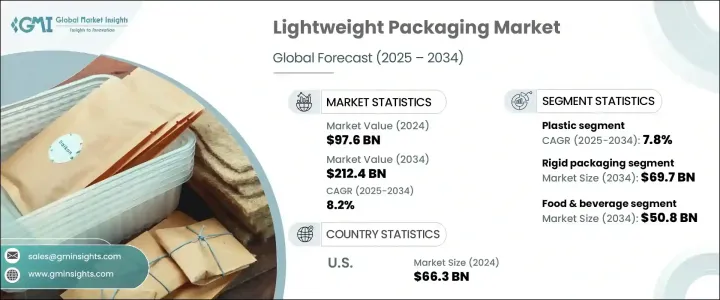

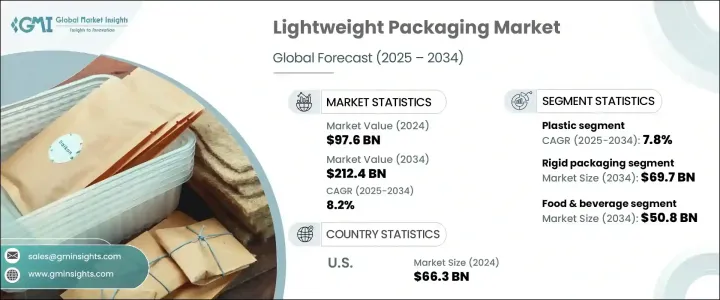

2024 年全球輕量化包裝市場價值為 976 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長,達到 2,124 億美元。該市場正在經歷顯著的成長,這主要歸因於多個行業對具有成本效益、永續的包裝解決方案的需求不斷成長。隨著全球貿易加速發展以及消費者行為轉向線上購物,尤其是在新興經濟體,對輕質耐用包裝的需求日益加劇。企業正在透過採用創新材料和技術來應對這項挑戰,以減輕運輸重量、降低碳足跡並提高供應鏈效率。

消費者和監管機構都在敦促企業開發環保替代品,同時不損害產品保護或性能。隨著世界逐漸轉向更環保的做法,輕量化包裝對於實現經濟和環境目標發揮重要作用。隨著製造商努力在成本效益、結構完整性和可回收性之間取得適當的平衡,市場對研發的投資也不斷增加。循環經濟原則的融入進一步加速了這一轉變,幫助企業不僅實現永續發展目標,而且獲得競爭優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 976億美元 |

| 預測值 | 2124億美元 |

| 複合年成長率 | 8.2% |

市場根據材料類型進行細分,包括塑膠、紙和紙板、金屬等。其中,塑膠因其多功能性、成本效益和高強度重量比而繼續佔據主導地位。預計到 2034 年,塑膠領域的複合年成長率將達到 7.8%。目前,市場傾向於可回收和生物基塑膠,擴大採用單一材料形式和可堆肥變體,這些變體具有強大的阻隔性能,同時解決了環境問題。這種轉變是由對性能和永續性的雙重需求所驅動的,尤其是在食品和飲料、醫療保健和個人護理等領域。

輕質包裝進一步分為硬包裝和軟包裝。預計到 2034 年硬質包裝市場將達到 697 億美元,製造商將專注於最佳化設計和減少材料使用。輕質塑膠容器、模製纖維替代品和薄壁玻璃瓶正在各行各業中逐漸普及,它們具有耐用性且對環境的影響較小。對於致力於維持產品完整性和延長保存期限的公司來說,循環包裝實踐和可回收性增強仍然是首要任務。

在德國強而有力的永續發展計畫和閉迴路回收系統的推動下,德國輕包裝市場預計到 2034 年達到 127 億美元。人們對單一材料包裝、可再填充形式以及遵守延伸生產者責任法規的偏好日益成長,並繼續推動德國市場的擴張。

全球市場的主要參與者包括 Berry Global、Amcor、Tetra Laval、Huhtamaki 和 Sealed Air。這些公司專注於減少材料使用、提高耐用性並創新回收解決方案。對研發、材料創新和製造最佳化的策略性投資正在推動市場競爭力和長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 電子商務與零售業的擴張

- 降低成本並提高供應鏈效率

- 醫藥和醫療保健產業對輕量化包裝的需求

- 增加可回收和生物基材料的採用

- 食品飲料業的成長

- 產業陷阱與挑戰

- 監管挑戰和合規成本

- 材料性能的局限性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 紙和紙板

- 金屬

- 其他

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 硬質包裝

- 輕瓶和罐子

- 輕質罐

- 輕盒子和紙箱

- 薄壁容器

- 軟包裝

- 袋裝

- 小袋

- 收縮包裝

- 泡殼包裝

- 保鮮膜

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 醫療保健和製藥

- 個人護理和化妝品

- 消費性電子產品

- 零售與電子商務

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Amcor

- Berry Global

- DS Smith

- Ecolean

- Graham Packaging

- Huhtamaki

- Intopack

- KM Packaging

- Novelis

- Sealed Air

- Smurfit Kappa

- Sonoco

- Stora Enso

- Tetra Laval

- UPM

- Westrock

The Global Lightweight Packaging Market was valued at USD 97.6 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 212.4 billion by 2034. This market is experiencing a significant upswing, largely due to the increasing demand for cost-efficient, sustainable packaging solutions across multiple sectors. With global trade accelerating and consumer behavior shifting toward online shopping, especially in emerging economies, the need for packaging that is both lightweight and durable has intensified. Businesses are responding by embracing innovative materials and technologies that reduce shipping weights, lower carbon footprints, and enhance supply chain efficiency.

Consumers and regulators alike are pushing companies to develop eco-conscious alternatives without compromising on product protection or performance. As the world gravitates toward greener practices, lightweight packaging is proving instrumental in meeting both economic and environmental goals. The market is also witnessing rising investments in R&D as manufacturers work to strike the right balance between cost-effectiveness, structural integrity, and recyclability. The integration of circular economy principles is further accelerating this shift, helping companies not only meet sustainability targets but also gain a competitive edge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $97.6 Billion |

| Forecast Value | $212.4 Billion |

| CAGR | 8.2% |

The market is segmented based on material type, including plastic, paper and paperboard, metal, and others. Among these, plastic continues to dominate due to its versatility, cost-efficiency, and high strength-to-weight ratio. The plastic segment is projected to grow at a CAGR of 7.8% through 2034. The market is currently leaning toward recyclable and bio-based plastics, with increased adoption of mono-material formats and compostable variants that offer strong barrier properties while addressing environmental concerns. This shift is driven by the dual need for performance and sustainability, especially in sectors like food and beverage, healthcare, and personal care.

Lightweight packaging is further categorized into rigid and flexible types. Rigid packaging is expected to reach USD 69.7 billion by 2034, with manufacturers focusing on optimizing design and reducing material usage. Lightweight plastic containers, molded fiber alternatives, and thin-walled glass bottles are gaining ground across industries, offering durability with a lower environmental impact. Circular packaging practices and recyclability enhancements remain top priorities for companies aiming to maintain product integrity and extend shelf life.

The German Lightweight Packaging Market is on track to hit USD 12.7 billion by 2034, driven by the country's strong sustainability initiatives and closed-loop recycling systems. The rising preference for mono-material packaging, refillable formats, and compliance with extended producer responsibility regulations continues to bolster market expansion in Germany.

Major players in the global market include Berry Global, Amcor, Tetra Laval, Huhtamaki, and Sealed Air. These companies are focused on reducing material usage, enhancing durability, and innovating recyclable solutions. Strategic investments in R&D, material innovation, and manufacturing optimization are driving market competitiveness and long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of the e-commerce and retail sector

- 3.2.1.2 Cost reduction and supply chain efficiency

- 3.2.1.3 Demand for lightweight packaging in pharmaceuticals and healthcare

- 3.2.1.4 Increased adoption of recyclable and bio-based materials

- 3.2.1.5 Growth of the food & beverage industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and compliance costs

- 3.2.2.2 Limitations in material performance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion & Killo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper & paperboard

- 5.4 Metal

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Billion & Killo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Lightweight bottles & jars

- 6.2.2 Lightweight cans

- 6.2.3 Lightweight boxes & cartons

- 6.2.4 Thin-walled containers

- 6.3 Flexible packaging

- 6.3.1 Pouches

- 6.3.2 Sachets

- 6.3.3 Shrink wraps

- 6.3.4 Blister packs

- 6.3.5 Wrap films

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion & Killo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Healthcare & pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Consumer electronics

- 7.6 Retail & e-commerce

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Killo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor

- 9.2 Berry Global

- 9.3 DS Smith

- 9.4 Ecolean

- 9.5 Graham Packaging

- 9.6 Huhtamaki

- 9.7 Intopack

- 9.8 KM Packaging

- 9.9 Novelis

- 9.10 Sealed Air

- 9.11 Smurfit Kappa

- 9.12 Sonoco

- 9.13 Stora Enso

- 9.14 Tetra Laval

- 9.15 UPM

- 9.16 Westrock