|

市場調查報告書

商品編碼

1684715

汽車變數排氣量幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Variable Displacement Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

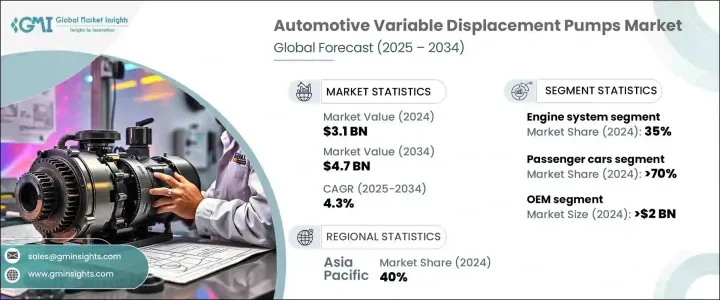

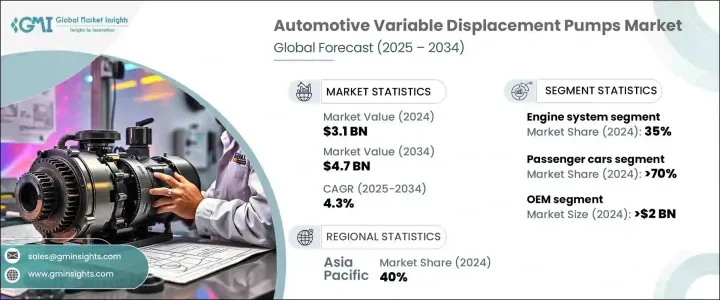

2024 年全球汽車可變排氣量幫浦市場價值 31 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.3%。世界各國政府都在執行更嚴格的法律,以降低碳足跡並推廣節能交通,迫使汽車製造商將先進技術融入他們的汽車中。變數排氣量幫浦正在成為關鍵的解決方案,可最佳化引擎性能、提高燃油經濟性並最大限度地減少能量損失。

隨著汽車製造商專注於實現永續發展目標,混合動力和省油汽車越來越受歡迎,進一步推動了對這些系統的需求。消費者越來越重視燃油經濟性,這使得製造商必須採用符合監管標準的節能組件。能源最佳化的需求也加速了汽車設計的創新,鼓勵製造商探索提高性能的新方法,同時滿足全球永續發展基準。隨著燃料價格的上漲以及混合動力和電動車的普及,可變排氣量幫浦將在現代汽車工程中發揮關鍵作用。對燃油效率的持續重視為行業參與者提供了巨大的成長機會,確保了未來幾年對這些幫浦的持續市場需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 4.3% |

市場按車輛類型細分為乘用車和商用車,其中乘用車在 2024 年佔總市場佔有率的 70%。可變排量泵浦對於最佳化混合動力汽車性能、減少非液壓應用中不必要的流體排氣量以及增強整體燃料管理至關重要。這些泵浦有助於調節能源消耗,使汽車製造商能夠滿足更嚴格的燃油效率要求,同時又不影響車輛性能。

根據應用,市場還分為引擎系統、傳動系統、動力轉向系統、燃料管理系統和煞車系統等。 2024 年,引擎系統佔據了 35% 的市場佔有率,其中可變排氣量幫浦在最佳化內燃機性能方面發揮關鍵作用。這些幫浦可調節流體流量來調節燃料消耗,提高整體效率,同時確保符合嚴格的排放法規。汽車製造商正在利用這項技術來設計更省油的引擎,讓他們在這個日益注重永續性和高性能的行業中佔據競爭優勢。

2024 年,亞太地區汽車可變排氣量幫浦市場佔有 40% 的主導佔有率,中國引領該地區的成長。對省油商用車的需求不斷成長,推動了這些泵浦的採用,特別是在降低燃料消耗是首要任務的運輸和物流領域。由於該地區擁有大量商用車輛,對先進的引擎最佳化解決方案的需求比以往任何時候都更加強烈。製造商正在大力投資創新泵浦技術,以幫助車輛符合燃油效率法規,同時確保高運行性能。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 零件供應商

- 製造商

- 技術提供者

- 最終用戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 定價分析

- 成本明細分析

- 衝擊力

- 成長動力

- 燃料成本上漲和環境問題

- 全球嚴格的排放和燃油經濟性法規

- 新興經濟體汽車產量提高,可支配所得增加

- 泵浦設計和控制系統的技術進步

- 產業陷阱與挑戰

- 初始成本高

- 與所有車型的兼容性有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按泵浦分類,2021 - 2034 年

- 主要趨勢

- 油泵

- 變速箱泵

- 動力方向機幫浦

- 水泵浦

- 燃油幫浦

- 冷卻液幫浦

第6章:市場估計與預測:依技術,2021 - 2034 年

- 主要趨勢

- 電子的

- 油壓

- 機械的

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- SUV

- 其他

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 8 章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋁

- 鋼

- 鑄鐵

- 複合材料

第 9 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 引擎系統

- 傳動系統

- 動力轉向系統

- 燃料管理系統

- 煞車系統

- 其他

第 10 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 11 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 12 章:公司簡介

- AISIN SEIKI

- Bosch

- Bucher Industries

- Continental

- Danfoss

- Denso Corporation

- Eaton Corporation

- GKN Automotive

- HELLA GmbH

- Hitachi Automotive Systems

- HUSCO Automotive

- Johnson Electric

- JTEKT Corporation

- Magna International

- Mikuni Corporation

- Parker Hannifin

- Rheinmetall Automotive

- Schaeffler AG

- Valeo

- ZF Friedrichshafen

The Global Automotive Variable Displacement Pumps Market was valued at USD 3.1 billion in 2024 and is projected to grow at a CAGR of 4.3% between 2025 and 2034. The demand for fuel-efficient and environmentally friendly vehicles is increasing, driven by stringent emission regulations and evolving consumer preferences. Governments worldwide are enforcing stricter laws to lower carbon footprints and promote energy-efficient transportation, compelling automakers to integrate advanced technologies into their vehicles. Variable displacement pumps are emerging as a key solution, optimizing engine performance, enhancing fuel economy, and minimizing energy losses.

As automakers focus on achieving sustainability goals, hybrid and fuel-efficient vehicles are gaining traction, further boosting demand for these systems. Consumers are increasingly prioritizing fuel economy, making it imperative for manufacturers to adopt energy-efficient components that comply with regulatory standards. The need for energy optimization is also accelerating innovation in vehicle design, encouraging manufacturers to explore new ways to enhance performance while meeting global sustainability benchmarks. With rising fuel prices and a shift towards hybrid and electric vehicle adoption, variable displacement pumps are poised to play a crucial role in modern automotive engineering. The continued emphasis on fuel efficiency presents significant growth opportunities for industry players, ensuring sustained market demand for these pumps in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.3% |

The market is segmented by vehicle type into passenger and commercial vehicles, with passenger cars accounting for 70% of the total market share in 2024. This segment is expected to generate USD 3 billion by 2034. The increasing adoption of hybrid and fuel-efficient vehicles is propelling the demand for advanced automotive components that improve efficiency and functionality. Variable displacement pumps are crucial in optimizing hybrid vehicle performance, reducing unnecessary fluid displacement in non-hydraulic applications, and enhancing overall fuel management. These pumps help regulate energy consumption, allowing automakers to meet stricter fuel efficiency requirements without compromising vehicle performance.

The market is also classified by application into engine systems, transmission systems, power steering systems, fuel management systems, and brake systems, among others. Engine systems held a 35% market share in 2024, with variable displacement pumps playing a critical role in optimizing internal combustion engine performance. These pumps adjust fluid flow to regulate fuel consumption, improving overall efficiency while ensuring compliance with stringent emissions regulations. Automakers are leveraging this technology to design more fuel-efficient engines, giving them a competitive edge in an industry increasingly focused on sustainability and high performance.

The Asia Pacific automotive variable displacement pumps market held a dominant 40% share in 2024, with China leading the region's growth. The rising demand for fuel-efficient commercial vehicles is driving the adoption of these pumps, particularly in transportation and logistics sectors where reducing fuel consumption is a top priority. With an extensive fleet of commercial vehicles operating in the region, the need for advanced engine optimization solutions is stronger than ever. Manufacturers are heavily investing in innovative pump technologies to help vehicles comply with fuel efficiency regulations while ensuring high operational performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising fuel costs and environmental concerns

- 3.10.1.2 Strict global regulations on emissions and fuel economy

- 3.10.1.3 Higher automotive production in emerging economies and rising disposable incomes

- 3.10.1.4 Technological advancements in pump design and control systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs

- 3.10.2.2 Limited compatibility with all vehicle types

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Oil pump

- 5.3 Transmission pump

- 5.4 Power steering pump

- 5.5 Water pump

- 5.6 Fuel pump

- 5.7 Coolant pump

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electronic

- 6.3 Hydraulic

- 6.4 Mechanical

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUVs

- 7.2.4 Others

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Aluminum

- 8.3 Steel

- 8.4 Cast Iron

- 8.5 Composite material

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Engine systems

- 9.3 Transmission systems

- 9.4 Power steering systems

- 9.5 Fuel management systems

- 9.6 Brake systems

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn,Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 AISIN SEIKI

- 12.2 Bosch

- 12.3 Bucher Industries

- 12.4 Continental

- 12.5 Danfoss

- 12.6 Denso Corporation

- 12.7 Eaton Corporation

- 12.8 GKN Automotive

- 12.9 HELLA GmbH

- 12.10 Hitachi Automotive Systems

- 12.11 HUSCO Automotive

- 12.12 Johnson Electric

- 12.13 JTEKT Corporation

- 12.14 Magna International

- 12.15 Mikuni Corporation

- 12.16 Parker Hannifin

- 12.17 Rheinmetall Automotive

- 12.18 Schaeffler AG

- 12.19 Valeo

- 12.20 ZF Friedrichshafen