|

市場調查報告書

商品編碼

1684588

釀造添加劑市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Brewing Additive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

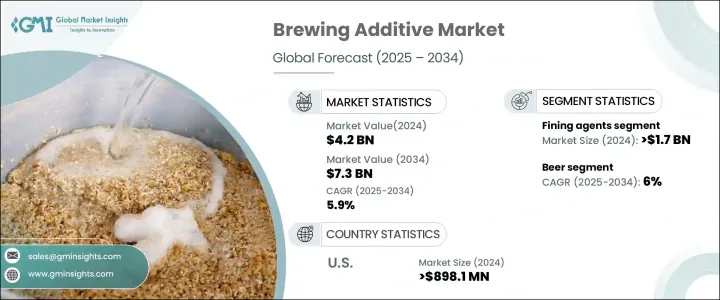

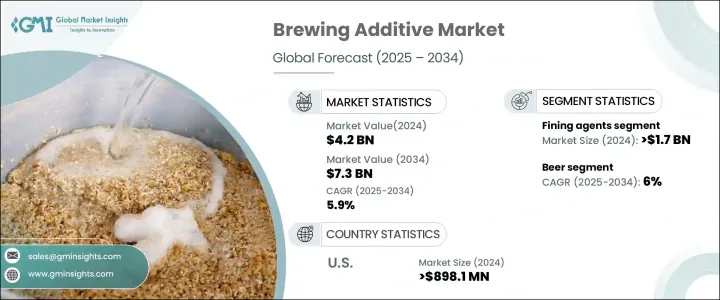

全球釀造添加劑市場預計將大幅成長,2024 年價值將達到 42 億美元,預計 2025 年至 2034 年的複合年成長率為 5.9%。這一成長是由消費者對具有更高清晰度、穩定性和豐富風味的優質酒精飲料的需求不斷成長所推動的。近年來,消費者越來越青睞精釀和高品質的酒精飲料,這推動了創新釀造添加劑的採用熱潮,這些添加劑可簡化生產流程,同時確保一流的一致性。啤酒廠越來越注重滿足客戶不斷變化的偏好,從而形成了以創新為關鍵的競爭性市場環境。

精釀啤酒、無酒精飲料和低酒精飲料的趨勢進一步推動了這個市場的發展。隨著消費者尋求更健康、更永續的替代品,釀酒業正在適應這種變化,採用更乾淨、更透明的環保天然原料。這種轉變與清潔標籤添加劑日益成長的需求相一致,其中成分來源透明且對環境永續。釀造過程的技術進步也刺激了對有助於提高生產效率和產品品質的高品質添加劑的需求。所有這些因素推動著充滿活力和競爭的格局,使該市場成為飲料行業最有前景的領域之一。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 5.9% |

釀造添加劑,包括澄清劑、穩定劑和消泡劑,對於確保持續生產高品質飲料至關重要。這些成分有助於增強產品的感官品質,例如清晰度和穩定性,這對於保持最終產品的吸引力至關重要。隨著對外觀美觀且清澈的飲料的需求不斷成長,這些添加劑在啤酒廠中的使用變得越來越廣泛。膨潤土、矽膠和魚膠等天然成分因符合清潔標籤趨勢而越來越受到青睞,滿足了人們對透明度和永續性日益成長的偏好。

2024 年,澄清劑領域創收 17 億美元,預計 2025 年至 2034 年期間將以 6.1% 的強勁複合年成長率成長。這些澄清劑有助於去除飲料中的不良顆粒、蛋白質和多酚,從而提高飲料的清澈度。消費者對高階飲料和精釀飲料的偏好日益成長,對飲料的透明度和產品穩定性有更高的要求,這大大促進了澄清劑的使用。

啤酒產業仍然是釀造添加劑市場的最大貢獻者,到 2024 年將達到 29 億美元。預計到 2034 年,該領域的複合年成長率將達到 6%。全球啤酒消費量,加上高級啤酒和精釀啤酒品種的日益普及,繼續推動對專用添加劑的需求。穩定劑、澄清劑、消泡劑等添加劑對於提高啤酒的生產效率、澄清度和風味穩定性起著至關重要的作用,進一步促進了該行業的發展。

在美國,2024 年釀造添加劑市場價值為 8.981 億美元,預計 2025 年至 2034 年的複合年成長率為 3.6%。美國的釀造業蓬勃發展,既包括大型啤酒廠,也包括創新微型啤酒廠,因此是美國這個市場的主要參與者。隨著精釀啤酒和非酒精飲料在該國越來越受歡迎,對優質釀造添加劑的需求預計將持續上升,這反映出人們正在不斷轉向高品質、創新的飲料解決方案。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對優質和精釀飲料的需求不斷增加

- 釀造製程的技術進步

- 家庭釀酒和小型釀酒廠的成長

- 產業陷阱與挑戰

- 原料供應波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 澄清劑

- 消泡劑

- 穩定劑

- 色彩增強劑

- 其他

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 葡萄酒

- 啤酒

- 其他

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- AEB Brewing

- Agrovin

- ATPGroup

- Enartis

- General Filtration

- Lesaffre

- Mangrove Jacks

- RahrBSG

- Still Spirits

The Global Brewing Additive Market is poised for significant growth, valued at USD 4.2 billion in 2024, with projections pointing to a CAGR of 5.9% from 2025 to 2034. This growth is driven by the increasing consumer demand for premium alcoholic beverages that offer enhanced clarity, stability, and rich flavor profiles. In recent years, consumers have gravitated towards craft and high-quality alcoholic drinks, which are fueling a surge in the adoption of innovative brewing additives that streamline production processes while ensuring top-notch consistency. Breweries are becoming more focused on meeting the evolving preferences of their customers, which has resulted in a competitive market environment where innovation is key.

The trend towards craft beers, non-alcoholic options, and low-alcohol beverages is further pushing this market forward. As consumers seek healthier and more sustainable alternatives, the brewing industry is adapting by embracing eco-friendly, natural ingredients that are both cleaner and more transparent. This shift aligns with the growing demand for clean-label additives, where ingredient sourcing is transparent and environmentally sustainable. Technological advancements in brewing processes have also spurred the demand for high-quality additives that help improve production efficiency and product quality. All of these factors are driving a dynamic and competitive landscape, making this market one of the most promising sectors in the beverage industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 5.9% |

Brewing additives, including fining agents, stabilizers, and antifoaming agents, are essential to ensuring the consistent production of high-quality beverages. These ingredients help enhance the sensory qualities of the product, such as clarity and stability, which are crucial for maintaining the appeal of the final product. As the demand for visually appealing and clear beverages continues to rise, the use of these additives has become more widespread among breweries. Natural ingredients, such as bentonite, silica gel, and isinglass, are increasingly favored due to their alignment with the clean-label trend, catering to the growing preference for transparency and sustainability.

In 2024, the fining agents segment generated USD 1.7 billion and is expected to grow at a robust CAGR of 6.1% from 2025 to 2034. These agents are instrumental in enhancing the clarity of beverages by removing undesirable particles, proteins, and polyphenols. The rising consumer preference for premium and craft beverages, which demand higher clarity and product stability, has significantly boosted the use of fining agents.

The beer sector remains the largest contributor to the brewing additives market, accounting for USD 2.9 billion in 2024. This segment is expected to grow at a CAGR of 6% through 2034. The global consumption of beer, coupled with the growing popularity of premium and craft beer varieties, continues to drive the demand for specialized additives. Additives like stabilizers, fining agents, and antifoaming agents play a critical role in improving the production efficiency, clarity, and flavor stability of beer, further contributing to the growth of this sector.

In the U.S., the brewing additive market was valued at USD 898.1 million in 2024, with a projected CAGR of 3.6% from 2025 to 2034. With a thriving brewing industry that encompasses both large-scale breweries and an innovative microbrewery sector, the U.S. is a key player in this market. As craft beers and non-alcoholic beverages gain traction in the country, demand for premium brewing additives is expected to keep rising, reflecting the ongoing shift toward high-quality, innovative beverage solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for premium and craft beverages

- 3.6.1.2 Technological advancements in brewing processes

- 3.6.1.3 Growth in home brewing and microbreweries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuations in raw material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Fining agents

- 5.3 Antifoaming agents

- 5.4 Stabilizers

- 5.5 Color enhancers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Wine

- 6.3 Beer

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AEB Brewing

- 8.2 Agrovin

- 8.3 ATPGroup

- 8.4 Enartis

- 8.5 General Filtration

- 8.6 Lesaffre

- 8.7 Mangrove Jacks

- 8.8 RahrBSG

- 8.9 Still Spirits