|

市場調查報告書

商品編碼

1684582

飲料罐市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Beverage Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

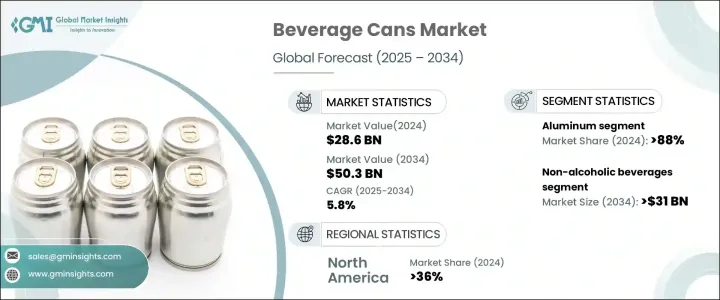

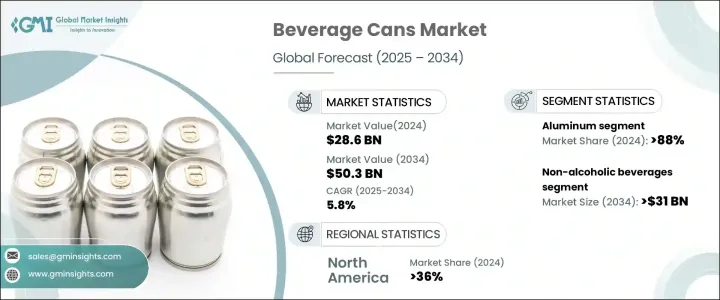

2024 年全球飲料罐市場價值為 286 億美元,預計將在 2025 年至 2034 年期間以 5.8% 的複合年成長率強勁成長。這一成長反映了消費者偏好向高階化和注重健康的選擇的顯著轉變。隨著人們生活節奏越來越快,攜帶式飲料消費量不斷成長,消費者越來越傾向於選擇那些方便且有益健康的產品。功能性補水選擇,例如注入抗氧化劑、電解質和其他有益健康成分的飲料,正獲得巨大的吸引力。對永續性的關注也推動了市場創新,因為具有環保意識的消費者和品牌都優先考慮可回收和環保的包裝。飲料罐以其卓越的可回收性和輕量化特性,已成為這些趨勢的關鍵推動因素,為市場持續擴張奠定了基礎。

市場按材料分為鋁和鋼,其中鋁在 2024 年佔據 88% 的主導佔有率。鋁的吸引力在於其無與倫比的永續性和可回收性,使其成為旨在滿足日益提高的環境標準的製造商的首選材料。鋁罐重量輕、耐用且易於回收,滿足了消費者和產業對環保解決方案的需求,同時保持了飲料的品質和新鮮度。這些罐子因其能夠保存風味、增強便攜性並減少浪費而廣泛應用於酒精和非酒精飲料類別。罐頭製造技術的進步進一步提高了罐頭的結構完整性和絕緣性,提升了鋁作為飲料行業主要材料的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 286億美元 |

| 預測值 | 503億美元 |

| 複合年成長率 | 5.8% |

市場的應用模式分為酒精飲料和非酒精飲料,其中非酒精飲料部分呈現顯著成長。預計這一類別的複合年成長率為 6%,到 2034 年將達到 310 億美元。低糖、功能性和植物性飲料等健康飲品越來越受歡迎,這推動了對創新包裝解決方案的需求。氣泡水、調味水和花草茶等產品擴大採用鋁罐包裝,因為鋁罐具有出色的便攜性、出色的保存性和高度的可回收性。消費者被這些選擇所吸引,因為它們符合健康和永續的大趨勢。

2024 年北美將引領飲料罐市場,佔全球收入的 36%。在美國,由於消費者優先考慮便攜、方便和環保的包裝,對飲料罐的需求正在激增。為了滿足這些期望,製造商開發了輕質、完全可回收的罐頭,以支持優質和功能性的飲料供應。這些努力與該地區對永續、健康產品日益成長的需求一致,鞏固了北美作為市場成長主要驅動力的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 中斷

- 未來展望

- 製造商

- 經銷商

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者對健康飲料的偏好日益增加

- 擴大鋁罐優質功能性補水產品的應用

- 罐裝非酒精飲料的激增

- 罐裝葡萄酒和即飲雞尾酒越來越受歡迎

- 精釀飲料產業的擴張推動了易拉罐的使用

- 產業陷阱與挑戰

- 含有人工添加物的罐裝飲料的健康認知

- 飲料罐市場可能過度飽和

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 鋁

- 鋼

第 6 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 1 件罐

- 兩片罐

- 三片罐

第 7 章:市場估計與預測:按產能,2021-2034 年

- 主要趨勢

- 小(330毫升以下)

- 中號(330 毫升 – 500 毫升)

- 大瓶(500 毫升以上)

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 酒精飲料

- 非酒精飲料

- 碳酸飲料

- 水果和蔬菜汁

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Ardagh Group

- Ball Corporation

- Baixicans

- Canpack

- Ceylon Beverage Can

- Crown Holdings

- Envases Group

- G3 Enterprises

- GZ Industries

- Nampak

- Novelis

- Orora Packaging

- Scan Holdings

- Showa Aluminum Can

- Speira

- Tata Steel

- Thai Beverage Can

- Toyo Seikan

- Visy

The Global Beverage Cans Market, valued at USD 28.6 billion in 2024, is set to experience robust growth at a CAGR of 5.8% from 2025 to 2034. This growth reflects a significant shift in consumer preferences toward premiumization and health-conscious choices. As lifestyles become increasingly fast-paced, on-the-go consumption of beverages is on the rise, with consumers gravitating toward products that offer convenience and added health benefits. Functional hydration options, such as drinks infused with antioxidants, electrolytes, and other wellness-enhancing ingredients, are gaining immense traction. The focus on sustainability is also driving innovation in the market, as eco-conscious consumers and brands alike prioritize recyclable and environmentally friendly packaging. Beverage cans, with their superior recyclability and lightweight characteristics, have emerged as a key enabler of these trends, positioning the market for sustained expansion.

The market is segmented by material into aluminum and steel, with aluminum commanding a dominant 88% share in 2024. Aluminum's appeal lies in its unparalleled sustainability and recyclability, making it the material of choice for manufacturers aiming to meet growing environmental standards. Lightweight, durable, and easy to recycle, aluminum cans address consumer and industry demands for eco-friendly solutions while maintaining the quality and freshness of beverages. These cans are widely adopted across both alcoholic and non-alcoholic beverage categories due to their ability to preserve flavor, enhance portability, and minimize waste. Advancements in can manufacturing technology have further improved their structural integrity and insulation, elevating aluminum's role as a staple in the beverage industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $50.3 Billion |

| CAGR | 5.8% |

The application landscape of the market is divided into alcoholic and non-alcoholic beverages, with the non-alcoholic segment witnessing notable growth. This category is projected to grow at a CAGR of 6%, generating USD 31 billion by 2034. The rising popularity of health-conscious choices, such as low-sugar, functional, and plant-based beverages, is fueling demand for innovative packaging solutions. Products like sparkling water, flavored water, and herbal teas are increasingly packaged in aluminum cans, offering superior portability, exceptional preservation, and high recyclability. Consumers are drawn to these options as they align with the broader trend toward wellness and sustainability.

North America led the beverage cans market in 2024, accounting for 36% of the global revenue. In the U.S., the demand for beverage cans is surging as consumers prioritize portable, convenient, and eco-friendly packaging. Manufacturers are meeting these expectations by developing lightweight, fully recyclable cans that support premium and functional beverage offerings. These efforts align with the region's growing appetite for sustainable, health-forward products, cementing North America's position as a key driver of market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising consumer preference for health-conscious beverages

- 3.5.1.2 Expansion of premium functional hydration in aluminum cans

- 3.5.1.3 Proliferation of non-alcoholic beverages in cans

- 3.5.1.4 Increasing popularity of canned wines and ready-to-drink cocktails

- 3.5.1.5 Expansion of craft beverage industry boosting can usage

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Health perceptions of canned beverages containing artificial additives

- 3.5.2.2 Potential over-saturation of the beverage can market

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 1-piece cans

- 6.3 2-piece cans

- 6.4 3-piece cans

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Small (below 330 ml)

- 7.3 Medium (330 ml – 500 ml)

- 7.4 Large (above 500 ml)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Alcoholic beverages

- 8.3 Non-alcoholic beverages

- 8.3.1 Carbonated soft drinks

- 8.3.2 Fruits & vegetable juices

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ardagh Group

- 10.2 Ball Corporation

- 10.3 Baixicans

- 10.4 Canpack

- 10.5 Ceylon Beverage Can

- 10.6 Crown Holdings

- 10.7 Envases Group

- 10.8 G3 Enterprises

- 10.9 GZ Industries

- 10.10 Nampak

- 10.11 Novelis

- 10.12 Orora Packaging

- 10.13 Scan Holdings

- 10.14 Showa Aluminum Can

- 10.15 Speira

- 10.16 Tata Steel

- 10.17 Thai Beverage Can

- 10.18 Toyo Seikan

- 10.19 Visy