|

市場調查報告書

商品編碼

1684191

裝飾層壓板市場機會、成長動力、行業趨勢分析和 2025 - 2034 年預測Decorative Laminates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

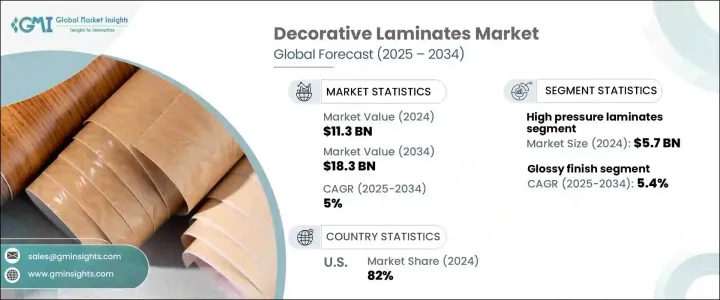

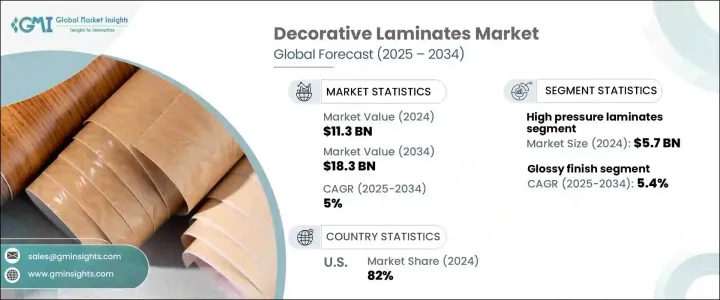

2024 年全球裝飾層壓板市場規模達到 113 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5%。受住宅、商業和工業領域對美觀耐用的室內表面的需求不斷成長的推動,該市場正在穩步成長。隨著室內設計趨勢的不斷發展,消費者和企業擴大選擇裝飾層壓板來增強空間的視覺吸引力,同時確保成本效益和使用壽命。人們對現代時尚室內裝飾的日益偏好導致家具、櫥櫃和地板應用對層壓板的需求激增,因為美觀、耐用性和價格實惠至關重要。這些材料提供豐富的顏色、圖案和飾面,滿足不同消費者的喜好,並允許無縫融入當代室內設計。

快速的城市化和房地產行業的擴張進一步促進了市場的成長,新建和改造項目均採用了裝飾層壓板,因為它們用途廣泛且易於維護。消費者之所以選擇層壓板,是因為它們具有抗污漬、防潮和防刮擦的性能,使其成為人流量大區域的實用選擇。此外,製造技術的進步提高了層壓板的性能和永續性,從而提高了抗刮性、抗菌性能和環保的生產方法。隨著人們對永續材料認知的不斷增強,製造商也推出了含有再生材料和低VOC排放的層壓板,以滿足消費者對環保產品的偏好。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 113億美元 |

| 預測值 | 183億美元 |

| 複合年成長率 | 5% |

高壓層壓板 (HPL) 在 2024 年創造了 57 億美元的產值,預計在 2025 年至 2034 年期間的複合年成長率為 5.2%。 HPL 因其出色的耐用性、抗刮性以及耐濕熱性而受到認可,仍然是住宅和商業應用的首選。辦公空間、零售店和飯店場所對這些層壓板的需求尤其強烈,因為這些人流量大的表面需要耐用的材料。企業和屋主青睞使用 HPL 作為檯面、牆板和工作站,因為它只需極少的維護就能長時間保持其外觀。

2024 年,光澤飾面部分佔據了 41% 的市場佔有率,預計在預測期內的複合年成長率為 5.4%。越來越多的消費者被光面層壓板所吸引,因為它們具有反光、高階的吸引力,可以為豪華內飾增添精緻感。這些飾面廣泛應用於現代廚房、浴室和高檔零售空間,這些地方人們都追求拋光、優雅的外觀。除了視覺吸引力之外,光面層壓板還易於清潔和維護,使其成為住宅和商業環境的實用而時尚的選擇。

2024 年,美國裝飾層壓板市場將佔據 82% 的佔有率,這主要得益於住宅和商業建築的成長。隨著新住宅開發、辦公空間和酒店項目的不斷增加,對實用而又時尚的層壓板的需求仍然很高。這些材料廣泛用於檯面、櫥櫃、牆板和地板,兼具耐用性、經濟性和美觀性。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析。

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 增加建築活動

- 對層壓解決方案的需求不斷增加

- 產業陷阱與挑戰

- 市場飽和,競爭激烈

- 永續性問題

- 成長動力

- 原料分析

- 貿易分析 (HS 編碼 - 482390)

- 出口前 10 個國家

- 進口前 10 大國家

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 高壓層壓板

- 低壓層壓板

- 三聚氰胺層壓板

- 飾面層壓板

- 其他(緊湊型層壓板等)

第 6 章:市場估計與預測:依設計,2021-2034 年

- 主要趨勢

- 霧面效果

- 光澤飾面

- 木材增益設計

- 抽象設計

- 其他(圖案設計等)

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 牆板

- 地板

- 檯面

- 家具

- 其他(門、櫥櫃等)

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

- 教育

- 零售

- HoReCa

- 企業

- 其他(水療服務、BFSI、醫療保健等)

- 工業的

第 9 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Arauco

- Duratuff Products

- Egger Group

- Formica Corporation

- FunderMax

- Greenlam Industries

- Kronospan

- Merino Group

- Pfleiderer

- Samling Group

- Sonae Industries

- Tafisa

- Travis Perkins

- Wilsonart

The Global Decorative Laminates Market reached USD 11.3 billion in 2024 and is projected to expand at a CAGR of 5% from 2025 to 2034. The market is experiencing steady growth, driven by the rising demand for aesthetically appealing and durable interior surfaces across residential, commercial, and industrial sectors. As interior design trends continue to evolve, consumers and businesses are increasingly opting for decorative laminates to enhance the visual appeal of spaces while ensuring cost-effectiveness and longevity. The growing preference for modern, stylish interiors has led to a surge in demand for laminates in furniture, cabinetry, and flooring applications, where aesthetics, durability, and affordability are crucial. These materials offer an extensive range of colors, patterns, and finishes, catering to diverse consumer preferences and allowing for seamless integration into contemporary interior designs.

The rapid urbanization and expansion of the real estate sector further contribute to market growth, with both new construction and renovation projects incorporating decorative laminates for their versatility and ease of maintenance. Consumers are drawn to laminates due to their resistance to stains, moisture, and scratches, making them a practical choice for high-traffic areas. Additionally, advancements in manufacturing technology have enhanced the performance and sustainability of laminates, leading to improved scratch resistance, antimicrobial properties, and eco-friendly production methods. With growing awareness of sustainable materials, manufacturers are also introducing laminates with recycled content and low-VOC emissions to meet consumer preferences for environmentally responsible products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $18.3 Billion |

| CAGR | 5% |

High-pressure laminates (HPL) generated USD 5.7 billion in 2024 and are expected to grow at a CAGR of 5.2% between 2025 and 2034. Recognized for their superior durability, scratch resistance, and ability to withstand moisture and heat, HPL remains a preferred option for both residential and commercial applications. The demand for these laminates is particularly strong in office spaces, retail outlets, and hospitality establishments, where high-traffic surfaces require long-lasting materials. Businesses and homeowners favor HPL for countertops, wall panels, and workstations due to its ability to maintain its appearance over time with minimal maintenance.

The glossy finish segment accounted for 41% of the market share in 2024 and is projected to grow at a CAGR of 5.4% during the forecast period. Consumers are increasingly drawn to glossy laminates for their reflective, high-end appeal that adds sophistication to luxury interiors. These finishes are widely used in modern kitchens, bathrooms, and upscale retail spaces, where a polished, elegant look is highly desirable. Apart from their visual appeal, glossy laminates are easy to clean and maintain, making them a practical yet stylish choice for residential and commercial settings.

The U.S. decorative laminates market dominated with an 82% share in 2024, largely fueled by growth in residential and commercial construction. As new housing developments, office spaces, and hospitality projects continue to rise, the demand for functional yet stylish laminates remains high. These materials are widely used for countertops, cabinetry, wall panels, and flooring, offering an ideal blend of durability, affordability, and aesthetic appeal.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Increasing demand for laminating solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Raw material analysis

- 3.8 Trade analysis (HS Code- 482390)

- 3.8.1 Top 10 export countries

- 3.8.2 Top 10 import countries

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 5.1 Key trends

- 5.2 High pressure laminates

- 5.3 Low pressure laminates

- 5.4 Melamine laminates

- 5.5 Veneer laminates

- 5.6 Others (compact laminates, etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 6.1 Key trends

- 6.2 Matte finish

- 6.3 Glossy finish

- 6.4 Wood gain designs

- 6.5 Abstract design

- 6.6 Others (pattern designs, etc.)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 7.1 Key trends

- 7.2 Wall panels

- 7.3 Flooring

- 7.4 Countertops

- 7.5 Furniture

- 7.6 Others (doors, cabinets, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Educational

- 8.3.2 Retail

- 8.3.3 HoReCa

- 8.3.4 Corporates

- 8.3.5 Others (spa services, BFSI, healthcare, etc.)

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arauco

- 11.2 Duratuff Products

- 11.3 Egger Group

- 11.4 Formica Corporation

- 11.5 FunderMax

- 11.6 Greenlam Industries

- 11.7 Kronospan

- 11.8 Merino Group

- 11.9 Pfleiderer

- 11.10 Samling Group

- 11.11 Sonae Industries

- 11.12 Tafisa

- 11.13 Travis Perkins

- 11.14 Wilsonart