|

市場調查報告書

商品編碼

1665355

工業無線感測器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Industrial Wireless Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

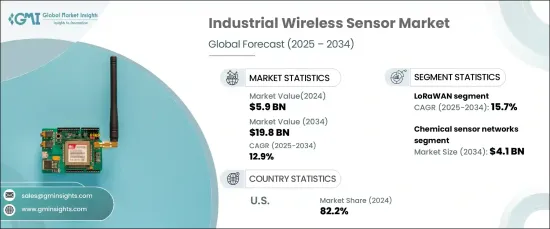

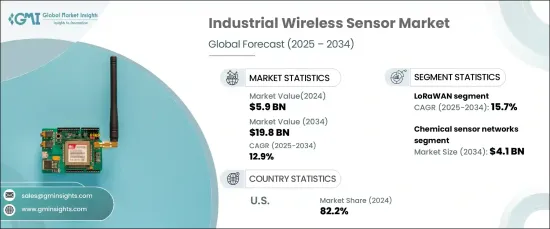

2024 年全球工業無線感測器市場價值為 59 億美元,預計 2025 年至 2034 年期間複合年成長率將達到驚人的 12.9%。無線感測器在實現無縫機器對機器通訊、促進即時資料收集和控制方面發揮關鍵作用。這些功能支援流程最佳化、品質保證和預測性維護等關鍵應用,使無線感測器對於現代工業運作不可或缺。

市場涵蓋的產品類型多種多樣,包括流量感測器、光感測器網路、溫度感測器、氣體感測器、濕度感測器、壓力感測器、液位感測器網路、運動和位置感測器網路、化學感測器網路等。其中,化學感測器網路預計將顯著成長,到 2034 年預計將達到 41 億美元。它們的無線連接允許部署在偏遠或危險的地方,而小型化和遵守嚴格的安全法規的進步進一步加速了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 59億美元 |

| 預測值 | 198億美元 |

| 複合年成長率 | 12.9% |

工業無線感測器市場中的連接選項包括 Wi-Fi、LoRaWAN、藍牙、Zigbee、近場通訊 (NFC)、WirelessHART、蜂巢式網路和 ISA 100.11a。 LoRaWAN 是成長最快的領域,預計在預測期內的複合年成長率為 15.7%。它的受歡迎程度源於其適合長距離、低功耗應用,例如石油、天然氣和農業等行業的遠端監控。 LoRaWAN 能夠在消耗最少能量的情況下遠距離傳輸資料,這使其成為大規模物聯網實施的理想選擇,特別是在需要廣泛感測器網路的行業。

美國引領工業無線感測器市場,到 2024 年將佔據 82.2% 的主導佔有率。旨在促進工業現代化的政府激勵措施進一步促進了市場的成長。美國也受益於領先的市場參與者和強大的技術基礎設施,這促進了創新並推動了對節能解決方案的需求。無線感測器正成為各行各業不可或缺的一部分,鞏固了其在塑造未來工業運作中的作用。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 工業自動化的普及

- 工業物聯網(IIoT)的擴展

- 無線通訊技術的進步

- 日益關注能源效率和永續性

- 遠端監控和預測性維護的需求不斷增加

- 產業陷阱與挑戰

- 對資料安全和隱私的擔憂

- 初始部署成本高且複雜

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 溫度感測器

- 氣體感測器

- 壓力感測器

- 濕度感測器

- 流量感測器

- 液位感測器網路

- 運動和位置感測器網路

- 光感測器網路

- 化學感測器網路

- 其他

第6章:市場估計與預測:依連結性,2021-2034 年

- 主要趨勢

- 無線上網

- 藍牙

- LoRaWAN

- Zigbee

- 近場通訊 (NFC)

- 蜂窩網路

- 無線HART

- ISA 100.11a

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 機器監控

- 資產追蹤

- 過程控制

- 安全管理

- 預測性維護

- 環境監測

- 其他

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 汽車

- 製造業

- 石油和天然氣

- 實用工具

- 礦業

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB Ltd.

- Advantech Co., Ltd.

- Analog Devices, Inc.

- Banner Engineering Corp.

- Beanair SAS

- Bosch Sensortec GmbH

- Digi International Inc.

- Emerson Electric Co.

- Endress+Hauser Group

- General Electric Company

- Honeywell International Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Omron Corporation

- Pepperl+Fuchs SE

- Rockwell Automation, Inc.

- Schneider Electric SE

- Sensata Technologies Holding PLC

- Siemens AG

- STMicroelectronics NV

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

The Global Industrial Wireless Sensor Market was valued at USD 5.9 billion in 2024 and is projected to grow at an impressive CAGR of 12.9% between 2025 and 2034. This remarkable growth is fueled by the rapid adoption of industrial automation, as businesses increasingly embrace advanced technologies to reduce human intervention, enhance operational efficiency, and ensure safety in high-risk environments. Wireless sensors play a pivotal role in enabling seamless machine-to-machine communication, facilitating real-time data collection and control. These capabilities support critical applications such as process optimization, quality assurance, and predictive maintenance, making wireless sensors indispensable to modern industrial operations.

The market spans a wide range of product types, including flow sensors, light sensor networks, temperature sensors, gas sensors, humidity sensors, pressure sensors, level sensor networks, motion and position sensor networks, chemical sensor networks, and others. Among these, chemical sensor networks are expected to witness significant growth, with projections reaching USD 4.1 billion by 2034. These sensors are essential for industries such as oil and gas, pharmaceuticals, and food processing, where monitoring chemical compositions and detecting hazardous substances is paramount. Their wireless connectivity allows deployment in remote or hazardous locations, while advancements in miniaturization and adherence to stringent safety regulations further accelerate market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 12.9% |

Connectivity options in the industrial wireless sensor market include Wi-Fi, LoRaWAN, Bluetooth, Zigbee, Near Field Communication (NFC), WirelessHART, Cellular Network, and ISA 100.11a. LoRaWAN stands out as the fastest-growing segment, anticipated to grow at a CAGR of 15.7% during the forecast period. Its popularity stems from its suitability for long-range, low-power applications, such as remote monitoring in industries like oil and gas and agriculture. LoRaWAN's ability to transmit data over long distances while consuming minimal energy makes it ideal for large-scale IoT implementations, particularly in industries requiring extensive sensor networks.

The United States leads the industrial wireless sensor market, holding a dominant share of 82.2% in 2024. This leadership is driven by the rapid adoption of Industrial Internet of Things (IIoT) technologies, advanced manufacturing practices, and significant investments in automation and smart factory initiatives. Government incentives aimed at fostering industrial modernization further boost the market's growth. The U.S. also benefits from the presence of leading market players and robust technological infrastructure, which fuel innovation and drive the demand for energy-efficient solutions. Wireless sensors are becoming integral across diverse industries, solidifying their role in shaping the future of industrial operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of industrial automation

- 3.6.1.2 Expansion of Industrial IoT (IIoT)

- 3.6.1.3 Advancements in wireless communication technologies

- 3.6.1.4 Rising focus on energy efficiency and sustainability

- 3.6.1.5 Increasing demand for remote monitoring and predictive maintenance

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Concerns over data security and privacy

- 3.6.2.2 High initial deployment costs and complexity

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Temperature sensor

- 5.3 Gas sensor

- 5.4 Pressure sensor

- 5.5 Humidity sensor

- 5.6 Flow sensor

- 5.7 Level sensor networks

- 5.8 Motion & position sensor networks

- 5.9 Light sensor networks

- 5.10 Chemical sensor networks

- 5.11 Other

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Wi-Fi

- 6.3 Bluetooth

- 6.4 LoRaWAN

- 6.5 Zigbee

- 6.6 Near Field Communication (NFC)

- 6.7 Cellular network

- 6.8 WirelessHART

- 6.9 ISA 100.11a

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Machine monitoring

- 7.3 Asset tracking

- 7.4 Process control

- 7.5 Safety management

- 7.6 Predictive maintenance

- 7.7 Environmental monitoring

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Manufacturing

- 8.4 Oil & gas

- 8.5 Utilities

- 8.6 Mining

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Advantech Co., Ltd.

- 10.3 Analog Devices, Inc.

- 10.4 Banner Engineering Corp.

- 10.5 Beanair SAS

- 10.6 Bosch Sensortec GmbH

- 10.7 Digi International Inc.

- 10.8 Emerson Electric Co.

- 10.9 Endress+Hauser Group

- 10.10 General Electric Company

- 10.11 Honeywell International Inc.

- 10.12 Microchip Technology Inc.

- 10.13 Mitsubishi Electric Corporation

- 10.14 NXP Semiconductors N.V.

- 10.15 Omron Corporation

- 10.16 Pepperl+Fuchs SE

- 10.17 Rockwell Automation, Inc.

- 10.18 Schneider Electric SE

- 10.19 Sensata Technologies Holding PLC

- 10.20 Siemens AG

- 10.21 STMicroelectronics N.V.

- 10.22 TE Connectivity Ltd.

- 10.23 Texas Instruments Incorporated

- 10.24 Yokogawa Electric Corporation