|

市場調查報告書

商品編碼

1665192

汽車天窗控制單元市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Automotive Sunroof Control Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

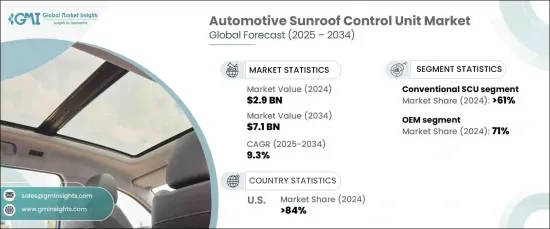

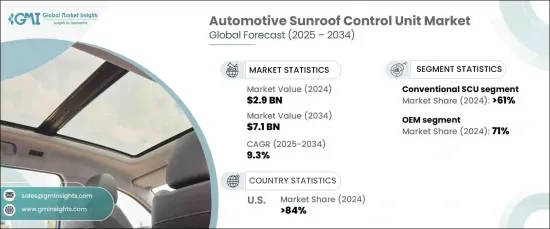

2024 年全球汽車天窗控制單元市場規模達到 29 億美元,預計 2025 年至 2034 年的複合年成長率為 9.3%。 這一市場擴張主要受豪華和高檔汽車需求不斷成長的推動,其中天窗已從高階豪華功能轉變為中檔汽車的理想選擇。如今,購車者越來越追求舒適性和時尚性,而天窗不僅美觀而且還能改善通風,因此成為必備功能。

此外,汽車電子領域的創新也為市場的成長做出了巨大貢獻。人工智慧 (AI)、物聯網 (IoT) 整合和增強型感測器系統等先進技術正在將 SCU 轉變為更智慧的設備。自動雨量感應關閉、應用程式控制操作和語音啟動等功能滿足了精通技術的消費者的需求,進一步推動了天窗控制單元的採用。隨著連網汽車成為常態,智慧 SCU 在提高安全性、便利性和整體駕駛體驗方面的作用變得越來越重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 71億美元 |

| 複合年成長率 | 9.3% |

市場主要分為傳統 SCU 和智慧 SCU。 2024年,傳統SCU佔據61%的市佔率。儘管智慧技術日益興起,但預計到 2034 年該細分市場的規模仍將成長至 38 億美元。對於想要降低成本同時滿足消費者期望的汽車製造商來說,這一領域可能仍然具有吸引力。

汽車天窗控制單元市場也按銷售管道細分,其中OEM (原始設備製造商)和售後市場是主要分類。 2024 年,由於汽車製造過程中 SCU 的整合, OEM領域佔據 71% 的主導佔有率。隨著天窗成為中階和高級車型的標準或可選功能, OEM安裝裝置的需求持續上升。這些設備因其相容性、耐用性和卓越的品質而受到青睞,這使它們成為製造商和消費者的首選。

美國汽車市場仍然是全球汽車天窗控制單元產業的關鍵參與者。由於美國擁有龐大的汽車產業以及對豪華和高檔汽車的高需求,預計將引領市場成長。隨著對智慧 SCU 和全景天窗等創新功能的日益關注,預計整個地區對先進天窗系統的需求將繼續成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 技術提供者

- 零件供應商

- 製造商

- 原始設備製造商

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對豪華和高檔汽車的需求不斷成長

- 汽車電子技術進步

- 更重視乘客的舒適度與安全性

- 電動車和連網汽車日益普及

- 產業陷阱與挑戰

- 實施成本高

- 易受技術故障影響

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按天窗,2021 - 2034 年

- 主要趨勢

- 全景天窗

- 內建天窗

- 傾斜滑動天窗

- 彈出式天窗

- 擾流天窗

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 轎車

- 越野車

- 掀背車

- 其他

第 7 章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 傳統 SCU

- 智慧型 SCU

第 8 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Aisin Corporation

- Automotive Sunroof-Customcraft (ASC) Inc.

- Beijing Automotive Group Co., Ltd.

- BOS Group

- CIE Automotive SA

- DeFuLai Automotive Parts

- Donghee

- Edscha

- Inalfa Roof Systems Group BV

- Inteva Products LLC

- Jincheng Accessories

- Johnan America Inc.

- Magna International Inc.

- Mingfang Automotive Parts

- MITSUBA Corporation

- Shanghai Mobitech

- Signature Automotive Products

- Wanchao Electric Appliance

- Webasto SE

- Yachiyo Industry Co., Ltd.

The Global Automotive Sunroof Control Unit Market reached USD 2.9 billion in 2024 and is estimated to exhibit a CAGR of 9.3% from 2025 to 2034. This market expansion is primarily driven by the growing demand for luxury and premium vehicles, where sunroofs have transitioned from a high-end luxury feature to a desirable option in mid-range vehicles. Car buyers now increasingly seek both comfort and style, and a sunroof offers not only aesthetic appeal but also improved ventilation, making it a must-have feature.

Additionally, innovations in automotive electronics are significantly contributing to the market's growth. Advanced technologies like artificial intelligence (AI), Internet of Things (IoT) integration, and enhanced sensor systems are transforming SCUs into smarter devices. Features such as automatic rain-sensing closure, app-controlled operation, and voice activation cater to the demands of tech-savvy consumers, further driving the adoption of sunroof control units. With connected cars becoming the norm, the role of smart SCUs in improving safety, convenience, and overall driving experiences is becoming more essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 9.3% |

The market is primarily divided into conventional and smart SCUs. In 2024, conventional SCUs represented 61% of the market share. Despite the rise of smart technologies, this segment is expected to grow and reach USD 3.8 billion by 2034. The affordability and simplicity of conventional SCUs make them a popular choice in entry-level and mid-range vehicles, where basic functionality, such as opening and closing the sunroof, is all that's required. This segment is likely to remain attractive to automakers who want to keep costs low while meeting consumer expectations.

The automotive sunroof control unit market is also segmented by sales channels, with OEM (original equipment manufacturer) and aftermarket being the key divisions. In 2024, the OEM segment held a dominant 71% share, driven by the integration of SCUs during vehicle manufacturing. As sunroofs become a standard or optional feature in mid-range and premium models, the demand for OEM-installed units continues to rise. These units are preferred for their compatibility, durability, and superior quality, which make them the top choice for both manufacturers and consumers alike.

The U.S. automotive market remains a key player in the global automotive sunroof control unit industry. With a significant automotive sector and a high demand for luxury and premium vehicles, the U.S. is expected to lead market growth. With an increasing focus on innovative features such as smart SCUs and panoramic sunroofs, demand for advanced sunroof systems is expected to continue growing across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 OEMs

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for luxury and premium vehicles

- 3.7.1.2 Technological advancements in automotive electronics

- 3.7.1.3 Increasing focus on passenger comfort and safety

- 3.7.1.4 Growing popularity of electric and connected vehicles

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 Susceptibility to technical failures

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Sunroof, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Panoramic sunroof

- 5.3 Built-in sunroof

- 5.4 Tilt-and-slide sunroof

- 5.5 Pop-up sunroof

- 5.6 Spoiler sunroof

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Sedan

- 6.3 SUV

- 6.4 Hatchback

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Conventional SCUs

- 7.3 Smart SCUs

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin Corporation

- 10.2 Automotive Sunroof-Customcraft (ASC) Inc.

- 10.3 Beijing Automotive Group Co., Ltd.

- 10.4 BOS Group

- 10.5 CIE Automotive S.A.

- 10.6 DeFuLai Automotive Parts

- 10.7 Donghee

- 10.8 Edscha

- 10.9 Inalfa Roof Systems Group B.V.

- 10.10 Inteva Products LLC

- 10.11 Jincheng Accessories

- 10.12 Johnan America Inc.

- 10.13 Magna International Inc.

- 10.14 Mingfang Automotive Parts

- 10.15 MITSUBA Corporation

- 10.16 Shanghai Mobitech

- 10.17 Signature Automotive Products

- 10.18 Wanchao Electric Appliance

- 10.19 Webasto SE

- 10.20 Yachiyo Industry Co., Ltd.