|

市場調查報告書

商品編碼

1665080

電動車 (EV) 增程器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Vehicle (EV) Range Extender Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

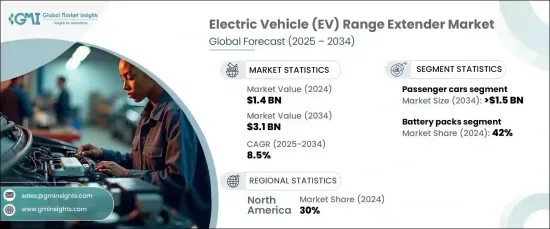

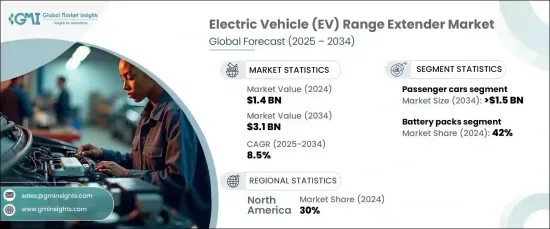

2024 年全球電動車增程器市場規模達到 14 億美元,預計 2025 年至 2034 年的複合年成長率為 8.5%。世界各國政府正在推出旨在推廣清潔汽車的政策,進一步推動對電動車的需求。同時,消費者越來越關注自己的碳足跡,從而促進了向電動車的轉變。

電動車面臨的一個重大挑戰是續航里程焦慮,即擔心在到達充電站之前電量耗盡的可能性。這一問題在充電基礎設施尚不發達的地區尤為明顯。增程器透過在運行過程中幫助電動車的電池充電來解決這一問題,從而使更長的旅程無需頻繁停車充電。這些系統對於居住在充電設施有限地區的消費者尤其有益,使電動車更適合長途旅行。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 31億美元 |

| 複合年成長率 | 8.5% |

此外,增程器在彌合電動車電池現有限制與電池技術預期改進之間的差距方面發揮關鍵作用。隨著充電網路在全球範圍內不斷擴張,增程器提供了一種臨時解決方案,使電動車成為基礎設施仍在發展地區的消費者更可行的選擇。這種靈活性鼓勵了更多人採用電動車,預計將推動市場進一步擴張。

氫燃料電池增程器也正在獲得發展動力,尤其是在將氫基礎設施建設作為脫碳目標一部分的市場中。這些系統利用氫氣產生電能,並且只排放水蒸氣,與傳統的電池供電的電動車相比,其續航里程更長、加油時間更短。這使得它們成為商用車和以永續發展為重點的領域的理想選擇。

市場分為乘用車和商用車,其中乘用車佔據主導地位。人們對農村和郊區充電選擇有限的擔憂日益加劇,導致許多消費者尋求增程器等解決方案,透過延長行駛里程來幫助緩解里程焦慮。此外,將電動傳動系統與增程器相結合的混合動力電動車 (HEV) 正變得越來越受歡迎。這些車輛具有城市零排放駕駛的優勢,續航里程更長。

在零件方面,市場包括電動馬達、電池組、發電機、電源轉換器和燃料電池,其中電池組在市場佔有率方面佔據領先地位。電池技術的創新,包括鋰離子電池和固態電池的改進,使得我們可以製造出更小、更輕的電池組,讓電動車在需要增程器之前行駛得更遠。此外,超快速充電技術的進步支持使用更大的電池組,使得長距離電動車旅行變得更加可行。

在北美,電動車增程器市場在 2024 年佔據了收入的 30%。隨著對長續航里程電動車的需求不斷成長,汽車製造商正在整合增程器,以使電動車更適合長途駕駛,特別是在充電基礎設施不太完善的地區。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 技術提供者

- 原料及零件供應商

- 汽車製造商

- 最終用戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 由於環保意識增強和政府要求,電動車的採用率不斷提高

- 在充電基礎設施有限的地區,解決續航里程焦慮問題的需求日益增加

- 全球排放法規趨嚴推動混合動力和增程式汽車解決方案

- 燃料電池和內燃機增程器技術的進步提高了效率

- 產業陷阱與挑戰

- 增程器技術的開發與整合成本高

- 電池技術進步帶來的競爭減少了對增程器的需求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 電動機

- 電池組

- 產生器

- 電源轉換器

- 燃料電池

第 6 章:市場估計與預測:按增程器,2021 - 2034 年

- 主要趨勢

- 內燃機(ICE)

- 燃料電池

- 基於電池

第7章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 氫

- 替代燃料

第 8 章:市場估計與預測:按車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- SUV

- 其他

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- AB Volvo

- Advanced Innovative Engineering (AIE)

- AVL

- Ballard Power Systems

- BorgWarner

- Ceres Power

- Continental

- Denso

- Eberspaecher

- Ep Tender

- Fagor Ederlan

- General Motors

- Horse Powertrain

- Hyundai Mobis

- Mahle

- Rheinmetall

- SAIC Motor

- Schaeffler

- Valeo

- ZF Friedrichshafen

The Global Electric Vehicle Range Extender Market reached USD 1.4 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2034. This growth can be attributed to heightened environmental awareness and the increasing demand for electric vehicles as a response to stricter government regulations. Governments worldwide are rolling out policies aimed at promoting cleaner vehicles, further propelling the demand for EVs. At the same time, consumers are becoming more conscious of their carbon footprint, contributing to the shift toward electric mobility.

One of the significant challenges for electric vehicles is range anxiety-concern over the possibility of running out of charge before reaching a charging station. This problem is particularly pronounced in regions where charging infrastructure is still underdeveloped. Range extenders address this concern by helping recharge the EV's battery during operation, thereby enabling longer journeys without the need for frequent stops to recharge. These systems are especially beneficial for consumers living in areas with limited charging facilities, making EVs more practical for long-distance travel.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 8.5% |

Additionally, range extenders play a pivotal role in bridging the gap between the current limitations of EV batteries and the expected improvements in battery technology. As charging networks continue to expand globally, range extenders offer an interim solution, making electric vehicles a more viable option for consumers in regions where infrastructure is still growing. This flexibility encourages greater EV adoption, which is expected to drive further market expansion.

Hydrogen fuel cell range extenders are also gaining momentum, especially in markets focusing on hydrogen infrastructure development as part of their decarbonization goals. These systems, which generate electricity from hydrogen and emit only water vapor, offer longer ranges and quicker refueling times compared to traditional battery-powered EVs. This makes them ideal for commercial vehicles and areas with sustainability-focused targets.

The market is segmented into passenger cars and commercial vehicles, with passenger cars holding a dominant share. The growing concern over limited charging options in rural and suburban areas has led many consumers to seek solutions like range extenders, which help alleviate range anxiety by extending the driving range. Additionally, hybrid electric vehicles (HEVs) that combine electric drivetrains with range extenders are becoming increasingly popular. These vehicles offer the benefit of zero-emission driving in cities, combined with extended range for longer journeys.

In terms of components, the market includes electric motors, battery packs, generators, power converters, and fuel cells, with battery packs leading the way in terms of market share. Innovations in battery technology, including improvements in lithium-ion and solid-state batteries, have allowed for the creation of smaller, lighter packs that enable EVs to travel further before requiring a range extender. Furthermore, advancements in ultra-fast charging technology support the use of larger battery packs, making long-distance EV travel more feasible.

In North America, the EV range extender market accounted for 30% of the revenue in 2024. Government incentives, such as tax credits for automakers and consumer subsidies, are driving the growth of EVs in the region. As the demand for EVs with longer ranges increases, automakers are integrating range extenders to make EVs more practical for long-distance driving, particularly in areas with less extensive charging infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Raw material & component suppliers

- 3.1.3 Automotive manufacturers

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing EV adoption due to rising environmental concerns and government mandates

- 3.9.1.2 Growing need to address range anxiety in areas with limited charging infrastructure

- 3.9.1.3 Stricter global emissions regulations pushing hybrid and range extender solutions

- 3.9.1.4 Advancements in fuel cell and ICE-based range extender technologies improving efficiency

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High development and integration costs for range extender technologies

- 3.9.2.2 Competition from improving battery technologies reducing the need for range extenders

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric motors

- 5.3 Battery packs

- 5.4 Generators

- 5.5 Power converters

- 5.6 Fuel cells

Chapter 6 Market Estimates & Forecast, By Range Extender, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Fuel cell

- 6.4 Battery-based

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Hydrogen

- 7.5 Alternative fuels

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedans

- 8.2.2 Hatchbacks

- 8.2.3 SUVs

- 8.2.4 Others

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AB Volvo

- 10.2 Advanced Innovative Engineering (AIE)

- 10.3 AVL

- 10.4 Ballard Power Systems

- 10.5 BorgWarner

- 10.6 Ceres Power

- 10.7 Continental

- 10.8 Denso

- 10.9 Eberspaecher

- 10.10 Ep Tender

- 10.11 Fagor Ederlan

- 10.12 General Motors

- 10.13 Horse Powertrain

- 10.14 Hyundai Mobis

- 10.15 Mahle

- 10.16 Rheinmetall

- 10.17 SAIC Motor

- 10.18 Schaeffler

- 10.19 Valeo

- 10.20 ZF Friedrichshafen