|

市場調查報告書

商品編碼

1665073

電動自行車增程器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Electric Bike Range Extender Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

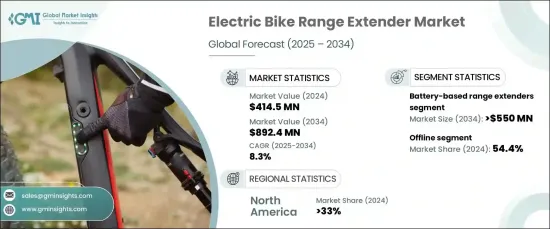

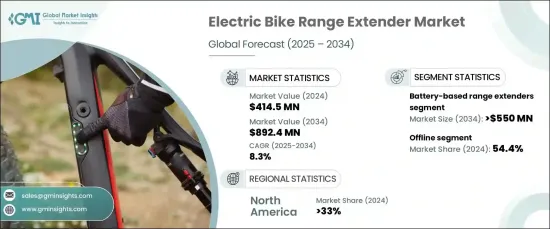

2024 年全球電動自行車增程器市場價值為 4.145 億美元,預計 2025 年至 2034 年期間複合年成長率將達到驚人的 8.3%。這一成長軌跡受到電動車普及率的推動,這是全球減少碳排放和減少對化石燃料依賴的舉措的一部分。包括電動自行車在內的電動車(EV)正成為永續發展目標、重塑全球城市交通和交通的關鍵。

城市交通的日益普及,尤其是在人口密集的城市,大大提高了電動自行車的普及度。電動自行車為短途旅行提供了實用、經濟高效且環保的解決方案,是傳統車輛的有吸引力的替代品。與汽車相比,自行車效率高、成本低、對環境的影響小,因而受到城市居民的青睞。人們對綠色技術和永續交通的日益重視推動了電動自行車的普及,從而推動了對電動自行車增程器的需求並促進了強勁的市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.145億美元 |

| 預測值 | 8.924 億美元 |

| 複合年成長率 | 8.3% |

市場按產品類型分類,包括基於電池、基於燃料電池和基於發電機的增程器。 2024 年,基於電池的增程器佔據了 60% 的主導佔有率,預計到 2034 年將產生 5.5 億美元的市場價值。消費者和製造商都青睞這些範圍擴展器,因為它們實用且功能友好。

電動自行車增程器的通路分為線上和線下。由於人們強烈偏好店內購物,因此線下購物將在 2024 年佔據 54.4% 的佔有率。客戶很欣賞能夠親自檢查產品、獲得專家建議並體驗親手演示的能力——這對於增程器等高投資產品尤其有價值。產品的即時供應以及實體零售店和本地分銷商的廣泛存在進一步增強了線下市場的吸引力,確保了其在主要市場的持續主導地位。

2024年,北美佔據電動自行車增程器市場的33%,顯示出顯著的區域成長。這種擴張歸功於該地區早期採用電動車,以及政府強力的激勵措施來促進電動車基礎設施(如充電站)。這些措施提高了人們對電動車解決方案的認知,推動了對電動自行車增程器的需求,並使北美成為全球市場的關鍵參與者。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 零件供應商

- 製造商

- 技術提供者

- 經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 電動車需求不斷成長

- 與智慧電池管理系統 (BMS) 整合

- 轉向再生能源

- 產業陷阱與挑戰

- 初期成本高

- 電池壽命問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 基於電池的增程器

- 基於燃料電池的增程器

- 基於發電機的增程器

第6章:市場估計與預測:依技術,2021 - 2034 年

- 主要趨勢

- 插入式範圍擴展器

- 無線範圍擴展器

- 混合範圍擴展器

第 7 章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋰離子電池

- 鎳氫 (NiMH) 電池

- 其他

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 通勤電動自行車

- 登山車

- 貨運電動自行車

- 折疊電動自行車

- 其他

第 9 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第 10 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 個人

- 商業用途

第 11 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 12 章:公司簡介

- Bafang Electric

- Bosch

- Brose Fahrzeugteile

- FAZUA

- Giant Manufacturing

- LG Energy Solution

- Mahle

- Panasonic Corporation

- Pedego

- Polaris Industries

- Rad Power Bikes

- Riese & Müller

- Samsung SDI

- Shimano

- Specialized Bicycle Components

- TQ-Group

- Valeo

- VanMoof

- Yamaha Motor

- Zehus

The Global Electric Bike Range Extender Market was valued at USD 414.5 million in 2024 and is projected to grow at an impressive CAGR of 8.3% from 2025 to 2034. This growth trajectory is fueled by the rising adoption of e-mobility as part of global initiatives to cut carbon emissions and reduce reliance on fossil fuels. Electric vehicles (EVs), including e-bikes, are becoming pivotal to achieving sustainability goals, reshaping urban mobility and transportation worldwide.

The increasing shift toward urban mobility, especially in densely populated cities, has significantly boosted the popularity of e-bikes. Offering a practical, cost-effective, and eco-friendly solution for short-distance travel, e-bikes present an attractive alternative to traditional vehicles. Urban dwellers are drawn to these bikes for their efficiency, reduced costs, and minimal environmental impact compared to cars. This growing emphasis on green technologies and sustainable transportation is driving the adoption of e-bikes, thereby propelling the demand for electric bike range extenders and fostering robust market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $414.5 Million |

| Forecast Value | $892.4 Million |

| CAGR | 8.3% |

The market is categorized by product types, including battery-based, fuel cell-based, and generator-based range extenders. In 2024, battery-based range extenders captured a dominant 60% share and are expected to generate USD 550 million by 2034. Their popularity stems from seamless integration with existing e-bike battery systems, delivering a reliable and cost-efficient way to enhance e-bike range. Consumers and manufacturers alike favor these range extenders for their practicality and user-friendly features.

Distribution channels for electric bike range extenders are divided into online and offline segments. The offline segment held a commanding 54.4% share in 2024, driven by a strong preference for in-store purchases. Customers appreciate the ability to physically inspect products, receive expert advice, and experience hands-on demonstrations-particularly valuable for high-investment items like range extenders. Immediate product availability and the widespread presence of physical retail outlets and local distributors further bolster the offline segment's appeal, ensuring continued dominance in key markets.

In 2024, North America accounted for 33% of the electric bike range extender market, demonstrating significant regional growth. This expansion is attributed to the region's early adoption of electric vehicles and robust government incentives promoting EV infrastructure, such as charging stations. These initiatives have heightened awareness of e-mobility solutions, driving demand for electric bike range extenders and positioning North America as a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology providers

- 3.2.5 Distributors

- 3.2.6 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for E-mobility

- 3.8.1.2 Integration with smart battery management systems (BMS)

- 3.8.1.3 Shift towards renewable energy sources

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial cost

- 3.8.2.2 Battery lifespan concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery-based range extenders

- 5.3 Fuel cell-based range extenders

- 5.4 Generator-based range extenders

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Plug-in range extenders

- 6.3 Wireless range extenders

- 6.4 Hybrid range extenders

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Lithium-ion batteries

- 7.3 Nickel-metal hydride (NiMH) batteries

- 7.4 Other

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Commuter electric bikes

- 8.3 Mountain electric bikes

- 8.4 Cargo electric bikes

- 8.5 Folding electric bikes

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Individuals

- 10.3 Commercial use

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Bafang Electric

- 12.2 Bosch

- 12.3 Brose Fahrzeugteile

- 12.4 FAZUA

- 12.5 Giant Manufacturing

- 12.6 LG Energy Solution

- 12.7 Mahle

- 12.8 Panasonic Corporation

- 12.9 Pedego

- 12.10 Polaris Industries

- 12.11 Rad Power Bikes

- 12.12 Riese & Müller

- 12.13 Samsung SDI

- 12.14 Shimano

- 12.15 Specialized Bicycle Components

- 12.16 TQ-Group

- 12.17 Valeo

- 12.18 VanMoof

- 12.19 Yamaha Motor

- 12.20 Zehus