|

市場調查報告書

商品編碼

1854885

床墊產業的電子商務E-commerce in the Mattress Industry |

|||||||

本報告對線上床墊市場進行了詳細分析,重點關註三大全球區域(北美、歐洲和亞太地區),並提供該行業的最新數據和統計資料。

本報告解答的關鍵問題:

- 全球床墊電商市場的現況如何?

- 從2020年到2025年,線上床墊產業的發展趨勢是什麼?

- 北美、歐洲和亞太地區線上床墊銷售的主要趨勢是什麼?

- 有哪些主要的線上床墊銷售公司?

- 主要的床墊公司如何因應電子商務趨勢?

- 在線銷售床墊的主要挑戰是什麼?

- 主要公司正在進行哪些投資以擴大其電子商務業務?

主要企業

|

|

亮點

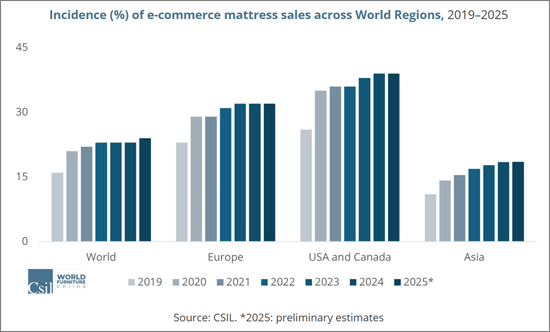

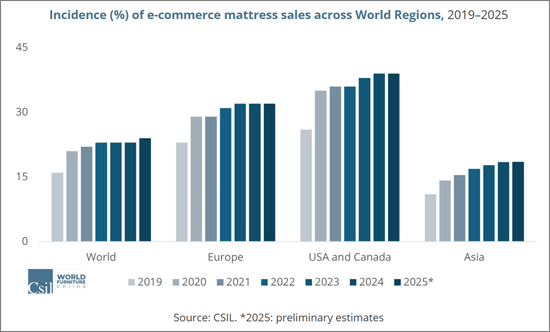

全球電商床墊市場規模現已超過150億美元,約佔全球床墊市場總額的四分之一。近年來,在製造技術的進步、零售策略的創新以及消費者偏好轉向線上購物的推動下,這一領域經歷了顯著增長。

儘管各地區的成長模式有所不同,但電子商務在許多地區的滲透率已經相當高。具體而言,自疫情高峰以來,北美和歐洲一直保持著穩定的成長,而亞太地區則持續擴張,其中印度的線下床墊市場成長尤為迅猛。

該行業的一個顯著趨勢是,實體零售商和直接面向消費者 (DTC) 的品牌都在採用全通路策略。線上優先的品牌正在開設實體展廳和快閃店,而傳統零售商則在加強其電子商務業務,推動線上線下無縫銜接。

目錄 (摘要)

簡介

摘要整理

- 床墊產業電子商務表現及市場特徵,2025年上半年公司洞察

第一章:床墊市場的電子商務:全球市場概覽

- 全球床墊市場概況:床墊消費、各國消費及國際貿易

- 床墊市場的電子商務:各國/地區銷售額、電子商務銷售額及電子商務銷售佔有率

- 電子商務商業模式分類

- 純線上零售商

- 線上線下融合型零售商:同時擁有實體店和線上銷售通路的零售商實體店和網店

- 專業家具店以外的連鎖店

- 線上床墊公司(直接面對消費者)

- 床墊製造商的線上銷售:製造商透過其自有網站進行銷售

第2章 線上床墊商務的特徵

- 業務發展與組織

- 配送選項

- 服務與退貨政策

- 床墊盒裝模式

- 產業供應商的角色

- 付款方式

第3章 美國和加拿大的電子商務床墊市場

- 零售和電商銷售:概述和需求推動因素

- 美國和加拿大的電商床墊銷售

- 競爭:按分銷管道劃分的線上銷售樣本公司及美國和加拿大主要零售商的線上銷售情況

- 電子商務零售商(線上零售商和線上銷售零售商)

- 線上床墊公司(D2C):主要線上公司的供應特性與雙人床墊價格比較

- 床墊製造商的線上銷售趨勢

第4章 歐洲的電子商務床墊市場:法國,德國,義大利,西班牙,英國

- 零售和電商銷售:概述和需求推動因素

- 歐洲電商床墊銷售

- 競爭:樣本公司按分銷管道劃分的線上銷售額以及歐洲主要零售商的線上銷售額

- 電子商務零售商(線上零售商和線上銷售零售商)

- 線上床墊公司(D2C):主要線上公司的供應特性與雙人床墊價格比較

- 床墊的線上銷售趨勢製造商

第5章 亞太地區的電子商務床墊市場:中國,印度,韓國

- 零售和電商銷售:概述和需求推動因素

- 亞太地區電商床墊銷售

- 電商零售商(線上零售商和實體零售商)

- 線下床墊公司(D2C)

- 床墊製造商的線上銷售趨勢

第6章 附錄:CSIL的全球電子商務床墊市場調查結果

- 調查結果:全球電子商務床墊市場

第7章 刊載企業

- 線下床墊銷售商清單:國家/地區、零售業態、業務類型和網站

CSIL's Report "E-commerce in the mattress industry" offers a detailed analysis of the online mattress market with a focus on three world areas (North America, Europe, and Asia Pacific), and the most up-to-date data and statistics of the sector.

This report aims to respond to the following questions:

- What is the current state of the e-commerce mattress market globally?

- How has the online mattress industry evolved between 2020 and 2025?

- What are the key trends in online mattress sales in North America, Europe, and the Asia Pacific?

- What are the top companies selling mattresses online?

- How are the largest mattress companies adapting to the e-commerce trend?

- What are the main challenges in selling mattresses online?

- What types of investments are major players making to strengthen their e-commerce presence?

The study analyses the largest retail mattress markets, estimating the current incidence of online mattress sales in key countries (the USA, Canada, China, India, South Korea, Germany, the UK, France, Italy, and Spain), the e-commerce mattress sales of the leading retailers (e-tailers, brick-and-mortar retailers, online mattress companies and mattress manufacturers) and providing company profiles highlighting their activity and performance in this sector.

Mattress sales and e-commerce mattress sales are provided for the time series 2020-2025 by country/region.

E-COMMERCE BUSINESS MODELS. The report identifies the leading online retailers involved in mattress sales by business model:

- E-tailers (pure e-commerce companies)

- Brick and Click companies (dealers with physical stores and web stores)

- Non-furniture specialists' chains (large multichannel dealers selling furniture, homewares, accessories, home improvement, lighting fixtures, and electronics).

- Online mattress companies (direct-to-consumer and start-ups selling online via their own web platform or through e-tailers)

- Mattress manufacturers selling online via own website

FEATURES OF THE ONLINE MATTRESS BUSINESS AND ORGANIZATION: The most important peculiarities of the e-commerce business in the mattress industry, including services (delivery and logistic options, payment methods, return strategies), product features (bed-in-a-box), sleep economy, and the role of industry suppliers.

ECOMMERCE IN THE MATTRESS INDUSTRY. THE LARGEST MARKETS: The report focuses on three world areas, North America (the United States and Canada), Europe (the United Kingdom, Germany, France, Italy, and Spain), and the Asia Pacific (China, South Korea, and India).

For each considered geographical area and country, the report provides: Retail and e-commerce sales (sector overview of economic and e-commerce indicators enriching the analysis) and E-commerce mattress sales (mattress sales and e-commerce mattress sales by country) up to 2025.

COMPETITION AND PROFILES OF THE LEADING COMPANIES IN THE ONLINE MATTRESS MARKET: online mattress sales by distribution channels and by leading retailers in Europe, the US, Canada, and the Asia Pacific.

The study also profiles the leading retailers and manufacturers operating in the online mattress market, highlighting their e-commerce activity and financial performance.

For online mattress companies, the report describes the most important supply features (number of trial nights, years of warranty, price of a twin mattress, in-home-delivery, and setup) and distribution strategy (presence of physical stores) and profiles of leading online mattress companies by country.

As regards mattress manufacturers selling online, leading players for each considered country are provided, together with information about their online activity.

SURVEY RESULTS: GLOBAL E-COMMERCE MATTRESS MARKET

The Report "E-commerce in the mattress industry" was also carried out through direct interviews with leading mattress manufacturers and retailers operating in the e-commerce mattress business and an online survey carried on by CSIL in September-October 2025, addressed to global retailers and manufacturers involved in the mattress industry.

Topics:

- E-commerce activity and Location

- Incidence of e-commerce sales on mattress sales

- Shipments and types of mattresses

- E-commerce mattress sales by sales channels

- Services offered for e-commerce mattress sales

- Share of mattresses returned

- Expected sales variation in 2025 over 2024 for online and total sales

- Main challenges in selling mattresses online

- Type of investments planning to strengthen e-commerce presence

Selected companies

Among the largest companies considered in the report:

|

|

Highlights:

The global e-commerce mattress market currently exceeds a value of US$15 billion and accounts for around one quarter of the total mattress market. This segment has seen strong growth in recent years, driven by advances in production technology, innovative retail strategies, and evolving consumer preferences for online shopping.

E-commerce penetration has consolidated in many regions, though growth patterns vary worldwide: steady after the pandemic peaking both in North America and Europe, rising in Asia-Pacific, with countries like India experiencing particularly rapid growth in the online mattress market.

An observed trend within this segment is that both brick and mortar retailers and DTC (Direct to Consumer) brands are adopting omnichannel strategies-online-first brands are opening showrooms or pop-up stores, while traditional retailers are strengthening e-commerce presence to create seamless online-offline integration.

TABLE OF CONTENTS (ABSTRACT)

INTRODUCTION

- Data gathering, terminology, processing methodology and sample of companies

EXECUTIVE SUMMARY

- E-commerce in the mattress industry performances and market peculiarities, companies' insights for the first half of 2025

1. E-COMMERCE IN THE MATTRESS MARKET: An overview of the world mattress market

- 1.1. An overview of the world mattress market: mattress consumption and consumption by country. International trade of mattresses

- 1.2. E-commerce in the mattress market: Mattress sales and e-commerce mattress sales by country/region; Share of e-commerce mattress sales

- 1.3. Models of e-commerce business

- E-tailers (pure e-commerce retailers)

- Brick-and-Click companies (dealers with physical stores and webstore)

- Non-furniture specialist chains

- Online mattress companies (direct-to-consumer)

- Mattress manufacturers selling online via their own website

2. FEATURES OF THE ONLINE MATTRESS BUSINESS

- 2.1. The business evolution and organisation

- Delivery options

- Services and return strategies

- Bed-in-a-box

- The role of industry suppliers

- Payment methods

3. E-COMMERCE MATTRESS MARKET IN THE UNITED STATES AND CANADA

- 3.1. Retail and e-commerce sales: overview and demand drivers

- United States. E-commerce as a percentage of total retail sales

- United States and Canada: Macroeconomic and e-commerce indicators

- 3.2. E-commerce mattress sales in the USA and Canada

- 3.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in the USA and Canada

- 3.4. E-commerce retailers (pure e-tailers, retailers selling online)

- 3.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

- 3.6. Mattress manufacturers selling online

4. E-COMMERCE MATTRESS MARKET IN EUROPE: France, Germany, Italy, Spain and the UK

- 4.1. Retail and e-commerce sales: overview and demand drivers

- Europe. Economic and E-commerce Indicators

- France, Germany, Italy, Spain, and the United Kingdom: e-commerce indicators

- 4.2. E-commerce mattress sales in Europe

- Mattress sales and e-commerce mattress sales in France, Germany, Italy, Spain and the United Kingdom

- 4.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in Europe

- 4.4. E-commerce retailers (pure e-tailers, retailers selling online)

- 4.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

- 4.6. Mattress manufacturers selling online

5. E-COMMERCE MATTRESS MARKET IN ASIA PACIFIC: China, India, and South Korea

- 5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India, and South Korea. Economic and E-commerce Indicators

- 5.2. E-commerce mattress sales in the Asia Pacific

- Mattress sales and e-commerce mattress sales in China, India, and South Korea

- 5.3. E-commerce retailers (pure e-tailers, retailers selling online)

- E-commerce retailers selling mattresses in the Asia Pacific: China, India, South Korea

- 5.4. Online mattress companies (direct-to-consumer)

- 5.5. Mattress manufacturers selling online

6. ANNEX: Results of the CSIL survey on the Global e-commerce mattress market

- 6.1. Survey results: Global e-commerce mattress market

- E-commerce activity

- Location

- Incidence of e-commerce sales on mattress sales

- Shipments and types of mattresses

- E-commerce mattress sales by sales channels

- Services offered for e-commerce mattress sales

- Share of mattresses returned

- Expected sales variation in 2025 over 2024 for online and total sales

- Main challenges in selling mattresses online

- Type of investments planning to strengthen e-commerce presence

7. MENTIONED COMPANIES

- List of mentioned companies selling mattresses online: country, retailing format, activity, website