|

市場調查報告書

商品編碼

1708693

按類型、最終用途行業和地區分類的碳補償市場Carbon Offset Market, By Typ, By End-use Industry, By Geography |

||||||

2025 年全球碳補償市場規模估計為 66,683 億美元,預計到 2032 年將達到 29,220.1 億美元,2025 年至 2032 年的複合年成長率為 23.5%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025年的市場規模 | 6668.3億美元 |

| 效能數據 | 2020-2024 | 預測期 | 2025-2032 |

| 預測期間:2025年至2032年的複合年成長率 | 23.50% | 2032年價值預測 | 29,220.10億美元 |

碳補償市場是指允許個人和組織透過從排放計劃購買排碳權來補償其碳排放的平台。過去幾十年來,快速的工業化和不斷成長的能源需求導致全球排放穩定增加,加劇了氣候變遷的不利影響,例如海平面上升和極端天氣事件增加。因此,減少碳排放並轉向更永續的能源來源的需求日益增加。碳補償市場為污染者提供了透過資助可再生能源發電發電廠、能源效率改進和從大氣中去除碳的林業計劃等計劃來抵消其排放的機會。雖然補償允許污染持續存在,但資金支持實現長期脫碳的綠色技術和基礎設施的發展。

市場動態

碳補償市場受到政府嚴格的法規和減少溫室氣體排放的承諾的推動。許多國家承諾在本世紀中葉實現碳中和,並正在引入碳定價機制來抑制石化燃料的使用。然而,一些補償計劃面臨著計劃成本高和額外性不確定性的挑戰。預計管理方案、企業永續性目標和排放目標將在預測期內推動全球碳補償市場的成長。此外,自願碳市場預計將在預測期內推動全球碳補償市場的成長。預計創新計劃開發、城市碳解決方案、供應鏈永續性、生態旅遊和自然保護將在預測期內為全球碳補償市場創造成長機會。

研究的主要特點

- 本報告對碳補償市場進行了詳細分析,並以 2024 年為基準年,給出了預測期 2025 年至 2032 年的市場規模和年複合成長率(CAGR%)。

- 它還強調了各個領域的潛在商機,並說明了該市場的引人注目的投資提案矩陣。

- 它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景和主要企業採用的競爭策略的重要見解。

- 它根據公司亮點、產品系列、關鍵亮點、財務表現和策略等參數,介紹了碳補償市場中主要企業的概況。

- 本報告的見解將使負責人和公司經營團隊能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

- 碳補償市場報告迎合了該行業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和金融分析師。

- 碳補償市場分析中使用的各種策略矩陣將有助於相關人員做出決策。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

- 一致的機會圖(COM)

第3章市場動態、法規與趨勢分析

- 市場動態

- 驅動程式

- 監理舉措

- 限制因素

- 缺乏標準化

- 機會

- 創新計劃開發

- 影響分析

- 監管情景

- 產品發布/核准

- PEST分析

- 波特分析

- 併購場景

4. 碳補償市場-冠狀病毒(COVID-19)疫情的影響

- COVID-19流行病學

- 供需側分析

- 經濟影響

5. 碳補償市場(按類型),2020 年至 2032 年

- 介紹

- 遵守

- 自願

6. 碳補償市場(依最終用途產業分類),2020 年至 2032 年

- 介紹

- 礦業

- 能源

- 運輸

- 住宅和商業

- 大樓

- 農業

- 林業

- 其他

7. 2020-2032 年碳補償市場(按地區)

- 介紹

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章 競爭態勢

- 3Degrees Inc.

- NativeEnergy

- ClimatePartner

- Carbon Credit Capital

- Terrapass

- Renewable Choice Energy

- Gold Standard

- Offsetters

- South Pole Group

- Veridium

- Cool Effect

- ClimateCare

- MyClimate

- Forest Carbon

- Verified Carbon Standard

第9章 章節

- 調查方法

- 關於出版商

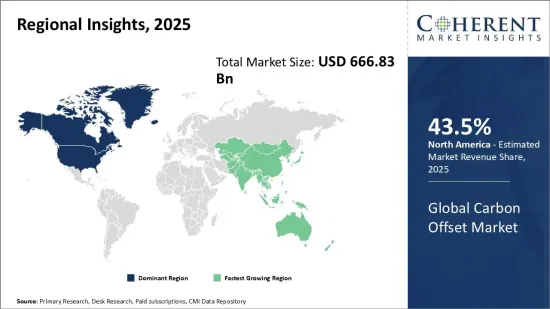

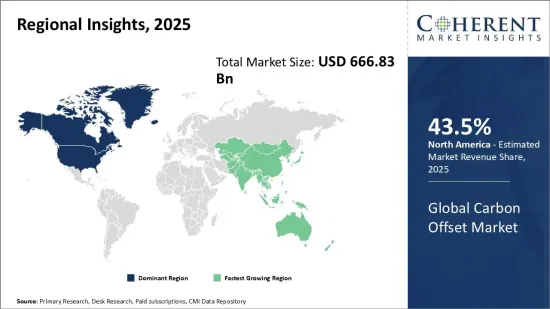

Global Carbon Offset Market is estimated to be valued at US$ 666.83 Bn in 2025 and is expected to reach US$ 2,922.01 Bn by 2032, growing at a compound annual growth rate (CAGR) of 23.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | US$ 666.83 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 23.50% | 2032 Value Projection: | US$ 2,922.01 Bn |

The carbon offset market refers to a platform that allows individuals and organizations to compensate for their carbon footprint by purchasing carbon credits from emission reduction projects. Over the past few decades, global emissions have steadily increased due to rapid industrialization and rising energy demands, leading to adverse effects of climate change such as rising sea levels and intensifying extreme weather events. As a result, there is a growing need to lower carbon emissions and transition to more sustainable energy sources. The carbon offset market provides an opportunity for polluters to offset their emissions through financing projects like renewable energy plants, energy efficiency upgrades, and forestry programs that remove carbon from the atmosphere. While offsets allow continued pollution, the funds support the development of green technologies and infrastructure that can help achieve long term decarbonization.

Market Dynamics:

The carbon offset market is driven by stringent government regulations and commitments to reduce greenhouse gas emissions. Many countries have pledged to become carbon neutral by mid-century and have implemented carbon pricing mechanisms to discourage fossil fuel use. However, high project costs and uncertainty over additionality of some offset projects pose challenges. Regulatory initiatives, corporate sustainability goals, and emission reduction targets are anticipated to drive the growth of the global carbon offset market over the forecast period. Moreover, the voluntary carbon market is expected to boost the growth of the global carbon offset market over the forecast period. Innovative project development, urban carbon solutions, supply chain sustainability, eco-tourism, and conservation are expected to create growth opportunities for the global carbon offset market during the forecast period.

Key features of the study:

- This report provides an in-depth analysis of the carbon offset market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period 2025-2032, considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the carbon offset market based on the following parameters - company highlights, product portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include 3Degrees Inc., NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool Effect, ClimateCare, MyClimate, Forest Carbon, and Verified Carbon Standard.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The carbon offset market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the carbon offset market

Carbon Offset Market Detailed Segmentation:

- By Type:

- Compliance Market

- Voluntary Market

- By End-Use Industry:

- Mining

- Energy

- Transportation

- Residential and Commercial

- Buildings

- Agriculture

- Forestry

- Other

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Company Profile:

- 3Degrees Inc.

- NativeEnergy

- ClimatePartner

- Carbon Credit Capital

- Terrapass

- Renewable Choice Energy

- Gold Standard

- Offsetters

- South Pole Group

- Veridium

- Cool Effect

- ClimateCare

- MyClimate

- Forest Carbon

- Verified Carbon Standard

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By End-Use Industry

- Market Snippet Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Regulatory initiatives

- Restraints

- Lack of standardization

- Opportunities

- Innovative project development

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Carbon Offset Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Carbon Offset Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Compliance Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Voluntary Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

6. Carbon Offset Market, By End-Use Industry Sectors, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Mining

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Energy

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Transportation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Residential and Commercial

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Buildings

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Agriculture

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Forestry

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

7. Carbon Offset Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Country 2021 -2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest Of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- Brazil

- Mexico

- Rest Of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- South Africa

- GCC Countries

- Rest of the Middle East and Africa

8. Competitive Landscape

- 3Degrees Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- NativeEnergy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- ClimatePartner

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Carbon Credit Capital

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Terrapass

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Renewable Choice Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Gold Standard

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Offsetters

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- South Pole Group

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Veridium

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Cool Effect

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- ClimateCare

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- MyClimate

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Forest Carbon

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Verified Carbon Standard

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

9. Section

- Research Methodology

- About us