|

市場調查報告書

商品編碼

1454227

黏劑市場:依聚合物基、依應用、按地區Hot Melt Adhesives Market, By Polymer Base, By Application, By Geography |

||||||

2024年黏劑市場規模為111.8億美元,預計2024年至2031年年複合成長率為3.8%,2031年達到145.6億美元。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年 | 2023年 | 2023/2024年市場規模 | 111.8億美元 |

| 實際資料 | 2019-2023 | 預測期 | 2024-2031 |

| 預測期間 2023/2024 至 2030/2031 年年複合成長率: | 3.80% | 2030/2031價值預測 | 145.6億美元 |

全球黏劑市場是一項重要的膠黏技術,包裝、鞋類和汽車等各種最終用途產業的需求不斷成長。熱熔黏劑是固態黏劑,加熱至熔點時會變成流體,可用於黏合多種材料。其非水性、對濕氣的低敏感性和快速黏合特性使其在製造和組裝應用中普及。由於包裝和鞋類產業的成長、環保黏劑取代溶劑型黏劑以及技術創新導致高性能黏劑的發展等因素,全球市場預計在未來幾年將顯著成長。 。由於其黏合性能,黏劑黏劑用於包裝、汽車、不織布、產品組裝、膠帶和標籤、木工、紙張黏合和電子產品。一種熱塑性聚合物,含有多種聚合物和添加劑,如顏料、樹脂和穩定劑。

市場動態:

由於電子商務的興起,包裝行業已成為黏劑的最大消費者。鞋類和消費品產業的市場開拓,特別是新興經濟體的市場發展,也支持了市場成長。製造商開發創新和永續的產品品種正在開拓新的應用領域和機會。然而,對石油原料的高度依賴影響了供應的穩定性,價格波動仍然是一個問題。此外,有關揮發性有機化合物排放的嚴格環境法規可能會阻礙市場擴張。生物基黏劑的引入透過解決永續性問題提供了新的機會。

本研究的主要特點

- 該研究報告對全球黏劑市場進行了詳細分析,並列出了以2023年為基準年的預測期(2024-2031)的市場規模和年複合成長率。

- 它還說明了各個細分市場的潛在收益成長機會,並為該市場提供了一系列有吸引力的投資提案。

- 它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景、主要企業採取的競爭策略等的主要考察。

- 它根據公司亮點、產品系列、主要亮點、財務表現和策略等參數,介紹了全球黏劑市場的主要企業。

- 該報告的見解將幫助負責人和公司經營團隊就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

- 全球黏劑市場報告迎合了該行業的各種相關人員,如投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

- 相關人員可以透過分析全球黏劑市場時所使用的各種策略矩陣來促進決策。

目錄

第1章 研究目的與前提

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章 市場動態、法規與趨勢分析

- 市場動態

- 促進因素

- 家具業需求增加

- 不織布衛生用品的成長

- 不斷發展的包裝產業

- 抑制因素

- 關於VOC排放的嚴格規定

- 原物料價格波動

- 機會

- 新應用的產品開發

- 新興國家市場拓展

- 主要亮點

- 監管場景

- 最近的趨勢

- 產品發布/核准

- PEST分析

- 波特的分析

- 合併、收購和合作

第4章全球黏劑市場 - 冠狀病毒(COVID-19)大流行的影響

- 新型冠狀病毒感染疾病(COVID-19)的流行病學

- 供需面分析

- 經濟影響

第5章全球黏劑市場,依聚合物基分類,2019-2031

- 乙烯醋酸乙烯酯(EVA)

- 聚烯

- 聚醯胺

- 苯乙烯嵌段共聚物(SBC)

- 其他

第6章全球黏劑市場,依應用分類,2019-2031

- 包裝

- 車

- 建造

- 保健品

- 其他

第7章2019-2031年全球黏劑市場(按地區)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- ASEAN

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東

- 海灣合作理事會國家

- 以色列

- 其他中東地區

- 非洲

- 南非

- 中部非洲

- 北非

第8章 競爭格局

- 公司簡介

- Henkel AG &Co.

- KGaA, HB Fuller

- Sika AG

- Arkema Group

- Ashland Inc.

- The 3M Company

- Jowat AG

- Sipol SpA

- Palmetto Adhesives Company

- Sealock Ltd.

第9章 章節

- 參考

- 調查方法

- 關於出版商

The hot melt adhesives Market size is valued at US$ 11.18 Bn in 2024 and is expected to reach US$ 14.56 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2023/2024: | US$ 11.18 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 - 2031 |

| Forecast Period 2023/2024 to 2030/2031 CAGR: | 3.80% | 2030/2031 Value Projection: | US$ 14.56 Bn |

The global hot melt adhesives market is an important adhesive technology that is seeing rising demand across various end-use industries such as packaging, footwear, automobile, and more. Hot melt adhesives are solid adhesives, when heated to their melting point, become flowable and can be used for bonding various materials. The properties of being non-aqueous, having low moisture sensitivity, and enabling fast bonding have made them popular for manufacturing and assembly applications. The global market is expected to grow substantially in the coming years due to factors such as growth in the packaging and footwear industries, the replacement of solvent-based adhesives with eco-friendly hot melt adhesives, and innovations leading to the development of high performance hot melt adhesives. Hot melt adhesive is an adhesive that is used across packaging, automotive, nonwovens, product assembly, tapes and labels, woodworking, paper bonding, and electronics sectors due to its adhesion properties. It is a thermoplastic polymer containing more than one polymer and additives such as pigments, resins, and stabilizers.

Market Dynamics:

The packaging industry is the largest consumer of hot melt adhesives owing to the rise in e-commerce. Growing footwear and consumer goods sectors, particularly in developing economies, are also pushing market growth. The development of innovative and sustainable product varieties by manufacturers is opening up new application areas and opportunities. However, high dependence on petroleum-based raw materials affects supply stability, and price volatility remains a challenge. Also, the stringent environmental regulations over volatile organic compound emissions can hamper market expansion. Introduction of bio-based hot melt adhesives provides new opportunities by addressing sustainability issues.

Key Features of the Study:

- This report provides an in-depth analysis of the global hot melt adhesives market, and provides market size (US$ Bn) and compound annual growth rate (CAGR %) for the forecast period (2024-2031), considering 2023 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global hot melt adhesives market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Henkel AG & Co., KGaA, H B Fuller, Sika AG, Arkema Group, Ashland Inc., The 3M Company, Jowat AG, Sipol SpA, Palmetto Adhesives Company, Sealock Ltd.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up gradation, market expansion, and marketing tactics.

- Global hot melt adhesives market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global hot melt adhesives market.

Detailed Segmentation:

- Global Hot Melt Adhesives Market, By Polymer Base

- Ethylene Vinyl Acetate (EVA)

- Polyolefin

- Polyamide

- Styrenic Block Copolymers (SBC)

- Others

- Global Hot Melt Adhesives Market, By Application

- Packaging

- Automotive

- Construction

- Healthcare Products

- Others

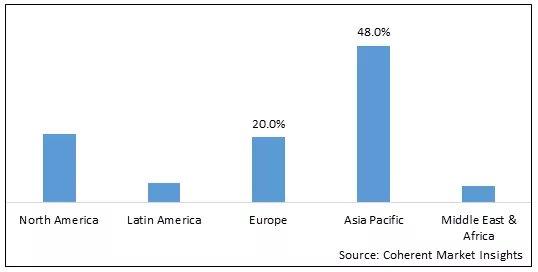

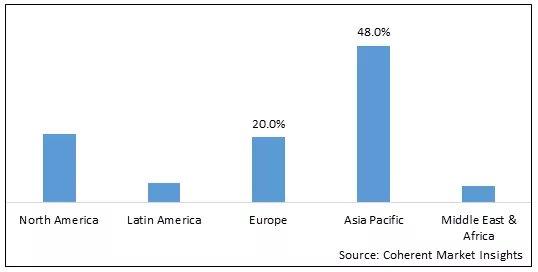

- Global Hot Melt Adhesives Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Top Companies in the Global Hot Melt Adhesives Market

- Henkel AG & Co.

- KGaA, H B Fuller

- Sika AG

- Arkema Group

- Ashland Inc.

- The 3M Company

- Jowat AG

- Sipol SpA

- Palmetto Adhesives Company

- Sealock Ltd

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Polymer Base

- Market Snippet, By Application

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Increasing demand from furniture industry

- Growth in nonwoven hygiene products

- Growing packaging industry

- Restraints

- Stringent regulations regarding VOCs emissions

- Volatility in raw material prices

- Opportunities

- Product development for new applications

- Market expansion in developing countries

- Key Highlights

- Regulatory Scenario

- Recent Trends

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Mergers, Acquisitions, and Collaborations

4. Global Hot Melt Adhesives Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Hot Melt Adhesives Market, By Polymer Base, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024-2031(%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Ethylene Vinyl Acetate (EVA)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Polyolefin

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Polyamide

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Styrenic Block Copolymers (SBC)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

6. Global Hot Melt Adhesives Market, By Application, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024-2031(%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Packaging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Automotive

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Healthcare Products

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031,(US$ Bn)

7. Global Hot Melt Adhesives Market, By Region, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2024-2031(%)

- Y-o-Y Growth Analysis, For Region, 2019 - 2031

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019-2031,(US$ Bn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019-2031,(US$ Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019-2031,(US$ Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019-2031,(US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019-2031,(US$ Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Polymer Base, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019-2031,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country/Region, 2019-2031,(US$ Bn)

- South Africa

- Central Africa

- North Africa

8. Competitive Landscape

- Company Profile

- Henkel AG & Co.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- KGaA, H B Fuller

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Sika AG

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Arkema Group

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Ashland Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- The 3M Company

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Jowat AG

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Sipol SpA

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Palmetto Adhesives Company

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Sealock Ltd.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

9. Section

- References

- Research Methodology

- About us