|

市場調查報告書

商品編碼

1896277

脈衝與快速充放電應用儲能技術(聚變能源、雷射武器、資料中心、電動車超快充電器等):技術趨勢與市場展望(2026-2046)Energy Storage for Pulse & Fastest Charge/ Discharge Applications (Fusion Power, Laser Gun, Data Center, EV Fastest Chargers, etc.): Technology, Markets 2026-2046 |

||||||

摘要

人工智慧資料中心、聚變能源、先進電磁武器、戰鬥機以及陸地、海洋和空中最快的電動車充電都需要超越電池本身能力的儲能技術。這些應用需要具備脈衝功率、快速充放電和其他獨特特性的儲能技術,以實現極高的利潤率。由於應用普及帶來的乘數效應,預計未來20年儲能系統的年出貨量將成長六倍,達到每年200億美元以上。

本報告詳細分析了脈衝和快速充放電應用儲能技術的巨大機會。 本報告介紹了一系列技術方案,包括新型鋰離子電容器和電容器/超級電容器混合元件,展示了它們在緊湊型結構中提供強大浪湧和再生能力的卓越性能。這些技術為雷射砲、重型土木工程設備和新型軍用飛機中的緊湊型脈衝雷達訊號裝置等應用提供了令人印象深刻的浪湧和再生能力。

最佳備用電源、最快電網管理和新一代再生能源

關鍵設施需要能夠幾乎瞬間充電的不間斷電源,以應對頻繁發生的停電。汽車充電也將在幾分鐘內完成,超越傳統電池的性能。這推動了新型脈衝電容器、石墨烯和金屬有機框架(MOF)超級電容器(包括用作結構電子裝置的超級電容器)以及用於最快電網管理的飛輪發電機的出現。 其他新興應用包括用於應對下一代高空風能、波浪能和潮汐能發電的小規模間歇性和電力浪湧的不可燃、無毒、免維護設備。

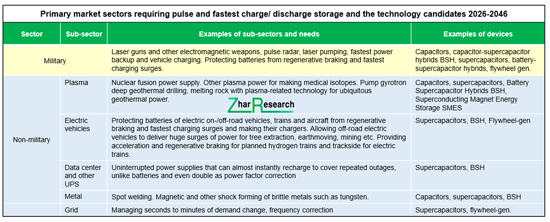

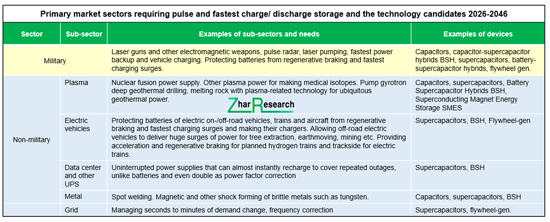

標題:需要脈衝和最快充放電儲能技術的關鍵市場領域和技術候選者(2026-2046 年)來源:Zhar Research 報告 "用於脈衝和最快充放電應用的儲能(聚變發電、雷射槍、資料中心、電動汽車最快充電器等):技術、市場 2026-2046 年"

目錄

第一章 摘要整理與結論

- 目標和範圍

- 研究方法

- 主要結論

- 需要脈衝應用和最快充放電儲能技術的主要市場領域和技術候選者儲能

- 超級電容器及其衍生技術的效能提升策略

- 基於能量密度譜的鋰離子電容器 (LIC) 市場定位

- 八項 SWOT 分析

- 超級電容器及其衍生技術

- 石墨烯超級電容器

- 電容器-超級電容器混合元件 (CSH)

- 電池-超級電容器混合元件 (BSH) 的 LIC 形式

- 鋰離子電容器形式的 BSH

- 石墨烯 LIC

- 飛輪儲能系統 (FESS)

- 超導磁儲能 (SMES)

- 路線圖

- 市場預測

- 儲能設備市場:電池與非電池

- 脈衝與快速反應非電池儲能市場: 7 個技術類別

- 脈衝與快速反應非電池儲能市場:6 個應用類別

- 脈衝與快速反應儲能市場佔有率(按地區劃分):4 個地區

第二章:引言:飛輪儲能系統 (FESS) 與超導磁儲能 (SMES)

- 概述

- 常用儲能方案

- 儲能工具包:依工作原理分類

- 電池的局限性

- 電容器及其衍生技術與電池的比較(包括線圈炮範例)

- BSH 和 EDLC 研究活動:按國家和技術分類

- FESS 和 SMES

- Zhar 研究配套報告

第三章:靜電儲能電容器與電容器-超級電容器混合型

- 概述

- 超級電容器的關鍵效能參數與銷售驅動因素

- 材料和外形尺寸選擇

- 超級電容器效能改進策略

- 一般性討論

- 活性電極-電解質配對的優先排序

- 石墨烯的重要性(包括SWOT分析)

- 11家石墨烯超級電容器材料/裝置開發人員和製造商的比較(5列)

- 研究計畫:純超級電容器(2025年)

- 電容器-超級電容器混合(CSH)的設計與應用

第四章 靜電電容與法拉第功能的混合:贗電容

- 理解贗電容

- 促使贗電容的三種機制贗電容與本徵/外在現象

- 亞鐵磁性贗電容的研究趨勢

- 贗電容優化路徑的出現

- 贗電容研究進展

第五章 具有法拉第功能的靜電混合元件:包括鋰離子電容器在內的電池-超級電容器混合元件 (BSH)

- 電池-超級電容器混合元件基礎

- BSH,尤其是鋰離子電容器 (LIC),創造了幾個重要的轉折點

- 鋰離子電容器 (LIC) 的諸多優勢與能量密度選擇

- 以能量密度譜定位鋰離子電容器 (LIC) 市場

- 超級電容器改良策略如何使 BSH 受益包括鋰離子電容器 (LIC)

- 活性電極-電解質對的優先排序

- 13 個關鍵結論:BSH 市場,包括鋰離子電容器 (LIC)

- EDLC 和 BSH 的技術應用案例(按應用領域劃分)

- 18 個關鍵結論:技術與製造商

- 研究方向調整的必要性

- SWOT 分析與路線圖

- 超越鋰離子電容器 (LIC) 的 BSH 研究:鈉離子 BSH、鋅離子 BSH 等

第六章 無電池脈衝、最快反應與類似儲能應用

- 電動車:AGV、物料搬運、汽車、卡車、巴士、電車、火車

- 超級電容器取代燃料電池系統中的電池

- 電網、微電網、削峰、再生能源以及不間斷電源、醫療

- 軍事:雷射砲、電磁軌道炮、脈衝線性加速武器、雷達、卡車等

- 電力與訊號電子、資料中心、卡車

- 焊接、脈衝金屬成形、脈衝加工

- 迴旋管鑽探深層地熱發電

第七章:製造商活動概況

- 基於10項標準評估103家超級電容器及相關公司:指標與研究方法

- 總結分析

- 列表

Summary

AI datacenters, nuclear fusion power, new electromagnetic weapons, jet fighters and fastest electric vehicle charging by land, sea and air all need energy storage beyond the capability of batteries alone. Such storage, capable of pulses, fastest charge/ discharge and other uniques has exceptional profit margins. Deliveries will increase sixfold in the next 20 years to over $20 billion yearly because these are all growth markets with the multiplier of increased adoption.

New analysis of rapidly increasing demand

The new Zhar Research report "Energy storage for pulse and fastest charge/ discharge applications (fusion power, laser gun, data center, EV fastest chargers etc.): technology, markets 2026-2046" details this excellent opportunity. It gives the spectrum of choice, including new lithium-ion capacitors and capacitor-supercapacitor hybrids compactly providing formidable power surges and regeneration to earthmoving, and laser guns and compact pulse radar signalling in new military aircraft.

Best backup, fastest grid management, next renewable energy

Critical facilities demand uninterrupted power supplies with near instant recharge to cover repeated outages, and we shall charge our cars in minutes - both better than batteries can provide. Expect new pulse capacitors, graphene and metal oxide framework MOF supercapacitors - some as structural electronics - and flywheel generators for fastest grid management. Other emerging applications include covering the modest intermittency and surges of next generation high altitude wind, wave and tidal stream power demanding non-flammable, non-toxic, fit-and-forget equipment.

Comprehensive report

The 230-page report has 7 chapters, 8 SWOT appraisals, 20 forecast lines, 53 infograms and tables and covers 116 companies. Latest 2025-6 research advances are covered. The 25-page Executive Summary and Conclusions (25 pages) is sufficient for those in a hurry. See key conclusions, the SWOT appraisals and the forecasts as tables, graphs and explanation 2026-2046 aided by roadmaps 2026-2046 for markets, technology and industry. The Introduction then puts energy storage in context, explains ongoing battery limitations and the alternatives.

Chapter 3. Electrostatic storage : Capacitors and capacitor-supercapacitor hybrids gives the basics, materials and format choices, strategies for improvement and latest research advances 2025-6. Chapter 4. Electrostatic hybridised with faradaic functionality: pseudocapacitors explains how this phenomenon occurs in all supercapacitors and it is usually minimised to achieve more ideal performance. However, there is much ongoing research on optimising it to improve energy density at a cost in other performance. What is it? Why? How?

Chapter 5. Electrostatic hybridised with faradaic functionality: battery-supercapacitor BSH hybrids including lithium-ion capacitors takes 105 pages because this is a larger and more-immediate opportunity. Why are they succeeding from fusion power to earthmoving vehicles. See 18 conclusions. Who wants their spectrum of choice from almost-a-supercapacitor to almost-a-battery? What manufacturers and successes along that spectrum and what are the latest research results 2025-6? Why progressing from lithium-ion capacitors to others that are sodium or zin BSH? Results so far?

Batteryless pulse and fastest response in action

Chapter 6. is on batteryless pulse, fastest response and similar storage in action (38 pages). This brings the subject alive with use in electric vehicles: AGV, material handling, car, truck, bus, tram, train. See supercapacitors replacing batteries on a fuel cell system and grid, microgrid, peak shaving, renewable energy and uninterrupted power supplies and medical applications of the various options. Military is well covered with its high profit margins and exacting demands: laser gun, railgun, pulsed linear accelerator weapon, radar, trucks, other. Power and signal electronics, data centers, trucks, welding, pulse metal forming and pulse machining and also powering gyrotron-drilled deep geothermal power - no drill bit just microwave melting of rock.

132 manufacturers analysed

The report then closes with Chapter 7 presenting 132 manufacturer activity profiles in 50 pages mainly of tables using colours and ten columns for analysis but starting with overall analysis pie chart. This new Zhar Research report "Energy storage for pulse and fastest charge/ discharge applications (fusion power, laser gun, data center, EV fastest chargers etc.): technology, markets 2026-2046" is your essential reading for a sober, PhD level analysis of your opportunities in this fast-growing sector.

CAPTION: Primary market sectors requiring pulse and fastest charge/ discharge storage and the technology candidates 2026-2046. Source Zhar Research report "Energy storage for pulse and fastest charge/ discharge applications (fusion power, laser gun, data center, EV fastest chargers etc.): technology, markets 2026-2046".

Table of Contents

1. Executive summary and conclusions

- 1.1 Purpose and scope of this report

- 1.2 Methodology of this analysis

- 1.3 Primary conclusions

- 1.4 Primary market sectors requiring pulse and fastest charge/ discharge storage and technology candidates 2026-2046

- 1.5 Strategies for improving supercapacitors and variants

- 1.6 Lithium-ion capacitor LIC market positioning by energy density spectrum

- 1.7 Eight SWOT appraisals

- 1.7.1 SWOT appraisal of supercapacitors and their variants

- 1.7.2 Graphene supercapacitor SWOT appraisal

- 1.7.3 SWOT appraisal of capacitor-supercapacitor hybrids CSH

- 1.7.4 SWOT appraisal of LIC form of BSH

- 1.7.5 SWOT appraisal of Lithium-Ion Capacitor LIC form of BSH

- 1.7.6 Graphene LIC SWOT appraisal

- 1.7.7 Flywheel Energy Storage System FESS SWOT appraisal

- 1.7.8 SWOT appraisal of Superconducting Magnet Energy Storage SMES

- 1.8 Roadmap 2026-2046

- 1.9 Market forecasts 2026-2046 in 20 lines

- 1.9.1 Energy storage device market battery vs batteryless $ billion 2025-2046

- 1.9.2 Batteryless storage for pulse and fastest response $ billion 2025-2046 in 7 technology lines

- 1.9.3 Batteryless storage for pulse and fastest response $ billion 2025-2046 in 6 application lines

- 1.9.4 Regional share of pulse and fast response storage value market % in four regions 2026-2046

2. Introduction including flywheel FESS and superconducting magnet SMES storage

- 2.1 Overview

- 2.2 Energy storage options in general

- 2.3 Energy storage toolkit by operating principle

- 2.4 Battery limitations

- 2.4.1 General

- 2.4.2 Lithium-ion battery fires are ongoing emitting toxic gas

- 2.5 Capacitors and their variants compared to batteries including coil gun example

- 2.6 BSH and EDLC research activity by country and technology

- 2.7 Flywheel energy storage systems FESS and superconducting magnet energy storage systems SMES

- 2.7.1 Background, basics, progress

- 2.7.2 Flywheel motor-generator SWOT appraisal

- 2.7.3 SMES

- 2.8 Sister reports from Zhar Research

3. Electrostatic storage : Capacitors and capacitor-supercapacitor hybrids

- 3.1 Overview

- 3.1.1 Capacitors and their variants: basics

- 3.1.2 Spectrum - capacitor to supercapacitor to battery construction, equivalent circuits

- 3.2 Factors influencing key supercapacitor parameters driving sales

- 3.3 Materials and format choices

- 3.4 Strategies for improving supercapacitors

- 3.4.1 General

- 3.4.2 Prioritisation of active electrode-electrolyte pairings

- 3.4.3 Significance of graphene in supercapacitors and variants with SWOT

- 3.4.4 Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 3.5 Research pipeline: pure supercapacitors 2025

- 3.6 Capacitor-supercapacitor hybrid CSH design and uses

4. Electrostatic hybridised with faradaic functionality: pseudocapacitors

- 4.1 Understanding pseudocapacitance

- 4.2 Three mechanisms that give rise to pseudocapacitance and the intrinsic/ extrinsic phenomena

- 4.3 Ferrimagnetic pseudocapacitors 2025-6 research

- 4.4 Pseudocapacitor optimisation routes emerging

- 4.5 Research advances with pseudocapacitors 2025-6

5. Electrostatic hybridised with faradaic functionality: battery-supercapacitor BSH hybrids including lithium-ion capacitors

- 5.1 Basics of battery-supercapacitor hybrids

- 5.2 BSH and in particular LIC create some valuable tipping points

- 5.3 The many advantages of lithium-ion capacitors LIC and the energy density choices

- 5.4 Lithium-ion capacitor LIC market positioning by energy density spectrum

- 5.5 How strategies for improving supercapacitors will benefit BSH including LIC

- 5.6 Prioritisation of active electrode-electrolyte pairings

- 5.7 13 Primary conclusions: BSH markets including LIC

- 5.8 Technology uses by applicational sector for EDLC vs BSH - examples

- 5.9 18 primary conclusions: technologies and manufacturers

- 5.10 How research needs redirecting: 5 columns, 7 lines

- 5.11 SWOT appraisals and roadmap

- 5.12 Research on BSH beyond LIC: sodiumc-ion BSH, zinc-ion BSH, other

6. Batteryless pulse, fastest response and similar storage in action

- 6.1 Electric vehicles: AGV, material handling, car, truck, bus, tram, train

- 6.2 Supercapacitor replacing battery on fuel cell system

- 6.3 Grid, microgrid, peak shaving, renewable energy and uninterrupted power supplies, medical

- 6.4 Military: Laser gun, railgun, pulsed linear accelerator weapon, radar, trucks, other

- 6.5 Power and signal electronics, data centers, truck

- 6.6 Welding, pulse metal forming and pulse machining

- 6.7 Gyrotron-drilled deep geothermal power

7. Manufacturer activity profiles

- 7.1 103 supercapacitor and variants companies assessed in 10 columns: index, methodology

- 7.2 Overview analysis

- 7.3 Listings