|

市場調查報告書

商品編碼

1421840

6G通訊的低損耗熱材料和結構:詳細的技術分析、路線圖和32個市場預測線(2024-2044)6G Communications Low Loss and Thermal Materials and Structures: Detailed Technology Analysis, Roadmaps and 32 Market Forecast Lines 2024-2044 |

||||||

Zhar Research 執行長Peter Harrop 博士表示: "滿足6G 對低損耗熱材料和結構的需求代表著一個價值超過100 億美元的市場。它們位於頻率更高、功耗更高的較熱基礎設施中,和更小的客戶端設備。”

來源:6G 通訊的低損耗熱材料和結構:詳細的技術分析、路線圖和 32 個市場預測線(2024-2044 年)

本報告調查了6G通訊用低損耗/熱材料和結構的市場,涵蓋了6G環境的趨勢和前景、6G低損耗材料及其應用、6□□G熱管理材料及其應用、它編制了地圖、市場規模趨勢和預測、影響市場成長的因素以及市場機會分析。

目錄

第 1 章執行摘要/概述/32 條市場預測線(2024-2044 年)

第 2 章簡介

- 為什麼我們需要 6G?

- 6G 的顛覆性面

- 擴大 6G 願望清單 - 對硬體的影響

- NTTDoCoMo、華為、三星和諾基亞的預測和現狀

- 6G標準

- 資訊圖:1980年至2043年1G到6G的發展與進步

- 三張資訊圖表:6G 在陸地、水和空氣上的實際應用、低損耗和熱需求

- 6G演進預測

- 非金屬擴大份額

- 反對 6G 的爭論

- 目前已知的6G通訊的SWOT評估

- 傳輸距離困境:需要在功率、熱和電介質方面取得進步

- 綠化困境:對材料的影響

- 20 種新興無機化合物在潛在 6G 通訊中的 14 種應用

- 潛在 6G 通訊中 10 個元素的 14 種用途

- 6 個新興有機家族在潛在 6G 通訊中的 14 種應用

- 摘要

- 6G高附加價值材料製造技術

- 6G 通訊材料和組件機會的 SWOT 評估

第 3 章 6G 低損耗材料及應用

- 6G 低損耗材料:定義、需求、選擇

- 5G、6G低損耗材料選擇的重大變化

- 6G 的不同介電需求與選項

- 19 個介電常數為 0.1 至 1 THz 的介電族

- 0.1 至 1 THz 範圍內 16 個電介質系列的耗散因數:概述

- 19 個電介質系列(0.1 至 1 THz)的耗散因數:詳細資訊

- 6G研究中主要提到的低損耗和導熱材料

- 6G整合低損耗材料的趨勢

- 根據形式和應用對 6G 低損耗材料進行妥協

- 正常介電特性與異常介電特性:6G系統應用

- 用於6G基地台和分散式設備的低損耗材料

- 適用於室內和室外 6G 用戶端設備的太赫茲波導

- 6G 低損耗材料機會:SWOT 評估

第 4 章 Epsilon 近零 (ENZ) 材料及其在 6G 中的應用

- ENZ的定義與現象

- ENZ材質開發實例

第 5 章 6G 熱管理材料與應用:概述

- 6G 對導熱材料的需求不斷增加:需要進一步創新

- 陸地與空中6G設備的散熱問題

- 解決熱挑戰時的關鍵考量因素

- 熱管理結構

- 6G熱材料集成

- 多樣化的新熱挑戰為新供應商創造了新的可能性

- 新型熱管:雙孔芯、兩種石墨烯選項

- 從最新專利中汲取的經驗教訓:自修復和高性能熱界面材料

- 對 6G 通訊熱材料機會的 SWOT 評估

第 6 章 6G 智慧型手機、物聯網節點和其他客戶端設備的熱管理材料

- 摘要

- 17 家公司針對三項導熱材料標準的目標活動

- 受 6G 影響,2023 年至 2043 年智慧型手機年銷售量將達 10 億部

- 2023年至2043年智慧型手機導熱材料將達到100萬平方米

- 從 5G 到 6G 智慧型手機和其他客戶端設備的過渡以及散熱技術的進步

- 6G熱界面材料

- WL Gore:隔熱材料氣凝膠

第 7 章 6G 熱管理中的通配符:熱超材料、熱水凝膠、熱電熱泵

- 摘要

- 用於6G微電子和太陽能發電被動冷卻的熱水凝膠

- 用於 6G 設備、基礎設施和太陽能發電的熱超材料

- 一般太陽能發電的輻射冷卻

- 熱超材料 - Plasmonics Inc 和 Radi-Cool

- Nano Meta 科技公司

- 6G晶片熱電溫控

- 無毒熱電材料

第 8 章固態冷卻

- 固態冷卻的定義與必要性

- 固態冷卻工具套件

- 11 個主要結論和 5 個資訊圖

- 未來固態冷卻最需要的化合物

- 12 種固態冷卻工作原理與 10 項功能的比較

- 固態冷卻研究管道:依主題與技術準備水平

- 新的固態冷卻中心

- 固態冷卻和過熱保護功能和格式

- 熱界面材料和其他冷卻的未來:透過熱傳導

- 有機矽導熱材料的SWOT評估

- 固態冷卻整體狀況以及 7 個新版本的 SWOT 評估

- 大量使用和建議不需要的材料:為您提供的機會

- 冷卻技術關注度和成熟度的三個曲線:2024 年、2034 年和 2044 年

第 9 章 6G 超材料

- 摘要

- 元原子和圖案選項

- 商業、營運、理論和結構方案的比較

- 超材料圖案與材料

- 6G所需的六種超材料的形式和範例

- 超表面底漆

- 超曲面

- 超材料的長期整體圖景

- 超表面能量收集很可能在 6G 中成為現實

- GHz、THz、紅外線和光學超材料

- 超材料和超表面的整體 SWOT 評估

Summary

6G Communications will bring huge benefits as long the challenges are solved. New low loss and thermal solutions are an essential part of this.

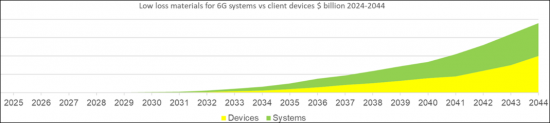

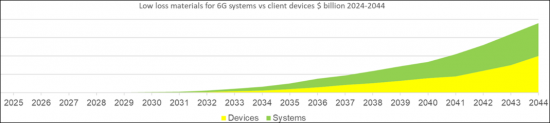

Dr. Peter Harrop, CEO of analysts Zhar Research says, "A market of over $10 billion awaits you if you solve its needs for better low loss and thermal materials and structures for 6G. These opportunities arrive mostly from higher frequencies, more power-hungry, hotter infrastructure and smaller client devices."

The commercially-oriented 318-page Zhar Research report, "6G Communications Low Loss and Thermal Materials and Structures: Detailed Technology Analysis, Roadmaps and 32 Market Forecast Lines 2024-2044" is your essential roadmap. The authors recommend that you consider both topics together because many of your potential partners, competitors and research sources are involved in both. Indeed, some emerging materials such aerogel silicas have uses for both purposes. No other report is as thorough, insightful or up-to-date on the two subjects. The information is constantly updated so you only get the latest.

Questions answered include:

- Winning and losing chemistries and companies?

- Potential partners, acquisitions and emerging competition?

- 20-year roadmaps of decision making, technical capability, adoption?

- Gaps in the market. The unsolved problems that are your opportunities?

- Phase One and Phase 2 evolution of 6G with materials, frequencies, functionality?

- Thirty-two 20-year forecasts of 6G low loss and thermal materials and their hosts?

- Preferred compounds, morphologies, devices, frequencies, active regions emerging?

The analysis is mainly presented as new timelines, infograms, SWOT appraisals, graphs, tables, 20-year forecasts and roadmaps. No nostalgia or academic obscurity but a wealth of latest research papers appraised and much further reading referenced for you to dig deeper if you wish.

The Executive Summary and Conclusions is sufficient in itself if your time is limited. It has 30 pages of choices, trends, possibilities, impediments, SWOT appraisals and technology comparisons and 20 primary conclusions. All the forecasts and roadmaps are in the 27 following pages, each as both tables and graphs with commentary.

Chapter 2 Introduction takes 38 pages to critically explain the 6G dream and reality and introduce a large number of the materials and the manufacturing technologies involved.

Chapter 3 at 58 pages is a core chapter of the report. Entitled, "Low loss materials and applications for 6G" It starts by explaining the important parameters for 6G dielectrics at device, board, package and reconfigurable intelligent surface RIS level. Understand the major changes in low-loss material choices from 5G to 6G. Here are thermoset vs thermoplastic vs inorganic compounds and the special cases of high resistivity silicon, phase change and electric-sensitive dielectrics for the arriving 6G THz frequencies and reasons for the increasing variety of dielectrics needed for 6G. Understand basic mechanisms affecting THz permittivity and seeking low loss through composites and porosity.

Permittivity 0.1-1THz for 19 dielectric families is displayed and compared plus dissipation factor 0.1-1THz for 16 dielectric families. The loss-frequency map is distilled into a choice of 14 families of low permittivity, low loss dielectrics for 6G against 5 criteria followed by detail. Infograms pull together the primary mentions of low loss and thermal materials in 6G research, the trend to integrated low loss materials for 6G and compromises with 6G low loss materials depending on format and application. They include, for example, polyphenylene oxide PPO, PPE, Noryl™ and why silica is one of the most popular porous options for 6G.

Understand low loss materials for 6G base stations and distributed equipment and the implications from traditional base station becoming ultra massive MIMO (UM-MIMO) for 6G even meta-radomes, low loss materials for reprogrammable intelligent surfaces in the propagation path and THz waveguides for 6G client devices, rooms and outdoors. Finally comes a SWOT appraisal of 6G low loss material opportunities. The nine-page Chapter 4. "Epsilon near zero ENZ materials and applications for 6G" explains that aspect.

Now comes a very comprehensive look at thermal materials for 6G. It starts with chapters on thermally conductive structure such as thermal interface materials and heat spreaders, depending on direction of heat dissipation because these are the largest commercial opportunity. In addition, evaporative, radiative and active and passive solid-state cooling and thermal insulation solutions are presented from the research pipeline and best practice for 6G applications.

46-page Chapter 5 opens the thermal material examination with "6G thermal management materials and applications: the big picture". That is brought alive with 24-page Chapter 6. "Thermal management materials for 6G smartphones, IOT nodes and other client devices" followed by a speculative 18-page Chapter 7, "Wild cards for 6G thermal management: thermal metamaterial, thermal hydrogel, thermoelectric heat pump". 17-page Chapter 8 concerns, "Solid state cooling" primarily meaning powered and unpowered smart materials that cool by being responsive and often multi-mode in function. This is because we believe that these should be more seriously considered by 6G developers, for example faced with at least ten times the power consumption and cooling requirement of 6G base stations compared to 5G. The report closes with 17 pages of Chapter 9 on, "Metamaterials for 6G communications" because these are involved in thermal management and other aspects.The new report, "6G Communications Low Loss and Thermal Materials and Structures: Detailed Technology Analysis, Roadmaps and 32 Market Forecast Lines 2024-2044" is essential reading for materials and subsystem suppliers and investors and it has much to interest product integrators, equipment manufacturers, and others in the 6G supply chain.

CAPTION Low loss materials for 6G systems vs client devices $ billion 2024-2044. Source, "6G Communications Low Loss and Thermal Materials and Structures: Detailed Technology Analysis, Roadmaps and 32 Market Forecast Lines 2024-2044".

Table of Contents

1. Executive Summary and Conclusions with 32 market forecast lines 2024-2044

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. 20 primary conclusions with 3 infograms

- 1.4. Examples of winning and losing 6G low loss, thermal materials and 6G frequencies

- 1.5. Organisations developing 6G hardware and likely purchasers

- 1.6. How material needs change with 6G communications

- 1.6.1. Effect of changing network structure

- 1.6.2. Prevalence of low loss and thermal materials in 6G research by formulation

- 1.7. The quest for 6G low loss materials

- 1.7.1. Basic mechanisms affecting THz permittivity are challenging at 6G frequencies

- 1.7.2. THz dielectric permittivity for 19 compounds simplified

- 1.7.3. Dissipation factor across THz frequency for 16 material families: the big picture

- 1.7.4. Choice of 14 families of low permittivity, low loss dielectrics for 6G vs five criteria

- 1.7.5. Seeking low loss through composites and porosity

- 1.7.6. THz dissipation factor variation for 19 material families: the detail

- 1.7.7. SWOT appraisal of 6G low loss material opportunities

- 1.8. The quest for 6G thermal materials

- 1.8.1. Changing balance of needs

- 1.8.2. Incremental and disruptive opportunities for 6G thermal materials

- 1.8.3. Comparison of thermal categories against locations, 5G and 6G needs

- 1.8.4. Seven thermal material attributes against nine physical options

- 1.8.5. Infographic: base station thermal issues and latest proposals

- 1.8.6. Here come energy harvesting thermal needs

- 1.8.7. SWOT appraisal of 6G Communications thermal material opportunities

- 1.9. Technology roadmaps 2024-2044 and 32 market forecast lines 2024-2044

- 1.9.1. Assumptions

- 1.9.2. 6G general roadmap by six categories 2024-2044

- 1.9.3. 6G RIS roadmap 2024-2044

- 1.10. Market forecasts for 6G low-loss and thermal materials in 14 lines 2024-2044

- 1.10.1. Low loss materials for 6G systems vs devices $ billion 2024-2044

- 1.10.2. Low loss materials for 6G devices area million square meters 2024-2044

- 1.10.3. Low loss materials for 6G value market % by frequency in two categories 2029-2044

- 1.10.4. Low loss and thermal materials for 6G value market % by location 2029-2044

- 1.10.5. Thermal management material and structure for 6G Communications infrastructure and client devices $ billion 2024-2044

- 1.10.6. 5G and 6G thermal interface material market $ billion 2024-2044

- 1.10.7. Smartphone thermal materials market area million square meters 2023-2043

- 1.10.8. 6G base stations thermal interface materials million square meters 2024-2044

- 1.11. Background forecasts in 18 lines 2024-2044

- 1.11.1. Total thermal interface material market $ billion 2024-2044

- 1.11.2. Smartphone units sold globally 2023-2044 if 6G is successful

- 1.11.3. 6G RIS market by four parameters 2024-2044

- 1.11.4. Market for 6G vs 5G base stations units millions yearly 3 categories 2024-2044

- 1.11.5. X-Reality hardware market with possible 6G impact $ billion 2024-2044

- 1.11.6. Fiber optic cable market global with possible 6G impact $billion 2024-2044

- 1.11.7. Global metamaterial/ metasurface market by five parameters 2024-2044

- 1.11.8. Terahertz hardware market excluding 6G $ billion globally 2024-2044

- 1.11.9. Internet of Things nodes number billion 2024-2044

- 1.12. Location of primary 6G material and component activity worldwide

2. Introduction

- 2.1. Why we need 6G

- 2.2. Disruptive 6G aspects

- 2.3. Widening list of 6G aspirations - impact on hardware

- 2.4. Predictions of NTTDoCoMo, Huawei, Samsung, Nokia and current status

- 2.5. 6G standards procedure settled

- 2.6. Infogram: Progress from 1G-6G rollouts 1980-2043

- 2.7. Three infograms: 6G in action land, water, air and low loss and thermal needs

- 2.8. Likely 6G evolution

- 2.9. Non-metals gain share

- 2.10. The arguments against 6G

- 2.11. SWOT appraisal of 6G Communications as currently understood

- 2.12. Transmission distance dilemma calls for power, thermal and dielectric advances

- 2.13. The going green dilemma - impact on materials

- 2.14. 14 applications of 20 emerging inorganic compounds in potential 6G communications

- 2.15. 14 applications of 10 elements in potential 6G communications

- 2.16. 14 applications of 6 emerging organic families in potential 6G communications

- 2.17. Roundup

- 2.18. Manufacturing technologies for 6G high added value materials

- 2.18.1. Reel to reel by technology

- 2.18.2. Thermal material manufacturing for 6G

- 2.18.3. New thermal interface material TIM manufacturing technology in 2022

- 2.18.4. New heat spreader manufacturing technology in 2022

- 2.19. SWOT appraisal of 6G Communications material and component opportunities

3. Low loss materials and applications for 6G

- 3.1. Definition, requirements and choices for 6G low-loss materials

- 3.1.1. Overview

- 3.1.2. Important parameters for 6G dielectrics at device, board, package and RIS level

- 3.1.3. Thermoset vs thermoplastic vs inorganic compounds

- 3.1.4. Special case: high resistivity silicon for THz frequencies

- 3.1.5. Special cases: phase change and electric-sensitive dielectrics for 6G

- 3.2. Major changes in low-loss material choices from 5G to 6G

- 3.2.1. Infogram: Changes from 5G to 6G: better parameters, lower costs, larger areas

- 3.2.2. Low loss materials adoption for 3G, 4G, 5G

- 3.3. Different dielectric needs and choices for 6G

- 3.3.1. Compared to 5G

- 3.3.2. Reasons for the increasing variety of dielectrics needed for 6G

- 3.3.3. Basic mechanisms affecting THz permittivity are challenging at 6G frequencies

- 3.3.4. Seeking low loss through composites and porosity

- 3.4. Permittivity 0.1-1THz for 19 dielectric families

- 3.5. Dissipation factor 0.1-1THz for 16 dielectric families: the big picture

- 3.5.1. The loss-frequency map explained

- 3.5.2. Choice of 14 families of low permittivity, low loss dielectrics for 6G against 5 criteria

- 3.6. Dissipation factor 0.1-1THz for 19 dielectric families: the detail

- 3.7. Primary mentions of low loss and thermal materials in 6G research

- 3.8. Trend to integrated low loss materials for 6G

- 3.9. Compromises with 6G low loss materials depending on format and application

- 3.10. Routine and unusual dielectrics have applications in 6G systems

- 3.10.1. Polyphenylene oxide PPO,PPE and Noryl™

- 3.10.2. Why silica is one of the most popular porous options for 6G

- 3.11. Low loss materials for 6G base stations and distributed equipment

- 3.11.1. Overview and the dielectric waveguide option

- 3.11.2. Traditional base station becomes ultra massive MIMO = UM-MIMO for 6G

- 3.11.3. Metaradomes

- 3.11.4. Low loss materials for reprogrammable intelligent surfaces

- 3.12. THz waveguides for 6G client devices, rooms and outdoors

- 3.13. SWOT appraisal of 6G low loss material opportunities

4. Epsilon near zero ENZ materials and applications for 6G

- 4.1. ENZ definition and phenomena

- 4.1.1. Contrast with low-loss materials covered in Chapter 3

- 4.1.2. ENZ definition

- 4.1.3. Unfamiliar functions of familiar materials

- 4.1.4. Magical functions useful for what?

- 4.2. Examples of ENZ material development

5. 6G thermal management materials and applications: the big picture

- 5.1. Greater need for thermal materials in 6G demands more innovation

- 5.2. Thermal issues with 6G equipment on land and in the air

- 5.2.1. Overview

- 5.2.2. Thermal issues with 6G infrastructure on land

- 5.2.3. Infogram: Base station thermal issues and latest proposals

- 5.2.4. Large battery thermal management for 6G

- 5.2.5. Extra thermal management challenges

- 5.2.6. Future needs and trends for 6G devices up to MW power provision for 6G

- 5.3. Important considerations when solving thermal challenges

- 5.3.1. Bonding or non-bonding

- 5.3.2. Varying heat

- 5.3.3. Placement

- 5.3.4. Environmental attack

- 5.4. Heat management structures

- 5.4.1. Learning from 5G

- 5.4.2. Choosing a thermal structure

- 5.4.3. Research on embedded cooling

- 5.5. Integration of 6G thermal materials

- 5.6. Diverse new thermal challenges emerging allow in new suppliers

- 5.6.1. Overview

- 5.6.2. Water-cooled photovoltaics for heating and electricity: Sunovate

- 5.6.3. Thermally conductive concrete for on-site 6G power transmission: Heidelberg

- 5.6.4. Thermoelectrics for 6G temperature control and electricity: Gentherm

- 5.6.5. Thermoradiative photovoltaics: Stanford

- 5.6.6. THz thermal switching of vanadium-dioxide-embedded metamaterials for 6G RIS

- 5.6.7. Thermally switched chalcogenide phase change materials for 6G RIS

- 5.6.8. Materials for thermal infrared and other photovoltaics: Sharp, Spectrolab, SolAero

- 5.6.9. Reconfigurable intelligent surface thermal management for 6G

- 5.7. New heat pipes in 2021 and 2022: biporous wick, two graphene options

- 5.8. Lessons from latest patents: self-repairing and better performing thermal interface material

- 5.9. SWOT appraisal of 6G Communications thermal materials opportunities

6. Thermal management materials for 6G smartphones, IOT nodes and other client devices

- 6.1. Overview

- 6.2. Targetted activity of 17 companies against 3 thermal material criteria

- 6.3. Smartphones billion yearly 2023-2043 with 6G impact

- 6.4. Smartphone thermal materials market area million square meters 2023-2043

- 6.5. Thermal progress from 5G to 6G smartphones and other client devices

- 6.5.1. Thermal management locations for 6G smartphones and other client devices

- 6.5.2. Thermal conductors currently: Henkel, ShinEtsu, Sekisui, Fujitsu, Suzhou Dasen

- 6.5.3. Microscale heat pipes

- 6.6. Thermal interface materials for 6G

- 6.6.1. Seven current options compared against nine parameters

- 6.6.2. Thermal pastes compared for 6G devices

- 6.6.3. Trending: phase change materials

- 6.6.4. Trending: annealed pyrolytic graphite

- 6.7. Thermal insulation internally aerogel WL Gore

- 6.7.2. Thermal insulation to protect smartphones from the sun and cold

- 6.7.3. other companies involved in silica aerogel insulation

7. Wild cards for 6G thermal management: thermal metamaterial, thermal hydrogel, thermoelectric heat pump

- 7.1. Overview

- 7.2. Thermal hydrogels for passive cooling of 6G microelectronics and photovoltaics

- 7.3. Thermal metamaterials for 6G devices, infrastructure and photovoltaics

- 7.4. Radiative cooling of photovoltaics generally

- 7.5. Thermal metamaterial - Plasmonics Inc and Radi-Cool

- 7.6. Nano Meta technologies Inc.

- 7.7. Thermoelectric temperature control for 6G chips

- 7.8. Non-toxic thermoelectrics

8. Solid state cooling

- 8.1. Definition and need for solid-state cooling

- 8.2. Solid state cooling toolkit

- 8.3. Eleven primary conclusions with five infographics

- 8.4. The most needed compounds for future solid-state cooling

- 8.5. Twelve solid-state cooling operating principles compared by 10 capabilities

- 8.6. Research pipeline of solid-state cooling by topic vs technology readiness level

- 8.7. Heart of emerging solid-state cooling

- 8.8. Function and format of solid-state cooling and prevention of heating

- 8.9. The future of thermal interface materials and other cooling by thermal conduction

- 8.10. SWOT appraisal for silicone thermal conduction materials

- 8.11. SWOT appraisals of solid-state cooling in general and seven emerging versions

- 8.12. SWOT appraisal of Passive Daytime Radiative Cooling PDRC

- 8.13. SWOT appraisal of self-cooling radiative metafabric

- 8.14. SWOT appraisal of Anti-Stokes fluorescent cooling

- 8.15. SWOT appraisal of electrocaloric cooling and thermal management

- 8.16. SWOT appraisal of magnetocaloric cooling

- 8.17. SWOT appraisal of mechanocaloric cooling

- 8.18. SWOT appraisal of thermoelectric cooling and temperature control

- 8.19. Undesirable materials widely used and proposed: this is an opportunity for you

- 8.20. Attention vs maturity of cooling technologies 3 curves 2024, 2034, 2044

9. Metamaterials for 6G applications

- 9.1. Overview

- 9.2. The meta-atom and patterning options

- 9.3. Commercial, operational, theoretical, structural options compared

- 9.4. Metamaterial patterns and materials

- 9.5. Six formats of metamaterial needed for 6G with examples

- 9.6. Metasurface primer

- 9.7. Hypersurfaces

- 9.8. The long-term picture of metamaterials overall

- 9.9. Metasurface energy harvesting likely for 6G

- 9.10. GHz, THz, infrared and optical metamaterials

- 9.11. SWOT assessments for metamaterials and metasurfaces generally