|

市場調查報告書

商品編碼

1638133

微電網 LDES(長時儲能)的巨大機會:太陽能建築、資料中心、社區、海水淡化廠、工業流程的市場和技術(2025-2045)Microgrid Long Duration Energy Storage LDES Becomes a Large Opportunity: Markets, Technologies for Solar Buildings, Data Centers, Communities, Desalinators, Industrial Processes 2025-2045 |

|||||||

微電網 LDES(長期能源儲存)市場規模預估達 540億美元:

雖然 LDES 主要視為電網的主流儲存,但其他重要應用有不同的要求和技術優先級,競爭力較弱。

本報告研究了微電網 LDES(長期儲能)市場和技術,並概述了電網和電網外 LDES 的領先和替代技術、關鍵能力、製造技術和材料、最終用戶行業和應用、研發趨勢和市場成長預測。

目錄

第1章 執行摘要與概述

第2章 簡介

- 概述

- 低密度脂蛋白

- 全球電力趨勢

- 超越電網:建築、工業流程、小型電網、微型電網等等

- 超越電網發電與管理

- 離網大趨勢

- 太陽能發電的大趨勢

- LDES 前景與成本挑戰

- Beyond Grid 儲存的多功能性

- 全面了解 LDES 技術在電網及其他領域的潛力

- 用於網格和超越網格的LDES 工具包

- LDES 中的物理和化學

- 為電網、微電網和建築提供最大數量 LDES 的技術

第3章 LDES 儲存選項的參數比較

- LCOS 概述、定義和實用性

- 等效效率與儲存時間:LCOS 運算、9 種技術系列、17個標準

- 9個 LDES 技術系列和 17個其他標準

- LDES 技術選項,包括電網

- 從已完成和計劃中的LDES 專案中學到的經驗教訓

- LDES 技術的可用網站和空間效率

- LCOS($/kWh)趨勢與儲存和放電時間

- LDES 電力 GW 趨勢與儲存和放電時間

- LDES技術的儲能天數和額定能量回收容量(MW)

- LDES 技術的儲存天數和容量(MWh)

- 該技術在經過各種延遲後為 LDES 提供峰值功率的潛力

第4章 Beyond Grid 領先的LDES 選項:氧化還原液流電池(RFB)

- 概述

- RFB技術

- SWOT 評估:固定式儲存

- SWOT 評估:LDES 的RFB 儲能

- LDES 的RFB 參數評估

- 56家RFB公司以8列比較

- 52家RFB公司的詳細資料

- 調查的可靠性

第5章 Beyond Grid 關鍵 LDES 選項:ACCB(高級傳統建築電池)

- 概述

- SWOT 評估:ACCB 協助 Beyond Grid LDES

- LDES 的ACCB 參數評估

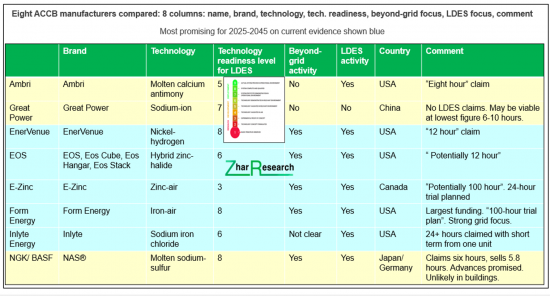

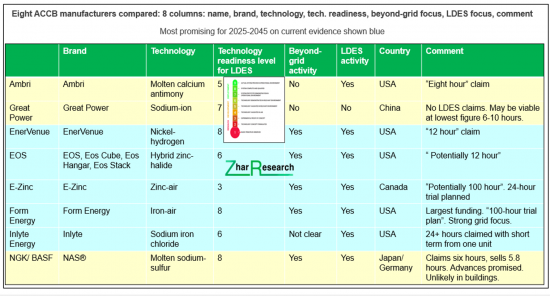

- 七家 ACCB 製造商的比較:名稱、品牌、技術、技術就緒性、超越電網焦點、LDES 焦點、評論

- Iron-air:Form Energy USA - SWOT 評估

- 熔融鈣銻:Ambri USA:SWOT 評估

- 鎳氫:EnerVenue USA:SWOT 評估

- 鈉離子:許多公司都在使用,但 Beyond Grid LDES 的潛力有限

- 硫鈉:NGK/BASF日本/德國等:SWOT分析

- Zinc Air:eZinc 加拿大:SWOT 分析

- 鹵化鋅:EOS Energy Enterprises USA:SWOT 分析

第6章 Beyond Grid的關鍵 LDES 選項:液化氣儲能(LAES 或 CO2)

- 概述

- 三家儲氣公司的比較

- LAES(液態空氣儲能)

- CO2(液態二氧化碳儲能)技術、市場、成果與展望

第7章 Beyond Grid LDES 儲存選項:APHES、CAES、ETES、SGES

- 概述

- 適用於電網及Beyond Grid應用的領先 LDES 工具包

- 先進的抽水蓄能發電:無需高山

- 壓縮空氣儲能(CAES)

- 超越電網 LDES 的電熱能儲存(ETES)

- 固體重力能儲存

第8章 前景不佳的Beyond Grid LDES 技術:傳統的PHES、CAES 和 H2ES

- 概述

- 超越電網 LDES 的傳統抽水蓄能發電

- 經濟與 SWOT 評估:CAES Beyond Grid LDES

- SWOT 評估:用於 Beyond Grid LDES 的氫氣 (H2ES)、甲烷和氨

Summary

Microgrid Long Duration Energy Storage LDES Headed to be a $54 Billion Market

Long Duration Energy Storage LDES is rightly seen as primarily mainstream storage for grids but a very substantial other use has different requirements and technology priorities and less competition. They are addressed in the unique new Zhar Research report, "Microgrid Long Duration Energy Storage LDES becomes a large opportunity: markets, technologies for solar buildings, data centers, communities, desalinators, industrial processes 2025-2045".

Some of the questions answered are:

- Gaps in the market?

- Emerging competition?

- Research pipeline analysis?

- Full appraisal of technology options?

- Technology sweet spots by parameter?

- Market forecasts and roadmaps 2025-2045?

- Technology readiness and potential improvement?

- Technology parameters compared against each other?

- Potential winners and losers by company and technology?

- Appraisal of proponents, your prospective partners and acquisitions?

- How "beyond-grid" LDES will progress - day to week, to months, why?

This comprehensive, commercially-oriented report has 394 pages with 143 infograms, tables and graphs, over 80 companies covered, 26 forecast lines, 10 SWOT appraisals and 8 chapters.

The 23-page Executive Summary and Conclusions is sufficient for those with limited time. Here are simply absorbed new graphics, 26 key conclusions and the new roadmaps and forecasts as table and graphs with explanations 2025-2045. The 22- page Introduction explains and exemplifies the Levelised Cost of Storage metric and efficiency as a function of storage duration. 9 LDES technology families are compared using 17 criteria and the lessons from current grid, fringe-of-grid and off-grid LDES are presented plus potential by many graphed parameters with explanations on the images.

The rest of the report consists of a deep dive into the most successful and the most promising beyond-grid LDES technologies then some that also have a place, not least because some beyond-grid applications will approach GWh levels of storage - it is not all about solar houses and small microgrids. These chapters detail latest applications, suppliers and potential for beyond-grid applications.

Four chapters are specific to these most promising options on current evidence - redox flow batteries including hybrid RFB bridging the properties of RFB and conventional batteries, advanced conventional construction batteries ACCB then liquid gas storage for delayed electricity. Each have their own chapters because of their major importance beyond-grid. Then a chapter covers other candidates that could be important later, but are currently less promising, notably advanced pumped hydro APHES, compressed air CAES, electric thermal energy storage ETES and solid gravity SGES. A final chapter explains other options that have little potential beyond-grid, the reasons being given, such as massive earthworks, long delays and unsuitability for urban locations. These are conventional pumped hydro PHES, underground CAES and hydrogen as intermediary - H2ES. They are candidates for grid applications.

Th 142-page Chapter 4. "Primary LDES options beyond grids: Redox flow batteries RFB" is the longest because this technology family has the most companies already making beyond-grid installations. Exceptionally, their sizes span almost grid-sized down to private houses and there is a strong research pipeline for this family also covered in this chapter, including 2025. See two SWOT appraisals. Learn the many options such as vanadium-based to iron, iron-chromium, organic and their latest pros and cons. Less space is given to hybrid RFB options, part ACCB, that may have only one tank of liquid, are smaller, but tend not to separate capacity and power for scalability. 56 RFB companies are compared in detail.

The 52-page Chapter 5. "Primary LDES options beyond grids: Advanced conventional construction batteries ACCB" examines three families, profiling leading proponents, some claiming, but not yet installing, LDES for over 24-hour duration. See four SWOT appraisals, latest results and objectives and our analysis and predictions. For example, some leading ACCB could be particularly useful for small sizes even down to solar houses. However, they may never offer the longest durations required or compete for the largest units where scalability from separating power and capacity can assist.

The 33-page Chapter 6. "Primary LDES storage options beyond grids: liquid gas energy storage LAES or CO2" completes the presentation of the most promising options for beyond-grid LDES on current evidence, with liquid air intermediary the most proven but needing cryogenics and liquid carbon dioxide being newer, possibly lower cost and catching up in interest and collaboration. The chapter is shorter because fewer companies and options are involved.

Chapter 7. "Other LDES storage options beyond grids: APHES, CAES, ETES, SGES", with 56 pages, explains four families of technology that are unlikely to be leaders in the beyond-grid LDES value market but are important secondary options. Notably, advanced pumped hydro involves such things as pumping heavy water up mere hills and regular water down disused mines and, because they do not have to be enormous, these currently look interesting for suitable beyond-grid sites as do above ground compressed air if it can be improved, thermal energy as intermediary, notably using heat pumps and finally lifting blocks - solid gravity energy storage - perhaps in special high-rise buildings and disused mines for instance.

The report ends by briefly explaining other technologies that are strong candidates for grid LDES, where long delays, huge up-front costs and massive earthworks are tolerable, this being almost never the case for beyond-grid sites. Chapter 8. "Technologies with less potential for beyond-grid LDES: conventional PHES, CAES, H2ES" has 25 pages.

CAPTION: Eight ACCB manufacturers compared: 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment. Source: Zhar Research report, "Microgrid Long Duration Energy Storage LDES becomes a large opportunity: markets, technologies for solar buildings, data centers, communities, desalinators, industrial processes 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. The different characteristics of grid utility and beyond-grid LDES 2025-2045

- 1.3. Overview

- 1.4. Methodology of this analysis

- 1.5 10 primary conclusions concerning the beyond-grid LDES market

- 1.6 10 primary conclusions concerning the beyond-grid LDES technologies

- 1.7. Beyond-grid LDES roadmap 2025-2045

- 1.8. Market forecasts in 26 lines 2025-2045

- 1.8.1. LDES total value market showing beyond-grid gaining share 2023-2044

- 1.8.2. Beyond-grid LDES market for microgrids, minigrids, other in 8 categories $ billion 2025-2045: table and line graphs

- 1.8.3. Beyond-grid LDES market for microgrids, minigrids, other in 8 categories $ billion 2025-2045: table and area graphs with explanation

- 1.8.4. Regional share of beyond-grid LDES value market in four categories 2025-2045

- 1.8.5. Total LDES market in 11 technology categories $ billion 2025-2045 table and graphs

- 1.8.6. Microgrid global market $ billion 2025-2045 with LDES commentary

- 1.8.7. Solar building energy storage global market $bn 2025-2045 with LDES commentary

2. Introduction

- 2.1. Overview

- 2.1.1. LDES

- 2.1.2. Global electricity trends

- 2.1.3. Beyond-grid: buildings, industrial processes, minigrids, microgrids, other

- 2.1.4. Beyond-grid electricity production and management

- 2.2. The off-grid megatrend

- 2.3. The solar megatrend

- 2.4. The LDES prospect and cost challenge

- 2.4.1. Prospect

- 2.4.2. Challenge: compelling economics for local provision of LDES

- 2.4.3. Example of avoiding LDES by input matching: Ushant island

- 2.4.4. Reducing LDES need: Photovoltaics can provide more even power over more of the day

- 2.4.5. The trend to needing longer duration storage

- 2.4.6. LDES cost challenge

- 2.5. Multifunctional nature of beyond-grid storage

- 2.6. Big picture of LDES technology potential for grid and beyond-grid

- 2.7. LDES toolkit for grid and beyond-grid

- 2.8. Physics vs chemistry for LDES

- 2.9. Technologies for largest number of LDES sold for grids, microgrids, buildings 2025-2045

3. LDES storage options compared by parameter

- 3.1. Overview and definition and usefulness of LCOS

- 3.2. Equivalent efficiency vs storage hours, LCOS calculation, 9 technology families, vs 17 criteria

- 3.3. Nine LDES technology families, vs 17 other criteria

- 3.4. LDES technology choices including for grids

- 3.5. Lessons from LDES projects completed and planned

- 3.6. Available sites vs space efficiency for LDES technologies

- 3.7. LCOS $/kWh trend vs storage and discharge time

- 3.8. LDES power GW trend vs storage and discharge time

- 3.9. Days storage vs rated power return MW for LDES technologies

- 3.10. Days storage vs capacity MWh for LDES technologies

- 3.11. Potential by technology to supply LDES at peak power after various delays

4. Primary LDES options beyond grids: Redox flow batteries RFB

- 4.1. Overview

- 4.2. RFB technologies

- 4.3. SWOT appraisal of RFB for stationary storage

- 4.4. SWOT appraisal of RFB energy storage for LDES

- 4.5. Parameter appraisal of RFB for LDES

- 4.6 56 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 4.7. Detailed profiles of 52 RFB companies in 92 pages

- 4.8. Research thrust 2025 and 2024

5. Primary LDES options beyond grids: Advanced conventional construction batteries ACCB

- 5.1. Overview

- 5.2. SWOT appraisal of ACCB for beyond-grid LDES

- 5.3. Parameter appraisal of ACCB for LDES

- 5.4. Seven ACCB manufacturers compared: 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 5.5. Iron-air: Form Energy USA with SWOT appraisal

- 5.6. Molten calcium antimony: Ambri USA with SWOT appraisal

- 5.7. Nickel hydrogen: EnerVenue USA with SWOT

- 5.8. Sodium-ion many companies but limited beyond-grid LDES potential

- 5.9. Sodium sulfur: NGK/ BASF Japan/ Germany and others with SWOT

- 5.10. Zinc-air: eZinc Canada with SWOT

- 5.11. Zinc halide EOS Energy Enterprises USA with SWOT

6. Primary LDES storage options beyond grids: liquid gas energy storage LAES or CO2

- 6.1. Overview

- 6.2. Three gas storage manufacturers compared: 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 6.3. Graphic: Increasing the liquid gas storage time and discharge duration to 2044

- 6.4. Liquid air energy storage

- 6.4.1. SWOT appraisal of LAES for beyond grid LDES

- 6.4.2. Parameter appraisal of LAES for beyond grid LDES

- 6.4.3. Operating principles: pure and hybrid

- 6.4.4. Highview Power and Enlasa, orsted, Sumitomo, Shanghai Power Equipment Research Institute

- 6.4.5. Phelas Germany

- 6.4.6. Researchers: Mitsubishi Hitachi, Linde, European Union, Others

- 6.5 Liquid carbon dioxide storage technology, markets, achievements and prospects

- 6.5.1. SWOT appraisal of liquid carbon dioxide for LDES

- 6.5.2. Parameter appraisal of liquid carbon dioxide for beyond grid LDES

- 6.5.3. Energy Dome, Italy

7. Other LDES storage options beyond grids: APHES, CAES, ETES, SGES

- 7.1. Overview

- 7.2. Primary LDES toolkit for grid and beyond-grid applications

- 7.3. Advanced pumped hydro does not need mountains

- 7.3.1. Overview

- 7.3.2. RheEnergise UK with SWOT appraisal

- 7.3.3. Quidnet Energy USA: pressurised hydro underground

- 7.4. Compressed air energy storage CAES

- 7.4.1. Overview

- 7.4.2. Augwind Energy Israel targets beyond-grid: discussion and SWOT

- 7.5. Electrical thermal energy storage ETES for beyond-grid LDES

- 7.5.1. Overview

- 7.5.2. Malta Inc USA with SWOT

- 7.5.3. RayGen Resources Australia

- 7.5.4. Antora USA with SWOT

- 7.5.5. Echogen Power Systems USA

- 7.5.6. Synchrostor UK

- 7.6. Solid gravity energy storage

- 7.6.1. Overview with parameter appraisal and SWOT

- 7.6.2. Sand in mines: IIASA proposal

- 7.6.3. ARES LLC USA

- 7.6.4. Energy Vault Switzerland, USA

- 7.6.5. Weights in mines and oil wells Renewell USA, Gravitricity UK

- 7.6.6. Underwater weights: SinkFloatSolutions France and others

8. Technologies with less potential for beyond-grid LDES: conventional PHES, CAES, H2ES

- 8.1. Overview

- 8.2. Conventional pumped hydro for beyond-grid LDES

- 8.2.1. Three options for conventional pumped hydro storage

- 8.2.2. Projects and intentions in nine countries

- 8.2.3. Economics

- 8.2.4. Parameter appraisal of conventional pumped hydro LDES

- 8.2.5. SWOT report for conventional pumped hydro as beyond-grid LDES

- 8.3. Compressed air energy storage CAES for beyond grid LDES: economics, SWOT appraisal

- 8.4. Hydrogen H2ES, methane or ammonia for beyond-grid LDES with SWOT appraisal

- 8.4.1. Overview

- 8.4.2. The hydrogen economy concept

- 8.4.3. Hydrogen in action in beyond-grid LDES

- 8.4.4. Parameter appraisal of hydrogen storage for LDES

- 8.4.5. SWOT appraisal of hydrogen, methane, ammonia for beyond-grid LDES