|

市場調查報告書

商品編碼

1700502

工業機械健康監測:2029 年的機會與預測Industrial Machine Health Monitoring: Opportunities & Forecasts Through 2029 |

||||||

隨著工業營運商擴大採用由 IIoT 支援的數據驅動策略,他們優先投資於監控其營運設備健康狀況的解決方案。透過持續監測壓縮機、變速箱、馬達、泵浦和其他工業機械的狀況和性能,製造商和其他工業運營商可以製定和管理維護策略,以幫助最大限度地提高正常運行時間和生產產量。因此,將感測硬體、即時監控功能和進階分析(如預測模型)整合到完整的端到端解決方案中的工業機器健康監控解決方案正在成為企業尋求營運效率和優化的關鍵工具。

本報告研究了全球工業機器健康監測解決方案市場,並按地區、銷售管道和行業垂直提供分析和預測。

它將回答哪些問題?

- 工業機械健康監測解決方案的市場規模是多少?

- 未來五年哪些地區和產業將推動成長?

- OT、IT 和 IoT 的整合如何塑造這個市場?

- 哪些工業自動化供應商最積極支持機器健康計畫?

- 網路安全問題如何影響這些解決方案的採用和實施?

本報告中介紹的供應商

|

|

|

感測技術的不斷成熟是該市場早期階段的一個基本成長因素。展望未來,工業人工智慧的出現和成熟有望成為市場最重要的技術成長動力之一。

市場多種多樣,包括機器健康新創公司、成熟的工業技術供應商、工業零件供應商和全球工業自動化巨頭。Augury、i-care 和 KCF Technologies 等專業機器健康提供者在早期階段創造強勁需求方面尤為成功。從解決方案的角度來看,該市場的競爭對手分為以下幾類:銷售感測器的公司、銷售感測器並透過服務合約提供手動診斷和建議的公司、銷售感測器並利用人工智慧提供自動診斷和建議的公司。除了主要供應商之外,該市場的競爭格局還充滿了各種專注於特定地區、產業或機器健康監測的利基競爭對手。

預計到 2024 年,食品和飲料產業將成為市場最大的收入驅動力。這主要是因為該行業的設施內有大量機器。食品和飲料行業的營運環境相對易於監控且不太複雜,這使得實施系統和節省成本變得更加容易。同時,預計到2029年,能源和發電產業將成為成長最快的工業產業。這是因為公司的環境、社會和治理 (ESG) 目標迫使他們解決碳排放和能源管理方面的要求。此外,汽車製造商和零件供應商也預計在預測期內大幅推動市場成長。

目錄

將會涉及哪些問題?

誰該閱讀這份報告?

本報告中介紹的供應商

執行摘要

- 主要發現

世界市場概覽

- 市場概況

- 市場驅動力和策略

- 推動數位轉型的勞動課題

- 感測器成熟度和互通性要求將塑造市場

競爭格局

- 概述

- 任務

- 透過收購獲得市場佔有率

- 增加一線工人的支持

- 擴展您的部署並適應不斷變化的客戶需求

- 機會

- 人工智慧解謎

- 實現跨 OT 堆疊的集成

- 尋求合作夥伴關係以進入新市場

全球市場:按細分市場

- 區域市場和預測

- 概述

- 工業化創造市場機遇

- 各行業市場及預測

- 概述

- 產業孤島限制了市場成長

- 監控技術市場預測

- 概述

- 機器知識的限制阻礙了替代技術

- 各通路市場預測

- 概述

- 最終用戶對 OEM 解決方案持謹慎態度

供應商亮點

- Advanced Technology Services (ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- 其他

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

關於作者

Inside this Report

As industrial organizations increasingly embrace the data-driven strategies enabled by the Industrial Internet of Things (IIoT), many have prioritized investments in solutions that monitor the health of their operational equipment. By continuously monitoring the status and performance of compressors, gear boxes, motors, pumps, and other industrial machinery, manufacturers and other industrial operators can develop and manage maintenance strategies that help maximize production uptime and output. As such, industrial machine health monitoring solutions - which combine sensing hardware, real-time monitoring capabilities, and advanced analytics (e.g., predictive modeling) within a complete, end-to-end solution - have emerged as critical tools in these organizations' pursuit of operational efficiency and optimization. This report covers the global market for industrial machine health monitoring solutions, including segmentations and forecasts by geographic region, channel, and industry.

What Questions are Addressed?

- How large is the market for industrial machine health solutions?

- Which regions and industries will drive growth over the next five years?

- How is the convergence of OT, IT, and IoT shaping this market?

- Which industrial automation suppliers have been most aggressive in supporting machine health initiatives?

- How have cybersecurity concerns affected the adoption and implementation of these solutions?

Who Should Read this Report?

This report is intended for those making critical decisions regarding product development, partnerships, go-to- market planning, and competitive strategy and tactics. It is written for executives, senior managers, and other decision-makers involved in the development, deployment, marketing, management, or sales of industrial machine health solutions, including those in the following roles:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Vendors Listed in this Report:

|

|

|

Executive Summary

The continued maturation of sensing technologies has been a foundational growth driver throughout the early stages of this market. Moving forward, the emergence and maturation of industrial artificial intelligence will be among the most critical technological drivers for this market.

This market is populated by a diverse mix of machine health startups, established industrial technology vendors, industrial component suppliers, and global industrial automation giants. Through the early stages of this market, dedicated machine health providers such as Augury, I-care, and KCF Technologies have been the most successful in generating demand due to their laser focus on this sector. From a solution perspective, competitors in this market generally fit into one of several categories: companies that sell sensors, companies that sell sensors and provide manual diagnostics and recommendations via service engagements, and companies that sell sensors and provide automated diagnostics and recommendations leveraging AI. Beyond the leading vendors, the competitive landscape is further populated by variety of niche competitors that serve select geographies, industries, or machine health monitoring applications.

The food and beverage industry was the leading sources of industrial machine health monitoring revenue in 2024 due, in large part, to the high volume of machinery present in facilities within this space. Operating environments within the food and beverage industry are generally less complex to monitor, allowing for straightforward deployments and easily demonstrable cost savings. The energy and power generation sector will be the fastest- growing industry segment through 2029 as corporate environmental, societal, and governance (ESG) goals drive operators to address mounting requirements such as those around carbon emissions or energy management. Automotive manufacturers and component suppliers will also drive significant growth through the end of the forecast period.

Key Findings:

- The maturation of industrial artificial intelligence will be a critical growth driver for this market.

- Requirements around openness and interoperability have intensified as industrial organizations continue gaining access to new operational data sources.

- Competitors whose deployments rely on professional services will find it increasingly difficult to scale their services capacity as their install base grows.

- The Asia-Pacific region will attain the highest growth rate through the end of the forecast period.

- Vendors overwhelmingly rely on direct sales to engage with customers.

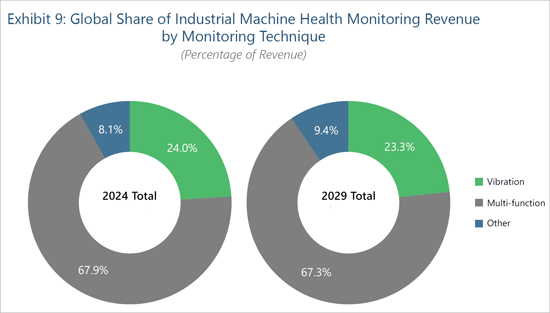

Monitoring Technique Segmentation and Forecast

Overview

Vibration monitoring - either via dedicated vibration sensors or multi-function sensors also including temperature and other measurements - generated the overwhelming majority of industrial machine health monitoring revenue in 2024. Due to its ability to identify abnormal behavior in common industrial equipment such as compressors, generators, fans, motors, pumps, and turbines, vibration monitoring is the de facto starting point for any industrial organization looking to prevent failures before they occur. The addition of temperature measurement allows multi-function sensors to provide a more comprehensive understanding of machine performance. Multi-function sensors from Augury, I-care, and other market leaders commonly include additional measurement parameters, such as impact and magnetic flux. The expanded coverage afforded by these additional measurement parameters will allow the growth rate of this segment to outpace that of the single- parameter vibration segment. Moving forward, vibration and multi-function sensors will continue to comprise the vast majority of this market through the end of the forecast period, however, alternative techniques such as corrosion monitoring, electrical monitoring, and oil analysis will grow at the greatest rate (nearly 16% per year through the end of the forecast period) as organizations begin to target non-rotating equipment such as drums, pipes, and tanks. Sensors measuring magnetic flux will become particularly attractive due to their ability to measure energy consumption and help organizations meet their ESG objectives.

Alternative Techniques Hindered by Limited Machine Knowledge

Even before the emergence of this IIoT-enabled market segment, vibration monitoring has long been at the forefront of industrial organizations' condition monitoring efforts. As such, solution providers have access to tremendous volumes of reference data detailing common failure points and fault conditions for most types of rotating industrial equipment. Used in conjunction with vendors' machine learning algorithms and AI capabilities, this reference data is a foundational element of the machine health market. Unfortunately, reference data for non- rotating, discrete machinery such as cranes and robots is comparatively scarce. Without a sufficient body of knowledge as to how these machines break and how they are fixed, vendors in this space have been hesitant to offer coverage in this area. To effectively cover assets with critical, non-rotating components, solution providers must amass not only sufficient reference data around each new class of machinery, but also sufficient in-house expertise to deliver value-adding advice to customers.

Table of Contents

What Questions are Addressed?

Who Should Read this Report?

Vendors Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Market Summary

- Market Drivers and Strategies

- Labor Challenges Prompting Digital Transformation

- Sensor Maturity, Interoperability Requirements Shaping Market

Competitive Landscape

- Overview

- Challenges

- Seizing Market Share via Acquisition

- Fostering Buy-In from Frontline Workers

- Scaling Deployments and Adapting to Evolving Customer Requests

- Opportunities

- Solving the AI Puzzle

- Enabling Integrations Throughout the OT Stack

- Pursuing Partnerships to Reach New Markets

Global Market Segmentations

- Regional Segmentation and Forecast

- Overview

- Industrialization Creates Market Opportunities

- Industry Segmentation and Forecast

- Overview

- Industry Silos Limit Market Growth

- Monitoring Technique Segmentation and Forecast

- Overview

- Alternative Techniques Hindered by Limited Machine Knowledge

- Channel Segmentation and Forecast

- Overview

- End Users Wary of OEM Solutions

Vendor Highlights

- Advanced Technology Services (ATS)

- AssetWatch

- Augury

- I-care

- KCF Technologies

- Others

- Bently Nevada

- Emerson

- MaintainX

- TRACTIAN

- Waites

About the Authors

List of Exhibits

- Exhibit 1: Global Revenue for Industrial Machine Health Monitoring

- Exhibit 2: Global Revenue for Industrial Machine Health Monitoring by Leading Vendors (2024)

- Exhibit 3: Global Revenue for Industrial Machine Health Monitoring by Region

- Exhibit 4: Global Share of Industrial Machine Health Monitoring Revenue by Region

- Exhibit 5: Global Revenue for Industrial Machine Health Monitoring by Industry

- Exhibit 6: Global Share of Industrial Machine Health Monitoring Revenue by Industry

- Exhibit 7: Global Revenue for Industrial Machine Health Monitoring by Monitoring Technique

- Exhibit 8: Global Share of Industrial Machine Health Monitoring Revenue by Monitoring Technique

- Exhibit 9: Global Revenue for Industrial Machine Health Monitoring by Channel

- Exhibit 10: Global Share of Industrial Machine Health Monitoring Revenue by Channel