|

市場調查報告書

商品編碼

1873720

伺服器DRAM價格上漲:長期戰略與產能爭奪戰-2025年第四季及以後Server DRAM Price Surge: Long-Term Strategy & Capacity Race - From Q4 2025 |

|||||||

價格

簡介目錄

由於供應緊張和雲端服務供應商的強勁需求,伺服器DRAM價格預計將大幅上漲。為了確保供應,客戶正在積極協商長期合約,這促使製造商擴大產能。製造商正將生產重心轉向高利潤的DDR5。雖然市場供應短缺預計將持續,且大規模新增產能需要數年時間,但製程技術的升級預計將在短期內加速供應。 PC DRAM價格也將上漲,但漲幅相對較小。

範例預覽

主要亮點:

- 伺服器 DRAM 價格大幅上漲:

- 由於雲端服務供應商的強勁需求和製造商供應緊張,伺服器 DRAM 價格大幅上漲,遠超過 PC DRAM 價格。

- 製造商滿足客戶需求的能力有限,也是造成價格持續上漲的原因之一。

- 長期供應協議:

- 雲端服務供應商正積極簽署長期採購協議,將供應期限延長至未來數年,以確保供應並鼓勵製造商投資擴大產能。

- 客戶接受更高的價格,表示他們對雲端服務機會充滿信心,也顯示製造商願意擴大產能。

- 製造商的策略轉變:

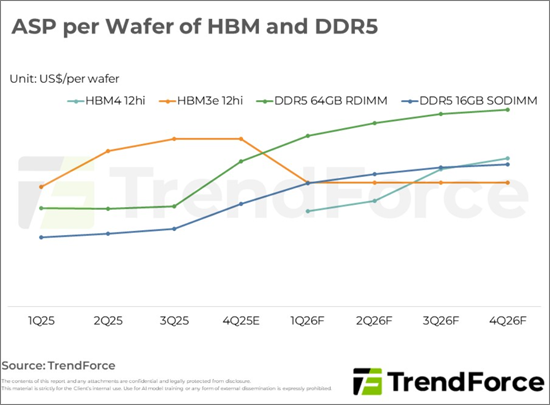

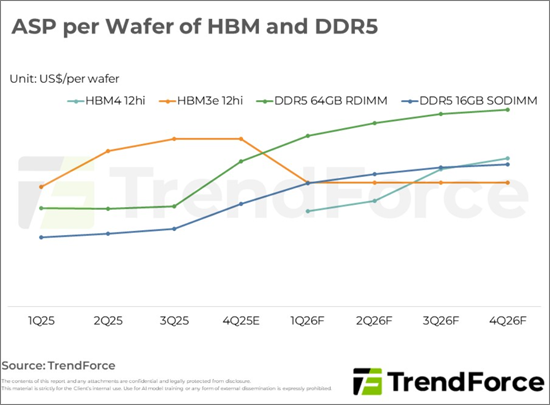

- 為了提高獲利能力,製造商正將生產重點轉向高附加價值的DDR5產品,預計每片晶圓的平均售價將超過HBM。

- 一些製造商已開始將產能從HBM重新分配到DDR5。

- 產能擴張的挑戰:

- 建造用於大規模生產的新無塵室需要數年時間,這會造成供應瓶頸。

- 短期內,預計製造商將加快製程升級或略微加快潔淨室建設,這將有助於增加位供應。

- 市場展望:

- 資料中心投資前景依然強勁,推動伺服器出貨量和每台伺服器DRAM容量的成長。

- 預計整個市場供應短缺的情況將持續,賣方可能仍將佔主導地位。

目錄

第一章:官方伺服器DRAM合約預估發布,季度價格大幅上漲促使供應商擴大生產

第二章:三星做出積極預估後,2025年第四季伺服器DRAM合約談判結束。 最新修訂的預測顯示,伺服器DRAM價格將成長43-48%,遠超PC DRAM的漲幅。

- 伺服器DRAM和PC DRAM價格預測的季度變化

第三章:CSP需求談判延長至2027年,供應商優先考慮業務擴張

第四章:晶圓價值成為產能受限供應商的價格錨點

- HBM和DDR5晶圓平均售價

簡介目錄

Product Code: TRi-0103

Server DRAM prices are projected to surge due driven by tight supply and robust cloud service provider demand. To secure supply, clients are aggressively negotiating long-term agreements, incentivizing manufacturers to expand capacity. Manufacturers are shifting production focus to high-margin DDR5. Market anticipates persistent undersupply, with substantial new capacity taking years to come online, while process upgrades accelerate short-term. PC DRAM also rises, but less significantly.

Sample preview

Key Highlights:

- Significant Server DRAM Price Increases:

- Strong cloud service provider demand and tight manufacturer supply are driving a substantial increase in server DRAM prices, significantly surpassing PC DRAM.

- Manufacturers' limited ability to meet customer needs contributes to continuous price escalation.

- Long-Term Supply Agreements:

- Cloud service providers are actively negotiating long-term purchasing agreements extending into future years to secure supply and incentivize manufacturers to expand capacity investment.

- Client acceptance of price hikes reflects confidence in cloud service opportunities and willingness to stimulate manufacturer expansion.

- Manufacturer Strategic Shift:

- To boost profitability, manufacturers are shifting production focus towards high-value DDR5 products, with their average selling price per wafer projected to exceed HBM.

- Some manufacturers have begun reallocating capacity from HBM to DDR5.

- Capacity Expansion Challenges:

- New cleanroom construction requires several years for large-scale production, creating a supply bottleneck.

- In the short term, manufacturers will accelerate process upgrades or slightly advance cleanroom construction to boost bit supply growth.

- Market Outlook:

- Data center investment visibility remains high, with increasing server shipments and DRAM content per server.

- The overall market is expected to remain seller-dominated with persistent undersupply.

Table of Contents

1. Formal Quotes for Server DRAM Contracts Emerge, and Significant Increases in Projected QoQ Hikes for Transaction Prices Encourage Suppliers to Expand Production

2. Following Samsung's Aggressive Quotes, 4Q25 Server DRAM Contract Negotiations Will Conclude; Latest Revised Projection Puts Server DRAM's Price Hike at 43-48%, Greatly Surpassing PC DRAM's Price Hike

- Projected QoQ Changes in Server DRAM and PC DRAM Prices

3. Suppliers Now Prioritizing on Expansions as Negotiations for Demand of CSPs Extended to 2027

4. Value of Wafers Set as Pricing Anchor for Suppliers' Products under Restricted Capacity

- ASP per Wafer of HBM and DDR5

02-2729-4219

+886-2-2729-4219