|

市場調查報告書

商品編碼

1794797

全球電子產品領域的需求概要(2025年)Overview of Global Electronics Sector's Demand in 2025 |

|||||||

價格

簡介目錄

2025 年,電子產業將呈現混合趨勢:人工智慧需求強勁,消費設備需求疲軟,早期拉動將消除季節性因素,導致未來成長放緩。

信息圖形

重點

- 2025 年,人工智慧需求將激增,而消費性電子產品(智慧型手機、筆記型電腦和電視)的成長將停滯或微乎其微。

- 關稅和補貼將導致庫存提前消化,擾亂傳統的銷售高峰,並增加下半年的風險。

- 雲端服務供應商將增加對受關稅影響較小的AI伺服器的資本投入,這將對通用伺服器預算帶來壓力。 “AI將獨自成功。”

- 邊緣AI將失去動力,終端設備將缺乏引人注目的AI應用,無法推動升級和消費者興趣。

- 到2026年,該產業將進入低成長整合階段,大多數產品將保持低迷,AI伺服器也將失去動力。

- 關稅的不確定性將影響PC OEM廠商和供應商的生產策略。

目錄

第一章:關稅和補貼拉動需求前期成長,擾亂傳統旺季

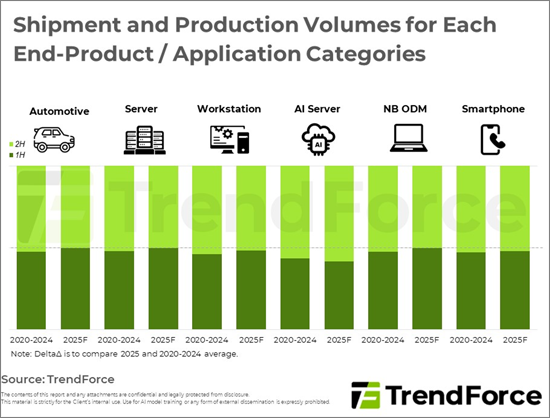

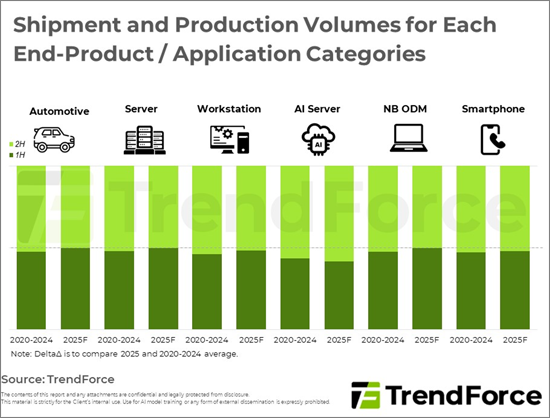

- 以最終產品和應用劃分的出貨量和產量-2025年上半年和下半年年度出貨量分佈與五年平均值的比較

第二章:AI伺服器的需求正在穩定成長。與其他應用相比,AI伺服器不易受到價格不確定性的影響,並受益於雲端運算服務供應商(CSP)資本投資的增加。

第三章:邊緣AI的熱潮正在逐漸消退,但替代浪潮尚未出現。殺手級應用暫時擱置。

第四章:展望2026年-成長放緩將導致產業成長放緩與整合。

簡介目錄

Product Code: TRi-0082

In 2025, the electronics industry sees diverging trends: strong AI demand, weak consumer devices, early pull-in erases seasonality, and future growth slows.

INFOGRAPHICS

Key Highlights:

- In 2025, AI demand surges while consumer electronics-smartphones, laptops, TVs-see stagnant or minimal growth.

- Tariff and subsidy impacts cause early inventory pull-in, disrupting traditional sales peaks and raising risks in the year's latter half.

- Cloud providers grow capital spending on AI servers, with less tariff impact, squeezing budgets for general servers. "AI alone thrives."

- Edge AI loses momentum; end devices lack compelling AI applications, failing to drive upgrades or noticeable consumer interest.

- By 2026, the industry enters a consolidation phase with slow growth, most products remain weak, and AI server momentum eases; breakthroughs needed for future cycles.

- Tariff uncertainty impacts PC OEMs' and suppliers' production strategies; DRAM supply-demand and other components merit close watch.

Table of Contents

1. Tariffs and Subsidies Have Caused Demand to Be Pulled Forward and Disrupts Traditional Peak Season

- Shipment and Production Volumes for Each End-Product / Application Categories - Distribution of Annual Shipments Between 1H25 and 2H25 vs. Averages of Previous Five Years

2. Demand Grows Steadily for AI Servers, Which Are Less Affected by Tariff-Related Uncertainties Compared with Other Applications and Have Benefited from CSPs' Increasing Capital Expenditure

3. Subsiding Topic of Edge AI Yet to Ignite Replacement Wave; Killer Applications Pending for the Time Being

4. Looking Ahead to 2026: Industry Enters Low-Speed Growth and Consolidation under Decelerating Increment

02-2729-4219

+886-2-2729-4219