|

市場調查報告書

商品編碼

1764336

全球汽車LED市場(2025年)- 照明與顯示產品趨勢2025 Global Automotive LED Market- Lighting and Display Product Trend |

||||||

全球汽車LED市場(2025年)- 照明和顯示產品趨勢預測,由於持續的經濟不確定性,2025年價格下行壓力將加劇。不過,TrendForce對車用LED廠商訂單積壓情況的分析顯示,汽車產量預計將在2025年下半年再次復甦。此外,隨著先進技術將繼續搭載於2026年車型,預計到2025年,車用LED和車用照明的市場規模將分別成長至34.51億美元和357.29億美元。

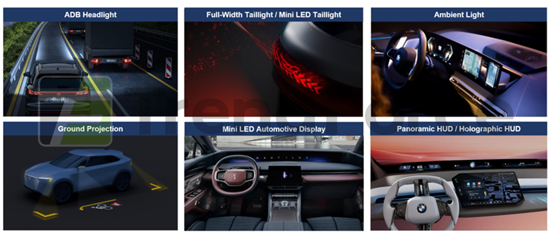

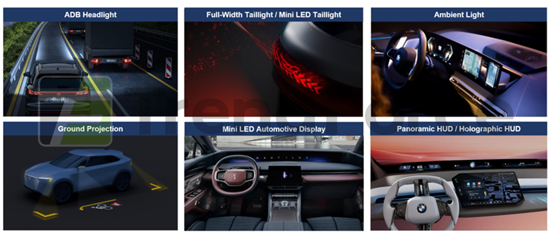

未來汽車照明將致力於個人化、通訊顯示、駕駛輔助和安全性提升

車用照明與顯示器市場趨勢

1.車頭燈

ADB車頭燈透過獨立控制高性能LED,提供更佳的道路照明,擴大駕駛者的夜間視野,並透過獨立控制延長偵測障礙物時的反應時間。無眩光遠光燈可減輕前車和對側車輛駕駛的不適感,並防止行人被車頭燈晃眼。根據TrendForce分析,由於全球經濟不確定性增加,ADB車頭燈市場滲透率的成長放緩,但到2029年仍有望達到21.6%。

Micro/Mini LED像素模組在ADB車頭燈的應用日益廣泛,可透過像素的獨立數位控制來調整照射區域,提高駕駛安全性。採Samsung的PixCell LED(COB技術)的Mini LED像素模組已成功搭載於Tesla Model 3/Y和NIO ES6。此外,Volkswagen、Porsche、SAICVolkswagen、NIO、Opel、Audi等汽車製造商將在2025年率先採用Micro LED頭燈解決方案。

ADB頭燈是大勢所趨,強調小發光面(LES)、高亮度和高對比。據TrendForce表示,汽車製造商對Micro LED ADB頭燈的平均像素要求為2萬像素。未來Micro LED像素陣列的產品趨勢可望朝兩個方向發展:3000-4000像素的低像素產品,以及70000-100000像素的高階產品。 OEM廠商的目標是每個頭燈達到10萬像素。因此,ams OSRAM和Nichia計劃持續提升Micro LED像素陣列的像素數量,以滿足汽車製造商的需求和目標。

2.尾燈

隨著汽車照明個人化、通訊顯示、駕駛輔助和安全性提升等趨勢的發展,Mini LED 尾燈(後部)和 RGB Mini LED 通訊顯示器(前部)應運而生。這些產品已應用於 IM Motors、GWM(SAR Mecha Dragon)、Changan(NEVO CD07)等品牌的車輛。根據 TrendForce 分析,目前主流設計主要採用 P3-P4 顯示屏,出於成本和功耗方面的考慮,功率為 100W。

ams OSRAM 創新開發了 ALIYOS 技術,將 Mini LED 與排列在纖薄柔性透明箔片上的不顯眼金屬線連接起來。 ALIYOS 技術為 Mini LED 陣列的放置提供了極大的靈活性。它們還可以作為可單獨尋址的單元形成任何形狀,實現基於區塊的燈光控制,允許動態顯示符號、文字、圖像和抽象畫,用於造型、資訊傳遞和警告。 ams OSRAM 正與全球主要汽車零件製造商和 OEM 合作,探索汽車內外照明領域的全新可能性。

3.裝飾照明

根據 TrendForce 分析,裝飾照明包括氣氛燈、格柵燈、全寬前飾條、ADS 標誌燈等。預計到2029年,裝飾照明市場規模將躍升至 3.11億美元,2024年至2029年的年複合成長率將達到 28%。其中,智慧氛圍 LED 市場在2024年至2029年的年複合成長率將高達 69%。

智慧氛圍燈採用內建驅動 IC 驅動的RGB LED。除了獲得 ISELED 聯盟認證的智慧氛圍燈外,ams OSRAM 和 Dominant 還相繼推出了搭載開放系統協定(OSP)的智慧氛圍燈。 ams OSRAM 的智慧氛圍燈已搭載於 ZEEKR MIX(2024年)車型,預計將被歐美汽車製造商採用。

除了 RGB LED 解決方案外,汽車製造商還計劃採用高顯色性(CRI 95 及以上)和可調色溫(2,700-6,500K)的白光 LED 解決方案,用於閱讀燈、車頂燈、化妝鏡和腳部空間照明。首爾半導體採用 SunLike 技術的環境白光 LED 產品處於業界領先地位。該產品已成功整合於Volvo Polestar 3/EX90 車型。其 1W 環境白光 LED 亮度高達 100 lm(CRI 95 以上)。

4.小型LED車載顯示器

隨著HDR、局部調光、廣色域和曲面螢幕設計的趨勢發展,包括NIO、General Motors、Li Auto、BYD、Ford、Geely、Stellantis在內的汽車製造商將在2024年開始採用車載Mini LED顯示器。Xiaomi、BMW、Mercedes-Benz、HKMC、BAIC、GWM、Sony預計將在2025年至2029年間推出搭載Mini LED顯示器的汽車。此外,全景和全像HUD預計將開始採用Mini LED技術來提升對比度,進一步推動車載顯示器市場的成長動能。

汽車照明市場規模及車燈廠商營收實績

根據TrendForce預測,在新能源汽車的帶動下,2024年全球汽車銷售將達到8,855萬輛,新能源汽車滲透率將達到25%。然而,隨著車燈廠商受到價格壓力、庫存去化、匯率波動等因素的影響,汽車照明市場規模將小幅下滑至346.58億美元。2024年,全球十大汽車照明廠商分別為Koito、Valeo、Forvia Hella、Marelli、Stanley、SL Corporation、Xingyu、HASCO Vision、ZKW、OPmobility。

車用LED廠商營收實績

2024年全球五大車用LED廠商分別為ams OSRAM、Nichia、Lumileds、Seoul Semiconductor、Dominant。ams OSRAM憑藉其穩定的品質、卓越的光效和高性價比,已成為全球高端汽車和新能源汽車製造商的首選供應商。Seoul Semiconductor的銷售業績主要得益於韓國和中國訂單的成長。此外,由於中國、歐洲和韓國市場需求的成長,億光預計2024年其車用LED銷售額將成長40%以上。弘凱光電致力於汽車市場應用,致力於光學感測技術,協助溝通和沈浸式體驗,並致力於為客戶提供一體化的加值服務。

TrendForce從七個角度分析車用LED市場的發展:

- (1)汽車照明與顯示器的產品趨勢

- (2)汽車照明市場規模與應用

- (3)汽車照明廠商營收與產品策略

- (4)車燈價格

- (5)車用LED市場需求(各產品應用與地區市場價值)

- (6)車用LED廠商營收實績與產品策略

- (7)車用驅動IC市場規模與產品趨勢

由此,為讀者呈現車用LED市場的完整市場動態。

目錄

第1章 汽車照明產品趨勢

- 汽車照明產品趨勢

- 頭燈產品趨勢

- 頭燈產品趨勢 - ADB 頭燈 vs. 小直徑頭燈

- LED 頭燈/ADB 頭燈滲透率分析,2025-2029

- ADB頭燈 - 優勢及監管分析

- ADB頭燈 - 矩陣式 LED/DLP/Micro LED 技術概述

- ADB頭燈 - 矩陣式 LED/DLP/Micro LED 技術分析

- ADB頭燈 - 矩陣式 LED/DLP/Micro LED 技術趨勢,2025-2029

- ADB頭燈 - Samsung PixCell LED 技術分析

- ADB頭燈 - 100像素Mini LED模組價格及成本預測

- ADB頭燈 - Tesla/Hella SSL 100頭燈價格及成本預測

- ADB頭燈 - Micro LED像素陣列規格分析

- ADB頭燈 - Micro LED像素陣列技術分析

- ADB頭燈 - 巨量轉移設備分析

- ADB頭燈 - Micro LED像素陣列價格及成本預測

- ADB頭燈 - Micro LED頭燈價格及成本預測

- ADB頭燈 - Micro LED頭燈市場應用分析

- Micro LED ADB頭燈 - 福斯/Porsche,2023-2024

- Micro LED ADB頭燈案例研究概況及供應鏈

- Micro LED ADB頭燈特性分析

- LED頭燈價格分析,2025年

- 雷射頭燈 - 產品設計及供應鏈

- LED尾燈產品趨勢

- 全寬尾燈價格價格與成本預測 - 0.2W SMD LED

- 全寬尾燈價格與成本預測 - 1515 LED

- Mini LED 尾燈 - ALIYOS

- Mini LED 尾燈合理價格與成本預測

- 類 OLED LED 尾燈產品趨勢

- 氣氛燈產品趨勢 - 動態視覺照明

- (智慧)氣氛燈 - 優缺點分析

- (智慧)氣氛燈 - 設計架構概述

- (智慧)氣氛燈 - 設計架構解決方案

- 智慧型氣氛燈 - 開放式系統協定(OSP)vs. ISELED

- 智慧氛圍燈 - 案例研究分析

- 氣氛燈白光產品趨勢

- 氣氛燈 - 市場情勢分析

- 格柵燈/前全寬條形燈產品趨勢

- 格柵燈/前全寬條形產品設計

- 自動駕駛系統標誌燈產品趨勢

- 地面投影產品趨勢

- (智慧)氣氛燈/裝飾燈LED市場,2025-2029

第2章 車上顯示產品趨勢

- 智慧座艙趨勢

- 智慧座艙-從現在到未來

- 車載顯示技術概述

- 2025-2029年車上顯示面板出貨量及滲透率

- 2025-2029年車用背光LED市場規模分析

- LCD(側光式/直下式)與OLED車用顯示器規格比較

- Mini LED車用顯示器-規格及供應鏈,2022

- Mini LED車載顯示器 - 規格與供應鏈,2023

- Mini LED車用顯示器 - 規格與供應鏈,2024

- COB/COG/POG 技術分析

- Mini LED 汽車顯示器發展時間表和規格,2022-2029

- NIO ET7/ET5/ES7 汽車顯示器 - 規格與成本分析

- Cadillac LYRIQ 汽車顯示器 - 規格和成本分析

- Buick Electra E5 汽車顯示器 - 規格與成本分析

- Cadillac Celestic 汽車顯示器 - 規格與成本分析

- Zeekr 7X 汽車顯示器 - 規格與成本分析

- Zeekr 009 汽車顯示器 - 規格與成本分析

- HKMC 汽車顯示器 - 規格與成本分析,2026

- 汽車顯示器成本分析 - 邊緣/直下式,2025

- Mini LED 汽車顯示器 - 直驅/掃描驅動IC的優缺點

- OLED車上顯示器發展規劃及規格,2022-2025

- 車上背光顯示器市場現況分析

- HUD市場出貨量 -2025-2029年產品及地區市場分析

- HUD廠商出貨量/市場佔有率分析,2024年

- HUD產品規格分析

- AR-HUD技術分析

- AR-HUD OEM供應鏈及產品規格分析

- 2025年HUD產品價格分析

- 全景HUD與全像HUD

- HUD市場現況分析

- Micro LED透明顯示器

- Micro LED車用顯示器應用概述

- 2025年Micro LED車用透明顯示器成本分析

- Micro LED車用顯示器市場現況分析

第3章 汽車照明市場規模及各廠商營收實績

- 汽車照明市場現況分析

- 2025-2029年汽車照明市場規模及應用分析

- 2022-2024年汽車照明廠商市場佔有率分析

- 2022-2024年全球前15大汽車照明廠商營收分析

- 汽車照明產業併購分析

- 15家車燈廠商營收及產品策略分析

- 中國車燈/模組廠商

第4章 汽車LED廠商營收及策略分析

- 全球汽車LED廠商名單

- 2023-2024年汽車LED廠商市場佔有率分析

- 2022-2024年全球前10大汽車LED廠商營收分析

- 全球前10大汽車LED廠商營收分析照明與背光,2023-2024

- 18家汽車LED製造商營收 - 照明與背光,2024年

- 6大汽車LED照明製造商營收預測 - 照明產品分析,2024年

- 2023年全球五大車燈LED公司營收分析

- 2024年全球五大車燈LED公司營收分析

- 2023年汽車LED廠商排名 - 中國/亞洲/歐洲、中東和非洲/美洲

- 2024年汽車LED廠商排名 - 中國/亞洲/歐洲、中東和非洲/美洲

- 18家汽車LED廠商營收及產品策略

第5章 汽車LED驅動IC市場及產品分析

- 汽車LED驅動IC市場規模2025-2029年分析

- Texas Instruments

- Macroblock

- Chipone

- Xm-Plus

- 車用 LED 驅動 IC 規格及價格分析

[Excel]

- 1.汽車市場出貨量 - 區域市場分析

- 2.2025-2029年車用 LED 市場價值、量及普及率 - 產品分析

- 3.2024-2025年車用 LED 市場價值、量及普及率 - 產品/區域市場分析

- 4.汽車照明/車用 LED 市場各參與者營收實績

- 5.車燈/車用 LED 市價分析

According to TrendForce "2025 Global Automotive LED Market- Lighting and Display Product Trend, towards 2025", due to the ongoing uncertainty in the overall economy, greater downward pricing pressure is anticipated in 2025. However, according to TrendForce's analysis on automotive LED manufacturers' orders on hand, car production is expected to recover again in 2H25. Additionally, with advanced technologies continuing to be incorporated into car models of 2026, the automotive LED and automotive lighting market value is forecasted to grow to USD 3.451 billion and USD 35.729 billion in 2025.

Automotive Lighting Will Concentrate on Personalization, Communication Display,

Driver Assistance, and Safety Upgrading in the Future

Automotive Lighting and Display Market Trend

1. Headlights

Through independent control of high-performance LEDs, the ADB headlights help expand drivers' nighttime field of view, giving them more time to react when seeing an obstacle and achieving better road lighting. Glare-free high beams help reduce discomfort for drivers of vehicles ahead, those of opposing vehicles, and prevent pedestrians from being dazzled by headlights. As TrendForce analyzes, increasing global economic uncertainty has slowed the growth of the ADB headlight market penetration rate, but still has the potential to reach 21.6% by 2029.

As Micro/Mini LED pixelated module is increasingly used for ADB headlights, the area of illumination can be adjusted for better driving safety through independent digital control of pixels. Mini LED pixelated modules utilized by Samsung's PixCell LED (COB technology) have been successfully implemented in the Tesla Model 3 / Y and the NIO ES6. In addition, Volkswagen, Porsche, SAIC Volkswagen, NIO, Opel, and Audi have been leading car makers in adopting Micro LED headlight solutions in 2025.

ADB headlights are the trend of the times, with an emphasis on a small light emitting surface (LES), high brightness, and high contrast. According to TrendForce, automakers require an average pixel count of 20,000 for Micro LED ADB headlights. The future product trend of Micro LED pixel arrays will have the opportunity to develop towards two polarizations: one is low-pixel products, using 3,000-4,000-pixels; the other is premium products, using 70,000-100,000-pixels. OEMs have set a target of 100,000 pixels per headlight. Therefore, ams OSRAM and Nichia plan to continually increase the pixel count of its Micro LED pixel array to meet automaker demands and goals.

2. Taillights

The increasing trend towards personalization, communication display, driver assistance, and safety upgrading for automotive lighting has given rise to Mini LED taillights (rear) and RGB Mini LED communication displays (front). These products have been installed in the vehicles of IM Motors, GWM (SAR Mecha Dragon), and Changan (NEVO CD07). According to TrendForce's analysis, current mainstream designs mainly incorporate P3-P4 displays and a 100W specification for cost and power consumption concerns.

ams OSRAM has innovatively developed its ALIYOS technology, connecting Mini LEDs with unnoticeable metal wires that are arranged on a slim, flexible, and transparent foil. ALIYOS offers great flexibility for the arrangement of Mini LED arrays. It can also form any shape as individually addressable units, achieving block-based light control, hence the ability to display symbols, words, images, and abstract pictures dynamically for styling, messaging, and warning. ams OSRAM is working with leading Tier 1 automotive suppliers and OEMs worldwide to explore new possibilities in both interior and exterior automotive lighting.

3. Decorative Lighting

As TrendForce analyzes, decorative lights include ambient lights, grill lamps, full-width front strips, and ADS marker lamps. The decorative light market scale is likely to jump to USD 311 million by 2029, with a 28% CAGR from 2024 to 2029. Specifically, the 2024-2029 CAGR for the intelligent ambient LED market will be a whopping 69%.

Intelligent ambient lights are equipped with RGB LEDs powered by built-in driver ICs. Beyond the intelligent ambient lights certified by the ISELED Alliance, ams OSRAM and Dominant have successively launched intelligent ambient lights with the Open System Protocol (OSP). The microcontroller can send commands to lighting units individually and obtain their status, enabling high-precision color calibration and temperature compensation. ams OSRAM's intelligent ambient lights are installed on the ZEEKR MIX (2024) model and is expected to be adopted by European and American automakers.

In addition to RGB LED solutions, automakers intend to adopt white LED solutions featuring high color rendering (CRI greater than or equal to 95), and adjustable color temperature (2,700-6,500K) for reading lights, roof lights, make-up mirrors, and foot room illumination. Seoul Semiconductor's ambient white LED product featuring SunLike technology leads the industry. The product has been successfully integrated into Volvo Polestar 3 / EX90. Its 1W ambient white LED achieves a brightness of up to 100 lm (CRI greater than or equal to 95).

4. Mini LED Automotive Displays

Following the trend towards HDR, local dimming, wide color gamut, and curved screen design, car manufacturers began adopting automotive Mini LED displays in 2024, including NIO, General Motors, Li Auto, BYD, Ford, Geely, and Stellantis. Xiaomi, BMW, Mercedes-Benz, HKMC, BAIC, GWM, and Sony are expected to release vehicles equipped with Mini LED displays between 2025 and 2029. Additionally, panoramic HUDs and holographic HUDs will start adopting Mini LED technology to enhance contrast ratio, which is expected to drive growth momentum for the automotive display market.

Automotive Lighting Market Scale and Automotive Lamp Player Revenue Performance

According to TrendForce, driven by NEVs, global car sales in 2024 hit 88.55 million units, with the NEV penetration rate reaching 25%. However, as automotive lighting manufacturers were affected by pricing pressure, inventory depletion, and exchange rate fluctuations, the automotive lighting market value slightly dropped to USD 34.658 billion. In 2024, the top ten automotive lighting players were Koito, Valeo, Forvia Hella, Marelli, Stanley, SL Corporation, Xingyu, HASCO Vision, ZKW, and OPmobility.

Automotive LED Player Revenue Performance

The top five automotive LED manufacturers in 2024 include ams OSRAM, Nichia, Lumileds, Seoul Semiconductor, and Dominant. Thanks to the stable quality, exceptional luminous efficacy, and good value of its products, ams OSRAM has become the preferred supplier for premium vehicle and NEV manufacturers worldwide. Seoul Semiconductor's sales performance was mainly benefited from order increases in Korea and China. In addition, thanks to the rising demand in China, Europe, and South Korea, Everlight saw its automotive LED revenue surge more than 40% in 2024. Brightek specializes in automotive market applications and has regarded light sensing for communication and immersive experiences as its target, aiming to offer integrated value-added services for its customers.

TrendForce has analyzed developments in the automotive LED market from seven perspectives:

- 1) automotive lighting and display product trends,

- 2) automotive lighting market scale and applications,

- 3) automotive lighting player revenue and product strategies,

- 4) automotive lamp prices,

- 5) automotive LED market demand (product applications and regional market value), and

- 6) automotive LED player revenue performance and product strategies.

- 7) automotive driver IC market scale and product trend.

In this way, we provide readers with a comprehensive picture of marketing dynamics in the automotive LED market.

Table of Contents

Chapter 1. Automotive Lighting Product Trend

- Automotive Lighting Product Trend

- Headlight Product Trend

- Headlight Product Trend- ADB Headlight vs. Small Aperture

- 2025-2029 LED Headlight / ADB Headlight- Penetration Rate Analysis

- ADB Headlight- Advantage and Regulation Analysis

- ADB Headlight- Matrix LED / DLP / Micro LED Technology Overview

- ADB Headlight- Matrix LED / DLP / Micro LED Technology Analysis

- 2025-2029 ADB Headlight- Matrix LED / DLP / Micro LED Technology Trend

- 2025-2029 ADB Headlight LED Market- LED vs. Micro/Mini LED Module

- ADB Headlight- Samsung PixCell LED Technology Analysis

- ADB Headlight- 100-Pixel Mini LED Module Price and Cost Estimates

- ADB Headlight- Tesla / Hella SSL 100 Headlight Price and Cost Estimates

- ADB Headlight- Micro LED Pixel Array Specification Analysis

- ADB Headlight- Micro LED Pixel Array Technology Analysis

- ADB Headlight- Mass Transfer Equipment Analysis

- ADB Headlight- Micro LED Pixel Array Price and Cost Estimates

- ADB Headlight- Micro LED Headlight Price and Cost Estimates

- ADB Headlight- Micro LED Headlight Market Application Analysis

- 2023-2024 Micro LED ADB Headlight- Volkswagen / Porsche

- Micro LED ADB Headlight Case Study Overview and Supply Chain

- Micro LED ADB Headlight Function Analysis

- 2025 LED Headlight Price Analysis

- Laser Headlight- Product Design and Supply Chain

- LED Taillight Product Trend

- Full-Width Taillight Price and Cost Estimates- 0.2W SMD LED

- Full-Width Taillight Price and Cost Estimates- 1515 LED

- Mini LED Taillight- ALIYOS

- Mini LED Taillight Price Sweet Spot and Cost Estimates

- OLED-Like LED Taillight Product Trend

- Ambient Light Product Trend- Dynamic Visual Lighting

- (Intelligent) Ambient Light- Pros-Cons Analysis

- (Intelligent) Ambient Light- Design Architecture Overview

- (Intelligent) Ambient Light- Design Architecture Solutions

- Intelligent Ambient Light- Open System Protocol (OSP) vs. ISELED

- Intelligent Ambient Light- Case Study Analysis

- Ambient Light White Product Trend

- Ambient Light- Market Landscape Analysis

- Grille Lamp / Full-Width Front Stripe Product Trend

- Grille Lamp / Full-Width Front Stripe Product Design

- Autonomous Driving System Marker Lamp Product Trend

- Ground Projection Product Trend

- 2025-2029 (Intelligent) Ambient Light LED / Decorative Light LED Markets

Chapter 2. Automotive Display Product Trend

- Smart Cockpit Trend

- Smart Cockpit- From Today to the Future

- Automotive Display Technology Overview

- 2025-2029 Automotive Display Panel Shipment and Penetration Rate

- 2025-2029 Automotive Backlight LED Market Value Analysis

- LCD (Edge / Direct-Type) vs. OLED Automotive Display Specification

- 2022 Mini LED Automotive Display- Specification vs. Supply Chain

- 2023 Mini LED Automotive Display- Specification vs. Supply Chain

- 2024 Mini LED Automotive Display- Specification vs. Supply Chain

- COB / COG / POG Technology Analysis

- 2022-2029 Mini LED Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- Buick Electra E5 Automotive Display- Specification and Cost Analysis

- Cadillac Celestiq Automotive Display- Specification and Cost Analysis

- Zeekr 7X Automotive Display- Specification and Cost Analysis

- Zeekr 009 Automotive Display- Specification and Cost Analysis

- 2026 HKMC Automotive Display- Specification and Cost Analysis

- 2025 Automotive Display Cost Analysis- Edge / Direct-Type

- Mini LED Automotive Display- Direct / Scan Driver IC Pros-Cons Analysis

- 2022-2025 OLED Automotive Display Schedule and Specification

- Automotive Backlight Display Market Landscape Analysis

- 2025-2029 HUD Market Shipment- Product vs. Regional Market Analysis

- 2024 HUD Player Shipment / Market Share Analysis

- HUD Product Specification Analysis

- AR-HUD Technology Analysis

- AR-HUD OEM Supply Chain and Product Specification Analysis

- 2025 HUD Product Price Analysis

- Panoramic HUD vs. Holographic HUD

- HUD Market Landscape Analysis

- Micro LED Transparent Display

- Micro LED Automotive Display Application Overview

- 2025 Micro LED Automotive Transparent Display Cost Analysis

- Micro LED Automotive Display Market Landscape Analysis

Chapter 3. Automotive Lighting Market Scale and Player Revenue Performance

- Automotive Lighting Market Landscape Analysis

- 2025-2029 Automotive Lighting Market Scale- Application Analysis

- 2022-2024 Automotive Lighting Player Market Share Analysis

- 2022-2024 Top 15 Automotive Lighting Player Revenue Ranking

- Automotive Lighting Industry M&A Analysis

- 15 Automotive Lamp Manufacturers Revenue and Product Strategies

- Automotive Lamp / Module Factories in China

Chapter 4. Automotive LED Player Revenue and Strategies

- Global Automotive LED Player List

- 2023-2024 Automotive LED Player Market Share Analysis

- 2022-2024 Top 10 Automotive LED Player Revenue Ranking

- 2023-2024 Top 10 Automotive LED Player Revenue- Lighting vs. Backlight

- 2024 18 Automotive LED Players' Revenue- Lighting vs. Backlight

- 2024 Top 6 Automotive LED Player Revenue- Lighting Product Analysis

- 2023 Global Top 5 Headlight LED Player Revenue Analysis

- 2024 Global Top 5 Headlight LED Player Revenue Analysis

- 2023 Auto Lighting LED Player Ranking- China / Asia / EMEA / Americas

- 2024 Auto Lighting LED Player Ranking- China / Asia / EMEA / Americas

- 18 Automotive LED Manufacturers Revenue and Product Strategies

Chapter 5. Automotive LED Driver IC Market and Product Analysis

- 2025-2029 Automotive LED Driver IC Market Value Analysis

- Texas Instruments

- Macroblock

- Chipone

- Xm-Plus

- Automotive LED Driver IC Specification and Price Analysis

[EXCEL]

- 1. Car Market Shipment- Regional Market Analysis

- 2. 2025-2029 Automotive LED Market Value, Volume and Penetration- Product Analysis

- 3. 2024-2025 Automotive LED Market Value, Volume and Penetration- Product / Regional Market Analysis

- 4. Automotive Lighting / Automotive LED Player Revenue Performance

- 5. Automotive Lamp / Automotive LED Market Price Analysis