|

市場調查報告書

商品編碼

1742160

微LED的顯示器及非顯示器用途的市場分析 (2025年)2025 Micro LED Display and Non-Display Application Market Analysis |

||||||

[洞察] Micro LED 拓展至顯示器領域,為透明與非顯示器應用開啟新的可能性

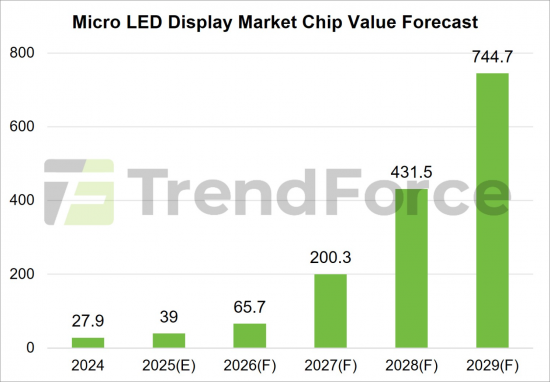

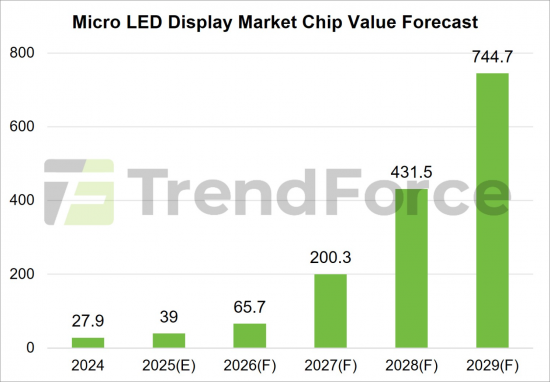

據報道,目前 Micro LED 技術在顯示器領域的發展主要面臨兩大課題:透過設計和生產改進來優化製造成本,以及找到獨特的利基市場。預計到2029年,用於顯示應用的Micro LED晶片市場規模將達到7.4億美元,2024年至2029年的複合年增長率為93%。

大型顯示器的成本改進正在進行中

目前,Micro LED顯示器市場主要以大型顯示器為主,三星在該領域處於領先地位。未來的成長需要突破幾個關鍵製造工藝,並需要中國晶片製造商與品牌製造商合作,共同推動晶片小型化。預計這將進一步增強量產Micro LED大型顯示器的成本優勢。

此外,隨著人工智慧的發展,頭戴式設備的使用範圍不斷擴大,而智慧駕駛生態系統的發展也帶動了對先進車載顯示器的需求不斷增長,因此這兩個領域有望成為未來MicroLED顯示器市場的主要支柱。

TrendForce指出,Micro LED大螢幕顯示器的業界標準通常為4K或更高解析度,但目前商用化並量產的像素間距僅為0.5毫米。進一步縮小像素間距對於與Mini LED顯示器的差異化至關重要,同時也必須克服驅動器連接良率低和麵板接縫問題等課題。

成本優化工作也正在轉向背板側,透過簡化製造流程來提高良率,並透過減少接縫來減少組裝步驟。這些努力有助於降低總成本。

Micro LED 憑藉其高亮度、高對比度和高透明度等獨特特性,持續吸引廠商的投資,這些特性使得 Micro LED 能夠整合到車窗透明顯示器、AR-HUD 和 P-HUD 等系統中,滿足駕駛員和乘客對虛擬與現實資訊無縫融合的需求。此外,Micro LED 與矽基板的結合,可為 AR 眼鏡的近眼顯示器提供強大的解決方案,而 Micro LED 也正在成為下一代支援元宇宙的頭戴式裝置的標準技術。

本報告提供微LED的顯示器及非顯示器用途的市場調查,彙整微LED的技術開發趨勢,微LED的顯示器及非顯示器用途的市場規模的轉變·預測,微LED透明顯示器趨勢,主要製造商的簡介等資訊。

目錄

第1章 微LED顯示器市場分析

- 市場規模的分析:大型顯示器

- 市場規模的分析:穿戴式顯示器

- 市場規模的分析:頭戴設備

- 市場規模的分析:汽車顯示器

- 市場規模的分析

- 晶圓需求的分析

第2章 微LED技術的開發

- 模組尺寸增大

- Micro LED 模組尺寸增加/拼接減少

- Micro LED 模組尺寸增加的優點 (1/2) - 無拼接

- Micro LED 模組尺寸增大的優點 (2/2) - 成本與商業效益

- 模組尺寸與拼接尺寸之間的關係

- 決定經濟最優的模組尺寸

- Micro LED 模組尺寸增大的課題

- Micro LED 拼接:大模組 vs. 小模組

- 拼接顯示幕

- 拼接連結點的技術課題

- Micro LED 拼接的商業策略:從像素間距角度

- Micro LED 拼接的最小可商業化尺寸:UHD(超高清)

- Micro LED 拼接的最大可商業化尺寸:從經濟拼接角度

- 商業化大型 Micro LED 顯示器的最佳尺寸

- 玻璃:藍寶石基 COC 的潛在競爭對手

- Micro LED 的散熱課題

- Micro LED 的 PPI 課題

- 高效 Micro LED 的宣告:即將實現

- Micro LED 產業趨勢 (1/2):部署到專業顯示器

- MicroLED 產業趨勢 (2/2):專注於 AR 的 MicroLED 公司

第3章 微LED透明顯示器

- 兩種類型的透明顯示器:直視型和微顯示投影型

- 直視型與投影型的主要差異 (1/2):視角

- 直視型與投影型的主要差異 (2/2):焦點問題

- 透明直視型顯示器面臨的課題:在逼真度和真實度之間做出權衡

- 兩種類型透明顯示器的基準比較

- 透明直視型顯示器的 SWOT 分析

- 透明直視型顯示器按應用的 SWOT 分析

- 透明直視型顯示器發展趨勢分析

- 選擇透明顯示器應用時的注意事項

- 不同透明顯示器技術原理的差異

- JDI 以其 OLED 顯示器重新進軍透明顯示器市場LCD

- 透明顯示器的應用範例

- 透明顯示器亮度與透過率的悖論

- MicroLED 透明顯示器

- 各種透明顯示技術比較

- 量產透明顯示器價格比較

第4章 微LED製造商趨勢

- 2025年的微LED企業的製造能力分析

- PlayNitride

- Ennostar

- HC Semitek

- AUO

- Innolux

- Extremely PQ

- Tianma

- BOE

- LGD

- Samsung

- Hisense

- Hongshi

- VueReal

- Aledia

附錄

[Insight] Micro LED Expands Beyond Displays, Unlocking New Opportunities in Transparent and Non-Display Applications

TrendForce's latest report, "2025 Micro LED Display and Non-Display Application Market Analysis", reveals that the current development of Micro LED technology in the display sector focuses on two key challenges: optimizing manufacturing costs through design and production improvements, and identifying unique niche markets.

TrendForce forecasts that the chip market value for Micro LED display applications will reach US$740 million by 2029, with a CAGR of 93% from 2024 to 2029.

Cost improvements continue for large-sized displays

Presently, the bulk of Micro LED's display-related market value is driven by large-sized displays, where Samsung holds a leading position. Future growth will rely not only on breakthrough across several critical manufacturing processes but also on collaborations between Chinese chipmakers and brand manufacturers to push chip miniaturization. This will further enhance cost advantages for mass-produced Micro LED large-sized displays.

Additionally, as AI broadens the application scenarios for head-mounted devices and as smart driving ecosystems drive up demand for advanced automotive displays, these two sectors are expected to become major pillars of Micro LED display market value in the years ahead.

TrendForce notes that the industry standard for Micro LED large-sized displays is typically 4K resolution or higher; however, the currently commercialized, mass-producible pixel pitch remains at 0.5 mm. Continued efforts to reduce pixel pitch are essential to further differentiate Micro LED from Mini LED video wall , along with overcoming challenges like low yield rates in driver connections and issues with panel seams.

Cost optimization is also shifting toward the backplane, where simplifying the manufacturing process can improve yields, and reducing the number of seams can cut down assembly steps. This contributes to overall cost reductions.

Micro LED's standout characteristics-high brightness, high contrast, and high transparency-continue to attract investment from manufacturers. These features enable Micro LED to integrate into transparent displays for automotive windows or as part of AR-HUD or P-HUD systems, meeting the growing demand for seamless integration of virtual and real-world information for drivers and passengers. Additionally, combining Micro LED with silicon substrates offers a robust solution for near-eye displays in AR glasses, positioning Micro LED as a benchmark for next-generation metaverse-focused head-mounted devices.

Transparent displays hold great promise; non-display applications open new doors

Micro LED technology also shows strong potential in transparent display applications. These can be categorized into direct-view and micro-projection systems, with the key differences lying in viewing angels and focal distance management. In terms of use case, transparent direct-view displays are better suited for public environments where content is viewed by multiple people, and Micro LED's combination of high brightness and high transparency makes it an ideal technology.

Meanwhile, micro-projection systems hold greater promise in privacy-sensitive personal electronic devices, where Micro LED offers ultra-miniaturized light engine solutions and is seen as the best option for micro-display technology in AR applications. Overall, Micro LED has significant room for expansion across diverse transparent display segments by developing both TFT and CMOS backplane platforms.

TrendForce emphasizes that the immediate priority for the Micro LED industry is to scale up the market quickly in order to realize economic efficiencies. As a result, non-display sectors have increasingly become important avenues for growth in addition to focusing on display applications.

These non-display opportunities span a wide range, including optical communication applications accelerated by AI, biotechnology-related medical uses, and industrial production areas such as 3D printing and photopolymerization. Ongoing innovations in these areas are adding further momentum to Micro LED's market expansion.

Table of Contents

Chapter 1. Micro LED Display Market Analysis

- 2025-2029 Micro LED Market Value Analysis-Large-sized Displays

- 2025-2029 Micro LED Market Value Analysis-Wearable Displays

- 2025-2029 Micro LED Market Value Analysis-Head-mounted Devices

- 2025-2029 Micro LED Market Value Analysis-Automotive Displays

- 2025-2029 Micro LED Market Value Analysis

- 2025-2029 Micro LED Wafer Demand Analysis

Chapter 2. Micro LED Technology Development

- 2.1. Module Enlargement

- Micro LED Module Enlargement/Reduced Tiling

- Enlarging Micro LED Modules Advantages (1/2) - Tiling Omitted

- Enlarging Micro LED Modules Advantages (2/2) - Cost and Commercial Benefits

- Relationships between Module Size and Tiling Size

- Deciding Economic Module Size

- Micro LED Module Enlargement Challenges

- Micro LED Tiling: Large Modules vs. Small Modules

- 2.2. Tiling Display

- Tiling Seams Technical Challenges

- Micro LED Tiling Commercial Strategies : A Pixel Pitch Perspective

- Lower Limit of Commercialization Size for Micro LED-tiled Displays: UHD

- Upper Limit of Commercialization Size for Micro LED-tiled Displays: Economic Tiling

- Most Suitable Sizes for Commercialized Large-sized Micro LED Displays

- Glass: A Potential Competitor to Sapphire-based COC

- Micro LED Heat Dissipation Challenges

- Micro LED PPI Challenges

- Manifesto for Achieving High-Efficiency Micro LED is Within Reach

- Micro LED Industrial Trends (1/2): Towards Specialized Display

- Micro LED Industrial Trends (2/2): Micro LED Enterprises to Focus on AR

Chapter 3. Micro LED Transparent Display

- Two Systems for See-through Displays: Direct-view and Micro display Projection

- Key Differences between Direct-view and Projection Systems (1/2): Viewing Angle

- Key Differences between Direct-view and Projection Systems (2/2): Focus Issues

- Transparent Direct-View Displays Challenges : Mutually Exclusive Relationship between Vitality and Reality

- Benchmarks between the Two Types of Transparent Displays

- Transparent Direct-view Displays SWOT Analysis

- Transparent Direct-view Displays across Different Applications SWOT Analysis

- Transparent Direct-view Displays Development Trend Analysis

- Things to Consider When Selecting Transparent Display Applications

- Technology Principles by Different Transparent Displays

- JDI Brings LCD Back to Transparent Display Competition

- Transparent Display Application Cases

- The Brightness-Transmittance Paradox in Transparent Displays

- Micro LED Transparent Displays

- Comparison between Different Transparent Display Technologies

- Prices of Mass-produced Transparent Displays

Chapter 4. Micro LED Manufacturer Dynamic

- 2025 Micro LED Player Capacity Analysis.

- PlayNitride

- Ennostar

- HC Semitek

- AUO

- Innolux

- Extremely PQ

- Tianma

- BOE

- LGD

- Samsung

- Hisense

- Hongshi

- VueReal

- Aledia

Appendix

- Intel-Samsung Patent Sale

- Advancing non-display Micro LED Technology Development - Avicena