|

市場調查報告書

商品編碼

1343613

二次電池黏合劑技術發展現況及展望<2023> Development Status and Outlook of Binder Technology for Secondary Batteries |

||||||

鋰離子電池(LIB)由於其高能量密度和容量密度,是最有前途的儲能裝置之一,可以滿足電動車和混合動力設備日益增長的儲能需求,是最有前途的能源之一減少碳排放的儲存裝置。隨著人們對綠色能源利用的興趣增加,其使用正在迅速擴大。

經過新能源儲存裝置和電動車的快速發展,鋰離子電池的需求穩步增長,電動車電池市場規模將從2025年的1960億美元增長到2030年的4010億美元,預計將持續增長年複合增長率為21%。

鋰離子電池的特性高度依賴電極,為了實現優異的電池性能,電極結構的最佳化是重中之重。 目前,負極和正極的活性材料正在商業化的LIB和研究中受到極大的關注和考慮,同時在低重量分數(□5wt%)下保持電極完整性和電化學化學。支持該過程的惰性粘合劑發揮重要作用。與活性材料和導體一樣,它在電極性能中發揮重要作用,但它受到的關注遠不如其重要性。

雖然黏結劑是電極中很小的一部分,但它對電極的整體性能起著重要的決定作用。 黏合劑起到將負極活性物質和正極活性物質黏合到集電體的各電極板上、提高耐久性的作用。 黏結劑必須(1)在電解液中電化學穩定(2)柔韌且不溶(3) >特別是對於正極粘結劑,重要的是它能夠抵抗氧化腐蝕。

因此,為了有效地將活性材料和導體與集流體連接,並適應體積膨脹以確保充放電過程中良好的電極結構,需要具有高的粘合強度和彈性。是必須的。 近年來,隨著黏合劑篩選和設計知識的提高,研究重點已從機械穩定角度轉向提供電化學優勢和結構支撐的多功能性。

近年來,隨著矽正極材料的日益普及,新一代的研究正在進行中,因為研究表明黏合劑對鋰化反應具有顯著影響,有助於提高電極容量和循環性能。 傳統的黏結劑主要採用氟樹脂PVDF(聚偏二氟乙烯)為正極,合成橡膠SBR(丁苯橡膠)和CMC(羧甲基纖維素)為負極,但因體積變化較大,矽負極用作黏合劑。不適合。正極材料使用PTFE(聚四氟乙烯)黏合劑,負極材料則使用PAA(聚丙烯酸)、PI(聚醯亞胺)等水系黏合劑。

PAA、PI等黏合劑屬於水性黏合劑,用於以水性溶劑作為電解質的矽負極材料。 與傳統的黏合劑相比,這些黏合劑具有更高的拉伸強度、優異的黏合力、能夠抵抗矽負極材料的體積膨脹,並且能夠包裹活性材料形成穩定的SEI(固體電解質界面)層。

PTFE是新一代正極材料黏合劑,具有疏水性,具有優異的耐化學性和耐熱性,有望用於乾電極製程和全固態電池。

PVDF黏結劑由日本吳羽、比利時蘇威、法國阿科瑪生產,SBR黏結劑由日本瑞翁生產,皆為昂貴產品,海外生產比例較高。

正極黏結劑由韓國Chemtros生產,負極黏結劑已由韓國Hansol Chemical成功國產化,供應給三星SDI和SK On。正極黏結劑也由LG化學和錦湖石化生產。電極黏合劑。我們供應。

全球鋰離子電池黏合劑需求量預計將從2025年的8.9萬噸增加到2030年的23.2萬噸,預計2030年金額約為4.4兆韓元。

本報告對全球二次電池黏合劑市場進行了調查和分析,概述了黏合劑的概況、開發實例、設計和合成的注意事項,以及包括鋰離子電池、鋰硫電池和全固態電池在內的下一代電池。國家電池.我們提供諸如粘合劑發展狀況等信息

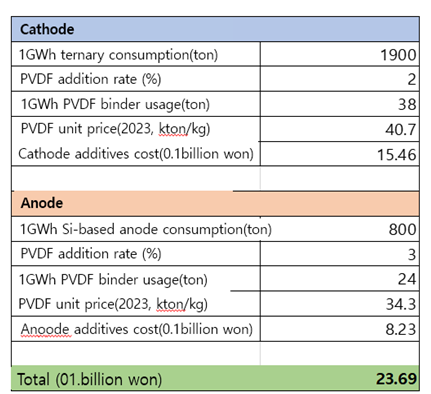

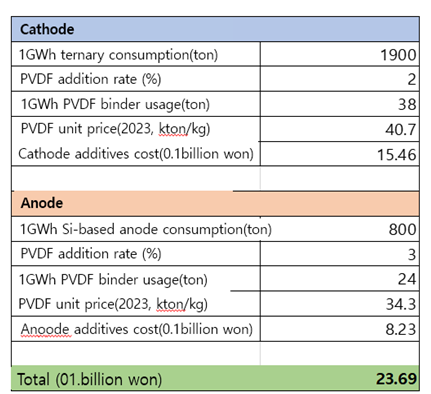

- 正極:NCM811,負極:Si系列

- 1GWh電池的PVDF正極黏合劑消耗量和成本約38噸,15.46億韓元

- 1GWh電池的負極黏結劑消耗量及成本約24噸、8.23億韓元

目錄

第 1 章 Binder 概述

- 簡介

- 定義、角色和要求

- 角色和特點

- 要求

- 類別和類型

- 型

- 它是如何運作的

第二章黏合劑類型及研發實務

- 正極黏合劑

- 非水性黏合劑

- PVDF正極黏結劑產業現狀

- (CMC+SBR)正極黏合劑產業現狀

- 水基黏合劑

- 其他黏合劑

- 陽極黏合劑

- 可插入陽極黏合劑

- 合金陽極黏合劑

- 新一代電池黏合劑 (1)

- 鋰硫 (Li-S) 電池黏合劑

- 乾法黏合劑

- 新一代電池黏合劑 (2)

- 固體電解質黏合劑

第三章 Binder 市場

- 黏合劑市場的整體前景

- 全球鋰離子電池 PVDF 市場前景

- 全球電池市場需求

- 全球鋰離子電池黏合劑需求預測

- 鋰離子電池黏合劑的價格展望

- 鋰離子電池黏結劑市場規模預測

- 全球磷酸鋰電池需求及正極材料需求預測

- 磷酸鐵鋰電池用聚四氟乙烯價格及市場前景

- PTFE黏合劑在磷酸鋰鐵電池中的應用

- 矽基正極黏合劑的市場前景

- 矽基負極材料市場展望

- 矽負極PAA黏合劑市場展望

- Tesla 4680 電池 Binder 成本分析

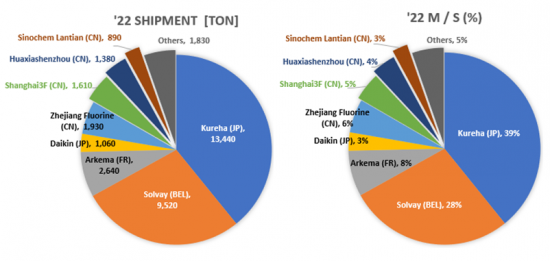

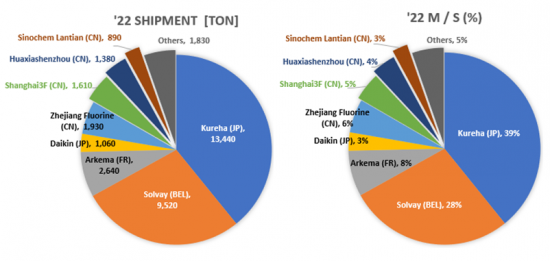

- PVDF黏合劑製造商出貨量及M/S

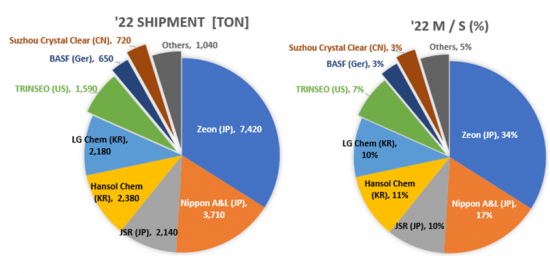

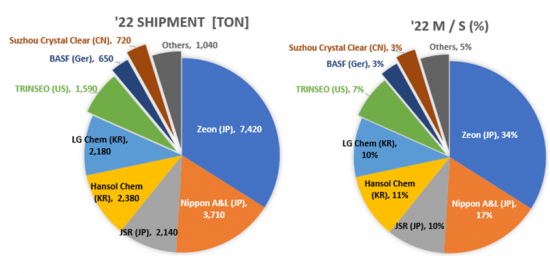

- SBR黏合劑製造商的出貨量和M/S

- CMC黏合劑製造商的出貨量和M/S

第四章黏合劑生產企業現況

- [1] Arkema

- [2] BASF SE

- [3] Solvay

- [4] Kureha

- [5] ZEON

- [6] JSR

- [7] Fujian Blue Ocean Black Stone

- [8] Dupont

- [9] Ashland Inc

- [10] MTI Corp.

- [11] TRINSEO

- [12] Xinxiang Jinbang Power Technology

- [13] Lihong Fine Chemical

- [14] Chemtros

- [15] Hansol Chemical

- [16] Kumho Petrochemical

- [17] Daikin Industry

- [18] Nanografi Nano Technology

- [19] Nippon Paper Group

- [20] APV Engineered Coatings LLC

- [21] Sichuan Indigo Materials Science & Technology

- [22] Guangzhou Songbai Chemical Co

- [23] Nippon A&L Inc

- [24] Daicel Miraizu Ltd

- [25] Sinochem Group Co

- [26] Ube Corp.

- [27] AOT Battery Equipment Technology

- [28] Shanghai 3F New Materials

- [29] GL Chem

第五章附錄(參考)

第六章參考資料

Lithium-ion batteries (LIBs) are one of the most promising energy storage devices to address the growing demand for energy storage in electric vehicles and hybrid devices due to their high energy and power density, and their use is increasing rapidly with the growing interest in utilizing green energy for carbon reduction.

According to SNE Research, after the rapid development of new energy storage devices and electric vehicles, the demand for LIBs has been steadily increasing, and the electric vehicle battery market size is expected to grow from $196B in '25 to $401B in '30, with a CAGR of 21%.

The characteristics of LIBs are highly dependent on the electrodes, and optimizing the electrode structure is a top priority to achieve superior battery performance. While the active materials of the anode and cathode are currently being studied and examined with great interest in commercialized LIBs as well as in research, the inactive binder, which maintains the integrity of the electrode and supports the electrochemical process at a low weight fraction (≤5wt%), occupies a critical position in the performance of the electrode along with the active materials and conductors, but has received less attention compared to its importance.

Although binders are a very small part of the electrode, they play a critical role in determining the overall performance of the electrode. The binder is responsible for the adhesion of the anode and cathode active materials to the respective pole plates of the collector and for their durability. The binder must be (1) electrochemically stable in the electrolyte, (2) flexible and insoluble, and (3) resistant to corrosion by oxidation, especially for cathode binders.

Therefore, a functional binder with high bond strength and elasticity is required to effectively connect the active material and the conductor to the collector and accommodate volume expansion to ensure good electrode structure during charge and discharge. Recently, with more insights into binder screening and design, the focus of research is shifting from a mechanical stabilization perspective to multifunctionality that provides electrochemical benefits as well as structural support.

Recently, with the increasing adoption of silicon cathode materials, a new generation of research is underway, as studies have shown that binders have a significant impact on the lithiation reaction, helping to improve electrode capacity and cycleability. Conventional binders mainly use PVDF (PolyVinyliDeneFluoride), a fluoroplastic, for the cathode and SBR (Styrene-Butadiene-Rubber) and CMC (Carboxyl Methyl Cellulose) binders, a synthetic rubber, for the anode, but they are not suitable for use in silicon anodes due to large volume changes.

PTFE (PolyTetraFluoroEthylene) binders have been used for cathode materials, and water-based binders such as PAA (PolyAcrylicAcid) and PI (PolyImide) have been attracting attention for anode materials.

Binders such as PAA and PI are water-based binders, which are used in silicon anode materials that use water-based solvents as electrolytes. Compared to conventional binders, these binders have high tensile strength, high adhesion, and are resistant to volume expansion of silicon anode materials and form a stable SEI (Solid Electrolyte Interphase) layer by wrapping the active material.

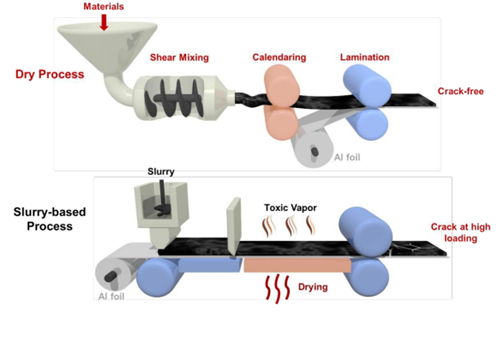

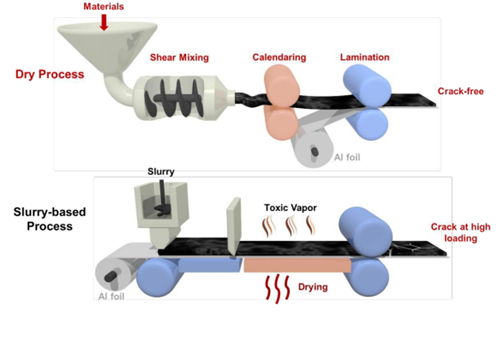

PTFE, a next-generation binder for cathode materials, is a hydrophobic material with excellent chemical and heat resistance and is expected to gain attention in dry electrode processes and all-solid-state batteries.

PVDF binders are produced by Kureha in Japan, Solvay in Belgium, and Arkema in France, and SBR binders are produced by Zeon in Japan, all of which are expensive items with a high proportion of foreign production.

The cathode binder is produced by Korea's Chemtros, and for the anode binder, Korea's Hansol Chemical has successfully localized it and is supplying it to Samsung SDI and SK On, while LG Chem. and Kumho Petrochemical are also supplying cathode binders.

Meanwhile, SNE Research's global demand forecast for binders for lithium-ion batteries is expected to increase from 89,000 tons in 2025 to 232,000 tons in 2030, with a value of about KRW 4.4 trillion in 2030.

High-energy-density batteries are expected to place higher requirements on high-performance binders, and from this perspective, binder design should consider the following.

- (1) The binder content should be less than or equal to 3 wt% of the total electrode mass without losing mechanical strength and adhesion.

- (2) Simplification of synthesis using water-based and dry-based polymers from the perspective of low cost and sustainability.

- (3) Multifunctional polymer binders that can integrate all necessary functions into one polymer.

- (4) Deep insights into polymer dispersion and degradation mechanisms, and more.

In this report, SNE has summarized in detail the information available in the literature on the design, synthesis, and application of binders for lithium-ion battery electrodes and forecasted the demand and market for binders based on our forecasts for lithium-ion batteries, and quoted market size and forecasts from external research organizations in the appendix to help readers understand the overall scale.

Finally, by summarizing the status of binder manufacturers and their main products, we hope to provide a holistic insight for researchers and interested parties in this field, which will help to improve the performance of batteries, including their energy density, fast charging capability, and long-term life characteristics.

Strong points of this report:

- (1) Provides a general overview of the binder and contains rich technical content

- (2) Includes key points to consider in design and synthesis through examples of binder development.

- (3) Summarizes the development status and case analysis of binders not only for LIBs but also for next-generation batteries such as Li-S and all-solid-state batteries.

- (4) Provides objective figures on the binder market through objective binder market forecasts based on SNE Research's battery forecasts.

- (5) Detailed information on the development status and product status of major binder companies.

[Shipments and M/S of PVDF binder manufacturers]

[Shipments and M/S of SBR binder manufacturers]

[Binder cost analysis for 4680 cells for Tesla]

- Cathode: NCM811, Anode: Si series

- PVDF cathode binder consumption and cost for a 1 GWh cell: Approx. 38 tons, KRW 1.546 billion

- PAA anode binder consumption and cost for a 1 GWh cell: Approx. 24 tons, KRW 0.823 billion

[A schematic of the dry and wet processes for electrode fabrication]

Table of Contents

1. Binder Overview

- 1.1. Introduction

- 1.2. Definition, Role, and Requirements

- 1.2.1. Role and Features

- 1.2.2. Requirements

- 1.3. Categories and Types

- 1.3.1. Types

- 1.4. Operation Mechanism

2. Types of binders and R&D practices

- 2.1. Binders for Cathodes

- 2.1.1. Non-Aqueous Binders

- 2.1.2. Industry Status of PVDF Cathode Binders

- 2.1.3. (CMC+SBR) Industry Status of Anode Binders

- 2.1.4. Water-based Binders

- 2.1.5. Other binders

- 2.2. Binders for Anodes

- 2.2.1. Insertable Anode Binder

- 2.2.1.1. Binders for Graphite Electrodes

- 2.2.1.2. Anode Binder for LTO

- 2.2.2. Alloy Anode Binders

- 2.2.2.1. Linear Polymer Binders

- 2.2.2.2. Crosslinked Polymer Binders

- 2.2.2.3. Branched and Extra-Large Polymer Binders

- 2.2.2.4. Conductive Polymer Binders

- 2.2.1. Insertable Anode Binder

- 2.3. Binder for Next-Generation Batteries (1)

- 2.3.1. Binders for Lithium-Sulfur (Li-S) Batteries

- 2.3.2. Binders for Dry Process

- 2.4. Binder for Next-Generation Batteries (2)

- 2.4.1. Binders for Solid Electrolytes

- 2.4.1.1. Overview of All-Solid-State Batteries

- 2.4.1.2. Sulfide-based All-Solid-State Battery Technology

- 2.4.1.3. Manufacturing of All-Solid-State Cells and the Purpose of Binders

- 2.4.1.4. Binder Technology for Cathodes

- 2.4.1.4.1. Binder Technology for Wet Processes

- 2.4.1.4.2. Binder Technology for Dry Processes

- 2.4.1.5. Binder Technology for Electrolyte Layers

- 2.4.1.6. Binder Technology for Anodes

- 2.4.1.6.1. Binder Technology for Graphite-Based Anodes

- 2.4.1.6.2. Next Generation Binder Technology for Anodes

- 2.4.1. Binders for Solid Electrolytes

3. Binder Market

- 3.1. Overall Outlook for the Binders Market

- 3.2. PVDF Market Outlook for Global LIBs

- 3.2.1. Global Battery Market Demand

- 3.2.2. Global LIB Battery Binder Demand Outlook

- 3.2.3. LIB Battery Binder Price Outlook

- 3.2.4. LIB Battery Binder Market Size Outlook

- 3.2.5. Global LFP Battery Demand and Cathode Material Demand Outlook

- 3.2.6. PTFE for LFP Batteries Price and Market Outlook

- 3.2.7. PTFE Binder Usage for LFP Batteries

- 3.2.8. Market Outlook for Binders for Silicon-based Cathodes

- 3.2.9. Silicon-based Anode Material Market Outlook

- 3.2.10. PAA Binders for Silicon Anode Market Outlook

- 3.2.11. Binder cost analysis for 4680 batteries for Tesla

- 3.2.12. Shipments and M/S of PVDF Binder Manufacturers

- 3.2.13. Shipments and M/S of SBR Binder Manufacturers

- 3.2.14. Shipments and M/S of CMC Binder Manufacturers

4. Binder Manufacturer Status

- [1] Arkema

- [2] BASF SE

- [3] Solvay

- [4] Kureha

- [5] ZEON

- [6] JSR

- [7] Fujian Blue Ocean Black Stone

- [8] Dupont

- [9] Ashland Inc

- [10] MTI Corp.

- [11] TRINSEO

- [12] Xinxiang Jinbang Power Technology

- [13] Lihong Fine Chemical

- [14] Chemtros

- [15] Hansol Chemical

- [16] Kumho Petrochemical

- [17] Daikin Industry

- [18] Nanografi Nano Technology

- [19] Nippon Paper Group

- [20] APV Engineered Coatings LLC

- [21] Sichuan Indigo Materials Science & Technology

- [22] Guangzhou Songbai Chemical Co

- [23] Nippon A&L Inc

- [24] Daicel Miraizu Ltd

- [25] Sinochem Group Co

- [26] Ube Corp.

- [27] AOT Battery Equipment Technology

- [28] Shanghai 3F New Materials

- [29] GL Chem