|

市場調查報告書

商品編碼

1286721

氧化物基全固態電池技術趨勢及市場前景<2023> Oxide-based Solid-state Battery Technology Trends and Market Outlook |

||||||

預計2030年全固態電池整體市場規模將增長至149GWh,2035年將增長至950GWh,佔電池市場總量的10%。 其中,使用氧化物固體電解質的全固態電池分為大塊型、小型薄膜型和層壓型。 預計將針對xEV開發散裝型,但由於實際應用存在較高的技術壁壘,目前預計將用作WeLion和半固態電池等混合動力電池,並預計在2030年左右投入使用。到2035 年,發電量將從27GWh 增長到約87GWh。

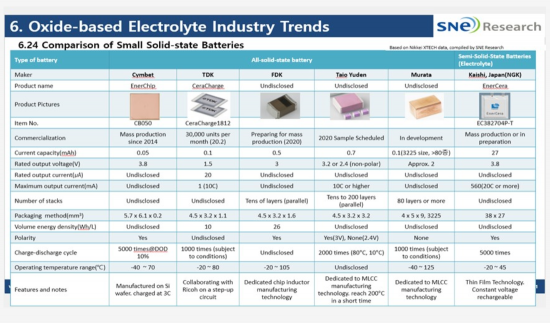

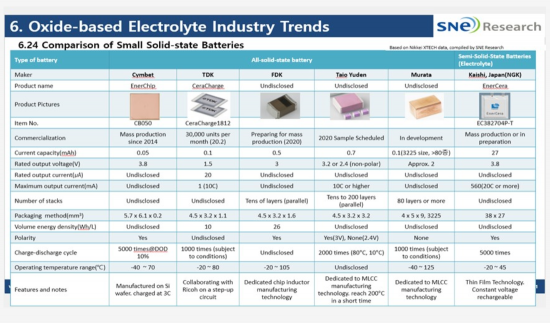

下表總結了目前商業化或正在準備的使用氧化物固體電解質的電池的製造商和規格。 其中大部分已被MLCC技術實力雄厚的日本公司商業化。

另一方面,最近有人嘗試在xEV中採用使用氧化物基固體電解質的電池,中國的WeLion開發了一種使用石榴石和NASICON型氧化物的混合電池,並進行了安全測試。據報導,已獲批准,將採用蔚來的150kWh電池組。 WeLion目前正在建設一條產能2GWh的大型生產線。

本報告調查了氧化物基全固態電池市場,詳細介紹了無機固體電解質的概況和技術,以及氧化物固體電解質面臨的主要挑戰以及旨在解決這些問題的研發現狀.. 我們還提供有關氧化物電池商業化公司的最新趨勢和製造工藝以及重要專利的信息。

此報告的特點

氧化物固體電解質技術含量豐富

- 1. 氧化物固體電解質的研發現狀、主要挑戰及解決方案

- 2.氧化物基固體電解質製造工藝技術

- 3.氧化物電解液行業主要企業趨勢及技術

- 4.氧化物固體電解質的市場前景

- 5.氧化物固體電解質相關主要企業專利分析

The performance of lithium-ion batteries (LIBs) has improved dramatically, especially in energy density, due to continuous technology development driven by the explosive demand for new electronics and electric vehicles. However, high energy density also poses the risk of fire or explosion, and explosive reactions can occur due to mechanical damage, over-discharge, electrical faults from overcharging, internal overheating, and secondary heat dissipation caused by external factors.

To prevent these risks, solid-state batteries are emerging as the next-generation battery technology that uses solid-state electrolytes. Solid-state batteries have the advantages of excellent safety, high energy density, high power output, and wide operating temperature range, and are free from the risk of explosion, while solid-state electrolytes have better ionic conductivity than liquid electrolytes at low temperatures below 0°C and high temperatures between 60~100°C.

Solid-state electrolytes, the most essential part of a solid-state battery, are divided into polymer-based and ceramic-based electrolytes, and ceramic-based electrolytes are further categorized into sulfide-based and oxide-based electrolytes. This report will discuss oxide-based solid-state electrolytes among ceramic-based solid-state electrolytes.

The full-scale development of oxide-based solid electrolytes began with the development of LiPON in 1992, which has the advantages of stable contact with lithium metal, a wide electrochemical window (0-5.5 V vs. Li/Li+), and negligible electrical conductivity. Therefore, LiPON was widely used as a reference electrolyte in the R&D of thin-film solid-state lithium batteries. However, it was only suitable for use as a thin-film electrolyte due to its low ionic conductivity (about 10-6 S/cm at 25°C) and was too fragile for application to large-scale batteries.

In 1993, perovskite-type LLTO (Li0.5La0.5TiO3) was developed, showing an ionic conductivity of over 2x10-5 S/cm, and in 1997, NASICON-type inorganic solid electrolytes including LAGP (Li1+xAlxGe2-x(PO4)3) and LATP (Li1+xAlxTi2-x(PO4)3) were first developed, showing high ionic conductivities of 10-4 S/cm and 1.3x10-3 S/cm, respectively. In 2007, a garnet-type ionic conductor LLZO (Li7La3Zr2O12) was first reported, which exhibited an excellent ionic conductivity of 3x10-4 S/cm at room temperature and excellent thermal and chemical stability, showing potential for application in solid-state lithium batteries.

Solid-state batteries with oxide solid electrolytes are still used as low-capacity power sources for IoT and small electronic devices because they need to be sintered at high temperatures, have low ionic conductivity, and are difficult to scale up, and the method using multilayer ceramic capacitor (MLCC) manufacturing technology is widely used.

The table below summarizes the manufacturers and specifications of cells with oxide-based solid electrolytes that are currently commercialized and in preparation. Most of them are commercialized by Japanese companies, which are strong in MLCC technology.

Meanwhile, attempts to use batteries with oxide-based solid electrolytes for xEVs have also been made recently, and WeLion, a Chinese company, has developed a hybrid battery using Garnet and NASICON-based oxides, which has passed safety tests and is reported to be used in the NIO 150kWh battery pack. WeLion is currently building a large-scale manufacturing line with a capacity of 2GWh.

The overall market outlook for solid-state batteries is expected to grow to 149 GWh in 2030 and 950 GWh in 2035, accounting for 10% of the total battery market. Among them, solid-state batteries with oxide solid electrolytes are divided into large bulk type and small thin-film and laminated types. The bulk type is expected to be developed for xEVs, but due to high technical barriers to commercialization, it is currently expected to be used as a hybrid or quasi solid battery like WeLion and is expected to grow from about 27 GWh in 2030 to about 87 GWh in 2035.

This report, in addition to dealing with the overall overview and technology of inorganic solid electrolytes, also summarizes the key issues related to oxide solid electrolytes and the research and development status for solving them in detail. It also covers the latest trends and manufacturing processes of companies that are commercializing oxide batteries, and finally conducts a survey and analysis of important patents. This report will be a great help to readers who want to know the status, technology flow, and market of oxide solid electrolytes and batteries that apply them.

Strong Points of this Report :

Technically rich content on oxide-based solid-state electrolytes:

- 1. Research and development status, major issues, and solutions for oxide-based solid-state electrolytes

- 2. Manufacturing process technology of oxide-based solid-state batteries

- 3. Trends and technologies of major players in the oxide-based electrolyte industry

- 4. Market outlook for oxide-based solid-state electrolytes

- 5. Patent analysis of major players related to oxide-based solid-state batteries